Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 6 December 2022 00:22 - - {{hitsCtrl.values.hits}}

The President has expressed interest in setting up an Asset Management Company in his budget speech

Banks and Financial Institutions are net contributors to a country’s GDP with their core function in granting credit to businesses and individuals.

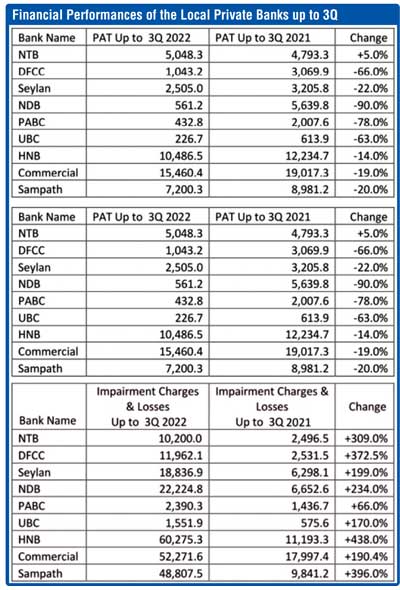

The industry is confronted with a huge challenge today with twin factors of super high interest underlying depressed credit demand and low liquidity. The resultant low credit growth has adverse marked knock-on effects on other streams of income as well such as trade finance, exchange gains and guarantee income.

A major area of concern has been collections and recoveries resulting in impairment charges putting further pressure on the bottom line. It is estimated that by the year-end NPAs to be close to 10%-12%. Estimated value is around Rs. 1.2 trillion. The problem is billions in impaired tourism, real estate and other assets are sitting on bank balance sheets waiting to be recovered with an improvement in the wider macro environment, which is very challenging and pushes banks to redeploy resources away from credit growth and a much needed contribution to GDP.

Solutions

The Government needs to work fast to give some breathing space to the liquidity stretched banks by creating an Asset Management Company (Bad Bank) to take over the toxic assets of the banks. If not shareholders will be forced to pump in new money into the financial sector. There are successful examples of such interventions. For example a National Asset Management Company (NAMA) was established as part of Ireland’s response to the banking and property crisis that combined to destabilise the country’s finances and economy from the latter part of 2008. In Ireland’s April 2009 Supplementary Budget, NAMA was given the objective of ‘cleansing and repairing the banks’ balance sheets’ as a ‘fundamental’ first step in achieving a sustained recovery in the Irish economy and its banking system’.

Brian McEnery of NAMA recently shared his experience in working as a member of the Board of Directors of Ireland’s specialist Non-performing Loan Bank (NAMA) which is the biggest NPL Bank in the world with a balance sheet of € 74 billion in non-performing loans. NAMA has been described as the best-performing non-performing loan bank in the world. McEnery explained how the concept of setting up a non-performing loan bank requires the involvement and commitment of the Government, the Regulator and the banking sector in order for it to be effective and profitable. He also explained the challenges faced by the banking community in Ireland and how the NPL Bank supports the banking system in mitigating its risks and minimising its costs. Further, he noted that such a vehicle brings stability to the banking industry and contributes positively to other macro-economic factors. It is seen as a win-win for all stakeholders concerned.

The other example, though with a wider remit over financially stressed companies is Danaharta, created in 1998 in Malaysia on the back of the Asian Financial Crisis.

The more recent example is the Indian twins created in 2021 – National Asset Reconstruction Ltd. (NARC) and the India Debt Resolution Company (IDRCL) following the financial market stress of the COVID disruptions, though the jury is still out on this initiative.

This NPL Bank can either be a Policy Bank for a limited period of (say) 10 years to purchase the Banks NPAs and continue to liquidate those assets until full discharge and closure or be a permanent player in the financial sector stepping in to support them with the ebb and flow of the wider macroeconomic metrics.

Most impaired assets post-COVID are now toxic to the banks and would continue to rattle the markets until the losses associated with the assets became clearer to the banks and can be recovered within their existing recovery powers.

Therefore given the need to stabilise the banking sector and restore the flow of credit into the economy while minimising the risk to the depositors, it would be best to create a vehicle to take over these impaired assets of the banks along with associated collateral at agreed upon valuations and for specified assets on the balance sheets of systemically important banks and, improve the availability and growth of credit in the country to stem its drag on the growth of the economy.

Way forward

Way forward

a) Legislate and create an Asset Recovery and Management Company Ltd. under the MOF, with all conceivable powers legislated by Parliament, including those accruing to the Banks and Financial Institutions, to recover these assets, including the Debt Recovery Act, the Crib regulations and even listed Company regulations plus additional protections against spurious legal challenges, given its overarching wider mission and objectives.

Or

b) Create a Specialised Bank under the Banking Act, with appropriate forbearance on banking requirements of ownership and other prudential norms, with supporting recovery powers legislated by Parliament, and with all conceivable powers, including those of the banks to recover these assets, including the Debt Recovery Act, the Crib regulations and even listed Company regulations plus additional protections against spurious legal challenges, given its overarching wider mission and objectives.

(Both vehicles will require serious high level banking expertise to set up)

Conclusion

Banking regulations must also get tough with the whole separation of investment banking from retail banking or in terms of ground realty i.e. Asset Investment and Trading for capital gains, from that of Credit and Banking operations. This must be clearly enshrined legislatively so that the former is backed by risk capital (i.e. equity and institutional debt capital) and the later by borrowings and customer deposits.

In the final analysis, as Brian rightly points out, “I believe prevention is better than cure, as in the strong property market in Sri Lanka. It’s like when that milk is in the pot, and the problem is when it boils over, it’s too late. So the thing is to keep a very watchful eye now and ensure the milk does not spill over and to keep a lid on it, and I think that is a good analogy to ensure the system doesn’t boil over and prevention is always better than cure.”

Reference: