Monday Feb 23, 2026

Monday Feb 23, 2026

Thursday, 14 August 2025 00:22 - - {{hitsCtrl.values.hits}}

The void left by Sri Lankan suppliers was effectively occupied by Indian tea exporters, solidifying India’s role as Iran’s

preferred supplier of orthodox tea

On 30 July 2025, President Donald Trump announced a 25% reciprocal tariff on imports from India, to take effect from 1 August (later formally deferred to 7 August). The justification cited included India’s high internal tariffs, non-tariff trade barriers, and its continued procurement of Russian military equipment and oil, particularly in the context of the ongoing Ukraine conflict.

On 30 July 2025, President Donald Trump announced a 25% reciprocal tariff on imports from India, to take effect from 1 August (later formally deferred to 7 August). The justification cited included India’s high internal tariffs, non-tariff trade barriers, and its continued procurement of Russian military equipment and oil, particularly in the context of the ongoing Ukraine conflict.

Sri Lanka, too, was targeted under the same reciprocal tariff framework, facing a 20% tariff on its exports to the United States, effective 7 August 2025.

In Sri Lanka, opposition politicians expressed strong criticism in the beginning, arguing that the Government had failed to engage meaningfully with the Trump administration on tariff-related discussions—especially in contrast to the proactive negotiations undertaken at that time by the Indian side. They noted that Sri Lanka lacked a coordinated diplomatic strategy during the period following President Trump’s “Liberation Day” proclamation, when the tariff structure was first proposed.

However, the latest revision, which reduced Sri Lanka’s originally proposed tariff rate (reportedly as high as 44%) to 20%, is now seen as placing the country on a more level playing field. Still, in the absence of a formal trade agreement and given President Trump’s unpredictable policy stance, there is considerable uncertainty regarding how US trade measures may evolve further. According to media reports, Sri Lanka is inclined to explore options to import US oil and agricultural commodities in an effort to maintain or possibly reduce the announced tariff rate.

This article will explore how India strategically outmanoeuvred Sri Lanka in the Iranian tea market during the period of sanctions, and how it financially capitalised on discounted Russian oil, both of which had significant implications for regional trade dynamics.

In the shifting geopolitical and economic landscape of the 21st century, few countries have displayed the kind of strategic economic agility that India has. Leveraging global crises and disruptions, India has managed to convert vulnerabilities into opportunities—especially in its trade engagements with sanctioned states like Iran and resource-rich powers like Russia. At the same time, its South Asian neighbour, Sri Lanka, has been mired in economic hardship, political volatility, and institutional inertia. Two key trade domains—tea and petroleum—illustrate how India’s assertive foreign economic policy created gains at the expense of Sri Lanka’s missed opportunities.

Tea trade with Iran: India’s gain amid sanctions, Sri Lanka’s missed bargain

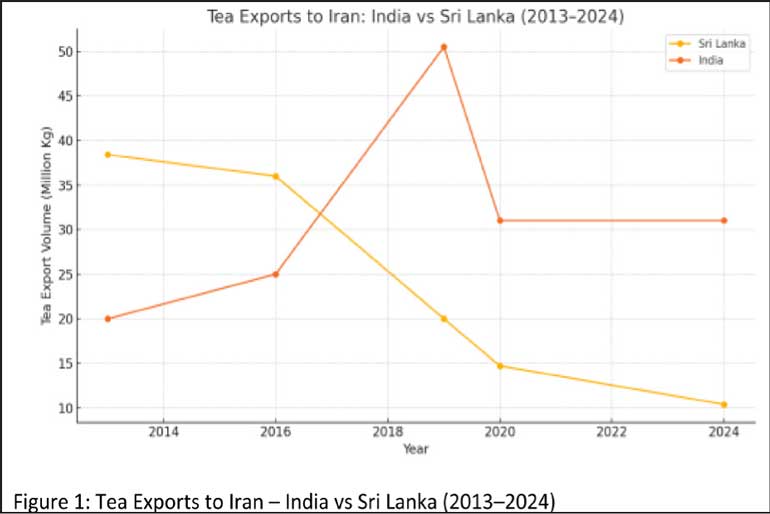

Tea has long been one of Sri Lanka’s principal export commodities. Its premium “Ceylon Tea” brand has dominated Middle Eastern and Central Asian markets for decades. Among its most loyal buyers was Iran, which imported tens of thousands of metric tonnes annually from Sri Lanka. In 2013, Sri Lanka exported over 38,420 metric tonnes of tea to Iran. However, by 2020, this figure had dropped drastically, with devastating consequences for the island’s already fragile export economy.

Sanctions, and the Indian advantage

The turning point came after 2018, when the United States re-imposed unilateral sanctions on Iran following the US withdrawal from the Joint Comprehensive Plan of Action (JCPOA). These sanctions primarily targeted Iran’s oil and financial sectors, making it difficult for traditional trading partners to transact in US dollars.

India, anticipating the geopolitical shift, activated a Rupee-Rial payment mechanism through UCO Bank in Kolkata—a state-run institution previously used for Indo-Iran trade. This allowed India to continue exporting non-sanctioned goods, such as tea, basmati rice, and pharmaceuticals, to Iran without violating US restrictions. This institutional foresight yielded immediate results. In 2018, India exported roughly 24.7 million kilograms of tea to Iran. By 2019, this number surged to over 50 million kilograms, effectively doubling in a single year. Iran quickly became India’s second-largest tea importer, absorbing nearly 20% of India’s total tea exports that year. Indian exporters also benefitted from Iran’s preference for whole-leaf orthodox tea, which matched India’s production strengths.

