Saturday Feb 14, 2026

Saturday Feb 14, 2026

Tuesday, 11 July 2023 00:00 - - {{hitsCtrl.values.hits}}

The financial sector globally has seen four major banks collapse this year while Sri Lanka navigates through its debt restructuring process – a historical and significant juncture in Sri Lanka’s economic history.

The financial sector globally has seen four major banks collapse this year while Sri Lanka navigates through its debt restructuring process – a historical and significant juncture in Sri Lanka’s economic history.

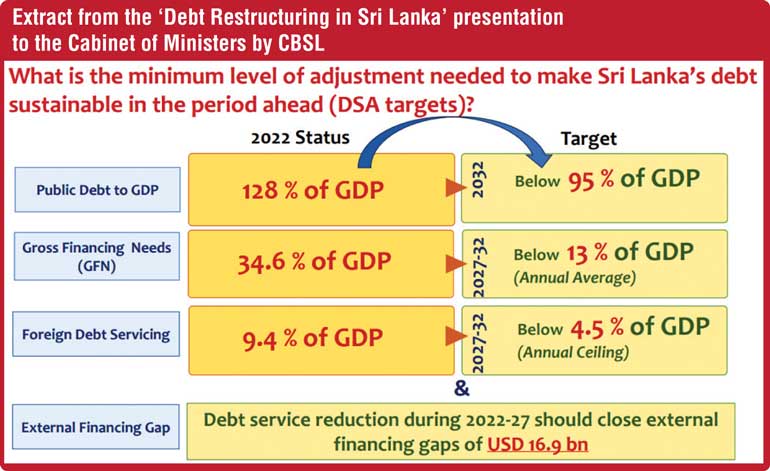

Sri Lanka’s legacy of living beyond our means since independence – where except for four years, we have had primary balance deficit (government revenue less government expenditure without interest) which led to the accumulation of debt and snowballing of interest. Access to concessional funding was constrained with the graduation to the middle-income country status in early 2000. Sri Lanka’s debt levels stand unsustainable at 128% of GDP amounting to more than $ 83 billion, where the safe level for a middle-income market economy is considered to be 70% of GDP. Interest cost is one of the highest in the world at about 6.5% of GDP.

Extended fund facility (EFF) was approved by International Monetary Fund (IMF) and the first tranche of $ 330 million was released in March 2023. The first review of IMF-EFF is due in September 2023 and the second tranche is due in October 2023. Bringing debt down to sustainable level is a key condition to the $ 2.9 billion rescue package from the IMF. Notable progress in debt restructuring is expected for the release of the second tranche. International lenders and investors insist that local institutions to whom Sri Lanka owes more than half of its debt, share the burden of envisaged debt treatment.

To achieve the above target by 2027-32, fiscal adjustment and external debt restructuring alone are inadequate. Further tightening of fiscal stance by way of increasing taxes and levies could economically and socially be costly. Domestic Debt Restructuring (DDR) with less impact to the banking sector was devised as an adverse impact to the banking sector could have wider repercussions to the economy.

Envisaged terms of DDR

Out of total domestic debt, treasury bills amount to about Rs. 4.7 trillion and treasury bonds amount to about Rs. 9 trillion. Approximately Rs. 2.6 trillion of treasury bills are held by the Central Bank of Sri Lanka (CBSL) and the rest with the public and institutions. About 40% of treasury bonds are held by superannuation funds/EPF and 30% by the banking system. The envisaged terms which were presented to the cabinet of ministers jointly by the CBSL and treasury entails interest rate cuts, extension of maturity and adjustment to principal (haircut).

Treasury bills which are held by the CBSL are expected to get restructured under the second phase. These are expected to be converted to treasury bonds which will help reduce gross financing needs (amount of new debt each year). The impact of this will be reflected as negative capital in the balance sheet of the Central Bank. Recapitalisation may be needed to mitigate negative equity’s adverse impact on CBSL’s credibility and independence.

Treasury bonds that are held by the superannuation funds/EPF will only be restructured which is approximately Rs. 2.5 trillion. The options given to the EPF are:

In addition, Sri Lanka Development Bonds (SLDB) which were issued in foreign currency domestically under Sri Lankan law where significant portion is held by the banking sector. The options given for these are:

The banking sector and DDR

The banking sector is considered to be the backbone of the economy where it supported businesses and the wider economy by way of granting debt moratoriums and other concessions due to the COVID-19 pandemic and concessions were granted to customers due to extraordinary macro-economic conditions. Loans under concessions as at 31.03.2023 amounts to Rs. 1.6 trillion which is 15.65% of total loans.

NPL ratio (share of stage 3 loans to total loans) stands at 13.3% as of May 2023 from 8.1% in Q1 2021. Total impairment on existing loan portfolio amounts to Rs. 916 billion. Further ROE on the banking sector stands at 8.9% – where average in emerging markets range from 14% to 15%.

The banking sector has been paying higher taxes than other corporates through which the sector is helping the Government’s fiscal consolidation efforts. Total tax burden to the banking sector is 48% (corporate tax of 30% and VAT on financial services of 18%). Further burden on the banking sector will be borne by not only shareholders but mainly depositors through lower return on savings.

Further it was discussed in various forums that inclusion of banks in the DDR process would trigger larger impact to the economy. It was disclosed that some of the banks with concentrated treasury bills and treasury bonds portfolio, their capital could get hit as much as 50% as a result of day one impact on cashflows. In addition, as per Verite Research 36% of banking sector’s net interest income is based on treasury bills and treasury bonds.

However, foreign currency debt restructuring is expected to have notable impact on the banking sector. ISBs and SLDBs contribute to 17% of the Government securities holdings of the banking sector – restructuring of this is expected to create a significant loss to the banking sector. Banks have considered the above possibility of haircut (adjustment to the principal) and as a prudence measure have considered the above for impairment provisioning.

Excessive burden on the domestic banking system could jeopardise financial system stability which could result in fiscal cost to the Government to restore financial stability. The number of insured depositors of the banking sector as at end of 2022 (which includes individuals and institutional accounts) is 57.2 million. Financial instability could lead to depositors’ stress, business closures, interruptions to the economic activity, reduced investor confidence, and reduced credit availability, which will impact effective transmission of monetary policy and could trigger multiple crises.

Further, with expectation of interest rate to reduce to 7% by end of July and to low single digit by end of 2023, the banking sector is expected to provide further relief to its customers and for the economy to recover.

An opportunity

EPF is the single largest institution with the largest asset base of Sri Lanka of Rs. 2.5 trillion – with Rs. 200 billion contributions and 170 billion withdrawals every year – resulting in a surplus on Rs. 30 billion. The EPF act itself prohibits the reduction of members’ account balances – any impact to EPF will therefore only be in the form of interest rate cut. EPF funds are mainly invested in treasury bonds and it’s time to realise the mismanagement of EPF in the past and to bring in professional fund managers to manage the country’s largest asset base which could earn a higher return while managing risk.

The economic crisis has compelled Sri Lanka to take the path of unpopular policies (as opposed to populist policies of the past which has accumulated and led to multiple crises) which were not politically possible in the past. The bailout package which was sought from IMF for the 17th time this year is different from previous times as Sri Lanka faces debt crisis in addition to balance of payment crisis. This in turn is an opportunity for solid fiscal consolidation and policy reforms as quoted by the governor of CBSL.

(The writer is a finance and accounting professional based in Channel Islands, United Kingdom and can be contacted at [email protected].)