Saturday Feb 14, 2026

Saturday Feb 14, 2026

Thursday, 28 November 2024 00:25 - - {{hitsCtrl.values.hits}}

Under a single policy interest rate mechanism, it is easier for the Central Bank to communicate its monetary policy stance to financial markets, the public, and other stakeholders

Background

Background

The Central Bank formally announced its transition to a single policy interest rate mechanism, effective 27 November 2024. This marks a significant milestone in the evolution of monetary policy in Sri Lanka. A single policy interest rate mechanism enhances the clarity of the Central Bank’s monetary policy stance by establishing a clear target for overnight interbank call market interest rates. Under this mechanism, the Central Bank introduced the Overnight Policy Rate (OPR) as its primary monetary policy tool to signal and operationalise its monetary policy stance. This transition is expected to enhance the efficiency and effectiveness of monetary policy signalling and transmission to the financial markets and the broader economy.

This article aims to brief the readers on the main changes introduced to the monetary policy framework and implementation under the single policy interest rate mechanism and the rationale for this shift.

The conduct of monetary policy by the Central Bank, aimed at achieving price stability, has undergone substantial evolution over the past several decades. During the early 1980s, the Central Bank adopted monetary targeting as its monetary policy framework, where monetary aggregates became the key nominal anchor in the conduct of monetary policy. Under this framework, reserve money functioned as the operating target, while broad money aggregates served as an intermediate target. In the mid-2010s, the Central Bank commenced conducting monetary policy within an enhanced framework, as an interim arrangement, with features of both monetary targeting and inflation targeting. This marked the beginning of a stronger emphasis on short-term interest rates, with the average weighted call money rate (AWCMR) – the rate at which banks transact in the interbank market - replacing reserve money as the operating target.

In 2020, the Central Bank formally moved to a Flexible Inflation Targeting (FIT) framework for the conduct of monetary policy. The enactment of the Central Bank of Sri Lanka Act in 2023 strengthened the legal foundation necessary to conduct monetary policy effectively under the FIT framework. Inflation targeting depends largely on the interest rate channel to transmit monetary policy actions to the broader economy. Consequently, the Central Bank’s adoption of FIT underscored its focus on influencing short-term interest rates through market-based instruments to achieve price stability.

The Central Bank introduced the repurchase facility in 1993 to absorb overnight excess liquidity from the domestic money market, while the reverse repurchase facility was introduced in 1995 to inject overnight liquidity. These facilities set the bounds for interbank call money market rates, with the Repurchase and Reverse Repurchase rates serving as the floor and ceiling, respectively. These rates are currently known as the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR), respectively. The policy interest rate corridor formed by the above rates was used from the early 2000s to signal changes in the Central Bank’s monetary policy stance, formally initiating the adoption of a dual policy interest rate mechanism. Open Market Operations (OMO) have been actively conducted to align short-term market interest rates with the Central Bank’s monetary policy objectives.

The Central Bank, from time to time, evaluates the effectiveness of its existing policy instruments and their ability to signal monetary policy intentions. These assessments include studying international central banking practices and technical consultations with international organisations. Following recent assessments, in its Annual Policy Statement for 2024, the Central Bank announced its intention to move towards a single policy interest rate mechanism, replacing the dual interest rate framework.

To support this transition, the Central Bank established a study group comprising technical staff. This group reviewed global experiences with single monetary policy interest rate regimes and proposed a framework best suited to Sri Lanka, along with an implementation roadmap. Following the deliberations and recommendations of the Monetary Policy Committee of the Central Bank, and the approval by the Monetary Policy Board of the Central Bank, consultations were held with financial market participants on the proposed mechanism, before its implementation.

The previous policy interest rate mechanism and its drawbacks

Up until 26 November 2024, the Central Bank conducted monetary policy operations under a corridor system with the announcement of two policy interest rates – the SLFR and the SDFR – defining the upper and lower bounds of the Standing Rate Corridor (SRC). This corridor guides overnight interest rates in the interbank call money market, as reflected by the AWCMR, which serves as the operating target under the current monetary policy framework. The Monetary Policy Board of the Central Bank communicated its monetary policy stance to the public by announcing the levels of the SLFR and SDFR, without specifying a precise point target for interbank transactions within the SRC.

In the absence of a clearly defined operating target in the Central Bank’s monetary policy communications, the AWCMR has been allowed to move within the SRC. Even though the Central Bank was aware of the rate around which it would like the interbank call money market rates to hover, transparency relating to where the AWCMR should lie within the policy rate corridor was lacking under the dual policy interest rate mechanism. This complexity created challenges in interpreting the Central Bank’s monetary policy stance.

