Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 4 November 2025 04:58 - - {{hitsCtrl.values.hits}}

Asian Digital Finance Forum & Awards 2025 participants

The Asian Digital Finance Forum & Awards 2025, held recently at Port City Colombo as part of the Asia International Digital Economy & AI in Finance Summit, built on the success of its 2022 and 2023 editions.

Organised by the Asian FinTech Academy (AFTA) in collaboration with the Fintech Association of Sri Lanka (FASL), the event was supported by a strong coalition of international partners including Tech London Advocates (TLA), Global Tech Advocates (GTA), the International Digital Economies Association (iDEA), and Wall Street Fintech AI Inc. (USA).

FinTech Intel (UK) served as Strategic Global Media Partner, while the Commercial Bank of Ceylon joined as Official Banking Partner and Hilton Colombo as Official Hospitality Partner.

The forum also received support from TLA Sri Lanka and the Sri Lanka & Maldives Chapter of the Colorado-USA based Global Academy of Finance and Management (GAFM), reflecting the country’s growing integration into global fintech and AI ecosystems.

|

| Commercial Bank Chairman Sharhan Muhseen delivers special address |

Convener of the Forum and Industry Fellow at the Global Fintech Institute (Singapore), Rajkumar Kanagasingam said: “As AI reshapes Asia’s financial landscape, intelligence must build trust, innovation must build bridges, and finance must create a fairer future for all.”

The forum themed, “Bridging Intelligence, Inclusion, and Innovation in Asia’s Financial Future,” featured keynote addresses from distinguished global experts who examined the convergence of AI, regulation, and sustainable growth across the financial sector.

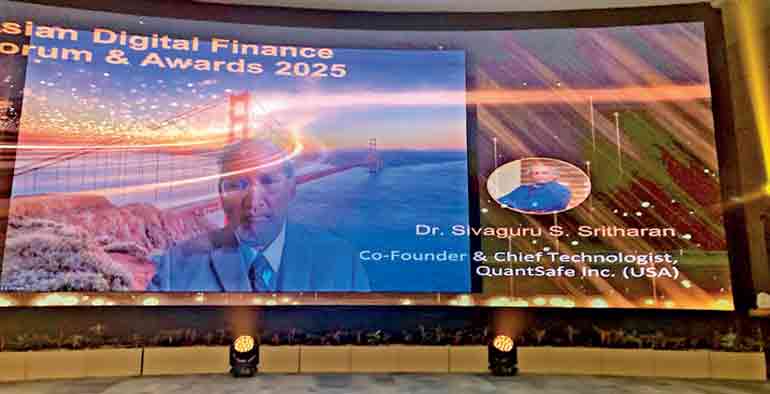

Pioneering aerodynamicist, AI researcher, and former U.S. Air Force Institute of Technology Provost Dr. Sivaguru S. Sritharan, delivered a keynote titled, “Quantum Computing, Turbulence Control, and Algorithmic Finance: Advanced Mathematics and AI at the Frontiers of Science.” He traced the evolution of algorithmic finance from Louis Bachelier’s 1900 Theory of Speculation to today’s convergence of quantum computing, AI, and turbulence control, highlighting how mathematical innovation continues to redefine risk modelling and financial systems. Dr. Sritharan called for greater investment in mathematical infrastructure and cross-disciplinary collaboration, urging finance leaders to unite advanced science with human values to “transform turbulence into trust.”

Cambridge Centre for Alternative Finance Associate Director (Research) Prof. Douglas Arner and University of Hong Kong Prof. of Law Kerry Holdings spoke on, “The Future of AI in Finance: Regulation, Innovation, and Sustainable Growth.” He emphasised that, “finance is now fintech,” outlining five transformative forces—quantum computing, edge storage, 6G connectivity, generative AI, and energy systems—as the foundation of future finance. Arner underscored Asia’s leadership in digital public infrastructure, from UPI and PIX to CBDCs and AI regulation, noting the region’s growing influence in shaping a more resilient and inclusive financial order.

Commercial Bank of Ceylon PLC Chairman Sharhan Muhseen and veteran investment banker with experience at Credit Suisse, Bank of America Merrill Lynch, and JPMorgan, delivered a special address on, “Innovations and Leadership in Digital Finance.” He observed that Asia’s fintech revolution—driven by AI, blockchain, and open banking—is expanding rapidly, but emphasised that technology alone is not enough; visionary and ethical leadership are essential to ensure transparency, security, and inclusion.

Complementing the keynote sessions, expert speakers examined Asia’s evolving digital finance landscape. Citibank Vice President Lakshitha Jayaweera discussed inclusive finance strategies; Ren Co-Founder and CEO Rukmal Weerawarana analysed AI’s developmental trajectory.

Cambridge Centre for Alternative Finance Associate Director – Research Prof. Douglas Arner delivers keynote address

A specialist in competency mapping and skills intelligence Dilshan Lankathilaka, presented “Enabling a Competency-Driven Sri Lanka in the Era of AI,” while BPC Banking Technologies Dulanjana Kumaratunge addressed sustainable digital ecosystem development.

All recognitions under the Asian Digital Finance Forum & Awards 2025 were validated through a rigorous independent process led by Global Validation Chair Dr. Sritharan, combining research, generative-AI-assisted analysis, and cross-border benchmarking. Each acknowledgment was honorary and non-competitive, based on leadership impact, innovation significance, and alignment with the forum’s mission to advance ethical and inclusive AI in finance.

The institutional honourees included Nium (Singapore) for Global Leadership in Cross-Border Payments Optimisation, recognising its contribution to redefining real-time payments and embedded finance across 190+ countries, and Paytm (India) for AI-Powered Financial Inclusion, acknowledging its pioneering role in expanding digital payments and democratising credit access through large-scale AI integration.

Individual honourees were Sopnendu Mohanty (Singapore) for AI & Fintech Governance Leadership, Neil Tan (Hong Kong) for AI-Driven Fintech Ecosystem Leadership, Purvi Munot (UAE/MENA) for Inclusive WealthTech Innovation, and Amira Abdelaziz (Egypt/MENA) for AI in Financial Inclusion & Policy.

A special Visionary Award for Next-Generation Financial Hub Development was presented to Port City Colombo in recognition of its commitment to developing an AI- and fintech-ready international financial ecosystem.

Previous special visionary honourees include the International Financial Services Centres Authority (IFSCA) of India, recognised in 2023 for its pioneering role in advancing cross-border fintech innovation through GIFT City, India’s emerging global financial hub.

The continuity of this recognition underscores Asia’s growing leadership in designing next-generation financial centres that integrate artificial intelligence, digital assets, and sustainable finance frameworks within globally aligned governance models.

The forum closed with a vision for the future — where Asia’s infrastructure, innovation, and intelligence converge to redefine finance, uniting the region’s resolve to harness AI responsibly and build an inclusive, equitable digital era.

QuantSafe Inc. Co-Founder and Chief Technologist and former US Air Force Institute of Technology Provost Dr. Sivaguru S. Sritharan delivers keynote address