Sunday Feb 15, 2026

Sunday Feb 15, 2026

Monday, 11 October 2021 00:00 - - {{hitsCtrl.values.hits}}

Internationally, the composition, nature of engagement, relevance of knowledge and talent base of corporate boards have drastically evolved

|

As much as agility and dynamism is important for overall corporate success, it is not going to be accomplished without the same traits being cultivated at the top most level of the business as well – the corporate boards. Whilst investors and analysts alike consciously evaluate the quality of management before investing in a company, only a few go to the extent of evaluating the quality of the apex steering unit of a company – leadership, steering and composition of boards are increasingly seen as fundamentally important by institutional investors in a vast majority of developed markets.

As much as agility and dynamism is important for overall corporate success, it is not going to be accomplished without the same traits being cultivated at the top most level of the business as well – the corporate boards. Whilst investors and analysts alike consciously evaluate the quality of management before investing in a company, only a few go to the extent of evaluating the quality of the apex steering unit of a company – leadership, steering and composition of boards are increasingly seen as fundamentally important by institutional investors in a vast majority of developed markets.

Boards of too many large companies tend to be heavily weighted towards people on the verge of or beyond retirement or people who often fall into the category of FoF group, i.e. ‘Friends of the Founder’ and many other boards are merely loaded with ‘names’. In today’s business environment of such dynamism and turbulence, companies need to take bold steps to transform from a compliance-centric model to developing highly skilled boards that are well- equipped to take on the challenges and opportunities that lie ahead – boards that are led by not ceremonial monitors but fiery leadership, expertise and talent relevant to the company, meaningful diversity and energetic pursuit of results – all whilst retaining the independence of the board, – ‘eyes on, hands-off’.

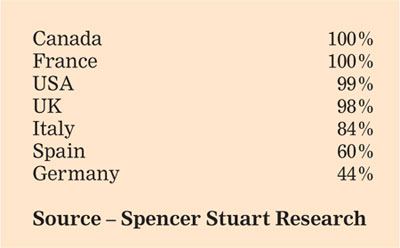

Strategic intervention is required to continuously review and recalibrate the composition and direction of the board so that they will remain relevant to the strategic course of the business as well as being a great enabler for the CEOs effectiveness. Companies must adopt the practice of annually reviewing the effectiveness of their boards. Shareholders must insist on an annual evaluation of board effectiveness and there should be some mechanism to report key outcomes of this evaluation to the shareholders, however, subject to preserving the confidentiality of sensitive information. Nearly all listed companies in the USA, Canada, France and UK conduct some kind of board assessment every year. Percentage of major listed companies conducting an annual board assessment.

It is fundamentally important that the shareholders take a complete shift in the way they look at their investee companies from just ‘stocks’ to taking up a more engaging and assertive role with the chairmen and boards to bring out seismic shifts in performance. Shareholder activism is a growing phenomenon in the US and UK that has evolved to drive effective governance at the top and greater corporate performance. An activist shareholder is a shareholder that uses an equity stake in a listed company, in particular, to put pressure on its management. Meaningful shareholder activism needs to be pursued in order to bring about the right changes at the top level of organisations so that businesses can successfully move away from a culture of ceremonial monitors to effective leadership at the top – as such, much greater emphasis is needed on boardroom effectiveness.

The corporate governance debate

The corporate governance debate

The historic developments in corporate governance provide useful insights to understand how the functions of boards have evolved to become more compliance-centric – however, the more recent developments are driving greater emphasis on strategic direction and operational results.

So what is corporate governance? It can be defined as a set of rules, practices and processes used to direct and control a business, which is essential to its sustainability and success. Then what is the connection with corporate success?

The early structured initiative came after the collapse of Coloroll and Polly Peck Consortium in the UK despite the healthy outlook in their financial statements – The Committee on the Financial Aspects of Corporate Governance was established in May 1991 by the Financial Reporting Council, the London Stock Exchange, and the accountancy profession under the leadership of Sir Adrian Cadbury, and thereafter the Committee was known as the Cadbury Committee.

The post Enron and Lehman Brothers business world saw a meteoric rise in the level of debate on Corporate Governance. Failures of boards in their strategic insight were directly attributed to a large number of chilling corporate failures in the US and UK, in particular – the corporate governance debate initially started as rather compliance-centric in response to these corporate failures, however, later evolved to be more robust performance focused frameworks.

The central components of this voluntary code, the Cadbury Code, are:

The Cadbury Committee was formed following some serious scandals and corporate collapses relating to financial reporting and integrity, hence, focused heavily on bringing in independent oversight at the board level.

Later on in 2002, much stricter legislative framework was introduced in the US, called Sarbanes-Oxley Act of 2002 (SOX) following the corporate scandals involving companies like Enron and WorldCom. SOX brought in tough requirements for directors to ensure and certify the accuracy of financial reports and also introduced penalties for non-compliance. SOX involved 11 major elements, including importantly,

The SOX took a legislative and prescriptive framework to set out how corporate governance should be strengthened and also increased the oversight roles of boards. They introduced specific rules and penalties.

