Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 1 September 2023 00:22 - - {{hitsCtrl.values.hits}}

Tourism debt stock has increased significantly because of the extraordinary high interest rates in 2022 and 2023

Moratorium management options

Introduction

Introduction

The tourism sector in Sri Lanka has historically been a significant contributor to the country’s economy. It plays a vital role in terms of foreign exchange earnings, job creation, and overall economic development. In 2018, the tourism sector emerged as the second-largest contributor to forex income. Officially $ 4.5 billion and around $ 500 million unofficially. The industry is undeniably the key to economic recovery given the growth and dynamics of the global tourism and hospitality industry.

However, the recent crisis within the country, including the Easter Sunday attacks, COVID lockdowns and economic crisis caused havoc within the sector. The multiple crisis has challenged the sector and exacerbated the debt accumulation in the sector. The sector is now recovering and the sector needs serious handholding to restructure the sector’s debt. A strategy is required to safeguard the industry’s future and whilst ensuring the stability of the banking sector and encouraging the banking sector to rise up to the challenge to support the tourism industry as a key thrust industry.

An effective partnership therefore between banks, businesses, and policymakers is crucial to ensure a well-coordinated and sustainable recovery. The tourism sector can contribute significantly to overall economic growth. Banks’ support through lending and financing will help the sector to recover, and drive economic activity.

Sustainable growth

Tourism, as an export-driven industry, fuels the economy by generating foreign exchange; it is an export that does not leave the country while stimulating multiple small industries that complement this service industry. This unique position deems it worthy of being designated a priority sector. Historically, it has demonstrated the ability to rapidly earn forex while creating employment opportunities, a vital buffer against the impacts of depreciation and inflation. However, the alarming rise in moratorium loan accumulations, interest on interest at 25-30%, especially in recent years, threatens the future stability of the sector.

Clear direction

In 2018 the total exposure of the tourism sector to banks’ was around 4.8% of the total gross loans and has now increased to 6.2%.

From 2018 to 2022, (Total loans: 2018 – Rs. 6,128,626/ 2022 – Rs. 9,176,698) total gross loans and advances in the banking sector has increased by 50% whereas the advances and penalties to the tourism sector grew by 95%; with a particularly sharp surge of 31% in the last year alone (December 2021-2022) compared to the growth of 5% in the banks’ total outlays for the same period.

This unsustainable growth in loan accumulation within a year of over 6 times compared to the total loan portfolio growth; compounded by interest-on-interest, which was further fuelled by the increased lending rates which peaked to 29.67% in Nov 2022 compared to 8% in 2019 has far outpaced the growth in the tourism sector itself where tourist arrivals reduced from 2.3 m in 2018 to only 719,000 in 2022 and has reached 767,000 year to date in 2023.

Stabilising the banking sector

The disproportionate growth in moratorium loan accumulations poses a threat to both the tourism industry and the banking sector. The non-cash moratorium interest accumulated gains reflected in balance sheets of banks have created a void in its Tier 1 capital which also imposes a direct threat to its stability. To prevent any destabilisation, a comprehensive restructuring plan is now necessary. The government needs to give leadership and direction to banks, so that banks can strengthen their balance sheets and avoid the need for additional capital infusion.

This can reduce the risk of NPLs further escalating and forced asset sales. The financial resources channelled into the tourism sector through loan restructuring will not only boost the industry but protect livelihoods. The industry is suffering from low service standards due to the exodus of trained staff to overseas markets and due to the inability to direct funds to invest in infrastructure upgrades to compete with other destinations. Several studies have shown that every $ 1 invested in the tourism sector can yield returns ranging from $ 2 to $ 10 or even more.

Conclusion

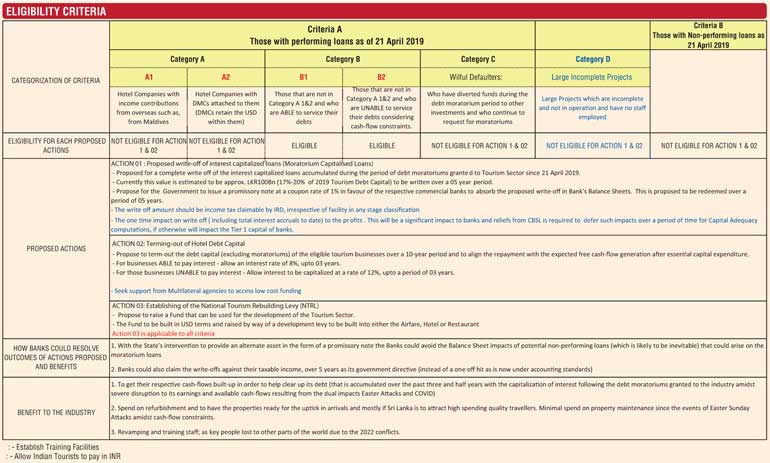

The tourism industry’s criticality as a vital growth sector cannot be overstated. The Government certainly needs to handhold the industry (without leaving it to regulators who don’t have a helicopter view of all sectors) to recover and to bring the industry back on a path of growth and sustainability. Therefore restructuring of sector moratorium loans (see given grid) is key to the tourism sector recovery. Therefore clear direction from the Government can give the tourism industry the much needed space to recover and facilitate the required re-investment the sector desperately needs to compete with other destinations.