Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 29 July 2025 03:50 - - {{hitsCtrl.values.hits}}

Unchecked authority can pave the way for unethical behaviour, financial mismanagement, and ultimately, corporate failure

Power imbalance in corporations

Power imbalance in corporations

Power imbalance often occurs when authority is concentrated on a single individual or a few executives, and it is at the heart of corporate mismanagement, corruption, and abuse of power. Concentration of power often restrains diverse perspectives and critical debate. Without input from multiple stakeholders, decisions may be made based on limited information or personal biases. Power imbalances often create fertile ground for corruption, as executives with unchecked authority may prioritise personal gain over the organisation’s objectives. Within a culture with a higher power imbalance, employees fear speaking out and whistleblowing, and finally, innovation and collaboration suffer.

When the power imbalance is high, there is often little oversight to challenge authoritative decisions. This can lead to reckless decision-making and corruption. Corruption can manifest in various forms, such as bribery, nepotism, and fraudulent financial practices. When corruption becomes endemic, it undermines stakeholder confidence and can trigger legal and regulatory repercussions. Too often, these issues are treated at the surface level, with actions taken to manage symptoms rather than addressing the root causes. Consequently, the core problems remain unaddressed, and challenges continue to resurface. This not only erodes stakeholder trust but also leads to corporate failure.

Power imbalances and failure cases

In Sri Lanka, while many instances of corporate mismanagement go unnoticed, several high-profile cases highlight the critical impact of power imbalances. The collapses of Golden Key Credit Card Company, Pramuka Bank, and ETI Finance, alongside the Central Bank bond scam and persistent issues within numerous State-Owned Enterprises (SOEs), often manifest as a combination of mismanagement, lack of accountability, weak risk management, and inadequate transparency. These issues are systemically rooted in underlying power imbalances that allow unchecked authority and discourage responsible governance.

Internationally, numerous corporate scandals underscore the critical risks associated with unchecked power. Cases such as Siemens AG illustrate how power imbalances can facilitate widespread unethical behaviour. Similarly, the Volkswagen emissions scandal demonstrated that unchecked authority could lead to deceptive practices with global repercussions, damaging the company’s reputation and resulting in significant financial penalties. These examples, alongside corporate collapses like Enron and Lehman Brothers, highlight that concentration of power and a lack of independent oversight can lead to devastating consequences, including financial ruin, reputational damage, and loss of investor confidence.

Governance models to mitigate power imbalance

Different models, such as unitary board, two-tier board, separation of roles and stakeholder governance model, have been in practice to overcome the governance challenges. Each approach has its strengths and weaknesses. The underlying rationale of this model is to minimise power imbalance, and this requires strong independent directors whatever the model.

The main issue in many Sri Lankan corporations is CEO duality. On the other hand, independent directors, who are supposed to offer objective oversight, are often appointed based on personal connections rather than merit or independence. As a result:

Therefore, the board oversight has become a formality rather than a functional control mechanism.

To address this challenge, a new approach to corporate governance is required: one that goes beyond conventional regulatory frameworks and focuses on rebalancing power within organisations. This can be achieved through stronger independent oversight, greater transparency in decision-making, enhanced stakeholder participation, and stricter enforcement of governance policies. By ensuring that no single entity or individual holds unchecked control, corporations can create a culture of accountability, reduce the risks of governance failures, and contribute to long-term economic sustainability.

The role of HR director in mitigating power imbalance

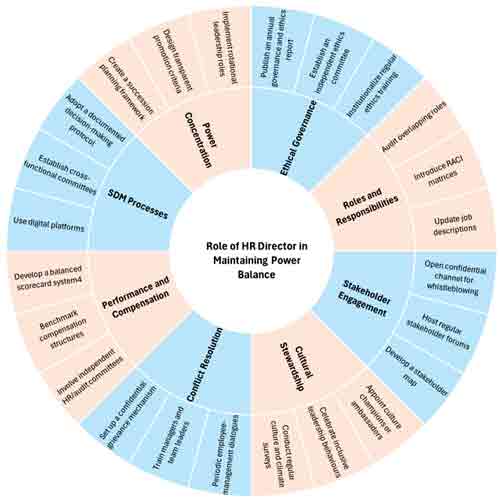

The role of human resources (HR) has evolved from an administrative function to a strategic function at the board level (see the article: Susil K. Silva, 7 February 2025, Daily FT). However, HR inputs at the board level are often limited to some workforce statistics in Sri Lankan companies. An independent HR director can play a crucial role in addressing power imbalances across the organisation, and here is how:

Mitigating power concentration: Ensuring fair hiring, promotion, and succession planning practices prevents the concentration of power in a few individuals.

Implement structured decision-making processes: Establish clear governance processes to ensure decisions are made collaboratively and transparently.

Performance and compensation oversight: Providing insights into fair performance evaluation and compensation strategies helps align executive behaviour with organisational goals.

Conflict resolution: Addressing disputes and fostering open communication channels between employees and management, which helps maintain harmony and build trust.

Cultural stewardship: Promoting a culture of accountability and inclusivity ensures that power dynamics remain healthy and transparent. Advocate for employee representation on the board, giving the workforce a voice in high-level decision-making.

Stakeholder engagement: Facilitate engagement between the board, employees, and other stakeholders, fostering a balanced and inclusive decision-making process.

Advocate for clear roles and responsibilities: Ensure job roles and responsibilities at the senior management level are well-defined to prevent power hoarding by certain members.

Promote ethical governance: Reinforce a code of conduct that emphasises ethical behaviour, transparency, and accountability. Act as a neutral advisor to the board on conflicts of interest or ethical dilemmas.

Concluding remarks

Power imbalances represent a critical vulnerability in corporate governance, with far-reaching consequences. As demonstrated by both local cases like Golden Key Credit Card Company, Pramuka Bank, and ETI Finance, as well as international scandals such as Siemens AG and the Volkswagen Emissions Scandal, unchecked authority can pave the way for unethical behaviour, financial mismanagement, and ultimately, corporate failure. These failures erode stakeholder trust, damage reputations, and undermine long-term sustainability.

To mitigate these risks, organisations must adopt comprehensive governance models that prioritise transparency, accountability, and independent oversight. This includes strengthening the role of independent directors, enhancing stakeholder participation, and strictly enforcing governance policies.

Furthermore, the strategic importance of independent HR directors in maintaining power balance cannot be overstated. By ensuring fair hiring practices, implementing structured decision-making processes, and advocating for ethical governance, HR leaders can foster a culture of inclusivity and accountability. Their role in performance and compensation oversight, conflict resolution, and cultural stewardship is vital for creating a healthy corporate environment where employees feel empowered to speak out and contribute to decision-making.

Addressing power imbalances requires a shift from merely managing symptoms to tackling root causes. This involves creating systems that promote open communication, encourage diverse perspectives, and ensure that no single entity or individual holds unchecked control. By fostering a culture of transparency and accountability, corporations can reduce the risks of governance failures and promote long-term economic sustainability.

Ultimately, the goal is to create organisations that are not only financially successful but also ethically sound and socially responsible. By embracing proactive measures to rebalance power, corporations can build resilience, foster innovation, and create long-term value for all stakeholders.

(The writer holds a PhD (Mgt. USJP), and is a Sr. Lecturer, Researcher, Management Consultant, Accredited Director (SL), Chartered Member CIPM, MSLIM, AMTID, with 26 years of managerial experience in construction and engineering, trading, apparel, manufacturing and education sectors. He has held positions such as CEO, Sr. Executive Vice President and Group Head of HR and Administration in large organisations.)