Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 6 January 2026 00:00 - - {{hitsCtrl.values.hits}}

Introduction

Government securities markets play an important role in public debt management, monetary policy transmission, and financial market stability, particularly in emerging and developing economies. Treasury bills constitute a key source of short-term financing for Governments and serve as a benchmark for risk-free interest rates in domestic financial markets. The performance of Treasury bill markets, reflected through yield movements, auction participation, and maturity composition, offers valuable insights into prevailing monetary conditions, investor expectations, and Government borrowing strategies.

Government securities markets play an important role in public debt management, monetary policy transmission, and financial market stability, particularly in emerging and developing economies. Treasury bills constitute a key source of short-term financing for Governments and serve as a benchmark for risk-free interest rates in domestic financial markets. The performance of Treasury bill markets, reflected through yield movements, auction participation, and maturity composition, offers valuable insights into prevailing monetary conditions, investor expectations, and Government borrowing strategies.

In periods of economic adjustment or transition, Treasury bill markets often undergo notable changes in pricing and issuance patterns. Variations in macroeconomic conditions, liquidity levels, fiscal financing needs, and market sentiment can lead to differences in yield behavior and auction outcomes over time. Comparing market performance across distinct time periods therefore provides an important means of understanding how Treasury bill markets evolve under differing economic and financial environments, without necessarily attributing these changes to specific causal factors.

Sri Lanka’s Treasury bill market presents a useful setting for such an analysis, following a period of severe macroeconomic instability, debt distress, and heightened market uncertainty, the country entered a new policy and governance phase with the formation of a new Government in late 2024. Against this background, the present study undertakes a comparative analysis of Sri Lanka’s Treasury bill market across two distinct one-year periods: Period 1 (November 2023 – October 2024), which represents the pre regime change phase, and Period 2 (November 2024 – October 2025), which corresponds to the post regime change phase. By examining changes in yield levels, accepted amounts, and maturity-wise auction outcomes for 91-day, 182-day, and 364-day Treasury bills, the study aims to document and compare key market characteristics across these periods. The analysis is descriptive and comparative in nature, focusing on identifying differences and patterns rather than establishing causal relationships.

While existing literature extensively examines the determinants of Government securities yields and debt issuance behavior, much of this research focuses on long-term Government bonds, cross-country analyses, or the role of specific macroeconomic variables. Relatively fewer studies conduct detailed comparative analyses of short-term Treasury bill markets within a single country across different time periods using auction-level data. Moreover, studies focusing on South Asian economies, particularly Sri Lanka, remain limited in number, despite the importance of domestic debt markets in these economies.

This lack of period-based, auction-level comparative evidence represents an important research gap. Understanding how Treasury bill market outcomes differ across distinct periods can enhance understanding of market behavior, debt issuance patterns, and maturity preferences over time. Such evidence is valuable for policymakers, debt managers, and market participants seeking to assess market performance and identify structural developments in domestic Government securities markets.

2.1 Government Securities market and the role of Treasury bills

The Government Securities market in Sri Lanka serves as a key mechanism for raising domestic debt to meet the Government’s short-term and long-term financing requirements. This market comprises Treasury bills and Treasury bonds, where Treasury bonds are medium- to long-term debt instruments, while Treasury bills represent short-term Government securities. Treasury bills are issued under the Local Treasury Bills Ordinance No. 8 of 1923, whereas Treasury bonds are issued under the Registered Stock and Securities Ordinance No. 7 of 1937. The Central Bank of Sri Lanka (CBSL), acting as the agent of the Government of Sri Lanka, is responsible for the issuance, settlement, and servicing of these Government securities (CBSL, 2025).

Treasury bills play a particularly important role in the domestic money market by providing a short-term financing avenue for the Government and a low-risk investment option for market participants. Treasury bills in Sri Lanka are short-term debt instruments issued with standard maturities of 91 days, 182 days, and 364 days. They are typically issued at a discount and redeemed at face value upon maturity, with the return to investors arising from the difference between the issue price and the face value. Treasury bills are highly liquid instruments and are actively traded in the secondary market (CBSL, 2025).

