Friday Feb 27, 2026

Friday Feb 27, 2026

Friday, 31 July 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The second phase of the primary Treasury bond auction held yesterday was opened on the maturity of 15.11.2022 at its weighted average rate due to its offered amount of Rs. 45 billion not been fully  subscribed at its first phase of the auction. Nevertheless, the said maturity was not able to attract its full offered amount, recording a shortfall of Rs. 6.79 billion. However, the total offered amounts of Rs. 35 billion and Rs. 30 billion, respectively, on the 01.02.2026 and 15.08.2027 were successfully accepted at its first phase of the auction.

subscribed at its first phase of the auction. Nevertheless, the said maturity was not able to attract its full offered amount, recording a shortfall of Rs. 6.79 billion. However, the total offered amounts of Rs. 35 billion and Rs. 30 billion, respectively, on the 01.02.2026 and 15.08.2027 were successfully accepted at its first phase of the auction.

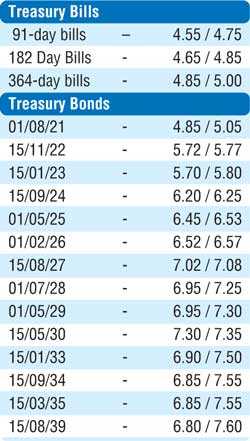

The two-year-and-three-months maturity of 15.11.2022 recorded a weighted average of 5.73%, equal to its pre-auction rate of 5.70/75 for a similar maturity but marginally below its stipulated cut off rate of 5.75%. The five-year-and-six-months maturity of 01.02.2026 recorded a weighted average of 6.50%, marginally below its pre-auction rate of 6.53/55 and below its stipulated cut off rate of 6.52%. The seven-year maturity of 15.08.2027 recorded a weighted average of 7.05%, marginally above its pre-auction rate of 6.95/00 for similar maturity but below its stipulated cut off rate of 7.08%.

In the secondary bond market, buying interest leading to the bond auction saw yields on the liquid maturities of 2024’s (i.e.15.06.24 and 15.09.24), 01.05.25, 2026’s (i.e. 01.06.26 and 01.08.26) and 15.05.30 decrease marginally to intraday lows of 6.16%, 6.19%, 6.45%, 6.65%, 6.66% and 7.27%, respectively, against its previous day’s closing levels of 6.15/25, 6.20/28, 6.45/48, 6.65/70, 6.65/72 and 7.30/35. However, subsequent to the outcome of the bond auctions, two-way quotes increased marginally across the board once again.

The total secondary market Treasury bond/bill transacted volumes for 29 July was Rs. 11.95 billion.

In money markets, the weighted average rate of overnight call money and repo remained mostly unchanged at 4.53% and 4.56%, respectively, as the surplus liquidity in the system stood at Rs. 134.77 billion.

Rupee appreciates

In Forex market, the USD/LKR rate on spot contracts appreciated marginally yesterday to change hands within the range of Rs. 185.65 to Rs. 185.72 before closing the day at Rs. 185.62/68.

The total USD/LKR traded volume for 29 July was $ 95.67 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)