Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 7 June 2022 03:05 - - {{hitsCtrl.values.hits}}

Continued from yesterday

IMF has just concluded a joint technical session with Sri Lanka to determine a roadmap for restoring macro-economic stability and debt sustainability that will serve as a platform for the negotiations with other creditors/lenders, later. Furthermore, this joint initiative once implemented in compliance with IMF conditions, is expected to increase investors’ confidence and also in securing additional resources from the IMF, the World Bank, Asian Development Bank, and other such agencies.

Amidst all these, there appears to be a silver lining in the dark financial clouds that hovering over Sri Lanka at present where even an adversity of this magnitude could be turned into an excellent medium or long-term investment opportunity. The silver lining in the dark horizon is that the leading international donor agencies are steadily moving towards ‘sustainable financing’ in compliance with the Paris Agreement on Climate Change in the present green economic era.

Sustainable finance roadmap for Sri Lanka

Sustainable finance refers to the process of taking environmental, social and governance (ESG) criteria (developed by the United Nations Principles for Responsible Investment – PRI) into account, when making investment decisions in the financial sector. These in turn will lead to more long-term investments in sustainable economic activities and projects.

Sri Lanka too joined this bandwagon in developing a Roadmap for Sustainable Finance way back in 2016/2017. It is aimed at integrating ESG criteria into financial decision-making processes in order to help build a more resilient and sustainable green economy. These sustainable finance practices are expected to promote assistance to make the businesses greener, climate-friendly, and socially inclusive.

This Sustainable Finance Road Map for Sri Lanka was prepared through an inclusive multi-stakeholder process and launched in 2019 with financial assistance from the Biodiversity Finance Initiative (BIOFIN) from the UNDP and technical support from the International Finance Corporation. In this ‘new normal’ era of post-pandemic banking, sustainable finance is expected to become a key mover in achieving social, economic, and environmental goals in a green economic milieu.

The Biodiversity Finance Plan (BFP) for Sri Lanka (2018-2024) prepared collectively by the then Ministry of Finance and Media, The Ministry of National Policies and Economic Affairs, and the Ministry of Mahaweli Development and Environment in 2019, intends to support sustainable biodiversity management efforts of Sri Lanka by mobilising finance for investing in biodiversity by both the public and private sector.

A considerable amount of background preparatory work detailed in three technical reports (i.) Policy and Institutional Review, (ii.) Biodiversity Expenditure Review, and (iii) Financial Need Assessment, has gone into developing this Biodiversity Finance Plan for Sri Lanka. It is expected to achieve national biodiversity targets that include conservation, sustainable management, and equitable distribution of benefits among all stakeholders, the three main pillars of the Convention on Biodiversity.

During this process, the national biodiversity and climate change-related strategic plans viz. National Biodiversity Action plan (NBSAP 2016-2022), National REDD+ Investment Framework and Action Plan (NRIFAP 2018-2022), National Action Program for Combating Land Degradation in Sri Lanka (NAP-CLD 2015-2024), and National Adaptation Plan for Climate Change Impacts in Sri Lanka (2016-2025) have been consulted for estimating the financial gap constraining investment needed for their effective implementation.

In addition, the vision of the BFP is directly linked to the following Sustainable Development Goals (SDGs), Goal 13: Climate Action; Goal 14: Life below Water, and Goal 15: Life on Land. It is indirectly linked to several other SDGs such as Goal 6: Clean Water and Sanitation, Goal 11: Sustainable Cities and Communities, and Goal 12: Responsible Consumption and Production.

The BFP has been designed to meet the biodiversity financing needs of the country by mobilising resources for investing in conserving biodiversity, promoting its sustainable use, and equitable sharing of its benefits. This is to be achieved with the participation of all major stakeholders – the Government, the corporate sector, and the community.

Thirteen different finance solutions viz. sustainable standards and certification, eco-labels, green lending, corporate social responsibility, lotteries, payment for ecosystem services, green bonds, ecotourism, conservation license plates, carbon markets, lobbying for public budget allocations, and diaspora savings and investment, have been identified based on the information given in national and sectoral planning documents of Sri Lanka. Each of these has been elaborated on in some detail with action plans in the BFP 2018-2022 document.