However, a more sustainable and educative outcome originated from the King reports in South Africa. In the early 1990s, the Institute of Directors in South Africa asked Supreme Court Judge Mervin E. King to chair a committee of corporate governance in the post-apartheid South Africa. The King committee published a series of reports with the most recent King IV report being published in 2017. Some of the overriding arguments across the series of King reports were the intertwined relationship between board effectiveness and corporate success and also the transformation of businesses from financial capitalism to inclusive capitalism.

Key outcomes and guidance from the King reports:

This is a wide-ranging protocol of international best practices and the King reports also give emphasis to ensuring operational effectiveness as well as corporate integrity.

These findings provide very important guidance to investors in evaluating proper governance standards in the companies that they invest in as well as strengthening the leadership role of the board. By championing effective governance at the top, the US corporations in particular have moved away from board appointments basis ‘collective-convenience’ to making appointments based on relevant skills to deliver results – thanks largely to the boldness of the shareholders in exerting formidable pressure at the top to deliver.

So what does it take to create a great board?

First thing is to realise that the sustained performance of the CEO and his or her team can very much be a function, in many cases, of the quality of the apex body of the organisation – the board. Corporate boards are expected to be more engaged, more knowledgeable and more effective than ever before.

There is so much written about the success of Steve Jobs and Apple Inc. – undoubtedly, one of the greatest business success stories. However, there is not so much known about the man who brought Steve Jobs back to the company and how he steered the top team to enable the right environment for the new CEO to perform.

In 1996 Edgar S. Woolard, Jr, former CEO of DuPont and an engineer by profession, joined the board of Apple. During the preceding few years before he joined, Apple had 3 CEOs and was already thought as history by most analysts. Some of the most interesting features of the early moves taken by Woolard, as the Chairman, included;

Within a year Apple was on a solid footing. In less than three years, the stock price went to a record of more than $ 100 from a low of $ 12 and the total value of the company rose from $ 2 billion to $ 18 billion. Thanks to this foundation, amongst other bold moves by the new board and CEO, today the company has grown well past $ 2 trillion in market cap.

The Apple board’s decision to hire Jobs is ranked by Fortune magazine editors as one of the “greatest business decisions of all time,” and Jobs would later say that the lead director who spearheaded it, Edgar Woolard, “was one of the best board members I’ve ever seen” and “one of the most supportive and wise people I’ve ever met”. This is a clear case of the importance of the board’s chair or any other board member to step in during tough times – develop close knowledge of the business and engage, however, resist the temptation to micro manage.

Delving into the composition of a board needs to be a structured and objective effort. Some of the important components to assess when dissecting a board are:

1) Personality types and collective chemistry

It takes all types to run a successful business. Social dynamics can be of positive as well as negative impact on board effectiveness.

An abundance of research suggests diverse boards outperform homogeneous ones. Traditionally, diversity has been defined by categories easily seen and measured: experience, gender and ethnicity. Common groupthink tends to be so pervasive across boards, it is essential that the board chair recognises different personality types and derives the best out of different personalities present in the board.

It then becomes the role of the Chair to be the overriding captain to work with the whole board and the individual board members, to ‘be greater than the sum of its parts’. Collective Chemistry is the intangible quality that ensures the sum of a board is far greater than its parts.

2) Extent of boardroom politics

At its very core corporate politics is nothing but adding complexity. This is a very challenging area which, if not managed proactively by the chair, can backfire badly on board functions – it can be even harder where there is an absence of clear direction from the shareholders. Boardroom politics could add to tensions; however, it need not always be counter-productive – a deft board chair can recast the moment to be intense yet healthy debates on relevant issues.

3)Dynamics of personal egos

In most cases, corporate boards carry people of great business judgment and valuable experience – invariably, they are also large personalities with a tendency for heavy egos. This can very well play out positively if there is clear understanding of the individuals and the board chair enables a unifying force that bonds directors. It is very much human to have such traits and keeping harmony and harnessing the exuberant positivity that some of these personalities bring in should be the focus for the board chair.

4) Underlying motivation

Too many companies are yet to come out of the FoF (Friends-of-the-Founder) syndrome and tend to be still packed with loads of ceremonial monitors – needless analysing why they even come on board, they become an invisible drag on the performance of the company.

So the board chair should have an inclination to bring on people with relevant skills and inner-fire to deliver results to the company – in the process they need to be fairly compensated for their contributions.

Roadmap to building an effective board

Every organisation needs to and, in most cases, has the flexibility to take a completely fresh view when reorganising the board. Internationally, the composition, nature of engagement, relevance of knowledge and talent base of corporate boards have drastically evolved. Basis international research and developments, I propose a seven-step framework to guide through a successful results-oriented reorganisation of a board.

1. Board leadership

An effective board chair is absolutely critical – the board chair is effectively the captain, guide and facilitator in steering the company for greater success. Great chairs are excellent coaches and they create conditions that allow other people to shine.

