Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 24 December 2025 03:39 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

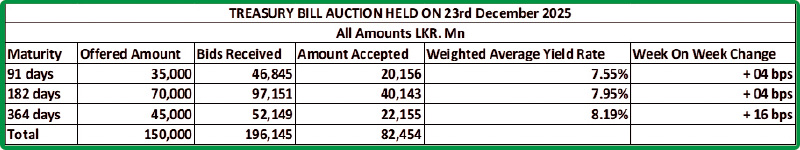

The 364-day Bill weighted average rate at yesterday’s Treasury Bill auction increased by 16 basis points (bps) to 8.19% while the 91-day and 182-day maturities increased by 4bps each to 7.55% and 7.95% respectively. This marks the first notable movement in Treasury Bill yields following a prolonged period of approximately 22 weeks during which rates remained broadly anchored at prevailing levels.

The 364-day Bill weighted average rate at yesterday’s Treasury Bill auction increased by 16 basis points (bps) to 8.19% while the 91-day and 182-day maturities increased by 4bps each to 7.55% and 7.95% respectively. This marks the first notable movement in Treasury Bill yields following a prolonged period of approximately 22 weeks during which rates remained broadly anchored at prevailing levels.

Nevertheless, the auction was undersubscribed, raising only 54.97% or Rs. 82.45 billion out of the entire Rs. 150 billion offered. The bids received-to-offered amount ratio was 1.31 times.

The Phase II of subscription is now open across all three maturities until 3.00 p.m. of business day prior to settlement date (i.e., 24.12.2025) at the WAYRs determined for the said ISINs at the auction. Given in the table are the details of the auction (Phase 1).

The Secondary Bond Market yesterday saw activity and transaction volumes, which were at healthy levels earlier in the day, tapered off into a virtual standstill.

The activity was bolstered by the news that India will provide a $ 450 million package to assist in the reconstruction of areas affected by Cyclone Ditwah in Sri Lanka, Indian External Affairs Minister Dr. S. Jaishankar announced. The package comprises a $ 350 million concessionary line of credit and $ 100 million in grants, aimed at supporting the rebuilding of cyclone-affected regions in Sri Lanka.

However, post auction announcement activity was seen decreasing to a virtual standstill.

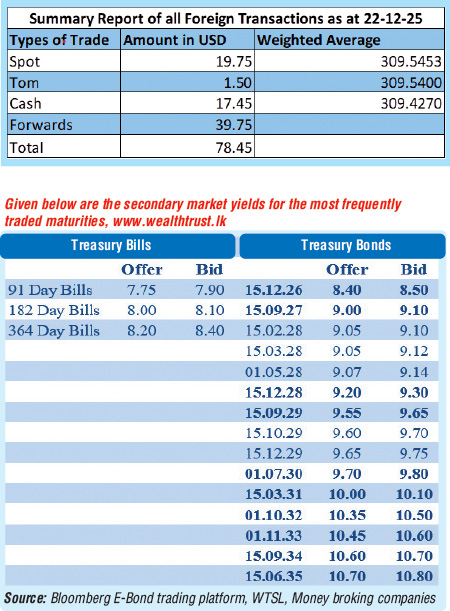

In terms of the Secondary Bond market trade summary, the 01.05.28 and 01.07.28 maturity traded at the rate of 9.07%-9.08%. The 15.12.28 maturity traded at the rate of 9.20%. The 15.09.29, 15.10.29 and 15.12.29 maturities were seen trading at the rates of 9.57%-9.58%, 9.60%-9.63% and 9.65% respectively. The 01.07.30 maturity traded up the range of 9.70%-9.72%. The 15.06.35 maturity traded at the rate of 10.68%.

The total secondary market Treasury Bond/Bill transacted volume for 22 December was

Rs. 6.51 billion.

In money markets, the net liquidity surplus increased further to Rs. 92.22 billion yesterday as an amount of Rs. 92.57 billion was deposited at Central Bank’s SDFR (Standing Deposit Facility Rate) of 7.25%. An amount of Rs. 0.35 billion was withdrawn from the Central Bank’s SLFR (Standard Lending Facility Rate) of 8.25%.

The weighted average rates on overnight call money and Repo stood at 8.02% and 8.05% respectively.

Forex market

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating to 309.65/309.75 as against its previous day’s closing level of

Rs. 309.50/309.65.

The total USD/LKR traded volume for 22 December 2025 was

$ 78.45 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)