Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 5 October 2021 02:35 - - {{hitsCtrl.values.hits}}

Sri Lanka’s economic crisis is not one-dimensional, it is a hodgepodge of internal and external factors, varying in degree of severity and as intertwined as a spider’s web – Pic by Lasantha Kumara

|

Crisis is upon Sri Lanka. President Gotabaya Rajapaksa decreed a state of emergency over food supplies last week, the dollar was being sold for over Rs. 230 on the black market (the only place it could be found), Sri Lanka was downgraded to CCC- by Standard & Poor rating agency (Fitch had downgraded the country to this level back in November) and general panic is setting in.

Crisis is upon Sri Lanka. President Gotabaya Rajapaksa decreed a state of emergency over food supplies last week, the dollar was being sold for over Rs. 230 on the black market (the only place it could be found), Sri Lanka was downgraded to CCC- by Standard & Poor rating agency (Fitch had downgraded the country to this level back in November) and general panic is setting in.

The most immediate impact an everyday citizen sees are empty shelves at supermarkets and pharmacies, which are caused by the Sri Lankan Government’s ban on imports. Import bans, something Sri Lankans have become intimately (and involuntarily) familiar with over the course of the past year, are only a symptom of a much larger macroeconomic problem.

Sri Lanka’s economic crisis is not one-dimensional, it is a hodgepodge of internal and external factors, varying in degree of severity and as intertwined as a spider’s web. I will therefore, to the best of my knowledge and understanding, document here the main causes and aggravating factors for anyone interested in this unfolding crisis.

Main causes

The economic crisis currently unfolding in Sri Lanka can be traced down to a few leading, and severe, reasons:

1. Debt sustainability, or the lack thereof

It is perhaps no surprise that the first reason mentioned is that of debt sustainability, or the lack thereof. Although certainly not new (economists have raised concerns as far back as 2019), it has overtaken economic conversations in importance in the recent past. Debt sustainability, according to the International Monetary Fund (IMF), refers to the Government’s capacity to meet its current and future debt obligations without exceptional financial assistance or defaulting on its obligations.

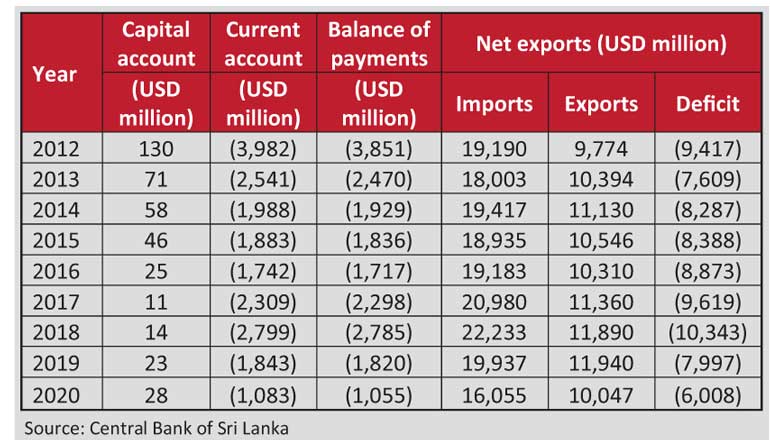

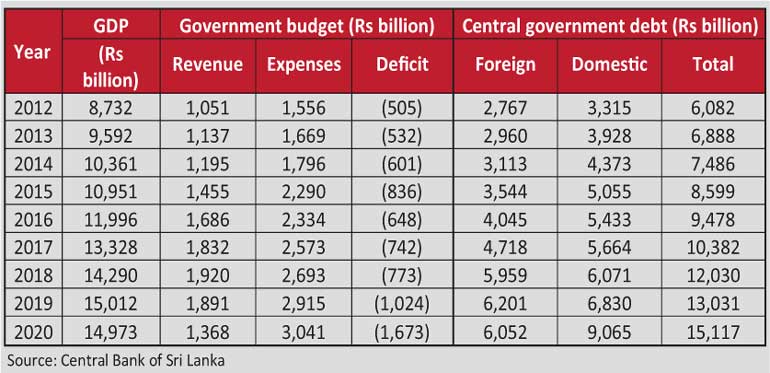

By the end of 2020, Sri Lanka’s debt-GDP ratio was 101% and is expected to rise to 108% by 2022. Between 2021 and 2025, Sri Lanka requires $ 4-5 billion annually to meet its foreign debt obligations.

