Saturday Feb 21, 2026

Saturday Feb 21, 2026

Thursday, 21 August 2025 00:50 - - {{hitsCtrl.values.hits}}

Sahasdhanavi power plant has been in the news from April this year due to multiple controversies, from the infamous picture of Dr. Tilak Siyambalapitiya signing the Power Purchase Agreement (PPA) with Deputy Chairman Ravindra Pitigalage. It was soon revealed that Dr. Siyambalapitiya was also the Chairman of LTL Holdings, thus appeared to be in flagrant violation of the CIABOC Act of 2024 provisions on conflicts of interest.

Sahasdhanavi power plant has been in the news from April this year due to multiple controversies, from the infamous picture of Dr. Tilak Siyambalapitiya signing the Power Purchase Agreement (PPA) with Deputy Chairman Ravindra Pitigalage. It was soon revealed that Dr. Siyambalapitiya was also the Chairman of LTL Holdings, thus appeared to be in flagrant violation of the CIABOC Act of 2024 provisions on conflicts of interest.

Soon it transpired that the cabinet approval for the PPA was obtained by showing a ridiculously low figure of Rs. 20.15/kWh, using historical rates for diesel, Natural Gas and exchange rate. PUCSL issued a clarification letter to the ministry, that changing these incorrect information would lead to Rs. 43.25/kWh and if LNG is not procured, the costs ballooning to Rs. 72/kWh.

Dr. Siyambalapitiya soon departed, and his roles at the helm of CEB and LTL Holdings were assumed by Professor Udayanga Hemapala, the Secretary of Ministry of Power, raising even bigger red flags on conflict of interest. During his period at the helm, both CEB and Sahasdhanavi issued statements giving figures close to what PUCSL stated, confusing the public.

When Professor Hemapala was asked about the cost of Regassified Liquefied Natural Gas (R-LNG) based power, by a journalist, he was unable to give a figure albeit heading all three institutions! Talk about accountability!

But none of these figures are closer to the real cost of the power plant, due to flawed assumptions. Here, I am using the official data to construct the cost of a unit of electricity for Sahasdhanavi for the year 2028.

Assumptions and the financial model

During the tender process, a financial model is developed, which has multiple input fields that are variable. Other figures are fixed (such as costs, efficiencies, O&M rates, etc.). Our job is to ask what are the variable figures and provide good estimations, as much as possible, derived from Government’s own documents, and making reasonable assumptions with full transparency, for the rest. Since the biggest unknown is the Natural Gas prices, I am relying on the expert report on LNG Introduction to Sri Lanka attached to the cabinet paper on the same topic. This cabinet paper was presented by Minister Kumara Jayakody in December 2024, and approved by the cabinet.

Here are the numbers I am focused on.

1. Exchange rate (for 2028): extrapolation from the long term trend

2. LNG procurement price: Expert Report

3. Natural Gas price delivered to the power plant: Expert Report with VAT added

4. Plant factor and operational model of Sahasdhanavi: CEB Generation Plan 2025-2044

Exchange rate

While the 20-year Rupee depreciation rate against the US Dollar is 5% year on year, I have taken a more conservative 4%. This would place the exchange rate at Rs. 337.50 per USD.

LNG procurement price

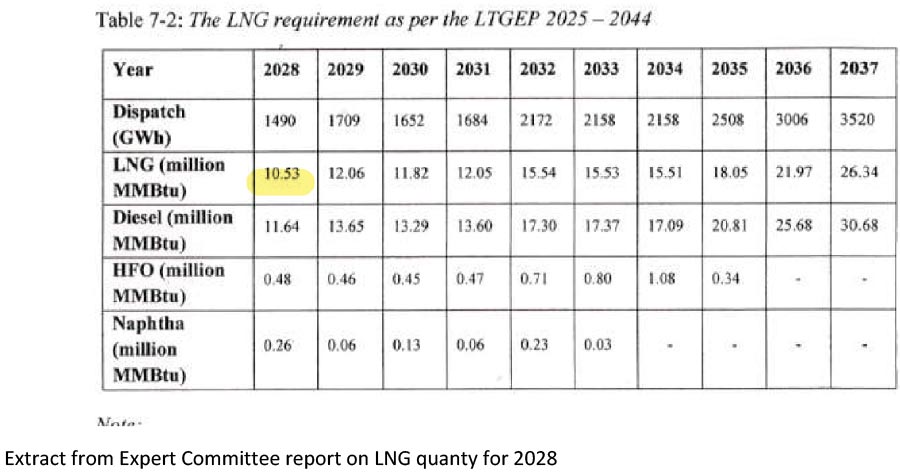

LNG procurement price is not easy to estimate. When this question was asked from CEB/LTL Chairman cum Ministry Secretary, he responded that since we do not have a supplier it is not known. However CEB and the Expert Report prices this as $ 11.20/MMBTU. This price is a possible long term contract bulk purchase price (for around 50 million MMBTU per annum), thus it is highly debatable if we can get such a price for small volumes that we are planning to buy for year 1 (a meagre 10.53 million MMBTU). However, let us take $ 11.20/MMBTU value as the input costs.