These studies provides a comparative analysis of Sri Lanka’s Treasury bill market across two distinct periods, pre and post the regime change, focusing on yield behavior, auction activity, and maturity-specific acceptance patterns. The findings reveal significant shifts in both market dynamics and Government borrowing strategy following the regime change

The Treasury bill market constitutes a core segment of the domestic money market, and movements in Treasury bill yields serve as a benchmark for short-term interest rates in the economy. As a result, changes in Treasury bill rates directly influence the pricing of short-term credit, the cost of funds for financial institutions, and overall liquidity conditions within the financial system (CBSL, 2025). Furthermore, Treasury bills are accepted as eligible collateral by the CBSL under its open market operations, reinforcing their significance in monetary policy implementation.

Treasury bills are widely regarded as default risk-free instruments due to the sovereign guarantee attached to their repayment. Financial institutions are encouraged by regulatory requirements to maintain significant exposure to such low-risk assets, thereby enhancing financial system stability. Treasury bills are issued in scripless form and recorded in the Central Depository System (CDS) of the CBSL, ensuring secure ownership registration and efficient settlement (CBSL, 2025).

Investors may purchase Treasury bills through the primary market via Primary Dealers or from the secondary market through licensed banks and Primary Dealers. These instruments offer high liquidity, tax advantages under prevailing laws, and full repatriation of interest and maturity proceeds for foreign investors, subject to applicable regulations (CBSL, 2025). Owing to these features, Treasury bills remain a cornerstone of short-term investment and liquidity management in Sri Lanka.

2.2 Treasury Bill yields

Treasury bill yields are widely used as indicators of short-term interest rates and monetary policy stance in an economy. As short-term, sovereign-backed instruments, Treasury bills are generally considered risk-free and therefore reflect the baseline cost of Government borrowing over short horizons. Existing literature documents that movements in Treasury bill yields are closely associated with changes in liquidity conditions, inflation expectations, policy interest rates, and overall market sentiment (Fabozzi, 2006; Mishkin, 2019).

Several studies highlight that short-term yields tend to respond more rapidly to changes in monetary policy compared to long-term Government bond yields, making Treasury bill rates particularly informative during periods of economic adjustment or policy transition. Variations in 91-day, 182-day, and 364-day Treasury bill yields may also capture shifts in investor expectations regarding near-term interest rate movements and macroeconomic stability (Gurkaynak, Sack, & Wright, 2007).

From a maturity perspective, yield differentials across Treasury bill tenors reflect the short end of the yield curve and provide insights into term preferences and expectations about future interest rate paths. A decline in yields across all short-term maturities is often interpreted as evidence of easing monetary conditions, improved confidence, or reduced risk premiums. Conversely, elevated or volatile yields may signal uncertainty, tight liquidity, or heightened fiscal financing pressures.

While much of the existing empirical literature focuses on the determinants of Government securities yields, fewer studies conduct descriptive comparisons of Treasury bill yield behavior across distinct time periods within a single market. Period-based analysis of Treasury bill yields can therefore contribute to understanding how short-term interest rate dynamics evolve under changing economic and policy environments, without explicitly modeling causal relationships.

2.3 Auction participation and bid volumes

Auction participation, typically measured through received bids, reflects investor demand and market appetite for Government securities. Higher bid volumes indicate strong demand, greater market confidence, and ample liquidity, whereas lower participation may suggest risk aversion, competing investment opportunities, or uncertainty regarding economic conditions (Bikhchandani & Huang, 1993).

The literature on Government securities auctions emphasises that bid-to-cover ratios and total bids received serve as important indicators of auction competitiveness and market depth. Changes in received bids over time can reveal shifts in investor behavior, particularly during periods of macroeconomic stress or policy realignment. Reduced bidding activity may also reflect strategic behavior by investors in response to expected interest rate movements or issuance policies.

In the context of Treasury bills, auction participation is especially sensitive to short-term liquidity conditions in the banking system, as financial institutions are major participants in primary auctions. Consequently, variations in bid volumes across periods may reflect changes in excess liquidity, regulatory requirements, or alternative short-term investment opportunities available to market participants.

2.4 Accepted amounts and issuance behaviour

Accepted amounts represent the volume of Treasury bills issued by the Government through the auction process and reflect both supply-side decisions and demand-side conditions. The literature notes that Governments actively manage accepted amounts to balance financing needs, cost considerations, and market absorption capacity (Missale, 2012).

A comparison of accepted amounts across periods can reveal changes in borrowing strategies, particularly during phases of fiscal consolidation or debt restructuring. Reductions in accepted volumes may indicate lower short-term financing requirements or deliberate efforts to limit issuance in response to favorable liquidity conditions. Conversely, higher accepted amounts often reflect increased funding needs or opportunistic borrowing during periods of strong demand.