Most of the prioritised financial solutions listed above are already in operation, though at a modest scale. They need to be scaled up with judicious resource mobilisation to be more responsive to the conservation and sustainable development, equitable sharing of biodiversity and ecosystem service benefits. Consequently, with all this background preparative work accomplished, Sri Lanka is in a strong position to make the current adversity into an opportunity of a lifetime.

Green bonds

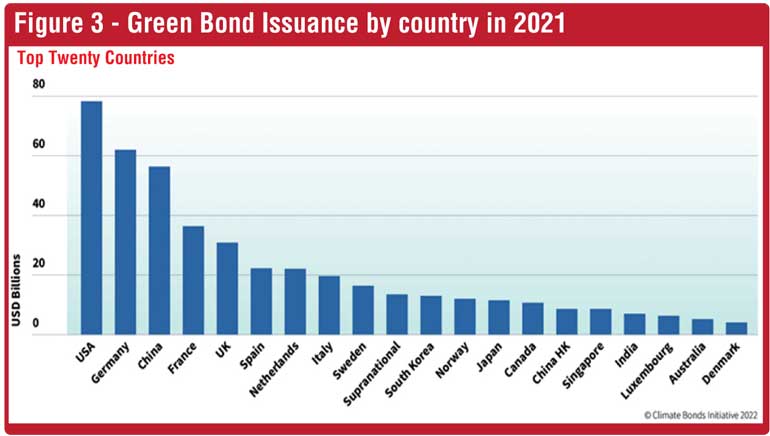

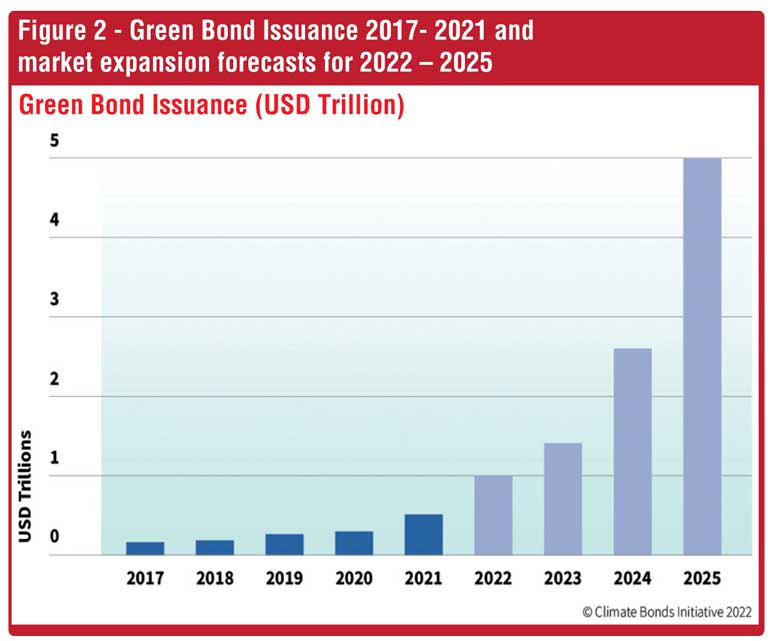

One of the fastest developing financial or refinancing solutions on a global scale is coming from issuance of sustainability-linked international sovereign green bonds and other similar instruments such as sustainability-linked bonds, climate bonds and social bonds (Figures 2 and 3). The repayment of debt using these green bonds and the like is tied to the achievement of institutional environmental, social and governance (ESG) targets, such as greenhouse gas emission reductions. The growth of green bonds in the global capital markets has been explosive in recent times and is increasingly attracting attention of the corporate entities around the globe. Global Green Bond investments have topped $ 500 billion in 2021 for the first time and it is expected to reach $ 1 trillion this year.

Most of the green bonds in the world have been issued to finance relatively large projects in the areas of Renewable Energy, Transport, Pollution Prevention and Control, Water and Waste Management, Environmentally Sustainable Land-use, Agriculture and Forestry, Reduction in Carbon Emission, and Green Infrastructure, and since of late for Biodiversity Conservation.

Governments, major financial centres and central banks world over are greening their financial systems by developing green bond guidance, green taxonomies, regulation, and reporting guidelines. Investors worldwide are waking up to the importance of incorporating biodiversity as part of ESG risk assessments and their effective management. This is due in part to the increasing focus on this topic since the United Nation’s Intergovernmental Science-Policy platform on Biodiversity and Ecosystem Services (UN-IPBES) produced its landmark Global Assessment Report on Biodiversity and Ecosystem Services in May 2019, casting the spotlight on the alarming declines of biodiversity worldwide.

