Sunday Feb 15, 2026

Sunday Feb 15, 2026

Wednesday, 23 April 2025 00:24 - - {{hitsCtrl.values.hits}}

Sri Lanka’s decision to apply VAT to digital services supplied by non-resident platforms is a

progressive step towards aligning with global norms

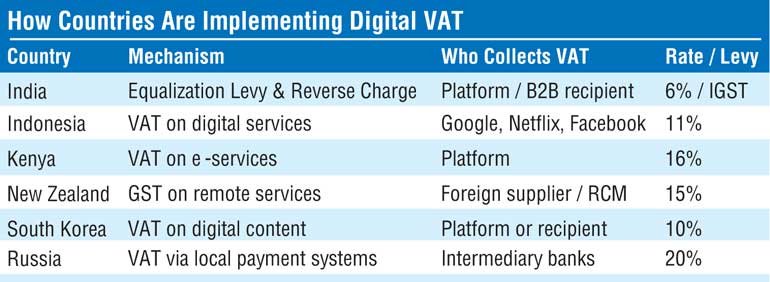

As the digital economy expands, governments across the globe are striving to ensure tax fairness and protect domestic revenues. A key component of this effort is the imposition of Value Added Tax (VAT) on digital services provided by foreign suppliers such as Facebook, Google, Amazon, and Netflix. Platforms that generate substantial income from local markets without a physical presence.

As the digital economy expands, governments across the globe are striving to ensure tax fairness and protect domestic revenues. A key component of this effort is the imposition of Value Added Tax (VAT) on digital services provided by foreign suppliers such as Facebook, Google, Amazon, and Netflix. Platforms that generate substantial income from local markets without a physical presence.

Sri Lanka will join this global trend by introducing VAT on digital services from 1 October 2025, the move marks a significant step in modernising the country’s tax framework in line with international best practices.

Why tax digital services?

In traditional economies, VAT is applied at the point of sale where goods or services are consumed. However, in the digital world, global platforms often escape VAT obligations by operating remotely. This results in a tax gap where foreign companies profit from local consumers while avoiding local tax obligations, a situation that undermines both revenue collection and competitive equity for domestic service providers.

International organisations such as the OECD have advocated for the “destination principle” in VAT systems, which states that tax should be levied in the country where the consumer resides, regardless of where the supplier is located.

The role of Reverse Charge Mechanism (RCM)

In many countries, the Reverse Charge Mechanism is used to ensure VAT compliance in Business to Business (B2B) cross-border transactions. Under this model, the buyer (recipient) of a digital service is responsible for VAT, not the foreign supplier.

Examples of Countries Using RCM for Digital Services:

In these jurisdictions:

For instance, a UK business using Google Ads from Ireland would self-account for UK VAT under reverse charge.

Sri Lanka’s VAT framework already contains provisions for VAT on imported services. It is expected that under the new 2025 digital VAT rules:

Impact on global platforms

Major platforms such as Google and Facebook have voluntarily registered for VAT in many jurisdictions. This includes:

These platforms have adapted by:

Sri Lanka’s approach

Sri Lanka’s decision to apply VAT to digital services supplied by non-resident platforms is a progressive step towards aligning with global norms. The change, effective from 1 October 2025, ensures that digital consumption within the country is taxed in the same way as local services, reducing unfair advantages and increasing government revenue.

Key definitions provided in the Act

“Electronic platform” means any procedure in the form of a website or mobile application used by one or more service providers to provide their services to the service recipients;

“Non-Resident Person” means any person who occasionally undertakes transactions involving supply of services, whether as principal or agent or in any other capacity, but who has no fixed place of business in Sri Lanka, and does not include a person registered under section 10, where such person carries on or carries out a taxable activity in Sri Lanka without a fixed place of business but having an agent to act on behalf of such person as referred to in section 55.”

The Commissioner General of Inland Revenue is expected to publish detailed guidelines for registration and payment procedures. These are likely to include:

Challenges ahead for the Government and the Inland Revenue

Closing remarks

Sri Lanka’s VAT policy shift on digital services signals a new era in taxation, one that embraces global realities while striving for fairness and fiscal sustainability. To ensure success, it will be critical for the government to implement simple, transparent systems for registration and compliance, foster public awareness, and remain adaptable in a rapidly evolving global economic landscape.