Sri Lanka’s stalled barter deal

Sri Lanka, which had historically dominated the Iranian tea market, found itself struggling to maintain its trade link. In 2021, Colombo announced a tea-for-oil barter arrangement with Iran. This deal was designed to repay an outstanding oil debt of $ 251 million by exporting tea instead of settling it in hard currency. While the agreement was innovative and technically in compliance with international sanctions (since tea is not a restricted commodity), it ultimately floundered.

The main reasons for its failure were bureaucratic inefficiency, declining tea production due to climate and fertiliser bans, and lack of institutional mechanisms similar to India’s rupee-rial channel. As a result, Sri Lanka’s tea exports to Iran fell to just 14,730 metric tonnes by 2020—a 60% decline from 2016.

India, meanwhile, stepped in to fill the vacuum. By 2020, Sri Lanka’s share in the Iranian tea market had dropped from 47% in 2016 to about 25%. The void left by Sri Lankan suppliers was effectively occupied by Indian tea exporters, solidifying India’s role as Iran’s preferred supplier of orthodox tea.

Petroleum trade: India’s refining edge and Sri Lanka’s growing dependence

India’s second major economic gain came in the petroleum sector, particularly following Russia’s invasion of Ukraine in February 2022. As Western sanctions isolated Russia from global energy markets, India emerged as a key customer of discounted Russian crude. But India did more than just purchase—it refined and resold.

India: Refinery of the East

Indian refineries such as those in Jamnagar (Reliance Industries), Vadinar (Nayara Energy), and Paradip (IOCL) began purchasing large volumes of Russian Urals crude at up to 30% discounts. These crude consignments were processed domestically and re-exported as refined petroleum products—including gasoline, diesel, and aviation fuel—to countries that had banned direct purchases from Russia.

Between December 2022 and December 2023, India exported over $ 6.65 billion worth of refined petroleum products derived from Russian oil. While much of this was destined for Western markets, several developing countries, including Sri Lanka, became indirect beneficiaries—or, as some analysts argue, dependent consumers—of this arbitrage strategy.

Sri Lanka’s fuel crisis and dependency

Sri Lanka’s plight in 2022 is well-documented. With foreign reserves dipping below $ 50 million and widespread shortages of fuel and essential goods, the country entered a state of economic emergency. The Government defaulted on its debt, leading to plummeting creditworthiness and difficulty accessing international fuel markets.

Sri Lanka made overtures to Russia to directly procure discounted crude but failed due to the absence of sovereign guarantees and logistical preparedness. The country turned to India, which responded by extending multiple lines of credit, including a $ 500 million credit line for fuel.

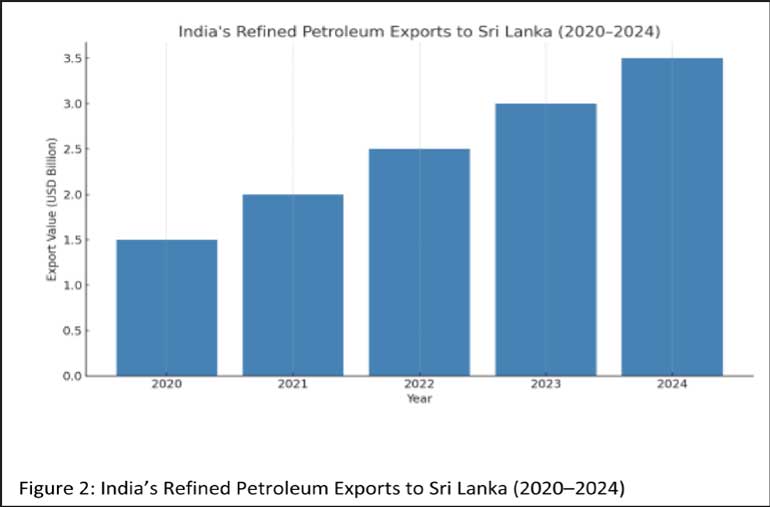

From 2020 to 2024, India’s refined petroleum exports to Sri Lanka surged dramatically:

By the 2023–24 fiscal year, petroleum products accounted for 17.04% of India’s total exports

to Sri Lanka.

Although official figures don’t trace the origin of the crude used in Indian refineries, it is widely accepted that a significant portion of the fuels exported to Sri Lanka were processed from discounted Russian oil. This positions India as both a beneficiary and a gatekeeper of global energy realignments.

Broader implications and lessons

The contrasting outcomes of India and Sri Lanka in these two trade segments highlight a deeper reality: the ability to benefit from global crises depends on institutional capacity, diplomatic adaptability, and economic preparedness.

India’s success factors:

Conclusion

India’s gains in tea and petroleum trade are not accidental—they are the result of calculated decisions, institutional foresight, and diplomatic agility. Whether through expanding exports to Iran amid sanctions or refining and redistributing discounted Russian crude, India transformed the crisis into leverage.

For Sri Lanka, the story has been more sobering. Once dominant in Iran’s tea market and self-reliant in regional trade, the country has seen its economic sovereignty curtailed. In both the tea and energy sectors, it ceded ground to India—ironically, a partner with whom it shares deep historical, cultural, and geographical ties.

The key takeaway is clear: in an era of uncertainty, agility and readiness determine who reaps the rewards and who bears the costs.

References:

1.CEIC Data, India Tea Export Volume, 2019

2.Indian Tea Association Reports, 2019

3.Sri Lanka Tea Board Export Statistics, 2013–2020

4.Ministry of Plantation Industries, Sri Lanka, 2021

5.Business Standard Report, February 2024

6.Indian DGCI&S Trade Bulletin, May 2024

7.Reuters, July 2023

(The writer is former Sri Lankan Ambassador to EU, Belgium, Turkey and Saudi Arabia, and former Head of Sri Lanka Mission in Moscow.)