Accepted amounts are also influenced by the central bank’s auction acceptance strategy, especially in systems where the central bank acts as the issuing agent. Changes in acceptance patterns may therefore reflect broader debt management objectives rather than purely market-driven outcomes.

2.5 Maturity structure of Treasury Bill issuance

The maturity composition of Treasury bill issuance is a critical aspect of public debt management. Existing literature emphasises that Governments strategically adjust maturity profiles to manage refinancing risk, interest cost risk, and rollover pressures (Broner, Lorenzoni, & Schmukler, 2013).

Short-term maturities, such as 91-day Treasury bills, provide flexibility and typically carry lower interest costs but expose the Government to higher rollover risk. Longer maturities, such as 364-day Treasury bills, reduce refinancing frequency and help stabilise debt servicing obligations, particularly during periods of declining interest rates.

Empirical studies suggest that shifts toward longer maturities often occur when Governments seek to lock in favorable borrowing costs or signal confidence in macroeconomic stability. Conversely, reliance on shorter maturities may increase during periods of uncertainty or constrained market access. Period-based analysis of maturity-wise accepted amounts can therefore shed light on evolving debt management strategies and market preferences over time.

2.6 Data source and sample

The analysis is based on secondary data obtained from CBSL website and employs statistical summary measures to evaluate trends over time. The study utilises Treasury bill auction data covering the period from November 2023 to October 2025. The full dataset is divided into two sub-periods for comparison:

Period 1 Pre regime change phase: November 2023 – October 2024

Period 2 Post regime change phase: November 2024 – October 2025

The dataset includes auction-level information on yields and accepted amounts for 91-day, 182-day, and 364-day Treasury bills. All observations within the respective periods are included, ensuring comprehensive coverage of auction activity during each year.

2.7 Analytical technique

For each variable, mean values are calculated for both periods, followed by absolute and percentage changes. This approach allows for clear identification of directional shifts in yields, auction activity, and maturity preferences. Further, graphical analysis is conducted to identify trends, patterns, and fluctuations in the Treasury bill market across different maturities. Time-series plots are used to visualise yield movements and accepted amounts over the study periods, enabling a more intuitive understanding of market behavior and highlighting periods of volatility or stability. This combination of descriptive statistics and graphical representation provides a comprehensive analytical framework for the study.

2.8 Analysis of yield changes

Table 1 presents the comparative mean yields of 91-day, 182-day, and 364-day Treasury bills during the pre and post regime change phases, together with the absolute and percentage changes between the two phases.

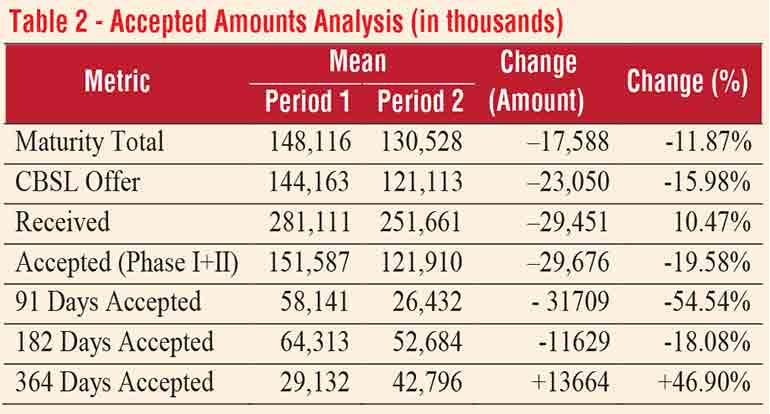

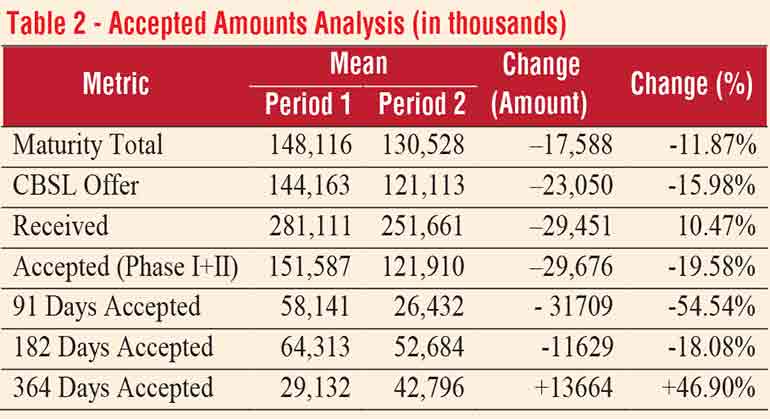

As shown in Table 1 above, 91 Days Yield saw the largest percentage drop of -28.20%, moving from a mean of 10.98% to 7.89% (with minimum of 7.5% of minimum and 15.93 of maximum in both periods) while 182 Days Yield experienced a decline of -26.27%, from 11.07% to 8.16% (with minimum of 7.72% of minimum and 14.93 of maximum in both periods). Further, 364 Days Yield decreased by -21.97%, from 10.78% to 8.41% (with minimum of 7.94% of minimum and 13.02 of maximum in both periods).

Treasury bill yields across all maturities; 91-day, 182-day, and 364-day declined significantly during the post regime change phase. The sharpest reduction was observed in the 91-day yield, which fell by 28.20%, followed by 182-day and 364-day yields, which declined by 26.27% and 21.97%, respectively. This pronounced decrease in yields indicates a lower short-term interest rate environment, likely reflecting improved liquidity, reduced market risk sentiment, easing monetary conditions, and an overall more stable or improving economic outlook during the post regime change phase

The time-series movements of yields further illustrate these trends. Figure 1 below shows the behavior of 91-day Treasury bill yield, demonstrating a sustained downward movement during the post regime change phase relative to pre regime change phase. Similar patterns are evident in Figure 2 and Figure 3, which depict the time-series behavior of the 182-day and 364-day yields, respectively.

Overall, Treasury bill yields across all maturities declined sharply during the post regime change phase, reflecting a clear shift in the short-term interest rate environment. This pronounced downward movement is consistent with improved liquidity conditions, reduced market risk sentiment, and easing monetary conditions, pointing to a more stable or improving economic outlook. Further, this likely reflecting a more stable or improving economic outlook, leading to lower risk premiums and reduced borrowing costs for the Government.

2.9 Analysis of accepted amounts and Auction activities

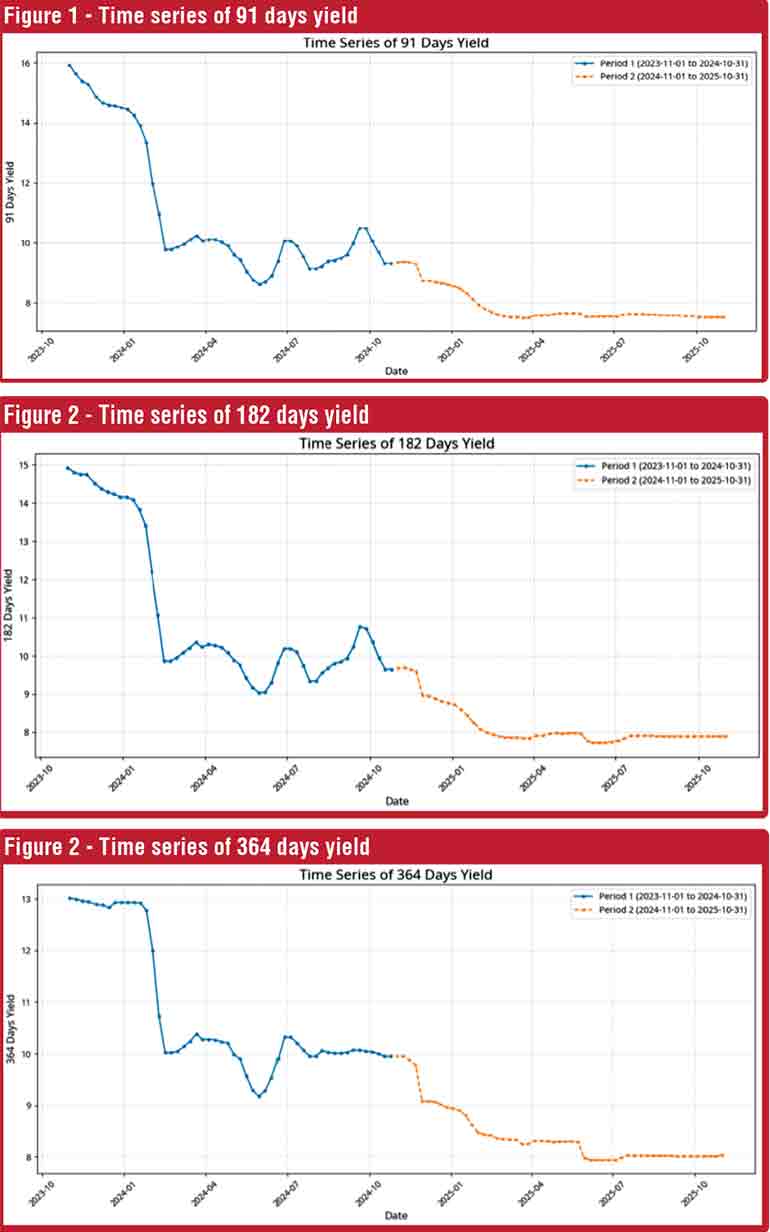

Table 2 presents a comparative analysis of auction-level activity, including maturity totals, Central Bank offers, received bids, total accepted amounts (Phase I and II), and maturity-wise accepted amounts for both periods.

As represented by Table 2, across the board, auction activity declined in Offers, received bids, and accepted amounts during the post regime change phase. The decline in received bids signals reduced investor appetite for Treasury bills. The decline in Accepted values reflects either CBSL tightening acceptance criteria; or reduced market participation.

The accepted amounts show a mixed but highly informative pattern, indicating a strategic shift in the Government’s borrowing profile. Both the mean Maturity Total and Accepted (Phase I+II) decreased by -11.87% and -19.58%, respectively. This suggests a general reduction in the volume of Government Securities being issued or accepted during the auction process amounts during the post regime change phase.

The most dramatic changes are observed in the maturity-specific accepted amounts, where 91 days accepted saw a massive reduction of -54.54%, dropping from a mean of 58,141 to 26,432. This is the largest decrease among all metrics. 364 days accepted experienced a substantial increase of +46.90%, rising from a mean of 29,132 to 42,796. This is the only metric to show a significant positive change. 182 days accepted saw a moderate decrease of -18.08%.

The time-series figures further illustrate these developments. Figure 4 shows the overall trend in accepted amounts (Phase I + II), highlighting lower acceptance levels amounts during the post regime change phase. Figures 5 and 6 demonstrate the pronounced decline in accepted volumes for 91-day and 182-day Treasury bills, respectively. In contrast, Figure 7 shows a clear upward trend in accepted amounts for 364-day Treasury bills amounts during the post regime change phase.

This pattern strongly suggests a deliberate policy decision to shift the borrowing mix away from very short-term (3-month) instruments towards longer-term (12-month) instruments. This provide interpretations as short-term maturities (91 days and 182 days) saw major reductions in accepted volumes. Conversely, 364 days acceptances increased substantially indicating a market shift favoring longer maturity instruments, possibly due to improved confidence in economic stability, or strategic changes in the Government’s debt management approach. By increasing reliance on longer-term instruments in a lower interest rate environment, the Government appears to have reduced refinancing risk while securing more stable funding conditions.

These studies provides a comparative analysis of Sri Lanka’s Treasury bill market across two distinct periods, pre and post the regime change, focusing on yield behavior, auction activity, and maturity-specific acceptance patterns. The findings reveal significant shifts in both market dynamics and Government borrowing strategy following the regime change.

Firstly, Treasury bill yields across all maturities; 91-day, 182-day, and 364-day declined significantly during the post regime change phase. The sharpest reduction was observed in the 91-day yield, which fell by 28.20%, followed by 182-day and 364-day yields, which declined by 26.27% and 21.97%, respectively. This pronounced decrease in yields indicates a lower short-term interest rate environment, likely reflecting improved liquidity, reduced market risk sentiment, easing monetary conditions, and an overall more stable or improving economic outlook during the post regime change phase.

Secondly, the analysis of auction-level activity demonstrates a mixed but informative pattern in accepted amounts. While overall auction activity including maturity totals, CBSL offers, and total accepted amounts declined in the post-regime change phase, maturity-specific trends indicate a strategic shift in borrowing. The acceptance of 91-day and 182-day Treasury bills decreased sharply, particularly for the 91-day bills, which saw a 54.54% reduction. In contrast, 364-day Treasury bill acceptances increased substantially by 46.90%, indicating a clear preference for longer-term instruments in the post-regime change period.

Overall, the post-regime change phase reflects a transformed Treasury bill market characterised by lower yields, reduced short-term borrowing, and a shift toward longer-term instruments. These developments signal a positive adjustment in the Government’s debt management strategy, improved market confidence, and a more stable financial environment.