Saturday Feb 14, 2026

Saturday Feb 14, 2026

Friday, 1 December 2023 00:20 - - {{hitsCtrl.values.hits}}

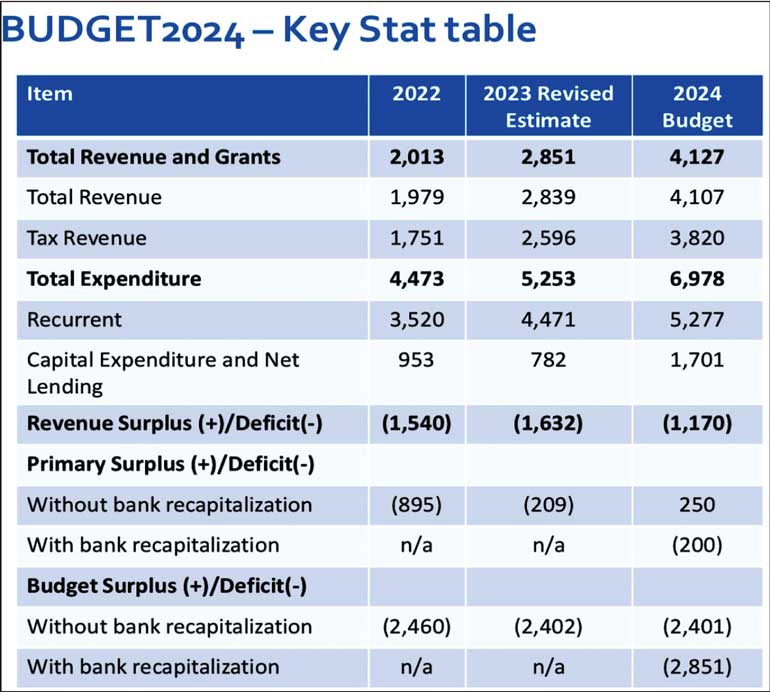

In Business, we are taught that repeating the same behaviour does not bring different results. However, what we saw in Budget 2024 was that it has not addressed the key issues for a growth agenda and not captured the lessons from Budget 2023. What we see from outside is, making it another ritual, than a drastic change to a strategy that would make Sri Lanka step out of the economic crisis. For instance, the revenue is weighted mainly on taxes from Rs. 1.9 trillion in 2022 to Rs. 2.8 trillion in 2023, and suddenly spiking to Rs. 4.1 trillion at 46% growth is practically impossible.

In Business, we are taught that repeating the same behaviour does not bring different results. However, what we saw in Budget 2024 was that it has not addressed the key issues for a growth agenda and not captured the lessons from Budget 2023. What we see from outside is, making it another ritual, than a drastic change to a strategy that would make Sri Lanka step out of the economic crisis. For instance, the revenue is weighted mainly on taxes from Rs. 1.9 trillion in 2022 to Rs. 2.8 trillion in 2023, and suddenly spiking to Rs. 4.1 trillion at 46% growth is practically impossible.

The President mentioned in a forum that the crisis was so severe that a single window budget cannot correct it but, in the absence of a robust growth agenda not spelt out, and a very thin focus on the area of “ governance” a question asked by many is who prepared Budget 2024.

Be that as it may, the collateral damage that 7 million plus people are in poverty and children in Nuwara Eliya, Hambantota and Monaragala stunted by 2 inches does not augur well for a Budget that does not address these issues.

It was very sad to see a majority voting for Budget 2024, even though the Opposition sure made some strong arguments. The annual Budget was seen as a more political agenda than wanting to correct the ground reality given that expenditure has soared from Rs. 3.5 trillion in 2022 to Rs. 4.5 trillion in 2023 and in 2024 to Rs. 5.2 trillion.

Budget 2024

If one analyses ‘ Budget 2024’presented last week in Parliament, the key question that many are asking is ‘ Who prepared Budget 2024’ given that we are on an IMF program which means it needed scientific thinking, while the ground reality at the household end should have been addressed.