Board chairs must be people with excellent leadership traits, strategic vision and relentless hunger for talent, however, must also be very conscious of the distinction between the board chair and CEO. In response to a global survey conducted by INSEAD, one board chair outlined this distinction, “the chair is responsible for and represents the board, while the CEO is responsible for and is the public face of the company”.

2. Board assessment

Board evaluations are unique and very different to other forms of management evaluations since it can involve top executives and complex personalities in very delicate and intricate business relationships. Board evaluation, at least on an annual basis, is essential towards building a more results-oriented board.

Board assessments are not evaluation scorecards or grading sheets. There is no magic formula for a board assessment. It is important to bear in mind that that one size does not fit all – there is no one approach or prescriptive method – the person who conducts the evaluation is fundamentally critical. A skilful facilitator can identify, with the full group’s affirmation, issues in dispute as well as aid in identifying critical skill gaps in the board.

3. Talent grid

The board chair and the rest of the board needs to recruit directors who add value – whether he or she is connected or known to the major shareholders should definitely not be a driver in this process.

The board chair should develop a talent grid basis the requirements of the future direction of the business and seek out new recruits as well as encourage healthy turnover amongst the existing ranks.

It is challenging to find someone with deep industry knowledge who isn’t associated with a competitor or a related business – however, this should be an important criterion in the selection process.

The push for more-relevant experience should not come at the price of diversity. Like-minded individuals are susceptible to groupthink, and variety in age, gender, and ethnicity as well as in experience and training is needed to guard against the self-confirming biases—and too easily reached consensus—that often endanger businesses.

Boards of the future will require new — and different — competencies and skill sets in increasingly important areas such as AI and automation, risk management, supply chain optimisation, mobile workforces and satisfying stakeholder demands for environmental, social and governance objectives.

4. Stay close to strategy and look forward

Boards still spend a vast amount of time in myopia – excessively spending time on going through the previous quarter’s results. In the research conducted by INSEAD across 31 countries, it was found that effective boards spent only about 15% of their time on management presentations whilst non-effective boards spent up to 70% of their time on this. With a pool of highly rated and talented people at the board, the board chair should be focusing most of their valuable time on the strategic course that lie ahead.

Certainly, an effective board knows that directors should be able to take meaningful part in discussions around strategy – deep knowledge of customer base, products and markets are essential. Developing relevant skill sets at board level around the strategic direction of the company should be the focus of the board chair. According to a former director at Ford, today more software goes into the Ford Focus than what went into the first space shuttle – accordingly, Ford board is deeply engaged in learning to run a technology – driven company.

5. Ensure that the right CEO is in place and potential successors are identified

Today’s boards need to work with management to exercise engaged and collaborative oversight. Successful CEOs tend to have very open sharing of facts with the board and educate the board continuously so the discussions are more straightforward and focus more on the issues at hand. It is the paramount duty of the board to make sure that the right CEO is in place and support him or her in achieving the set goals.

There is increasing evidence that suggest companies that manage to develop internal talent for succession to the top position tend to carve out a sustainable path for greater results. According to an annual study of CEO succession at 2,500 public companies in the US conducted by Booz & Company, over the past four years from 70% to 80% of CEOs have been promoted from inside. This is clear indication that more boards are identifying and readying internal talent for the top job.

Whilst it is important for the board to cultivate good working relationships with the CEO and other senior personnel, they must also resist the temptation to micro manage – once again, it is “eyes on, hands-off”. Good boards, therefore, make sure to respect the boundaries.

6. Board independence – very critical

Following the famous ‘diesel-dupe’ in 2015 and resulting fines that the Volkswagen Group had to pay in the US amounting to $ 18 billion, the board of Volkswagen came under enormous pressure by the shareholders to remove the then Chairman Ferdinand Piech and other directors and connected people from the Piech family, the controlling shareholders of Porsche as well – the board effectively suffered from ‘FoF’ (Friends of the Founder) symptoms. Internationally, companies that have sustainably posed consistent results tend to have one emerging factor in common – greater proportion of truly independent directors on the board. For it is increasingly clear that sound strategic oversight, invariably, comes with objectivity.

7. Commit and collaborate

All well said, however, in the absence of true commitment by individual directors, it is difficult to expect a board to deliver results to shareholders.

Commitment in terms of attendance at board meetings must be of utmost importance. In addition, people who represent more than five boards should not be encouraged on the board because they just will not be able to deliver the necessary focus and commitment required to build a great company.

Boards should work to develop deeper understanding and excellent working relationships amongst members of the board. Increasing number of boards in the US conduct annual strategic offsites at which issues are aired and detailed discussions are conducted. They also help in building closer working relationships amongst members of the board.

Corporate success will be sustainably driven by well-steered and highly-skilled boards that will reward their shareholders and drive long-term value for employees, customers, and communities as well. The shareholders and board chairs need to create the urgency at the top level to recalibrate their boards and realign the businesses to take up greater challenges – a robust and strategic framework is fundamentally important to set the transformation process on fire.

(The writer holds an MBA from Cranfield and is Chief Strategist at Bluestreams. He could be reached via email at [email protected].)