Although Sri Lanka has not yet availed herself of this innovative financial solution of investing in Green Bonds, it is ideally placed to benefit from this emerging opportunity, for Sri Lanka being one of 36 global hotspots of biodiversity. Sri Lanka has actively participated in sustainability-focused investments through the Sustainable Banking Network of the International Finance Corporation, and it is a fortuitous coincidence that the present Governor of the Central Bank, himself, has taken an active role in this global network activities in the past (see photo).

The Central Bank of Sri Lanka and the financial sector, in general, have been moving in the direction of sustainable financing with the preparation of the required technical details listed earlier. The latest addition to it is the ‘Sri Lanka Green Finance Taxonomy’ (a classification system established to provide guidelines for integrating sustainability into investment decisions), published by the Central Bank on 6 May 2022. Green Bond Principles (GBP) is one of several well-known taxonomies that provide guidelines specific to green bonds.

Consequently, Sri Lanka has already put in place the necessary institutional infrastructure in financial markets for entering into green bond initiatives. Furthermore, Sri Lanka has been raising international finance by issuing bonds since 2007. As such, the government and the financial institutions are quite familiar and well equipped with the necessary groundwork to enter the international (green) bond market. The BFP reports that the Government of Sri Lanka recommends the issuing of international sovereign green bonds as a sustainable finance solution to mobilise relatively large sums of debt capital for investing in large-scale biodiversity projects, combatting land degradation, arresting habitat and species loss, maritime reef conservation, coastal conservation, and sustainable energy.

All these project documents (viz. NBSAP, NRIFAP, NAPCLD, and NAPCCI) prepared with broader consultation and supported by the respective UN agencies are therefore, consistent with the global conventions as well as national-level policies and strategies on biodiversity, climate change, and land degradation. The Wildlife and Forest Conservation Departments have carried out several biodiversity and ecosystem management projects including the preparation of two pilot scale novel Landscape Management Plans – one for Sinharaja Rain Forest Complex and the other for Hurulu-Kaudulla-Kantale forest complex with financial support from the Ecosystem Conservation and Management Project (ESCAMP 2018-2022) of the World Bank. These plans are available as excellent opportunities for consideration in raising funds from international capital markets for restructuring at least some of the ISBs into Green Bonds. Similarly, Forestry Sector Master Plan first prepared in 1995 is being revised to meet the present-day forestry sector needs which again, together with NBSAP, NRIFAP, NAPCLD, and NAPCCI are good candidates for similar capital investment considerations during the debt restructuring process.

Green energy

With respect to sustainable energy, especially the generation of electricity has become one of the most critical issues at present in Sri Lanka. The UNDP and ADB joint assessment of ‘Sri Lanka’s Power Sector – 100% Electricity Generation through Renewable Energy by 2050’ provides opportunities for green-bond solutions, among others in this area. Sri Lanka being one of the forty-three countries of the Climate Vulnerable Group which are disproportionately affected by climate change, has signed the declaration at the 22nd COP meeting of UNFCCC in Marrakech, Morocco in 2016 to reach these ambitious renewable electricity generation targets by 2050.

However, the UNDP-ADB joint assessment records that the Long-term Generation Expansion Plan (LTGEP) for Sri Lanka, 2015-2034 (http:// pucsl.gov.lk/english/wp-content/uploads/2015/09/Long-Term-Generation-Plan-2015-2034-PUCSL.pdf) envisages adding at least two more coal-fired power plants, one in Trincomalee (2 x 300 MW) in 2029 onwards and the other in the Southern Region (3 x 300 MW) from 2027 onwards. The report however cautions that stiff resistance from local communities and possible litigation moves by environmental groups may lead to change this long-term generation plan.

According to the same report (table 41: p 113), several thermal power plants are likely to be retired from operation due to their age-related malfunctioning and these capacities also will need urgent replacements to ensure Sri Lanka’s growing electricity demands. Therefore, actual future coal-based capacity addition to our national grid may be much lower than planned. The same report adds that by 2050, the 100% Renewable Energy scenario can potentially save $ 18-$ 19 billion on imported coal as compared with the base case scenario, which relies heavily on coal.