Natural Gas price delivered to the power plant

LNG has to be regassified to convert into Natural Gas through a specialised process. What the Government is proposing is to revive an outdated 2020 tender to bring in a Floating Storage and Regassification Unit (FSRU) which is now significantly oversized and overpriced.

The cost for infrastructure (regassification) for the year is given as $ 102.60 million. With the LNG procurement cost, the total is $ 220.51 million, for 10.53 million MMBTUs, giving the R-LNG cost as $ 20.94/MMBTU. These costs do not have any taxes. At minimum 18% VAT must be applied, taking the costs up to $ 24.71/MMBTU. The fact that LNG bought at $ 11.20 more than doubles when delivered to the power plant, is probably a world record, and shows the absurdity of the team who is hell bent on straddling an oversized and overpriced stranded asset on the electricity consumers, while violating all procurement norms.

Plant factor

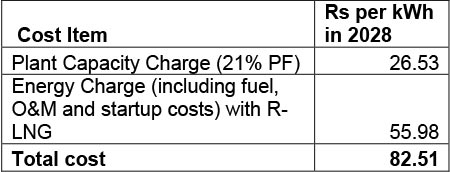

To get the plant factor of Sahasdhanavi power plant we can refer to CEB Generation Plan, which marks the “New Combined Cycle Plants” plant factor to be 21%. Since the capacity charge is tagged to the dollar, the total cost that will be paid to Sahasdhanavi in 2028 will be Rs. 17 billion – meaning each and every unit of electricity consumed by public will go up by One Rupee just to pay this capacity charge. 21% plant factor means the plant will only generate 643 million kWh for the year, making the capacity charge as high as Rs. 26.53/kWh!

Aspiring to buy electricity at Rs. 82/kWh!

Now we can determine the cost of electricity for the year 2028 from Sahasdhanavi from R-LNG. And it’s a whopping Rs. 82.51 per kWh, while operating on R-LNG!

Now let us assume that the LNG project does not go through, and this plant will be operated in diesel. The import costs will be higher due to Rupee depreciation but since its 2028, we can assume that the Rs. 50/litre current surcharge is also reduced, leaving the price paid by Sahasdhanavi same as today at Rs. 289/litre. The capacity charge is different for diesel operation as per the PPA, so we get a total of Rs. 90.96/kWh.

The biggest irony will be watching the President, who came to power claiming he will reduce electricity costs by one-third, laying the foundation stone for a plant which will be providing electricity at rates between Rs. 82-91/kWh!

The pricing risks

As mentioned earlier, using $ 11.20/MMBTU as LNG price is a high risk endeavour. It is akin to a retail buyer building a business case with the wholesale price of a product. The likely case is that we will not be able to secure a long term Brent tied contract for the meagre volumes we have. Any long term contract is based on volume commitments (take-or-pay), and any LNG vendor, who assesses the volume risk will run a mile away from us, especially when we openly say that in rainy years, we will buy significantly lower quantities than this. This is what happens when Mechanical Engineering Professors with zero knowledge of LNG markets are put in charge of expert committees to create the stage for others to make money.

And all of this, before LNG vendors look at our credit ratings.

The likely case will be that instead of a long term volume contract priced against Brent, we are forced to buy LNG in the spot market, which has the highest price volatility that in the last three years pushed LNG prices as high as $ 50/MMBTU. With bulk of the Asian LNG coming from strait of Hormuz, these are clear and present risks.

Experts who write reports without doing a simple sensitivity analysis, let alone pricing risks, should be prosecuted by law, be they from universities or even DFIs.

To baseload or not baseload and other myths of Sahasdhanavi

Sahasdhanavi, in their press statement makes a large number of questionable statements about the importance of this “baseload plant”, showing them still locked in an outdated paradigm. This is indeed a surprising fall for a company, whose reputation is on engineering excellence, and is currently headed by Professor Hemapala, who is a lecturer at University of Moratuwa. Looks like Dr. Siyambalapitiya is not an anomaly at Moratuwa after all.

