Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 13 October 2020 01:04 - - {{hitsCtrl.values.hits}}

The first-ever Chinese visit to a South Asian nation since the global coronavirus epidemic and the Sri Lankan Government’s ‘travel bubble’ plan to allow the Chinese delegation without quarantine into the country explains the influence China has in this island nation

A rating cut of two notches followed by the Government’s denial… Sri Lanka has yet to come out of this vicious cycle in managing the economy.

Moody’s Investors Service last week downgraded the island nation’s sovereign rating to Caa1, which is “poor quality and very high credit risk,” equal to the rating of Iraq, Mali, Angola, and Congo, from B2 or “speculative and a high credit risk,” the ratings enjoyed by countries like Turkey, Kenya, Nigeria, and Jamaica.

The rating agency has said the coronavirus-induced shock will significantly weaken Sri Lanka’s already fragile funding and external positions. It also said the heightened liquidity and external risks stem from Sri Lanka’s limited secured funding sources to meet its material external debt service payments over the coming years, during which period market refinancing will remain vulnerable to shifts in investor sentiment.

“At the same time, fiscal and external pressures will continue to limit the scope for reforms to address long-standing credit vulnerabilities, denoting weakening institutions and governance, an important driver of today’s rating action,” it said in the statement.

Though the Government, rejecting the Moody’s action, has said the rating downgrade was “unfair” and “premature”, it cannot be a surprise to the Central Bank and the Finance Ministry.

On 17 April this year during the lockdown, Moody’s placed Sri Lanka’s B2 ratings under review for downgrade, citing “the acute tightening in global financing conditions, fall in export revenue, and sharp slowdown in GDP growth as a result of the global coronavirus outbreak exacerbate Sri Lanka’s existing government liquidity and external vulnerability risks, raising risks of heightened financing stress and macroeconomic instability”.

Moody’s rating downgrade follows the rating cut by both Fitch Ratings and Standard and Poors’ early this year. The Government rejected their downgrade as well. With all three downgrading, the Government’s borrowing cost from international capital market is likely to be expensive than earlier. The government is unlikely to tap the global capital markets for ISBs this year given the COVID-19 pandemic and possible higher risk premium it will have to pay.

No default at any cost

State Finance Minister Ajith Nivard Cabraal last week assured that Sri Lanka would never default any sovereign debts and said that the decision to ban all the import was due to preserve dollars to repay the foreign loans. As the Minister said, the $ 1 billion international sovereign bond borrowing was repaid last week.

The Government will have to pay nearly $4.5 billion per annum for the next three years and this means it needs a lot of foreign borrowing in the face of possible slowdown in the exports due to lingering COVID-19 pandemic.

Cabraal separately in the Parliament this week said the Government would not either sell any assets or cut down any government expenditure to manage the ballooning fiscal deficit, adding that the authorities are looking at all the options including panda bonds, samurai bonds, treasury bond swaps, and syndicated loans to boost the reserves.

“We will use the appropriate option at the appropriate time,” he told the Parliament.

Sri Lanka has also planned to insulate some investors from exchange rate fluctuations to attract more foreign inflows into local-currency bonds and other sectors. The risk cover is subject to inflows being in a range of $25 million to $1 billion. However, it is yet to be seen if this offer will be attractive given the post-COVID-19 economic revival around the world. Foreign Direct Investments (FDIs) could slow down in the next few months if not for years as global corporates are looking for cost cutting to survive in the business.

Sri Lanka’s key foreign exchange earner foreign remittances could slow down as most of the countries which provide jobs to locals are still struggling to recover from the COVID-19 pandemic. Tourism earnings will have to wait until the authorities open the main international airport, which has been postponed indefinitely due to the latest situation on COVOD-19.

Export earnings from garments also could slow down unless the world increasingly demand more personal protection equipment (PPE), which have been helping Sri Lanka’s exports up at the moment. With the latest cluster found in one of the top garment exporters, export revenue from the textile could have a hit.

As a result, Sri Lanka’s economic dependency on large economies for bilateral loans and grants to cushion its reserves will deepen and the island nation hardly has many options in this.

Debt, economic crisis

Successive Sri Lankan governments have rejected the claims of deteriorating economic conditions. Each government has blamed the previous government for the economic woes, but no remedies have been found to address a looming economic crisis. This Government is no exception.

Sri Lanka is likely to see a contraction in her economic growth this year, if the fear of COVID-19 spreading continues and the policy makers do not massage the economic numbers. It will be the first negative economic growth since 2001following the terrorist attack on the main Colombo airport. Though Cabraal says economy is recovering and likely to end the year with a 1% growth, economic experts predict otherwise.

Sri Lanka’s debt to Gross Domestic Product (GDP) has risen to 86.8% at end 2019 from 83.7% in the previous year. The rupee was under depreciation pressure until the Government imposed the import ban to preserve US dollars. Foreign inflows are expected to slow with the tourism taking a bow after the pandemic. The fiscal deficit is expected to hit 11-year high of 9% this year due to lack of revenue and unavoidable high expenditure in the face of long lockdown. The island nation is also facing a heavy debt repayment schedule until 2025.

Sri Lanka is facing an exceptional year in 2020 given the lockdown and an election. The data from January to end April show we need more loans to bridge deficit. According to the official numbers, Sri Lanka has spent Rs. 1.95 for every rupee earned as Government revenue in the first four months. It has spent 70 cents to pay loan interest, 1.0 rupee for salaries, wages, pensions, and other welfare payments, while it also allocated 25 cents for public investment.

As a result, the Government had to borrow 94 cents for each rupee it earned. The repayment of loan instalment is not included in this equation. The Government had borrowed further 1.24 rupees for every rupee it had earned in the first four months to repay the loan instalment.

If the Government is unable to borrow at an affordable borrowing cost, an economic collapse is inevitable. So who is going to save Sri Lanka through bilateral loans?

Japan’s LRT woes

Sri Lanka’s new Government will need some time to repair the severed diplomatic ties with Japan after it abruptly and unilaterally decided to cancel over $1.5 billion Japan International Cooperation Agency (JICA)-funded Light Rail Transit (LRT) project.

The JICA signed a concessionary agreement with Sri Lanka for about ¥30 billion in March last year under the previous Government and the total cost of which would be about ¥246.6 billion ($2.2 billion).

Not only was the project cancelled, Dr. P.B. Jayasundera, the Secretary to President Gotabaya Rajapaksa, in a letter dated 21 September and circulated on social media, also called the JICA-funded project “very costly and not the appropriate cost-effective transport solution for the urban Colombo transportation infrastructure”.

Government Spokesman Keheliya Rambukwella later said the Government was thinking of a more efficient project that can achieve the same results but within $500 million. Adding to the woes, Trade Minister Bandula Gunawardena is quoted to have said that the project would be awarded to a Chinese company at a 6% interest rate.

The Japanese loan carries an interest rate of 0.1% and is repayable over 40 years with a 12-year grace period. Japan has already funded sections of new expressways and a key bridge to reduce traffic congestion in and out of the capital.

With this new development, the Japanese Government is highly unlikely to come forward for any soft loan or grants for Sri Lanka. The Central Bank has been in discussion with its Japanese counterpart for a $500 million borrowing through Samurai bonds. However, this deal has yet to reach final stages, Government officials say.

Some Government official say Japan has been very stringent on its project procurement process. This mean local politicians cannot play with the Japanese-funded projects and siphon off money unlike in some other projects.

EU, US struggles

The European Union (EU), except for the current GSP plus trade concessions, is unlikely help Sri Lanka in its looming economic crisis. With the pandemic, the EU has its own woes to overcome. Some of its key members are still suffering of the COVID-19 spreading. With no time frame for a possible anti-coronavirus vaccine, the bloc is unlikely to give priority for Sri Lankan debt crisis.

Since the end of the 27-year war in which Government forces annihilated Tamil Tiger terrorists, EU has been constantly campaigning against Sri Lanka over human rights abuses. The strong Tamil diaspora in countries like Germany, France, and Switzerland have been instrumental in this. Even the GSP plus trade concession is linked to Sri Lanka Government’s human rights performance and in 2009 the island nation lost the concession because of the alleged war crimes in the final phase of the war. The trade concession helped the country’s top exports garments to expand its market share in the EU.

Major EU countries have expressed interest in pumping their money in the private sector. However, bureaucratic measures that had ranked Sri Lanka behind many of its peers in dong business and perception of alleged malpractices involved with approvals in Government offices have discouraged EU investors. So Sri Lanka is not going to get the money to face the impending economic crisis from EU countries either as grants or investments.

The United States, on the other hand, has been ready to help Sri Lanka through its $480 million grant of Millennium Challenge Corporation after the Sri Lankan Government sought assistance since 2002. The grant was approved by the Cabinet just before the last year Presidential Election and that decision was heavily criticised by the present Government’s policy makers when they were in Opposition. One of the main allegation put forward by them was that it was to grab Sri Lanka’s productive lands and rural farmer may lose their lands if Sri Lanka signs the agreement. Some of the coalition partners in the current Government have clearly said they do not want the grant and the MCC assistance has become a political hot potato than its real meaning. It was even used as for political manipulation even before 5 August General Election. The MCC deal is not completely off the table yet. The Government has yet to officially approach the US authorities while the MCC also has not completely terminated the deal.

It is evident that given the upcoming Presidential Election and the worst impact of the pandemic in the world, the US may not be able to help Sri Lanka to come out of its economic crisis. The world’s largest economy will undergo some policy shift if the Democrat Joe Biden wins in the next month presidential poll. In such a scenario, a senior Government official said, there is a likelihood of US will demand again to address human rights violations.

The US Federal Reserve and the Central Bank of Sri Lanka have recently entered into an agreement to use US dollar liquidity as a temporary source when required. The facility is available for ‘Foreign and International Monetary Authorities’ (FIMA).

The Central Bank has pledged $1 billion worth of US Treasury Bonds to be held in its reserve and enter into a repo facility with the FED. This will help the country to settle some short term debts, but still they are not investments.