Being brutally honest, the authors of Budget 2024 have not adequately picked up the lessons from the last budget using the analysis done by the IMF, research reports done by private sector organisations and the sector wise bottom up plans that were submitted.

Let’s be objective, we must balance the income and expenditure not with increases in taxes but hard decisions on the growth agenda given the military is in place where any form of democracy for voicing the share of mind is arrested or crushed. Sri Lanka needs an aggressive cutting edge growth model based on exports, tourism, FDIs, remittances and sale of non-profitable government entities. We have to come out of the current economic debacle while addressing the fundamental hygiene issue ‘governance’ that is not addressed by the hierarchy due to political ramifications.

Sri Lanka has no option but to achieve a +2-3% GDP growth in 2024 and then a 4-5% GDP growth by 2025/6 even though the global economy is experiencing a recession.

We have to win back the respect of the global financial community that was destroyed by rhetoric like ‘home grown model’ that cut a very sorry picture globally. Budget 2024 fell short of this is my view but sadly we see many good initiatives that are in play but for an odd reason not addressed in Budget 2024. Let us analyse this in greater detail.

Supreme Court decision

Supreme Court decision

Let us first focus on the fundamentals to check the sentiments of the public sector delivery mechanism. A point to note is, senior officials, First Class honours graduates in the public sector with a rich experience curve spanning over 20 years, but their knowledge has been overlooked in the last five years due to the political agenda at play.

Research reveals that these senior public sector officials have intimated to the political hierarchy many intakes on the looming financial crisis as way back as 2017. But they have not had an ear for it. The Supreme Court decision that came after careful deliberation is a big win for the public sector of Sri Lanka. Now this behaviour cannot be repeated.

To be specific, the tax break that cost the Treasury Rs. 681 billion, the decision on the $500 million ISB and the delay in going for IMF support led to the final Waterloo where Sri Lanka had to declare bankruptcy, was mentioned even as far back as June, 2021.

The collateral damage is that over seven million people are in poverty with 51% of them in the estate sector and over 550,000 homes are in darkness as their electricity supply has been cut. Almost 35 % of households have had to give up consuming milk powder. It’s time that someone takes responsibility for this situation. The five bench panel has done justice to this reality.

Last year budget – disaster

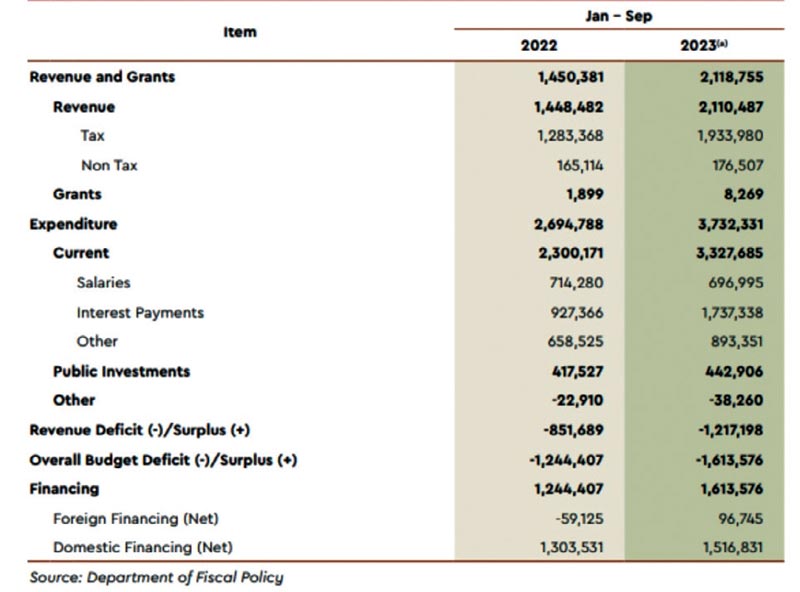

Let’s do a reality check on this year’s performance. Budget 2023 implementation progress has been an absolute disaster. As per the study by Verite- 68% of the projects in Budget 2023 that was passed in Parliament has no data to demonstrate a movement forward while 48% of the projects had zero data to show progress.

A deeper analysis reveals that 25 key projects with an allocation of over 49.3 billion rupees had no data on the impact. There was an accountability issue and responsibility which is very sad for a country trying to grow out of the economic crisis. Going into specifics the report states that the budget proposal, “Developing export processing zones” has been in successive budgets as way back as 2014 but not implemented for years.

Verite Research goes on to state that in the organisation’s history of reviewing budget proposals since 2017, the worst performing year has been 2023. Once again it is the reality and let’s accept it and see how we can pick up the pieces as we plan Budget 2024. One can make a judgment on the motivation level of the public sector as we firm up the 2024 strategic plan for Sri Lanka.

No. 1 issue: 2024

While accepting the above reality, let’s focus on the Budget 2024 proposals. In the IMF second tranche evaluation last September, a key recommendation was to reduce ‘corruption vulnerabilities and increase the governance level’. A 16 point plan was given specifically, e.g. a website to be hosted where all public tenders are advertised with the specifications with all contenders to be announced on a public domain. This transparency not only helps rebuild confidence but also sends a signal to the international creditors that we as a nation are becoming accountable and responsible for results. This key strategy should have received priority in Budget 2024 if we were serious about real reforms next year. Alas, it was addressed way down the pecking order. It was just a mention rather than serious action. I guess Sri Lanka will never learn. We lost the opportunity again even after the landmark judgment by the Supreme Court on who was responsible for the financial crisis as a result of which Sri Lanka became a bankrupt country.

A point to note is that the President commented at one point that the ‘IMF 16 point plan’ was a matter that Parliament must address rather than the executive. The best possible platform to bring this issue to the surface would have been the “Budget 2024 Proposals”. The logic being, it would fuel political debate and receive a strong share of voice in the media too. This would give a signal to the people, about the new culture to be instilled in Sri Lanka. But sadly, for political reasons and I guess not to upset the status quo it was not done by the architects of Budget 2024.

Sri Lanka continues to be a country embedded in corruption like the Health Ministry scandals reported in the media, the seconded sugar tax scam of Rs. 10 billion that happened last month, the 199 high-end cars imported by one dealer using the permits of those working abroad etc. and now the cricket board fiasco that includes the COPE Chair also aiding and abetting. What a sad time for Sri Lanka. Let’s see how things evolve during the next few weeks.

Revenue model 2024

Sri Lanka needs a more aggressive growth agenda in Budget 2024 given the above facts. A point to note is that we do have robust plans driven by the private sector but sadly it was not captured. The 45% revenue increase projected for 2024 is at Rs. 4.1 trillion, the estimated total tax revenue of Rs. 3.82 trillion consists of Rs. 2.23 trillion in taxes from goods and services, Rs. 1.08 trillion from income tax and Rs. 0.5 trillion taxes from external trade. The Budget does not disclose the breakup of the detailed tax revenue sources which is not acceptable. This detail is a must so that there is transparency and commitment by all stakeholders, especially, because there is a 15%-17% drop every year on the budgeted revenue.

Focusing on the 18% VAT decision to drive the revenue is highly skeptical given that Fitch estimates that cost structures will go up by 8.7%. This means consumption will further drop which would slow down the economy once again. Hence, the 45% revenue target is not practical. Even in the current year we see that there will be a -16% swing on the targeted revenue vs. actual.

I would strongly drum up support to drive up tourism so that we can accrue indirect VAT revenue across the value chain. I would strongly recommend that we table the ‘Global Tourism Promotional campaign’ to be launched in January 2024 in the key nine markets. The private sector is crying out for this single minded activation that has been marred by financial irregularities. Let’s use the 2024 Budget to table this and make this sacrosanct in the public sector activity plan.

This must be supported by an innovative sales promotional campaign using global tour operators so that we use a Push and a Pull strategy to attract tourists to the country. It is mandatory that in the key markets a public relations blitz drive be done to make Sri Lanka a top of mind destination. While exhibitions are a good initiative, it is, however, the ‘old model of destination marketing’. The new strategy of drive tourism is an aggressive multimedia online promotional campaign linked to a below the line activation.

We cannot attract high end tourists if we do not re-fleet the vehicle pool of tourism companies. We have to find a policy to make this happen in the short term. The Government must not get involved in pricing decisions like the minimum room rate, where the thriving MICE tourism business got impacted post this decision. Let’s accept reality once again. The tourism industry is a 99.9% private sector industry. Let the market dynamics take control. All these facts must be captured in Budget 2024. The 700 billion rupee debt stock will be the next tsunami to hit the country as the moratorium period is over. Budget 2024 will not have the fat to cushion this shock but it must be addressed if we are to be real at least now.

Let’s not wait for tourism awards and accolades from global entities to drive awareness of Sri Lanka tourism. We must take control and do brand equity development work to drive the conversion. We must monitor the performance.

The much talked about wealth and property tax was not even mentioned in Budget 2024. While the formulation of the architecture is happening, we should at least set a target launch date and a modest value included to the revenue model.

But sadly, the revenue collections are only targeting the formal sector in the professional category and not the A+ Socio Economic Group that does not feel the heat of the economic crisis. Hence, my logic on the theme ‘Who prepared Budget 2024’.

Expenditure cut

An interesting insight from the Budget 2024 document is that the breakdown on expenditure of 6.9 trillion rupees has not been focused and rationalised given that we cannot balance the numbers by just focusing on revenue growth. The data clearly reveal that ‘Defence forces’ consume almost half the recurrent expenditure which needs details and 45,000 foot soldiers were recruited in 2021 by the former President, who are actually not military by definition. Sri Lanka has to face reality and re-align the structure based on the country’s economic strategy. A point to note is that in the Budget 2024 there is no mention on how to restructure or re-purpose this skill set which is strange. We have to bring this line item to the main line economic development agenda of the country.

The current year’s half year data reveal that recurrent expenditure is growing at a+52% against last year’s value but the tax revenue collection number is at +44%. It means, the high taxes the people had to pay have not resulted in a positive cash flow to the country, as the expenditure has increased substantially. I still question the thinking of Budget 2024.

Drive exports

Let’s accept it, Budget 2024 is very thin on exports strategy development. FTAs with Bangladesh, Thailand and Singapore will take two to three years to materialise even after inking the document given the incubation time for solid trade agreements that take four years. Even if we sign an FTA with Thailand that can give Sri Lanka RECEP (Regional Economic Corporation Partnership), we cannot push the system given the supply chain of Sri Lanka is in shambles.

A better option would have been to focus on the current FTA with India and move it to a Comprehensive Economic Partnership Agreement (CEPA) that would cover merchandise and services too. The apparel sector has already set its sights on a $1 billion deal from India but let’s also note that almost 6 factories have shut in Sri Lanka due to the demand drop from the West.

The FTA with India needs strong political will given that Non Trade Barriers (NTBs) are the key hindrance for trade. India has been a close friend to Sri Lanka financially in the last two years. We must make this partnership a ten billion dollar business to Sri Lanka in the medium term that is currently just below one billion dollars.

A key initiative in this strategy that Budget 2024 must have is the SME development agenda that is wafer thin. Let’s once again accept it; tsunami and the financial crisis destroyed the supply chain of the country. The SME sector must be given priority and a detailed work program sketched out if Sri Lanka is to recover, 70 % of the GDP being SMEs, which many forget.

What next?

The economic crisis has forced Sri Lanka to see reality. People who made mistakes have been identified. Corruption should be addressed in the near term. We know the key steps to implement if we are serious about growing out of the economic crisis. Budget 2024 has not been sharp enough to capture these realities. But, let’s not give up.

(The writer has served the British multinationals for almost 20 years and then served the United Nations( UNOPS) for Sri Lanka and the Maldives. He is an alumni of Harvard University and a former Sri Lanka Export Development Board and Sri Lanka Tourism Chairman)