Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 31 December 2025 00:04 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

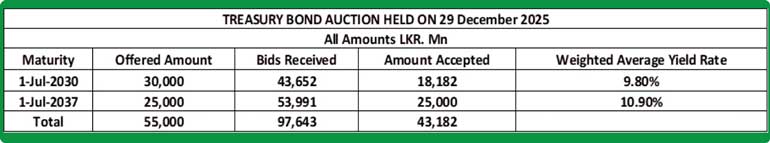

The Bond auctions conducted yesterday successfully raised 78.51% or Rs. 43.18 billion out of the Rs. 55 billion total offered amount. The longer tenor 01.07.37 maturity was issued at the weighted average of 10.90% and was fully subscribed raising the entire maturity-wise offered amount of Rs. 25 billion at the 1st phase in competitive bidding.

The shorter tenor 01.07.30 maturity was issued at a weighted average yield of 9.80%. However, the maturity was undersubscribed at the 1st phase which led to the opening of the 2nd phase.

An issuance window for only the 01.07.2037 maturity is open until 3.00 p.m. of business day prior to settlement date (i.e., 31.12.2025) at the Weighted Average Yield Rate (WAYR) determined for the said ISIN at the auction, up to 10% of the respective amount offered. Given in the graph are the details of the auction.

This comes ahead of today’s scheduled weekly Treasury Bill auction. The auction will have on offer a total amount of Rs. 120 billion. The auction will comprise of Rs. 30 billion in 91-day bills, Rs. 50 billion in 182-day bills, and Rs. 40 billion in 364-day bills. The offered amount is in line with the maturing volume, which is estimated at around Rs. 117.98 billion.

For context, at the weekly Treasury bill auction held last Tuesday (23 December) weighted average yields recorded their first notable upward movement in nearly 22 weeks, ending a prolonged period of yield stability. The 364-day weighted average rate increased by 16 basis points to 8.19%, while yields on the 91-day and 182-day maturities rose by 4 basis points each to 7.55% and 7.95%, respectively. Despite the upward adjustment in yields, the auction outcome reflected subdued demand conditions. Of the Rs. 150 billion on offer—the largest issuance size in the past 28 weeks—only Rs. 82.45 billion was raised, translating to a 54.97% subscription rate. Total bids received amounted to 1.31 times the offered volume.

Meanwhile, the secondary Bond market was mostly quiet amidst the conducting of the Treasury Bond auction. Limited trades were observed on selected maturities. Accordingly, trades were observed on the 01.05.28 and 01.07.28 maturities at the rates of 9.10%-9.13% and 9.14% respectively. The 15.10.28 and 15.12.28 maturities were seen changing hands at the rates of 9.20% and 9.22% respectively. The 01.07.30 maturity was observed trading at the rate of 9.87% post auction.

The total secondary market Treasury Bond/Bill transacted volume for 26 December was Rs. 3.88 billion.

In money markets, the net liquidity surplus increased steadily for the 5th consecutive day to Rs. 124.26 billion yesterday. An amount of Rs. 143.26 billion was deposited at Central Bank’s SDFR (Standing Deposit Facility Rate) of 7.25%, while an amount of Rs. 19 billion was withdrawn from the Central Bank’s SLFR (Standard Lending Facility Rate) of 8.25%. The weighted average rates on overnight call money and Repo stood at 8.03% and 8.06% respectively.

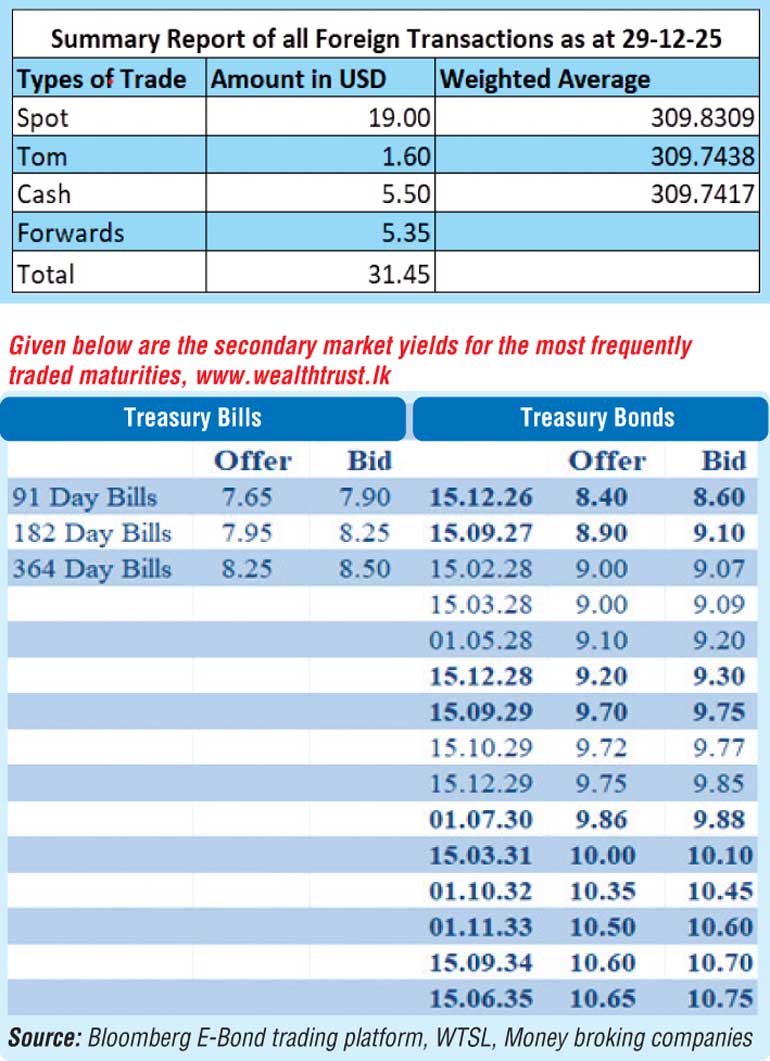

Forex market

In the Forex market, the USD/LKR rate on spot contracts were seen trading at a low of Rs. 310.15 yesterday before closing the day at Rs. 310.00/310.20 as against its previous day’s closing level of Rs. 309.85/309.95.

The total USD/LKR traded volume for 29 December 2025 was $ 31.45 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)