This is next to impossible while Sri Lanka runs not only a whopping budget deficit but also a staggering balance of payments deficit (a balance of payments deficit means the value of money flowing out of the country is greater than the value of money flowing in to the country). In July 2021, upon settling a $ 1 billion bond, Sri Lanka’s foreign exchange reserves fell to a low $ 2.8 billion.

Sri Lanka would normally finance these deficits through borrowings, but with low credit ratings this is now a lot harder than it used to be. In the recent past, Sri Lanka has relied on the issuance of bonds to finance such shortfalls, but the most recent issuances of Sri Lanka Development Bonds (SLDBs) have been undersubscribed, a signal of waning investor confidence in the country (if the downgrades by ratings agencies were not enough of a warning).

In the interim, Sri Lanka has resorted to short-term currency swaps with countries like China and Bangladesh. Such short-term fixes, however, come at high cost: they have short repayment periods, high interest rates and can generally only be used for specific purposes (such as for trade between the two countries).

This all makes an impossible situation even worse and despite much urging, the Government refuses to consider an IMF bailout plan. An IMF bailout plan would see Sri Lanka committing credibly to some serious austerity measures that would enable the reduction of Sri Lanka’s deficits gradually to sustainable levels. Despite the Government’s stubbornness however, an IMF bailout seems inevitable, and would bring about much needed (albeit unpopular) reform into the Sri Lankan economy.

2. Foreign exchange (forex) shortage

The shortage of foreign exchange in the country stems essentially from the necessity for Sri Lanka to services its debt. The Central Bank notified banks in June 2021 that they will not be lending dollars to banks, and instead for private banks to seek it out in the other markets. But, the rapid depreciation means that those with dollars on their hand, i.e. exporters, are not willing to trade it in, they are holding onto it in hopes of a higher rate (i.e. a more depreciated rupee).

No amount of coaxing seems to have convinced many exporters to part with their dollars however, and the foreign exchange crisis continues. Under the IMF’s Special Drawing Rates (SDR) allocation aimed at helping countries recover from COVID, Sri Lanka received an unconditional, non-debt inflow equivalent to $ 787 million. Additionally, the Central Bank was also able to arrange a few short-term currency swaps to temporarily increase its reserves to just over $ 3.5 billion.

However, this is only equivalent to about 1.5-2 months’ worth of imports, even less (or next to nothing) when you consider Sri Lanka’s upcoming debt settlements. Sri Lanka’s dollar denominated debt repayment obligations come up to $ 6.1 billion in the coming two years.

Managed-float exchange rates. The Central Bank of Sri Lanka follows a managed-float exchange rate policy, meaning the exchange rate is allowed to adjust to market demand and supply, but within a pre-determined band. This is to curb any excessive volatility. This kind of policy means that the Central Bank has to intervene when the rate threatens to break the band, and the bank does this using one of two ways: by using its dollar reserves or by adjusting interest rates.

The Central Bank’s decision to continuously defend the rupee over several decades has eroded its reserves to an extent too and created a situation where the rupee is overvalued. The issue with this policy at present is that the Central Bank has depleted dollar reserves and is not in a position to intervene in the market to control the exchange rate through this mechanism.

The Central Bank instead increased the Statutory Reserve Ratio (the percentage of its deposits that commercial banks must keep at the Central Bank) and interest rates in order to curb pressure on the dollar. But there is excessive liquidity (too much cash) in the market resulting from money printing, and therefore the impact of increasing the interest rates on the exchange rate have been negligible.

3. COVID-19 pandemic

Of course, the COVID-19 pandemic is one of the major contributors to the economic crisis in Sri Lanka, without it the country may have been able to squeeze through with the $ 3-5 billion the tourism industry generally brings in. The pandemic, however, isn’t specific to Sri Lanka and there are many examples of tourism-heavy economies that have weathered on without emerging on the other end with a crisis on their hands.

It is now more than 18 months since Sri Lanka went into its first lockdown, yet the authorities have failed to adopt comprehensive strategies and policies to respond proactively to emerging problems. Most COVID-related policies have been ad-hoc, garbled and failing to adequately respond to the issue at hand; Sri Lanka’s COVID vaccination policy is a good example, its passive response to the emergence of the Delta variant in the community is another.

According to official statistics, Sri Lanka’s economy contracted by 3.6% in the year 2020. Sri Lanka’s exports fell by $ 1.8 billion, which was a 16% reduction from 2019. In the first six months of 2021, Sri Lanka exported $ 5.7 billion, extrapolating this signals that exports could recover to pre-COVID levels by the end of the year (if we disregard the impact that other issues such as the organic agriculture policy would have). Therefore, the economic crisis cannot be attributed purely to the pandemic.

4. Reduction of taxes

President Gotabaya brought in a new tax regime soon after his election in November 2019 which saw the abolishment of the pay as you earn (PAYE) taxes, reduction of corporate taxes and the reduction of value added services taxes which effectively reduced the Government’s tax revenue by as much as Rs. 560 billion.

This may however have benefitted the economy to some extent via an increase in aggregate demand if Sri Lanka hadn’t entered the COVID-19 pandemic just a few short months later. As the pandemic hit, it was necessary to mobilise state funds to fight the pandemic and provide income support to struggling citizens. With a much lower tax base, this became increasingly hard.

Even in the absence of a pandemic, the reduction in taxes is ill-advised, Sri Lanka has run a budget deficit (meaning Government expenditures are greater than Government revenue) for over two decades now; in 2020 the budget deficit was a whopping Rs. 1.6 trillion, higher than it has ever been before. Running a budget deficit necessitates the use of borrowed finances, making an already perilous debt situation even worse.

5. Modern Monetary Theory

Modern Monetary Theory (MMT) is the idea that a sovereign nation which issues its own currency can never run out of money, because it can simply print more money to meet its Government’s debt obligations. While MMT has its proponents and opponents on both sides of the argument, the dangers of MMT for an economy like Sri Lanka is profound.

Increasing the money supply without a commensurate increase in production means the money has only one place to go; and that is into commodity prices. Despite the reassurance of some professionals who went so far as to opine that money printing does not lead to inflation, Sri Lanka is starting to see the effects of excessive money printing on Sri Lanka; in August 2021, year-on-year inflation was at 6%, while food inflation (a more reliable indicator in my opinion) was at 11.5%.

Sri Lanka’s debt, however is not a rupee-denominated problem; yes, the Government has managed in the past year to reverse its foreign-to-domestic debt ratio in favour of domestic debt but Sri Lanka still has to meet annual debt repayments amounting to $ 4-5 billion till 2025. Increasing the supply of rupees to solve a foreign-debt problem will only work to further depreciate the Sri Lankan rupee.

Moreover, Sri Lanka runs a twin deficit, both a budget deficit and a current account deficit, which means Sri Lanka’s demand for dollars persists. Therefore, the excessive printing of money advocated and implemented by Sri Lanka’s proponents of MMT have put pressure not only on commodity prices, but also on the exchange rate, depreciating the rupee to levels hitherto unknown.

[Note: although the Government can technically finance its domestic debt by printing money (more MMT), this is a slippery slope and is not an advisable route to take as it can lead to hyperinflation and a complete erosion of the value of the rupee].

6. Government expenditure

Having mentioned it several times prior, it is only fair to talk about Sri Lanka’s budget deficit. While it has reached new heights following tax cuts, Sri Lanka has consistently run a budget deficit for decades: prior to 2020, it averaged the past few years at around 6% of GDP. In 2020, it almost doubled to 11.2%.

Despite the severe lack of financial capacity, every successive government has expanded the civil service by a few 100,000 jobs every year or so: in 2020, salaries to civil servants amounted to 58% of Government revenue, if you add civil pensions into the equation it goes up to 80% of Government revenue. This leaves very little non-debt revenue to undertake the many other obligations of the Government.

The Government’s interest payments are another significantly large cost, in 2019 it was Rs. 900 million. These stem mainly from non-concessionary loans that have been undertaken by successive governments to finance a myriad of large infrastructure projects: some of which have been almost completely unproductive (such as the Lotus Tower in the heart of Colombo).

Then there is also the case of loss making state-owned enterprises (SOE); every year, some of these SOE’s rack up billions in losses, they are highly inefficient and are a drain on public finances.

