Saturday Feb 14, 2026

Saturday Feb 14, 2026

Saturday, 18 March 2023 00:08 - - {{hitsCtrl.values.hits}}

Much for us to consider about the IMF, a decisive player in our lives for the foreseeable future, and on the horizon, the prospect of a new Asian regional financial architecture

Much for us to consider about the IMF, a decisive player in our lives for the foreseeable future, and on the horizon, the prospect of a new Asian regional financial architecture

They would be shocked to note that in Sri Lanka, the contents of the IMF agreement are kept secret from all those actors including Parliamentarians and would be made public only after signatures have been placed on it, committing Sri Lanka, that means all of us, to it.

The IMF has now entered the ordinary citizen’s consciousness as the most impactful global institution for us Sri Lankans at the present time. Everything from local government elections to tax policies, that shape our daily lives and cover most of our human rights, are being affected by our relationship with the IMF. Important human rights such as Freedom of Assembly and Expression are being violated by the Sri Lankan Government in the name of its agreement with the IMF.

The IMF has now entered the ordinary citizen’s consciousness as the most impactful global institution for us Sri Lankans at the present time. Everything from local government elections to tax policies, that shape our daily lives and cover most of our human rights, are being affected by our relationship with the IMF. Important human rights such as Freedom of Assembly and Expression are being violated by the Sri Lankan Government in the name of its agreement with the IMF.

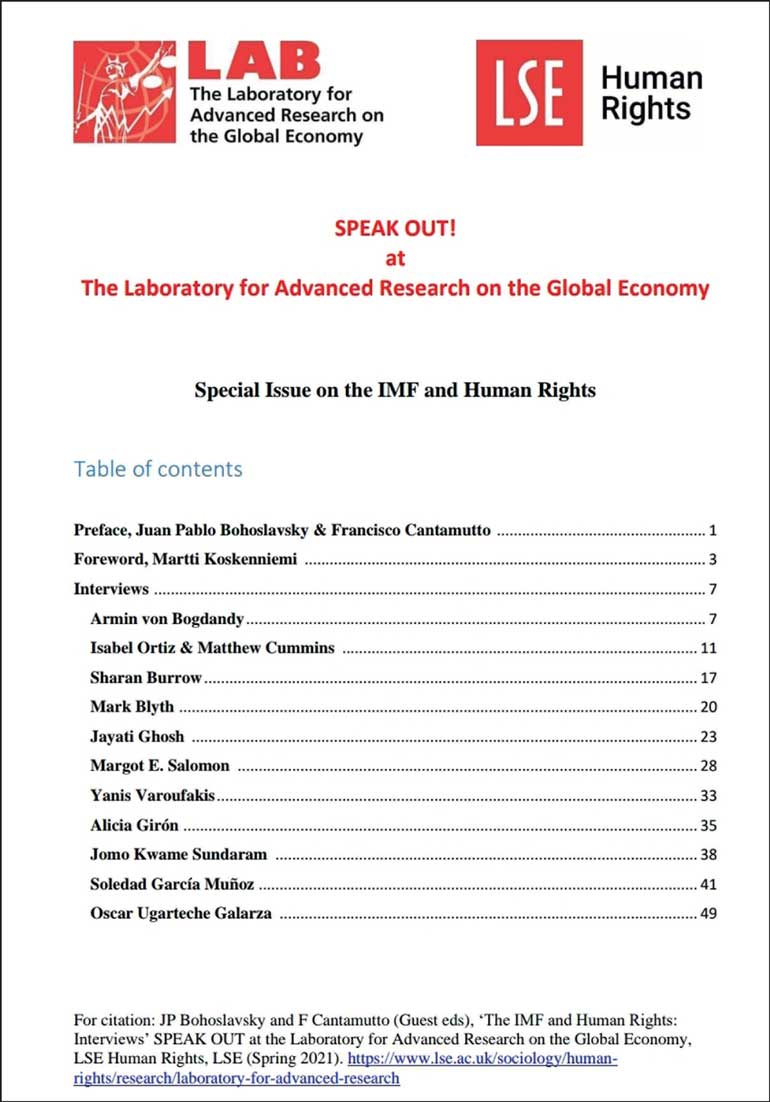

The London School of Economics (LSE) publication “Special Issue on the IMF and Human Rights”, comprises a series of interviews carried out from January to April 2021 with two guest editors in collaboration with the SPEAK OUT! Series at the Laboratory for Advanced Research on the Global Economy at LSE Human Rights. [The full title of the publication is JP Bohoslavsky and F Cantamutto (Guest eds), ‘The IMF and Human Rights: Interviews’, SPEAK OUT at the Laboratory for Advanced Research on the Global Economy, LSE Human Rights, LSE (Spring 2021)]. https://www.lse.ac.uk/sociology/humanrights/research/laboratory-for-advanced-research

Choices, not just algorithms

The first paragraph of the introduction by Martti Koskenniemi, Professor of International Law, clarifies why these interviews are relevant:

Today, bearing in mind that the World Food Program has declared 59% of the Sri Lankan population suffers from “food insufficiency”, the LSE interviews help us to understand the context in which our own agreements with the IMF are being considered.

Sri Lankans will readily agree with Koskenniemi’s position that rather than the question of human rights vs. the economy, the “difficulties” with agreements with the IMF are more about “contrasting views about which and whose rights should be prioritized through the economic policies pursued by international financial institutions.”