India’s approach

Being the close neighbour of Sri Lanka, India has been there for many of the Sri Lankan worries whether it is the three-decade war or post-war economic development. Unlike in the past, the current Sri Lankan government wants to engage with India. Foreign Secretary Jayanath Colombage’s ‘India First’ foreign policy is part of it.

India has already signed for a $ 400 million three-month currency swap to boost Sri Lanka’s foreign reserves while both countries are in discussion for debt moratorium. Both are also in discussion for a $1.1 billion currency swap. India is Sri Lanka’s top trading partner and Indian private sector has expressed to invest in Sri Lanka in many ways.

However, India has its own limitations given it is the second worst COVID-19-hit country in the world. And the perception of Sri Lankans with regard to India has been mostly not that great due to historic events. Role of South Indian Tamil Nadu in providing military training for Sri Lanka’s northern Tamil groups including Liberation Tigers of Tamil Eelam or popularly known as LTTE has still been discussed among senior Sri Lankan military officials. This is the reason some Sri Lankan political parties before polls use anti-Indian sentiment to get attention and win votes.

More than everything in the current geopolitical context, India is worried about increasing China’s influence in Sri Lanka.

“China’s influence in Sri Lanka has gone beyond the point of no return now,” a Western diplomat based in Sri Lanka says. “But Sri Lanka has an obligation to work with India as agreed in 1987 deal on the Indian Ocean regional security,” the diplomat said referring to Indo-Sri Lanka deal which was later became the 13th Amendment of the Constitution.

There has been controversy surrounding the 13th Amendment which is about power devolution as some Sri Lankan legislators see it as an Indian interference in policies. India has been of the view that it could curb any future ethnic conflicts.

India also prefers more private sector investments that government-to-government financial assistance, Government officials who are aware of the discussions between the two countries say.

China, China, China

When it comes to Sri Lanka’s bilateral borrowings in the current context, the only country it could rely on with very little or no conditions is China. Though there are many concerns raised by India and the West led by the United States on possibility of China using the South Asian island for its military purposes, the Colombo Government had been increasingly compelled to depend on China for infrastructure financing and investments.

Government officials say Chinese funding slowed under the previous Government led by former President Maithripala Sirisena after he halted all Chinese projects soon after he came to power in January 2015. That Government, under the theme of ‘Good Governance’ said it would follow a non-aligned foreign policy and wanted to do away with pro-China policy, which it said was followed by its predecessor.

It is unlikely that any other countries will lend Sri Lanka at this difficult time given COVID-19 pandemic in the US, India, and many Europe nations. Those countries are still struggling to recover from the worst ever deadly disease since 1918.

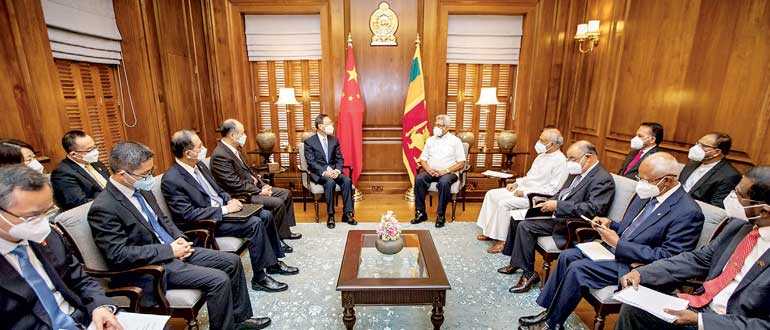

In this background, the visit of a ‘high-powered Chinese delegation’ this week, led by senior Chinese leader and top foreign policy official Yang Jiechi, who is a member of the Communist Party of China’s Politburo is crucial.

The first-ever Chinese visit to a South Asian nation since the global coronavirus epidemic and the Sri Lankan Government’s ‘travel bubble’ plan to allow the Chinese delegation without quarantine into the country explains the influence China has in this island nation. The visit took place amid worsening India-China relations and rising US-China tension. The Chinese delegation met Sri Lanka’s President and the Prime Minister and the meeting came two weeks after the virtual meeting between the prime ministers of Sri Lanka and India.

It also comes days after the ‘Quad’ meeting in Tokyo, where US Secretary of State Mike Pompeo urged to collaborate the regional allies in Indo-Pacific against what he called Chinese Communist Party’s “exploitation, coercion and corruption”. China has already lent $ 500 million “facility agreement” in March to fight against COVID-19 on Colombo’s request. The meeting also is seen as crucial for China to move ahead with its key investment launched by Xi-Jinping in 2014 after the project company was included in a blacklist by the United States.

China has been flexible on lending for Sri Lanka, mostly with no strong conditions like other countries though there will not be any soft loans, say a Government official. “As far as Sri Lanka can ensure the repayment on time and the deals are only on commercial basis, there should not be any concerns both locally and internationally.”

(The writer is former Reuters Economic Reporter for Sri Lanka and current Head of Training at Center for Investigative Reporting Sri Lanka. He could be reached at [email protected])