Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 28 February 2024 00:20 - - {{hitsCtrl.values.hits}}

Whilst the Treasury must be ecstatic with the collection of tax revenue in 2023, the Government should also ponder on granting relief to the individual taxpayers

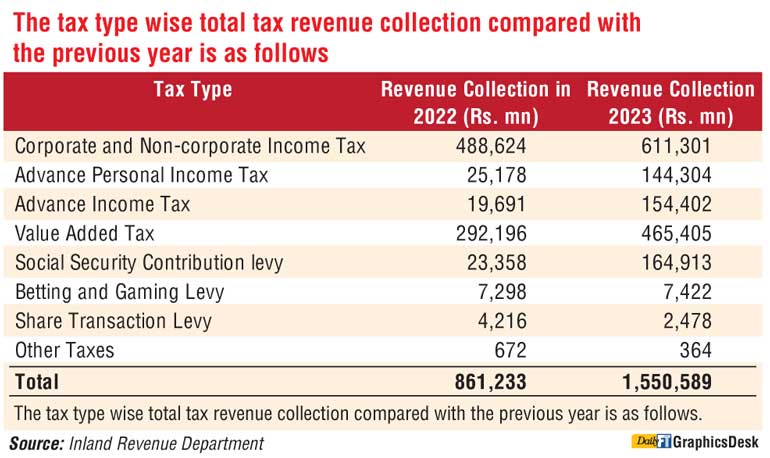

The Inland Revenue Department (IRD) published a press release dated 11 January 2024, stating that the IRD recorded a massive tax collection amounting to Rs. 1,550,589 million for the year 2023. This reflects a significant increase of almost 80% when compared to the tax collection by the Commissioner General of Inland Revenue (CGIR) in the year 2022.

The Inland Revenue Department (IRD) published a press release dated 11 January 2024, stating that the IRD recorded a massive tax collection amounting to Rs. 1,550,589 million for the year 2023. This reflects a significant increase of almost 80% when compared to the tax collection by the Commissioner General of Inland Revenue (CGIR) in the year 2022.

It is interesting to note that, as per the statistics disclosed, 39% of the 2023 tax collection by the CGIR is from Corporate and Non-corporate Income Tax while 9% is from Advance Personal Income Tax (APIT) and 10% is from Advance Income Tax (AIT). Thereby, a total of 58% is collected from Income Tax.

This composition of direct to indirect taxes may differ in the year 2024 since Value Added Tax (VAT) has been subject to numerous changes with effect from 1 January 2024, with the intention of enhancing revenue notably from Indirect Taxes. The amendments introduced to the VAT regime include the VAT rate change, exemption removal and the VAT threshold change. These changes may have the effect of generating a greater collection from indirect taxes in 2024, when compared to the collection from direct taxes.

Whilst the Treasury must be ecstatic with the collection of tax revenue in 2023, the Government should also ponder on granting relief to the individual taxpayers. It is clear that the Government revenue would increase in 2024 due to the higher revenue collection from indirect taxes, stemming from the changes introduced to VAT. Considering such an increase in revenue, the Government could consider providing certain tax reliefs to the individual taxpayers.

The personal tax slabs in Sri Lanka are Rs. 500,000 where each slab will be taxed at progressive income tax rates ranging from 6% to 36%. Prior to 1st January 2023 one may recall, an individual enjoyed an annual relief of Rs. 1.2 million on certain expenditure incurred by him such as health expenditure including contributions to medical insurance, educational expenditure incurred locally by such individual or on behalf of such individual’s children, interest paid on housing loans, contributions made to any local pension scheme, expenditure on purchase of shares/ financial instruments listed in the Colombo Stock Exchange or treasury bonds/treasury bills.

Given the current context, an expenditure relief for expenses incurred on health and education may be warmly welcomed by the general public since these are common expenses incurred by everyone. Further, shelter is a basic human need, and since the Government is not able to provide shelter to all its citizens, the Government should empower people to construct a house for oneself. An individual could be extended relief by allowing a deduction on housing loan interest when a person obtains a housing loan for the purpose of constructing a house.

In addition to re-introduction of expenditure relief the Government could consider enhancing the first 2 tiers/slabs from Rs. 500,000 p.a to Rs. 1 million p.a. Currently, taking into account the Rs. 1.2 million per annum tax free allowance, an individual receiving Rs. 141,667 per month will be paying taxes at 4% and at 8% for the next Rs. 41,667 p.m. While an increase of the slabs to Rs. 1 million each (the first 2 tiers), would mean an individual would be paying tax at 4% where income is Rs. 183,333 and at 8% only where the income for the month is between Rs. 183,333 to Rs. 266,700.

In the 2024 Budget Speech, the total tax revenue collection estimated for the year 2024 is Rs. 3,820 billion, out of which a major composition is from indirect taxes (58%). The above proposed reliefs may not hinder the tax revenue collection if such reliefs are introduced with proper limitations.

(The writer is Principal – Tax and Regulatory, KPMG.)