The Ceylon Electricity Board’s long-term generation planning is based on the “least cost principle” which has led to its focus on significantly cheap coal-based capacity development. However, they have not considered the environmental and health cost externalities in their calculations. Inclusion of the cost of carbon emission, air-quality and health related issues and other externalities would provide a more realistic picture of benefit/cost of the use of coal for electricity generation. Unfortunately, the natural resource economists have not yet brought these environmental and health costs associated with coal-fired power plants in Sri Lanka to the attention of the CEB. Alternatively, it may be that the information available either from Sri Lanka or our neighbouring countries have not been taken into consideration in the calculation of ‘least cost’.

Unless these developments are taken into consideration, the roadmap developed as a part of the LTGEP, while making provisions for increased adoption of renewable energy in the electricity generation mix, is unlikely to be the basis on which the Sri Lanka can transform its power sector into a 100% RE sector by 2050. Consequently, there is a pressing need for updating the LTGEP with the global shifts to renewable energy sources mandated by the Sri Lankan government in compliance with the UNFCCC recommendations. Such projects could be very attractive for international donors, and they may rank very high in eligibility for Green Bond investments.

Furthermore, the COP 26 meeting of the UNFCCC held in Glasgow in 2021 set a new gold standard on the ‘Paris Alignment of international public finance’ to move away from Coal - the single biggest contributor to climate change – by the end of 2021. Sri Lanka along with Chile, Montenegro and their European partners pledged that no new Coal Power Plants to be constructed in their respective countries. Alok Sharma, the British minister of State at the cabinet office who was also the COP 26 president announced that more than 40 countries reached a deal and pledged to phase out coal – the dirtiest fossil fuel – by the 2040s. Two notable exceptions apparently had been the USA and China although the US has pledged to end public financing for fossil fuel projects abroad without any carbon capture and storage technology, by the end of 2022.

In light of these recent developments, there is more than a silver lining in our gloomy horizon that Sri Lanka can capitalise on its current debt restructuring process to transform some of her International Sovereign Bonds to Green Bonds for funding Non-conventional Renewable Energy projects through effective engagement at the future negotiations with the IMF and the lenders/creditors. These projects typically involve renewable energy generation and emission reductions among a host of other benefits. Shifting from a coal power to a solar power project in Sampur in eastern Sri Lanka may be one such project put forward by the National Thermal Power Corporation of India recently although the details of the agreement have not been made public, as yet.

There is an enormous potential for Sri Lanka to tap into these green/sustainability bond markets to finance its infrastructure projects/investments such as in waste management, renewable energy projects, biodiversity conservation, public transportation, climate change adaptation and mitigation. As shown above, large/medium/small scale green investment project plans have already been prepared and the sustainable financing infrastructure is already in place, and what is needed is a matter of prioritising these differently sized projects in consultation with appropriate stakeholder groups.

Sri Lanka is a relatively small island with unparalleled diversity of physical, biological and cultural features. Most of her leading agricultural exports (tea, rubber and spices) are in the hands of a diverse set of smallholders which, in a way, are more resilient to cataclysmic changes that may come with the vagaries of the climate from time to time. Therefore, the biodiversity finance projects need not only conserve and sustainably utilise the natural resources but also take adequate measures to distribute the benefits equitably among these smallholders who had been the backbone of the Sri Lankan enterprise. Sri Lanka is known world over as a ‘paradise of smallholders’ and the preservation of that cultural tradition is more important in the future.

Finally, although Sri Lanka has been caught somewhat unawares in a violent tropical thunderstorm (its origin perhaps be rooted in extra-tropical climes), the charting out of it seems to be reasonably well laid out by the technocrats with the support from the international agencies. In order to steady the ship in these viciously turbulent waters, we obviously need a matching political leadership with a clear vision, honesty, integrity, calm but stern demeanour and above all strong and selfless commitment to steer the ship out of the rough seas to calmer waters. The least we need at this critical moment of despondency is a mutiny on board the ship which will only help those prying to grab the best of – as some would call it – ‘this unsinkable aircraft carrier’ in the Indian Ocean.

Concluded

Part I of this article was published in the Daily FT on 6 June and can be seen at https:// www.ft.lk/columns/The-Sri- Lankan-debt-crisis-A-layman-sreview/ 4-735768

(The writer is a member of the Sustainable Development Council and can be contacted at [email protected].)