These populist, and unproductive expenditure outlets are detrimental to Sri Lanka’s economic recovery from this crisis (whenever that may be) and should not continue to be the modus operandi of future governments. Weaning politicians off of making election promises which rack up the deficit, weaning citizens off of such dependency on the state and reforming the public sector are perhaps much easier said than done, but luckily the IMF bailout package comes handy here.

Aggravating factors

In addition to the main causes behind the economic crisis, there have been a multitude of factors that have further aggravated the economic crisis in Sri Lanka.

1. Cold turkey organic agriculture push

Defying rationality, President Gotabaya instituted an overnight organic policy by banning non-organic fertilisers (and pesticides and weedicides) in agriculture in April 2021. The health concerns with respect to the use of non-organic fertilisers maybe well placed, but the real reason behind this overnight ban is likely the shortage of foreign exchange: Sri Lanka spends $ 250 million a year on the purchase of fertilisers.

But, this cold turkey organic policy threatens Sri Lanka’s future dollar-earning potential; even those previously on President Gotabaya’s organic advisory committee fear the worst. Master Tea maker, Herman Gunaratne thinks Sri Lanka’s tea production would be slashed in half, causing an approximate loss of $ 625 million to the country and affect the income prospects of three million Sri Lankans who depend on the tea industry.

It could also affect the country’s cinnamon and pepper industry as well as the domestic production of fruits and vegetables. Local farmers already fear that yields may reduce by 30-50%. Sri Lanka imports approximately $ 400 million worth of fruits and vegetables per year to meet its total domestic demand, and if the domestic production of these food items reduces, there may be more food shortages or a bigger import bill.

The last thing Sri Lanka needs is lower export earnings and a steeper import bill.

2. Bad COVID management policies hindering tourism recovery

The tourism industry brings in $ 3-5 billion in foreign exchange earnings into the country, but Sri Lanka’s mismanagement of the pandemic are affecting the country’s tourism recovery prospects. While Sri Lanka battles its fourth, and by far its deadliest wave of COVID, the Government has decided to re-open the country to tourists. Unfortunately, Sri Lanka is still on the red/amber lists of three out of its top five source markets (United Kingdom, Germany and France) and so tourism recovery is not coming any time soon.

Till July 2021, however, Sri Lanka has only seen some 19,300 tourists entering the country, less than 1% of its usual 2.3 million tourists visiting annually. Even if Sri Lanka manages to double this by the end of the year, it is still only 2% of the usual, and therefore begs the question of opportunity cost; is the cost of attracting such a few number of tourists into the country, that is, the risk of bringing in new variants into the country (and creating another wave) worth it?,

Vietnam, another tourism dependent economy, suffered an 80% dip in tourism arrivals in 2020 but authorities in Vietnam are strictly pursuing a zero-case approach aimed at boosting traveller confidence before all else. McKinsey predicts that Vietnam’s tourism industry will recover fully by 2024. Sri Lanka’s response however has been confusing.

In December 2020, a bio-bubble was created to bring in tourists from Ukraine, a country with a high number of COVID infections at the time, however this bubble was coordinated not by the tourism authorities but by a private entity. Now, in the middle of its deadliest wave, the country has opened up once again to tourists from India and Pakistan. The priority of the authorities appears to be in hand-holding a few tourists into the country, however this small volume of tourists is meaningless for tourism recovery.

The priority for tourism recovery needs to be in arresting the spread of COVID, particularly the Delta variant in the country; failing to do so means Sri Lanka risks undergoing a muted performance in the year 2022 as well.

3. Global supply and prices

Pent-up demand, and stressed supply chains caused by the COVID pandemic undoubtedly contributes to rising commodity prices in Sri Lanka (as we are a very import-dependent country). Sri Lanka usually imports about $ 19-20 billion worth of goods annually.

When you couple this with the rapid depreciation of the Sri Lanka rupee, it is no surprise that commodity prices are rising in Sri Lanka. Food shortages, however, are not purely a global supply problem. The food shortage in the country is caused by the shortage of foreign currency in the country. Importers generally open letters of credit with banks which have a credit period of 180 days, meaning they actually pay the bill 3 months after they buy the goods.

