Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 13 August 2025 00:14 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

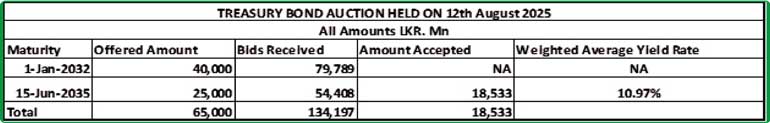

All bids received for the Rs.40 billion, 6-year maturity of 01.01.2032 were rejected at its auction conducted yesterday, the first such instance since September 2024 where bids on the 15.09.34 maturity were rejected.

However, the offered amount of Rs.25 billion on the new 10 year, 15.06.2035 maturity was almost fully accepted at its 01st and 2nd phases of the auction at a weighted average rate of 10.97%.

Given below are the details of the auction,

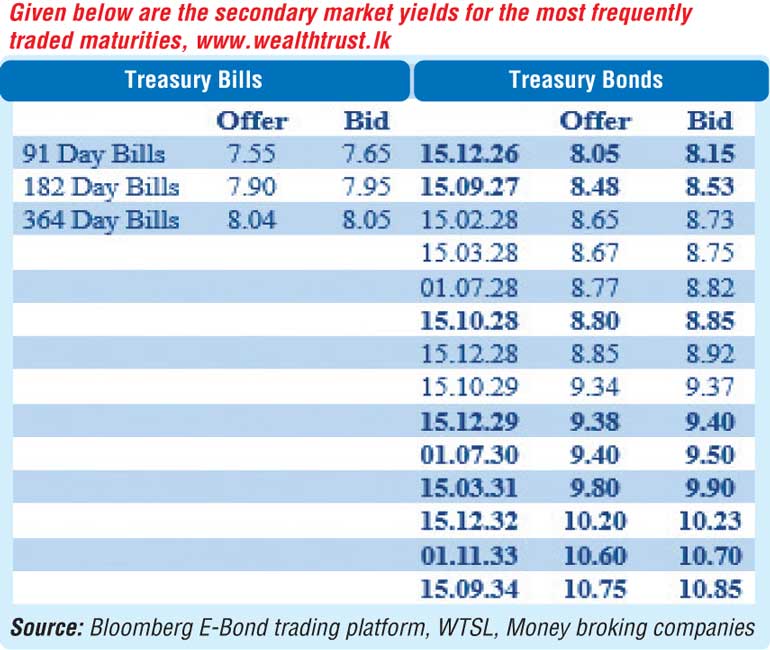

Meanwhile activity in secondary bond market picked up following the auction outcomes as the 15.12.29, 01.07.30, 15.03.31 and 15.12.32 maturities changed hands at levels of 9.39%, 9.45%, 9.85% to 9.80% and 10.25% to 10.20% respectively.

This is ahead of today’s bill auction, where in total an amount of Rs. 103.5 billion will be on offer, consisting of Rs. 40 billion on the 91-day, Rs. 33.5 billion on the 182-day and Rs. 30 billion on the 364-day maturities.

For reference, at the weekly Treasury bill auction held last Wednesday (06/08/25), weighted average yield rates remained broadly stable, for the third consecutive week. Accordingly, the weighted average rate on the 182-day tenor and the 364-day tenor remained unchanged at 7.91% and 8.03% respectively. However, the 91-day tenor registered a marginal decline of 01 basis point to 7.61%. The auction raised the entire total offered amount of Rs. 82.00 billion at the 1st phase in competitive bidding. This marked the first instance of full subscription following two consecutive weekly Treasury Bill auctions going undersubscribed. Further to the T-bill auction held on 6 August, Rs. 8.20 billion being the maximum aggregate amount offered was raised at the 2nd phase across all three maturities, out of a total market subscription of Rs. 13.70 billion.

The total secondary market Treasury bond/bill transacted volume for 11 August was Rs. 1.28 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 7.85% and 7.86% respectively while the net liquidity surplus recorded at Rs. 97.89 billion.

Forex market

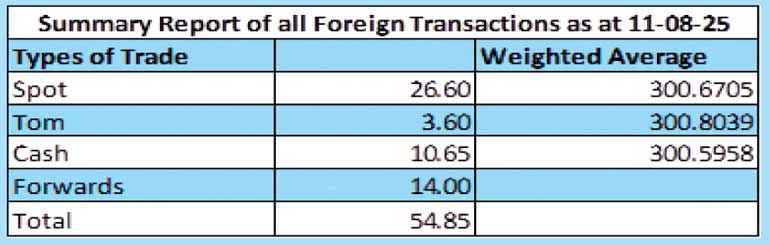

In the Forex market, the USD/LKR rate on spot contracts closed the day at Rs. 300.95/301.05 as against Rs. 300.85/301.00 the previous day.

The total USD/LKR traded volume for 11 August was $ 54.85 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)