Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 3 January 2024 00:15 - - {{hitsCtrl.values.hits}}

"It is a paradoxical truth that tax rates are too high today and tax revenues are too low, and the soundest way to raise the revenues in the long run is to cut the tax rates."–John F. Kennedy

The fiscal crisis following with foreign exchange issues in 2021 have thrown the spotlight on the capacity of Sri Lankan Governments to find their spending commitments and meeting debt obligations. Tax revenue mobilisation remains essential to achieve economic growth, meeting bilateral creditors’ conditions. Moreover, it is important to meet Sustainable Development Goals. A majority of citizens and companies are reluctant to comply with their tax obligations, however, changing their views on taxes is not an easy task for governments. Why do the public evade tax liability? If people evade taxes because tax rates are too high, efforts must be made to reduce tax rates. If people evade taxes because of the perception that they do not receive much in benefits, and is a waste of tax money from their tax payments, governments need to increase the benefit-to-cost ratio. If people evade taxes because they view their government as corrupt or inefficient, governments must make an attempt to become more efficient and less corrupt. Another grave perception is private sector tax money being used to feed government sector employees and SOEs. Tax revenues are the primary source of public financing for any country, and play a vital role in helping them support economic development and social well-being. But governments are frequently confronted with citizens and companies that refuse to pay their taxes, and the consequences are fiscal, economic and social.

A major blow to the Sri Lankan economy comes from different dimensions, mainly lack of fiscal discipline, weak governance and corruption, leading to pitiable public trust on the system. The Government struggles to maintain sufficient spending on public services and infrastructure needed to combat poverty and create a more equal society. In dire need of increased domestic revenue, and under pressure from a growing fiscal deficit, Sri Lanka needs to adopt out of the box and pragmatic strategies to enhance the tax net. To ensure efficiency and equity in revenue mobilisation, governments need to design better tax policies, modernise revenue administrations, and implement country-specific structural reforms. It is imperative to maintain key principles of tax concept fairness, certainty, convince efficiency and neutrality. These are the basics. Considering the dire situation in fiscal discipline and tax collection all stakeholders should assess the situation profoundly and arrive at an acceptable pragmatic approach.

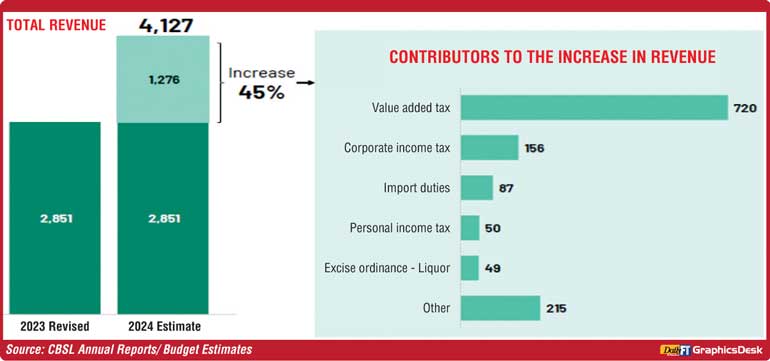

The 2024 Budget presented on 13 November 2023, anticipates a 45% increase in total revenue, with total expenditure growing by 24%, thereby reducing the budget deficit to 7.6% of GDP from the 8.4% of GDP expected for 2023. Sri Lankan budgets have consistently overestimated the capacity to raise revenue, which would continue this time as well. The Budget also outlines important administrative measures to expand the tax base in terms of personal income tax. How are we going to achieve numbers? The recent increase in VAT is not the sustainable solution; that would lead to more and more issues and contract economic growth and ignite socio- economic issues. It’s high time to address this situation and implement some pragmatic and progressive structural transformation as stated below:.

|

President and Finance Minister Ranil Wickremesinghe presenting 2024 Budget - File photo |

Tax awareness and tax education

Taxpayer education with a particular focus on youth combined with better communication remains the most appropriate tool for encouraging people to pay their taxes. Teaching tax compliance to youth is a tool that would certainly support to inculcate a conducive tax culture in a country. Age is one of the main determinants of tax compliance worldwide; ideally tax education should integrate into the school curriculum or through the use of art. I believe it should start from Grade 8. Focus on strategies to increase trust between taxpayers and tax administrations could lead to higher “tax morale” and, when implemented alongside reforms to boost enforcement and improve facilitation, could trigger higher rates of compliance. Youth should understand that free education comes from the proceeds of tax money. Thus, they have the moral duty to pay back to society as a loyal tax payer. Unfortunately, this understanding is not in our culture, mainly trade unions, political ideologists, student societies, before they ask for their rights, they need to show their moral responsibility and commitment towards the nation.

