Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 5 April 2024 00:20 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market yesterday experienced a significant slowdown, with activity virtually at a standstill except for a few transactions. Market participants were largely in a holding pattern, adopting a “wait and see” approach in anticipation of the upcoming bond auctions. Consequently, two-way quotes were seen edging upwards.

Accordingly, limited trades were observed on the maturities of 15.11.24, 15.01.25, 15.09.27 and 15.01.28 within the ranges of 10.32%, 10.42%, 12.00% and 12.10% respectively, on moderate volumes.

The upcoming round of Treasury Bond auctions due on the 08th of April, will have on offer a total of Rs. 85.00 billion. Today’s auctions will comprise of Rs. 25.00 billion from a maturity of 15th December 2026 with a coupon rate of 11.25%, Rs 25.00 billion from a maturity of 15th of September 2029 with a coupon of 11.00% and Rs. 35.00 billion from a maturity of 1 October 2031 with a coupon rate of 09.00%.For context, at the previous round of auctions held on the 12 March 2024, the entire offered amount of Rs 270 billion was fully subscribed. Which was incidentally the largest in Sri Lanka’s history. However, yields recorded mixed results. The weighted average yields were seen increasing on the 2026 and 2028 maturities as compared to the previous round of bond auctions conducted on the 13 February where both maturities were previously offered. The 15.12.26 maturity recorded a weighted average rate of 11.33% as against 10.81% at the previous auction. While the 15.12.28 maturity average was recorded at 12.25% as against 11.90% at the previous auction. However, 15.03.31 maturity was issued at a weighted average of 12.42% as against its pre-auction rate of 12.35/65. The total bids received exceeded the total offered amount by close to 2 times, which is also an impressive outcome given the scale of the auction.

In secondary market bill transactions, July and October 2024 maturities were seen changing hands at 10.14% to 10.11% and 10.31% respectively while February/March 2025 maturities were reported at 10.10%.

The total secondary market Treasury bond/bill transacted volume for 3 April was Rs. 75.64 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.63% and 9.08% respectively. The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight and 7-day reverse repo auction for Rs. 28.71 billion and Rs. 15.00 billion at the weighted average rates of 8.59% and 8.85% respectively.

The net liquidity surplus stood at Rs. 121.54 billion yesterday as an amount of Rs. 7.61 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 9.50% against an amount of Rs. 157.85 billion deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.50%.

Forex Market

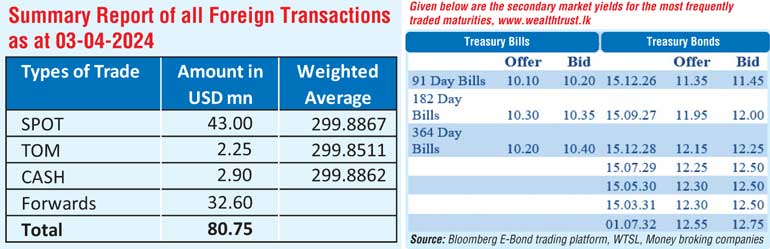

In the Forex market, the USD/LKR rate on spot contracts closed the day up at Rs. 299.70/299.80 against its previous day’s closing level of Rs. 299.80/299.95.

The total USD/LKR traded volume for 3 April was US $ 80.75million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)