Since the IMF has now become a dominant or determining fact of life for us, it is important to take note of what he says about the work of international financial institutions:

“… in the advice they give, their development and credit policies and conditionalities – is always choice and never just “application” of some algorithm or mathematical formula… For every significant economic model there is a counter-model based on different priorities, that picks from history different examples and arranges the pertinent data into a divergent set of recommendations and economic program. It would be wrong from this perspective to keep insisting on the merely technical character of the work of bodies such as the IMF or the World Bank.”

So, there is always, everywhere, someone making a choice—meaning, a decision—including the IMF officials dealing with Sri Lanka and Lankan officials dealing with the IMF.

He also claims that despite their assertion about human rights not being part of their mandate, what they do “can be understood by reference to choices made to support this right while, inevitably in a world of limited resources, refraining from supporting that.”

Vocabularies

Those of us without any expert technical knowledge of how global financial institutions work and the complicated methods they use, can however make ourselves aware of the limitations experts face in making those decisions. This information alerts us to their vulnerabilities and explains their failures. It helps us to understand that experts can and do get things wrong, and the constant invocation of their technical expertise isn’t the failsafe that it appears to be.

One factor is to do with language. Koskenniemi says:

Since expertise of language that’s required to be mastered makes them pretty much biased towards a certain “set of values”, it is right and just for those who will eventually be impacted by those biases to ensure their concerns are heard. Koskenniemi concludes that “… if the question is never raised about the effect of those politics on the rights of the affected groups, it is hard to see how they could be justified beyond the small group of experts having produced them.”

The LSE Special Issue contains 11 interviews with a range of international experts including with professors Jayati Gosh and Yanis Varoufakis who have recently taken part in several conferences discussing Sri Lanka’s engagement with the IMF.

The first interviewee Armin von Bogdandy, Professor for Public Law, European Law, and International and Economic Law at the Goethe University Frankfurt, comments on the IMF position that it is “not allowed to nor legally forced to consider human rights when granting loans or offering policy and technical advice.” He says that the IMF’s status as a UN Specialized Agency obliges it to respect the United Nation’s human rights objectives contained in the UN Charter and that the IMF’s Guidelines on Conditionality of 2002 requires it to “pay due regard to domestic social and political objectives”.

Alternatives to austerity

Consider the following question to Isabel Ortiz of Columbia University and Matthew Cummins, an economist with UNICEF:

“… are there parts of society that were protected and did not have to make sacrifices like the majority?”

The answer:

They also assert that:

They cite 8 options approved by the UN which include:

They urge ‘national public dialogue’:

They would be shocked to note that in Sri Lanka, the contents of the IMF agreement are kept secret from all those actors including Parliamentarians and would be made public only after signatures have been placed on it, committing Sri Lanka, that means all of us, to it.

Another interviewee, Sharan Burrow suggests that the IMF does not learn from its own research:

Today, bearing in mind that the World Food Program has declared 59% of the Sri Lankan population suffers from “food insufficiency”, the LSE interviews help us to understand the context in which our own agreements with the IMF are being considered. Sri Lankans will readily agree with Koskenniemi’s position that rather than the question of human rights vs. the economy, the “difficulties” with agreements with the IMF are more about “contrasting views about which and whose rights should be prioritized through the economic policies pursued by international financial institutions”

Double standards

Here’s a counter-perspective on “Austerity” that you may not have heard of. Mark Blyth, Professor of International Economics, author of a book entitled “Austerity: The History of a Dangerous Idea”, says the following in his interview:

He critiques a study that looked at the experience of “several small open economies who cut their spending and then grew out of the recession that they found themselves in – Denmark, Australia, Sweden or Ireland….” leaving out that the spending cuts “had nothing to do with the boom”.

Blyth says that “the current head of the IMF said recently that survival trumps fiscal rectitude”. That an IMF head acknowledged this is an encouraging development. He says that “… as early as 2013 the IMF research department was beginning to dismantle the case for austerity. By 2017 the orthodoxy had changed.”

However he says this change in the IMF’s attitude towards austerity doesn’t seem to apply to countries “that are usually indebted to the IMF in sub-Saharan Africa and Latin America”. Double standards seem to apply in their case. He found a more mixed picture with “the same conditionalities and ‘privatize/liberalize’ policies being followed as before. So yes, the technical and analytic stuff matters, but its diffusion into policy is not guaranteed.” This is clearly not good news for Sri Lanka.

Prof. Jayati Ghosh, University of Massachusetts Amherst, says that the IMF is making the “right noises in general” at the top leadership level. However:

“…in dealing with individual developing countries, the IMF is still insisting on conditionalities that would limit fiscal expansion or even cut public spending, and reduce the state’s ability to protect citizens and engage in greater health expenditure.”

In a pretty discouraging analysis indicating what we may expect for ourselves, she says of the IMF:

Accountability gap

Margot E. Salomon, Associate Professor at the LSE, commenting on the accountability gap of International Financial Institutions such as the IMF says:

However, addressing the case of sovereign debt, she says:

Yanis Varoufakis, the former Finance Minister of Greece has a firmly cautionary message about the IMF:

A new financial architecture

Oscar Ugarteche Galarza, Senior Researcher, Instituto de Investigaciones Económicas UNAM (i.e., University of Mexico) says:

In answering a question on the redesign of the international financial architecture he predicts an Asian-driven confrontation within the IMF:

Much for us to consider about the IMF, a decisive player in our lives for the foreseeable future, and on the horizon, the prospect of a new Asian regional financial architecture.