Capture informal sector

Many individuals that engage in high paying self-employment, categorised as informal sector employment are not properly captured by the tax net. Absorbing such individuals into the tax net is a difficult task as such businesses are not required to prepare annual accounts while some transactions take place outside banking channels, allowing them to under report income. Bringing such informal activities into the tax net requires long term strategies. Providing incentives to individuals to register with the IRD, encouraging informal sector businesses to register for VAT, simplifying the tax calculation and adopting withholding taxation mechanisms on certain payments and income can be identified as a few steps to bring the high earning informal sector into the tax net.

Establishment of large taxpayer office/HNWI

The High-Net-Worth Individual (HNWI) tax consultation unit in the IRD would support to collect more revenue. The HNWI unit embarked on a thorough and proactive process of personal face-to-face meetings with each of these potential targets, to educate them on their rights and obligations as taxpayers, and to signal that their tax affairs were under scrutiny. This has been very successful in Uganda and many developing countries.

Panoramic view untapped segments and crackdown on tax evaders

Deploy young professionally qualified Inland Revenue Department (IRD) team in key income earning entities such as private hospitals, private education institutes, professional associations, etc. It is a known fact that professionals like medical practitioners, lawyers, tutors make sizable income that are not being accounted for as annual taxable income. As a strategy, private hospitals should not make any cash payments to doctors/consultants. Have a minimum fees threshold for every surgery, add a certain percentage for specialty/complexity. But it should be clearly disclosed that hospitals should share these details with the IRD office. Propose to set up 24*7 IRD office at major private hospitals and income generating entities.

Financial system support

Banks and other financial institutes have a major role to play towards enhancing the tax net. They can support the system in many ways, e.g. at the time of lending, allowing import and exports, opening of accounts, etc. Discourage lending and advice clients who maintain two sets of financials. It is common knowledge that banks indirectly support businesses to evade taxes. How do they lend substantial amount to clients showing distorted and doctored financials. It is ethically and morally wrong to encourage these types of clientele. Further, banks should not encourage or allow imports by individuals /or companies that do not have tax files. In some business entities they open multiple accounts under their workers, family members and route business through such accounts. Moreover, they close the account within a short period of time and open new accounts under different names, the main purpose being to evade tax payments. Also they make minimum cash deposit through bank counters to CAP Rs. 200K or Rs.300K. Control and compliance should not be exceptional to few banks, it should be common to all banks.

Ground level close scrutiny

Carry out inspection of each and every shop (door to door) in major commercial hubs, e.g. Main Street, in the Pettah, and educate the business community and get compulsory registration for tax. Post follow up is very essential to ensure proper tax payment. The IRD can cluster the area and assign officers as relationship managers (RMs) to support the business community. IRD officials should not deprive their moral duty and obligation. Heavy penalty should be imposed for breach of trust and professional negligence, even cancel professional memberships. Propose to set up IRD office in major economic centres and identified business hubs in Sri Lanka. This would help IRD officials to get hands-on-experience on the ground situation and close scrutiny in respective businesses- mainly cash movements, trade, book keeping and different business dynamics.

Meticulous monitoring mechanism on BOI registered companies

Another key tax bleeding sector is BOI approved companies. Evaluate all BOI registered companies and see the progress and tax payment records. Certain companies still show loss and do not comply with BOI directions/expectations, while deliberately trying to conceal actual financial performances. Most of the companies show negative returns to hoodwink the system and get maximum benefits. Appoint IRD/ BOI team in clusters to advice and collect taxes.

Introduce windfall tax

Impose one-off windfall tax on industries that make supernormal profits. A windfall tax is a one-off tax levied by governments against certain industries when economic conditions allow those industries to experience above-average supernormal profits. In other words, introduce one-off solidarity wealth taxes and windfall taxes to end crisis profiteering. It was observed that certain sectors recorded exorbitant revenue and profits during crisis time. The idea is that extra revenues can be ear-marked to support low-income families during the cost-of-living crisis. This should not be used as a tool to collect tax in the long run, otherwise it would discourage capital investments, R and D, investor confidence, challenge “fairness of tax, “etc. Windfall tax is very common in every country. 25 European countries announced windfall tax, Russia, Pakistan, India also implemented windfall tax.

Financial sector

The CBSL’s latest report indicates that investment in Treasury bills by the banking sector has increased by 11.8% (Q-o-Q) Rs. 1.46 trillion by the end of the third quarter from Rs. 1.29 trillion by end June. Treasury bill investments have increased by 57.3% in the nine months of 2023. This clearly shows that FIs are still making good money from TB interest income instead of core banking business which in return is a burden to the Government and tax payers. Introduce a withholding tax (WHT) or a super gains tax on Treasury bill trading for primary dealers and large corporate investors with a minimum investment threshold. It is clear that interest earned on government securities will have to be declared by individuals in their individual income tax files and pay the personal income tax rate based on which slab the investor falls into. FD investors should pay WHT as well as declare interest income on personal income tax.