However, due to the shortage of foreign currency and the rapid depreciation of the rupee means banks don’t have the capacity to open letters of credit on behalf of importers. The Central Bank is not lending private banks any dollars and neither do banks have enough dollar reserves to lend.

In addition, importers are no longer able to buy dollars at forward rates (basically you agree to buy an X amount of dollars at an agreed upon rate on a particular date in the future. This serves as a mechanism to mitigate the exchange rate risk usually) because the rupee is depreciating so fast and banks are not willing or able to meaningfully absorb this risk.

A majority of Sri Lanka’s imports are not for direct consumption, approximately 57% are intermediate goods (such as fuel, chemicals, fertilisers) which are used heavily in the country’s production activities. Another 20% are investments goods like machinery, transport equipment and building materials. Only about 20% are consumption goods like vegetables, fruits and sugar.

Imports bans, therefore, are not a long-term solution for the Sri Lankan economy, as this would cripple its production (and thereby the economy). Rising global commodity prices means that Sri Lanka will need even more dollars to purchase the imported goods it needs to run its economy.

4. Other factors that don’t warrant an entire section

Corruption. There is an immense amount of corruption in the country, giving way to unscrupulous rent-seekers that greatly hinders Sri Lanka’s true growth potential. Many such rent-seekers also enjoy the perks of the Government’s protectionist policies. A country that rewards corruption and fails to set the right incentives in place are unlikely to achieve sustained, long-term and equitable economic growth.

Ad hoc-ism (as heard on an Al Jazeera interview with opposition MP Dr. Harsha De Silva). Ad hoc and overnight decisions have become quite commonplace in President Gotabaya’s Government (such as the organic agriculture policy) and are a deterrent to investors who value policy stability.

Miscommunication. Miscommunication and mixed communications are another hallmark of this Government: while one Government MP tweets that there will be no lockdown extension, another tweets the exact opposite. This hardly inspires any confidence in foreigners, be it tourists or investors (or even locals for that matter).

(Not) listening to the experts. The Government’s COVID policies are the poster-child of why listening to the experts is important, and the same can be said of its economic policies. Failing to do so, is rather detrimental.

In conclusion

Sri Lanka needs to focus more on growing its export revenues and less so on attempting to cut down its imports through bans. Since nearly 80% of imports are intermediate and investment goods which are used in the country’s production activities, import substitution is not a viable strategy for the country.

If, for example, Sri Lanka was able to increase its export earnings by even 50% in the coming years, this would make our import-dependency self-sustaining in the long-run and eventually ease off the country’s balance of payments crisis. For this however, innovation and investment are key: but an economic crisis is not a conducive environment for this.

In addition to boosting the exports of goods, focusing on increasing revenue through the export of services has significant potential in Sri Lanka. In 2019 Sri Lanka exported $ 7.4 billion in services (and imported $ 4.6 billion), creating a net inflow from services of $ 2.8 billion. This includes earnings from tourism of $ 3.6 billion. Transport services, such as sea and air freight and passenger services brought in $ 2.3 billion, ICT services another $ 1.05 billion. Investing in human capital development and enabling the right regulatory environment to improve the value and volume of services would boost this category of exports.

Developing the tourism industry in the country would be a significant boost to the economy as well, but strategic efforts to develop tourism to cater to a higher volume of tourists are lacking. The country must focus on destination development (such as increasing occupancy in the East Coast and developing new tourism experiences) to prevent over-tourism to present tourism hotspots, improving the experiences available in present tourism destinations and improving public transport for better accessibility.

Therefore, unless the Government by some miracle is able to secure a willing lender (or maybe a tax amnesty bill) to ease its debt settlement burdens (and meet its other deficits), going to the IMF for a bailout seems inevitable. Although painful, the reforms that would be ushered in under IMF’s watchful eye are much needed; the Government needs to get a grip not only on its debt obligations but also on its expenditures and revenues, and work towards reducing its budget deficits.

|

(The writer is an economic analyst with experience working for leading Sri Lanka think tanks on a variety of social and economic issues. She is formally qualified in economics from the University of London and University of Warwick. This article was originally published on her blog, https://writtenbyreh.wordpress.com/2021/09/08/sri-lankas-economic-crisis-how-did-we-get-here/)