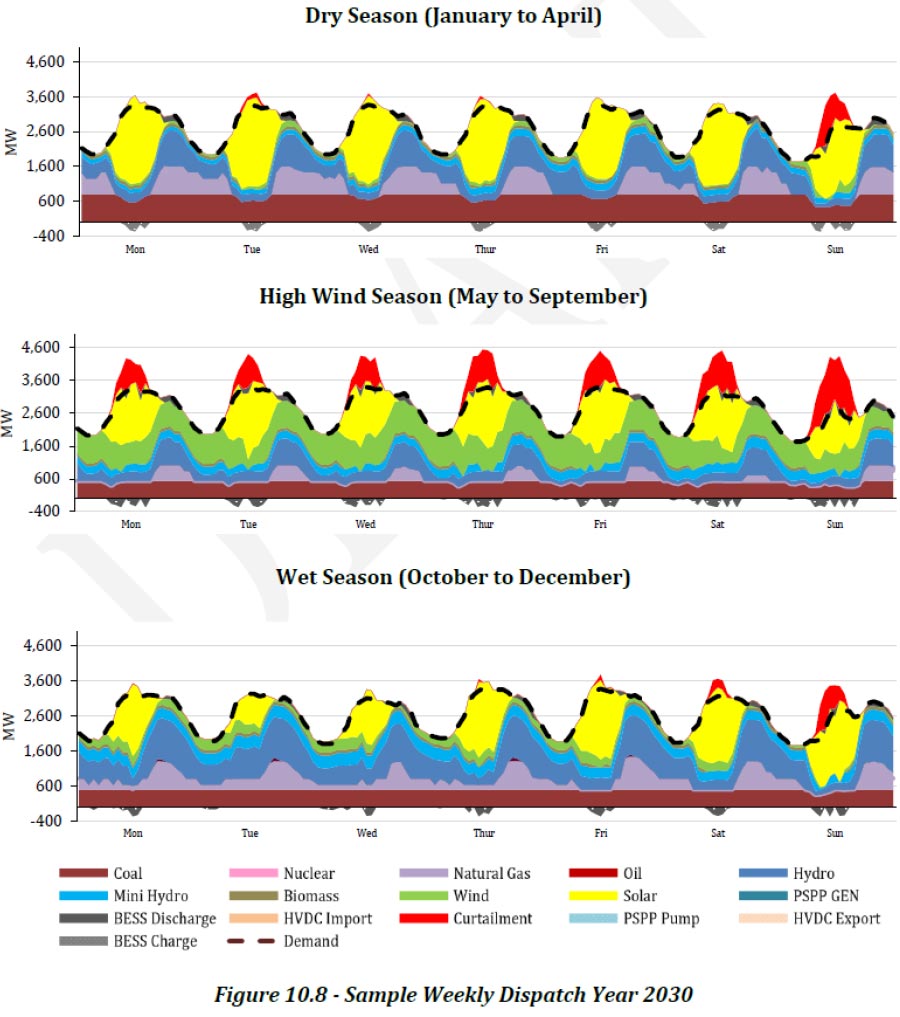

This baseload myth is easy to debunk. One has to simply look at the CEB’s own generation plan where they provide the projected load curves for 2030, for three “seasons”, showing that in no season, a plant operating with R-LNG is running under baseload conditions. Not only that, it shows that in two out of three scenarios, CEB is even unable to operate all three coal plants as baseload plants, with forced shutdowns! How Professor Hemapala missed this as he is also the Chairman of CEB, is surprising.

What is commonly known in the industry is LNG is only used for baseload plants. This itself shows that we have not only outlived the coal era, but also the LNG era. But a group of engineers who are behind the times and technology, occupying policy chairs, are scuttling the sector from becoming a modern utility.

The demand conundrum, stranded assets and the next default

In reality, the costs are likely to be higher for R-LNG based power plants. That’s because CEB continues to underestimate the cost trajectories and public appetite for renewable energy. Every additional unit made from renewable energy beyond CEB projection, increases the cost of R-LNG. Now it is clear why this Government is hell bent on killing renewables (some politically appointed leaders in CEB have not been shy in openly admitting this). It is to create space for the expensive LNG enterprise.

But the reality is different. No state has been successful from keeping public away from renewable energy. If, as the Government says, it will open up wholesale electricity markets, it is impossible to stop renewable energy and battery storage from eating the LNG demand, so that the 1.2 billion LNG FSRU becomes a massive stranded asset that can trigger the next financial crisis of the country.

No country has reduced electricity costs with LNG. No country is importing LNG to run plants at the margin. Even India is openly admitting LNG based power is too expensive, with 3 out of their 5 LNG terminals now classified as stranded assets. We are rushing to join that club.

Whither to Sri Lanka?

Sahasdhanavi and the LNG FSRU are two massive unwanted projects that will keep Sri Lanka tied to expensive electricity costs for the next 20 years. There are other solutions, built around renewable energy which can mimic all of the services that Sahasdhanavi claims they provide, at absurdly cheaper rates than this.

In fact, CEB is like a schizophrenic, who is investing in syncons, BESS with grid-forming inverters, large scale wind, solar and BESS on the one hand, and talking about bringing in LNG to run at the margin on the other.

We all know what the solution to our power crisis is – it is renewable energy coupled with storage. As long as we have policy makers who are lost, and advisors who are taking the country for a ride, and “experts” who are naught but filles-de-joie, we will be wallowing in our own created abyss, strapped in an expensive, out-of-date electricity system till kingdom come.