Friday Feb 20, 2026

Friday Feb 20, 2026

Friday, 29 January 2021 01:08 - - {{hitsCtrl.values.hits}}

Jaye Container Terminal of the Colombo Port, fully - owned by the SLPA

The transformation of both the shipping and port operation businesses around the world and especially in Asia has been quite remarkable over the last two decades. Opportunities created by these developments have attracted the attention of governments, companies and civil societies, particularly in South Asia. But none of these changes can to date undermine the importance of the natural geographical advantages that the Port of Colombo enjoys. The critical challenge for Sri Lanka is how it can maximise its geographical location and natural features in line with the evolving dynamics of port operations in such a way as to benefit from the three Asian growth engines of China, India and Japan.

The transformation of both the shipping and port operation businesses around the world and especially in Asia has been quite remarkable over the last two decades. Opportunities created by these developments have attracted the attention of governments, companies and civil societies, particularly in South Asia. But none of these changes can to date undermine the importance of the natural geographical advantages that the Port of Colombo enjoys. The critical challenge for Sri Lanka is how it can maximise its geographical location and natural features in line with the evolving dynamics of port operations in such a way as to benefit from the three Asian growth engines of China, India and Japan.

Over the past decade or so, two terminals namely, SAGT and CICT have been revenue generating avenues for the Sri Lankan economy despite the fact that the Government of Sri Lanka’s shareholding in the operating companies in both these terminals is just around 15%. In such a background any mishandling of the East Container Terminal (ECT) operations will only serve as an unnecessary hurdle to the Colombo Port’s further expansion and growth in terms of efficiency and economy.

Transshipment Business

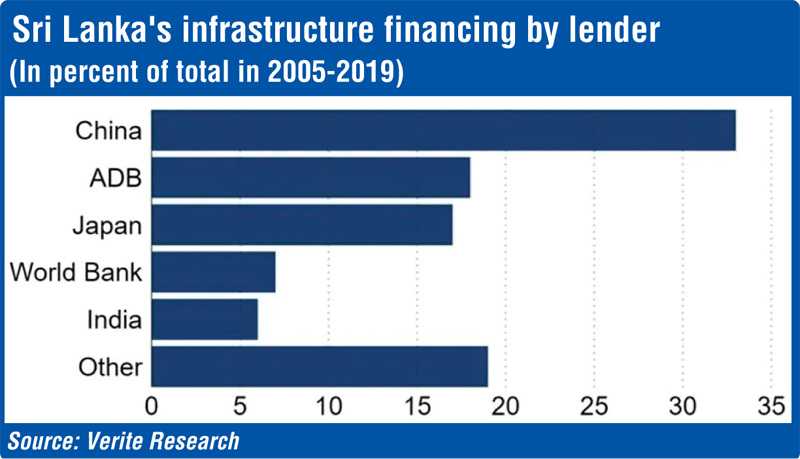

President Gotabaya Rajapaksa was absolutely spot on when he referred to the transshipment business that relies quite extensively on India. According to an article written by Dr. Jehan Perera in ECONOMYNEXT, “President Gotabaya Rajapaksa has announced that the government will be entering into an agreement with the Adani Group based in India to offer them 49% of the shares in a joint venture company. This joint venture will include Japanese government financing and will manage one of the terminals in Colombo Port.” Several companies from India, Japan and Sri Lanka will invest in the East Container Terminal of Colombo Port. The fact that almost 70% of the Colombo Port’s transshipment business is connected to India gives both the Government and people of Sri Lanka substantial leverage, not only in economic terms but also from a political perspective. Irrespective of where you stand on this issue today, one thing is certain – the Indian region is going to be one of the fastest growing economies in the world for the immediate short term and the foreseeable medium term. Equally important to keep in mind is the fact that Japan, which has one of the largest merchant fleets in the world, has been a reliable development partner for our country. Japan since the San Francisco Peace Treaty in 1951 has been one of the greatest supporters of Sri Lanka. Japan has poured a lot of money into Sri Lanka. Therefore, Government negotiators should not lose sight of the big picture and Sri Lanka’s opportunities in the region. Shipping agents say that the capacity at Colombo Port is nearing saturation and, therefore, development of the East Container Terminal should have happened many years ago, whilst some disagree.

Colombo Port

Given the challenges Sri Lanka has, we should not selectively portray foreign investment in a bad light. At the same time, it is definitely not the case that the Government should agree to everything that the Indian and Japanese investors demand when it comes to the ECT. Sri Lanka must negotiate hard, negotiate fair, engage in good faith, and ensure that all parties engage in a constructive manner. Increasing the competitiveness and attractiveness of the Colombo Port will bring massive material benefits to the general population and the economy. At a time of challenging economic and financial constraints, compounded by the slow return to normality because of the COVID-19 pandemic, strategic handling of the ECT matter will only be in the best interests of Sri Lankan businesses and the wider economy. With a dynamic BOI Chairman in office, who knows the game and has had the exposure, this may not be too hard to achieve. Sri Lanka needs good FDIs at this moment in time to ride out the current economic challenges.

(Note: There were several inquiries about why my FT columns were pulled out. Given the repeated social media attacks on FT articles with my byline, by a person using a fake account. I personally requested the articles and the interviews be pulled down, so that my content providers and team can check the veracity of the allegations. I take full responsibility for any gaps and also wish to take a breather.)