Attractive tax amnesty

Extend tax amnesty for people who declare assets and liquid funds that should be used for investments in startup projects, various industries, etc. The Government could accord them a special tax slab for a specific period. This would certainly support in three ways (1) raise revenue quickly; (2) increase future tax compliance (e.g., by encouraging taxpayers to declare and pay previously undeclared tax, file tax returns, or register to pay taxes, and stay current on their tax obligations) (3) induce the repatriation of FX earnings to the country.

Ease pressure on APIT payees

Avenues to make a downward adjustment to Advance Personal Income Tax (APIT) slabs. Salaried segment spending habit and pent-up demand would drive the economy. It would not be effective if the Government taxed monthly fixed income earners. They are the people who actively spend in an economy. They pay direct and indirect tax aggregating 50%-60%. If the Government puts more pressure and burden on Payee tax payers it would certainly have ripple effects on economic activities. Progressive personal income tax rates (12 to 20 %) could be introduced with a flat rate of 20 %. If we fail to do so economic contraction and social unrest would be inevitable in the future.

Progressive wealth tax

It is reported that a top 1% of Sri Lankans own 31% of the personal wealth in the country Without exerting much burden on high net worth individuals, the Government could introduce tax payer friendly wealth tax system depending on the wealth measurement used and transparent wealth tax thresholds. Tax rates should not be detrimental to the payer and should not keep on changing from time to time. The Government can introduce this tax either for a specific period or continue with a very minimal rate. It should not discourage high net worth tax payers and induce capital flight.

User friendly online Tax return system

The current system is not at all user friendly and the ordinary person cannot understand. Many citizens and business owners are often unfamiliar with the technical jargon of tax-related topics. Hence, it is imperative for revenue agencies to have plans to reduce taxpayers’ compliance burden by making it easy for them to understand the system. Even professionals get confused and the system operation itself discourages tax payment. In addition, there are many technical and process improvements in the current system.

Inculcate customer relationship management concept in IRD

Compulsory assignment of IRD tax officials to all businesses and corporate offices is needed. This is basically an introduction of the Customer Relationship Management (CRM) concept. These officers could liaise with auditors, banks, tax consultants and other institutions. The process would lead to a very transparent way to calculate taxes. They could also support individual tax payers in an organisation.

Revenue Collection Authority

This is a good initiative by the Government. The Authority should consist of private and public sector professionals with high integrity and an unwavering record. It should not be filled with the traditional set of people who have limited experience and would not think out of the box.

Outsource tax collection

It is evident and observed that at present the IRD staff is not sufficient to go into minute cases. In this regard, delegate to the private sector the collection of minor amounts of delinquent taxes that would also save tax administration money. Just as it is often advisable to turn tax collection over to banks, it would be worthwhile to place collection of minor delinquent taxes in the hands of specialised agencies. The same idea is behind both propositions: to free up resources in order that the tax administration may concentrate on its basic functions.

Capture through mobile connections

Effective and strong communication through proper source of communication mode. As per GSMA intelligence shows there were 36 million mobile connections in Sri Lanka in 2023 which indicates that mobile connections in Sri Lanka were equivalent to 165.5 % of the total population in January 2023. This is the best mode of communication to create awareness of the importance of taxes and use tactical strategy to exert pressure to register as a tax payer. Clients that have multiple connections must be in a position to afford high mobile bills, which means they are liable to pay tax from their income. It should be mandatory to register as a tax payer if one has an average mobile bill up to a certain amount. Necessary legal provisions should be enacted for mobile network providers to disclose necessary information and customer segments, high value clients etc.

Enhanced audit and verification program/Work ethics and punishment

All stakeholders should adhere to professional ethic compliance, transparency that is important in the process of enhancing the tax net and revenue. Breach of trust in profession, support “tax cheat “and fraudulent act, aggressive tax avoidance should be seriously dealt with and penalised to the maximum. The IRD should introduce a new “name and shame” policy whereby names, addresses, and tax settlement amounts are published in newspapers.

Reliable data and MIS

Carry out a profound study and census to identify business entities in each geographical area, proper segmentation in business, Micro, individual business, SME, corporate, etc. Deploy IRD officials in each provincial secretariat divisions to educate and push them for tax assessment and payments.

Miscellaneous sources

Compulsory tax file should be introduced for air ticket issuance, credit card, event organising companies, club membership. Charge certain percentage (One –off or monthly) on professionals who leave the country for permanent stay. This is to recover certain percentage based on the expenses incurred for free education.

The writer holds a PhD (MSU-Malaysia), MBA(University of Wales), MCIM (UK), AIB(SL), PgDip (Cranfield University School/CA SL), SLIM