Sunday Feb 15, 2026

Sunday Feb 15, 2026

Friday, 15 November 2019 00:00 - - {{hitsCtrl.values.hits}}

I am no lawyer. What follows is simple and straightforward information available in the websites of the US State Department1 and a website that offers information on renouncing US citizenship.

Renouncing and relinquishing are not the same. Renouncing your citizenship is different from relinquishing your citizenship. I do not know what the 19th Amendment requires of a US and Sri Lankan dual citizen who wishes to be our President.

The procedure to renounce your US citizenship is to appear before a consular representative of the US State Department. You make a formal statement that you no longer wish to be a US citizen. You fill out paperwork. You pay the fees. You sign an oath and hand in your passport. You have renounced your US citizenship.

Relinquishing your US citizenship is a different tango altogether. If you wish to join the army of another country, you must relinquish your US citizenship. What I understand from this stipulation is that if I wish to be the President of Sri Lanka and the Commander-in-Chief of its defence forces, then I must relinquish my US citizenship under US law. That process is governed by a different procedure. I don’t dare approach that territory; only a good US law firm should advise you on that process. But when you do relinquish your US citizenship, you are entitled to a document that will be issued to you by the US State Department titled the ‘Certificate of Loss of Nationality’.

This is the document required by Japan and Singapore from persons who hold dual citizenship of the US before joining their respective state agencies. The main advantage of relinquishment is that it allows you to claim that your US citizenship has effectively ended.

To relinquish the US Citizenship, you need to do the following:

Get a second citizenship in another country.

Leave the US

Appear before the US Consul in that country.

File Form 8854: The Expatriation Information Statement.

Pay the due Exit Tax.

As an expatriate, you will be able to visit and even stay for a certain time in the United States; the mere fact of being an expatriate does not make you exempt as a US tax resident. You can still become taxable in the US under the normal US tax rules if you continue to have US-sourced income. Form 8854 is targeted at ‘covered expatriates’ who claim a net worth of $2 million or more, have an income tax liability higher than $162,000 for the five-year period prior to expatriation, or those who have failed to certify that they have complied with all US federal tax obligations for the preceding five years. They are then subject to an Exit Tax. This is the last chance for the Internal Revenue Service to tax a person before giving up US citizenship and long-term residency.

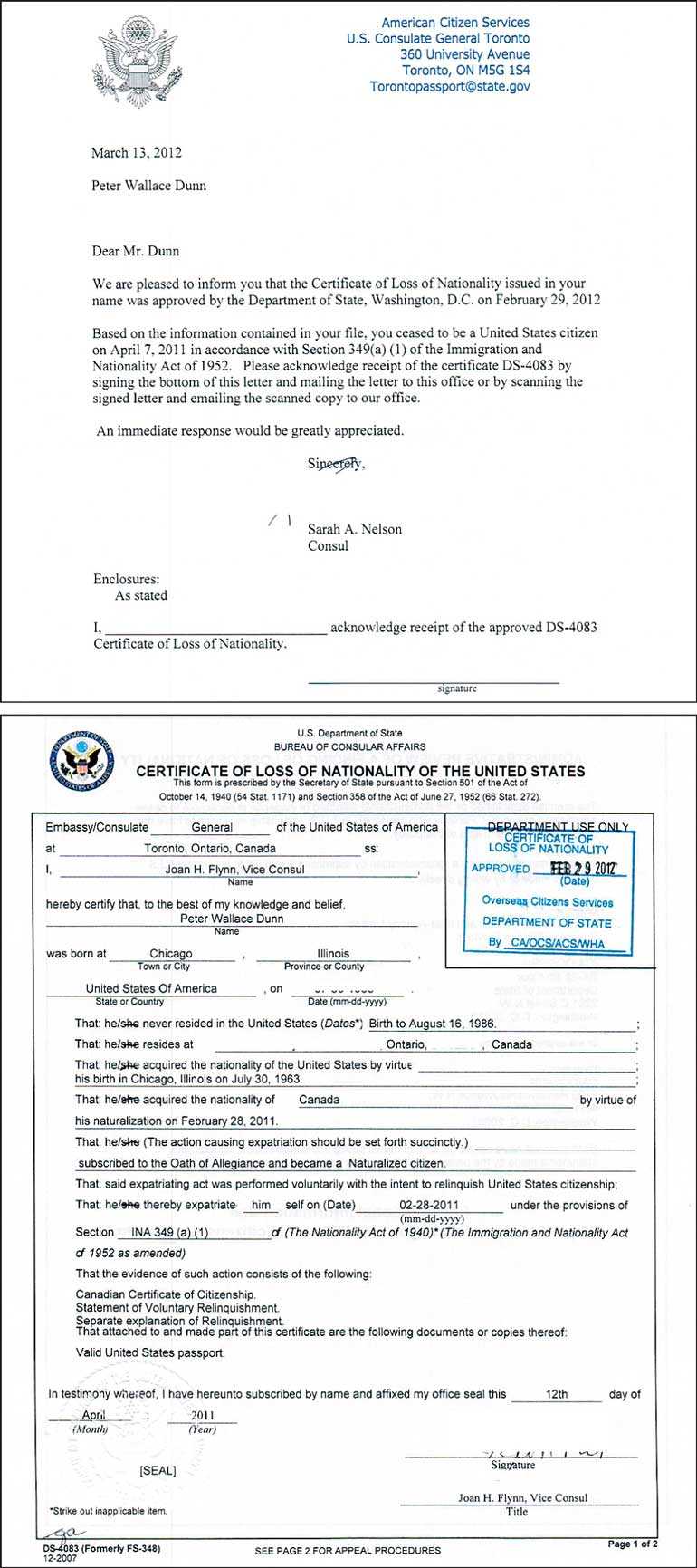

It is similar to an estate tax on the gains in your assets. It is calculated on the basis that such assets were sold on the day you relinquish your citizenship and is subject to a capital gain. Currently, the rate on net capital gains is 23.8% including the net investment income tax. Generally the Certificate of Loss of Nationality is sent with a covering leytter. The loss of nationality has to be approved by the US State Department in Washington DC and the overseas mission informed accordingly. The official website of the US State Department offers the following advice: Questions concerning renunciation of US citizenship in the United States pursuant to INA section 349(a)(6) must be directed to United States Citizenship and Immigration Services (USCIS) of the Department of Homeland Security.

A person seeking to renounce US citizenship must renounce all the rights and privileges associated with such citizenship. In the case of ‘Colon v. U.S. Department of State’, 2 F.Supp.2d 43 (1998), the US District Court for the District of Columbia rejected Colon’s petition for a writ of mandamus directing the Secretary of State to approve a Certificate of Loss of Nationality in the case because, despite his oath of renunciation, he wanted to retain the right to live in the United States while claiming he was not a US citizen.

Lastly, I give two samples of the Loss of Nationality Certificate and the usual covering letter issued by a US overseas mission.

Footnote:

https://travel.state.gov/content/travel/en/search.html?search_input=loss+of+nationality+certificate++&data-sia=false&data-con=false&starton=0#