Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 30 January 2026 00:26 - - {{hitsCtrl.values.hits}}

Context

Context

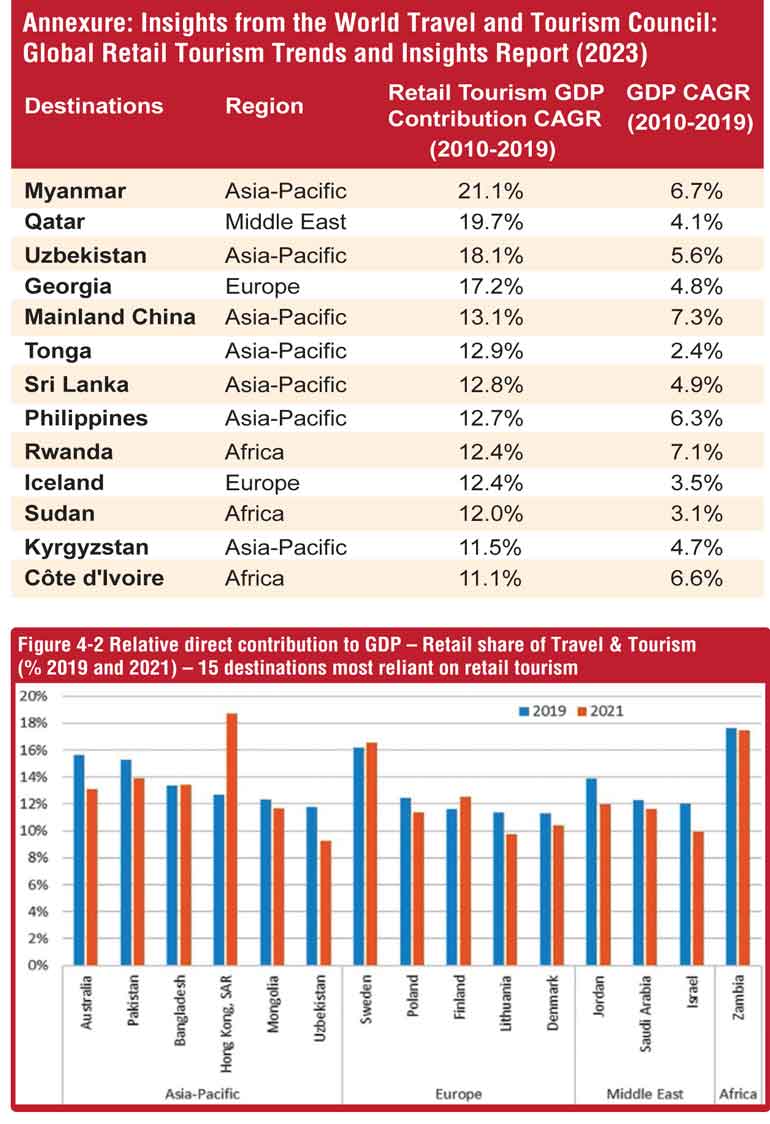

Globally retail tourism represents about 6%1 of travel and tourism’s direct contribution to world GDP. According to the World Travel and Tourism Council, Sri Lanka had the 7th highest growth rate in retail tourism to GDP contribution of 12.8%2 between 2010-2019, much higher than 4.9% GDP growth. Sri Lanka has immense potential to establish itself as a leading retail tourism hub in the region. By leveraging its strategic location, cultural diversity, and growing tourist arrivals, the country can significantly enhance its attractiveness for high-spending tourists. This proposal outlines a strategy centred on tariff rationalisation and VAT refund reforms to achieve the dual objectives of optimising Government revenue and increasing tourist dollar spend.

1. Objectives

1.1 Government revenue optimisation: Streamline tariffs and tax structures to encourage retail activity and consumption by tourists, ensuring a sustainable increase in Government revenue without compromising economic competitiveness. Presently a high tariff structure on luxury items is not conducive to make Sri Lanka a retail destination.

1.2 Increase dollar spend by tourists: Increase their average daily spend from the current under $200 a day to at least $600 (3X) to help achieve the $ 8 billion of tourism earnings by 2030. Presently, in Asia Pacific it is estimated that 10-15% of tourism earnings are from retail. Based on an average of 10% and earnings of $4.3 billion in 2018, it is estimated that tourism retail could be around $ 400 million in Sri Lanka. For the $ 8 billion tourism target to be achieved, retail tourism can contribute and increase to become more than a $ 1 billion industry.

2. Proposed strategies

1st Stage- Tariff rationalisation:

To achieve the twin goals of revenue optimisation and increased tourist spending, Sri Lanka should simplify import tariffs: Reduce import duties on high-demand consumer goods such as luxury watches, gem and jewellery, electronics, and branded fashion wear. Lower tariffs will make Sri Lanka a competitive retail destination for tourists.

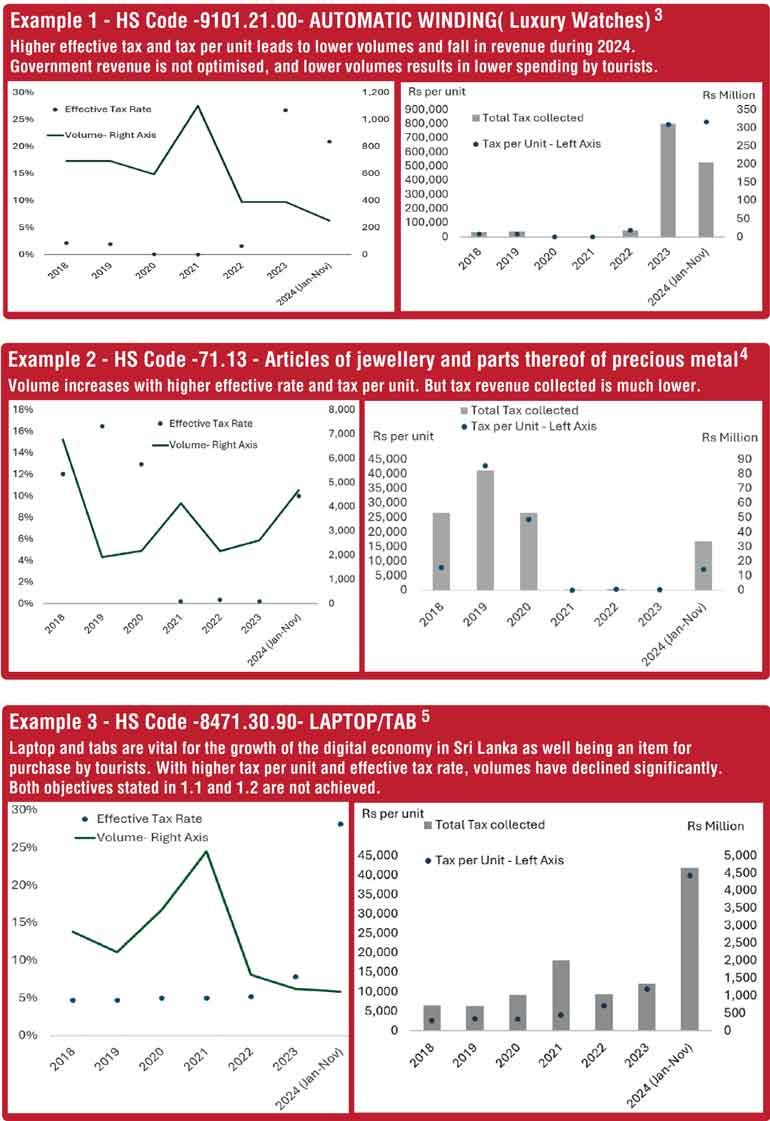

Example 1: HS Code -9101.21.00- Automatic Winding (Luxury Watches)3

Higher effective tax and tax per unit leads to lower volumes and fall in revenue during 2024. Government revenue is not optimised, and lower volumes results in lower spending by tourists.

Example 2: HS Code -71.13 - Articles of jewellery and parts thereof of precious metal4

Volume increases with higher effective rate and tax per unit. But tax revenue collected is much lower.

Example 3: HS Code -8471.30.90- Laptop/Tab5

Laptop and tabs are vital for the growth of the digital economy in Sri Lanka as well being an item for purchase by tourists. With higher tax per unit and effective tax rate, volumes have declined significantly. Both objectives stated in 1.1 and 1.2 are not achieved.

Steps to be taken:

1. Identify a basket of items that can be promoted for the retail hub concept. This can be items related to branded clothing, footwear, luxury watches, gem and jewellery items.

2. In the tariff rationalisation process, the tax rate on duties can revert to a pre-crisis level for certain goods that can be provided for retail tourism. For example, HS Code -9101.21.00 has only 2% Nation Building Tax in 2019.

3. The final step is on providing VAT relief through the digitised VAT refund mechanism.

2nd Stage- Digital VAT Refund Mechanism for Tourists (12-18 month implementation)

A streamlined digital VAT refund process is crucial to attract high-spending tourists. Key recommendations include:

3. Expected outcomes

3.1 Increased tourist spend: By reducing barriers to consumption and enhancing the retail experience, Sri Lanka can increase daily tourist spending to at least $600, aligning with regional competitors such as Dubai, Thailand, Malaysia and Singapore.

3.2 Boost in Government revenue: Tariff rationalisation and improved tax compliance from increased sales volumes will result in a net positive impact on Government revenue.

3.3 Economic diversification: A thriving retail tourism sector will create new opportunities for local businesses, particularly in the handicraft, textile, and jewellery industries.

3.4 Enhanced tourist satisfaction: A seamless VAT refund process and competitive pricing will improve Sri Lanka's reputation as a tourist-friendly destination, driving repeat visits

(The author is a veteran in retailing luxury watches and jewellery)

References

1 According to the World Travel and Tourism Council and Oxford Economic for the year 2019

2 World Travel and Tourism Council: Global Retail Tourism Trends and Insights Report (2023)

3 Data Source: Sri Lanka Customs

4 Data Source: Sri Lanka Customs

5 Data Source: Sri Lanka Customs

6 Typically, these operators deduct a handling fee from the VAT amount before issuing the refund to the tourist. For instance, in the Bahamas' VAT Free Scheme, Global Blue offers a "VAT OFF" process where they support either 81.5% or 100% VAT OFF at the register. In this context, Global Blue invoices 9.5% of the VAT payable as a commission to the Government for all VAT OFF transactions.