Furthermore, the use of standing facility rates as policy interest rates has led to mixed signalling effects on monetary policy communications. Under the previous framework, the Central Bank’s targeted level of the AWCMR is not known by the market. Operations conducted to bring the AWCMR to the internally accepted level, which the Central Bank thinks is best depending on market conditions at the time, were questioned by some stakeholders. Movements in the AWCMR within the corridor - whether due to the Central Bank interventions in line with its monetary policy stance, market conditions or OMOs to address interbank market frictions – could be interpreted differently by market participants. While some might view these movements as deliberate policy actions, others might see them as natural market outcomes. This lack of a point target in the previous framework resulted in several challenges, including mixed signalling effects and reduced effectiveness in monetary policy transmission.

Alternative monetary policy operational frameworks

Globally, monetary policy operational frameworks come in three flavours: 1. corridor system, 2. floor system, and 3. ceiling system. Under a corridor system, the central banks adjust the supply of liquidity using OMO and standing facilities to a level where the target short-term interest rate clears the money market. The standing facilities are priced at a margin around the target interest rate, which provides the upper and lower bounds of the interest rate corridor. Meanwhile, a floor system supplies reserves in abundance through OMO, lending to banks or asset purchases, and provides a floor for the interest rate via a deposit facility. Under a ceiling system, central banks abstain from providing liquidity to the banking system through OMO. Instead, the liquidity deficit is met by the central bank’s lending priced at the policy interest rate. However, the ceiling system has not been widely used since the global financial crisis.

Most emerging market economies (e.g., India, Malaysia and the Philippines) are found to operate in a mid-corridor system, where the central bank’s policy rate is announced and, in addition, a predetermined margin is also announced to set the upper and lower bounds of the policy corridor. More importantly, the middle of the corridor serves as the key policy interest rate of such central banks, and monetary policy aims at maintaining the overnight market interest rates closer to the target defined by the key policy interest rate. However, the global financial crisis led most advanced economies (e.g., Canada, the United Kingdom and the Eurozone) to operate under a floor system for its conduct of monetary policy. Although the COVID-19 pandemic and the subsequent economic crisis warranted a continuation of the floor system, it is not regarded as a permanent framework for those economies.

Sri Lanka’s previous system could be classified as a corridor system. However, it fell short of a fully-fledged corridor framework because it only specified the corridor margins and lacked an announcement of a key policy interest rate within the corridor to anchor the AWCMR.

The main changes introduced

Under the single policy interest rate mechanism, the Central Bank introduced the Overnight Policy Rate (OPR) as its primary monetary policy tool to signal and operationalise its monetary policy stance, effective 27 November 2024. The appropriate level of the OPR will be periodically reviewed during the Monetary Policy Reviews to ensure domestic price stability within the FIT framework. The Monetary Policy Board will adjust the OPR as necessary to reflect changes in the monetary policy stance of the Central Bank, with such adjustments communicated transparently to the public. In alignment with this policy change, the Central Bank will target AWCMR to remain at or around the announced OPR. The AWCMR will continue to serve as the operating target within the Central Bank’s FIT monetary policy framework. With this transition to the single policy interest rate mechanism, the SDFR and the SLFR will no longer be considered policy interest rates of the Central Bank.

The operational framework of the new mechanism

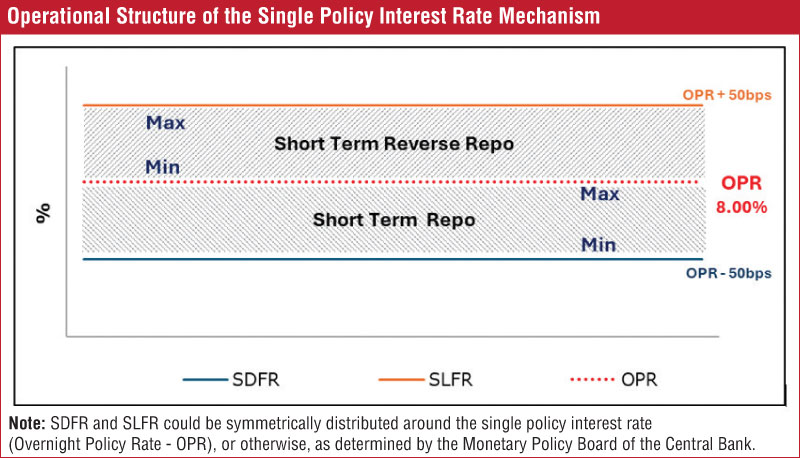

The Central Bank continues to conduct OMOs under the single policy interest rate mechanism to maintain AWCMR at or around the OPR. The standing facilities, namely, the Standing Deposit Facility and the Standing Lending Facility, will continue to be available to participatory institutions for overnight transactions with the Central Bank. The interest rates applicable for these facilities, i.e., the SDFR and the SLFR, are linked to the OPR, with pre-determined margins as decided by the Central Bank. Currently, these margins are symmetric around the OPR and are set by the Monetary Policy Board based on market conditions.

Effective 27 November 2024, the Central Bank set the OPR at 8.00%, moving to a single policy interest rate mechanism from its dual policy interest rate mechanism. As decided by the Monetary Policy Board, SDFR and SLFR are linked to the OPR with a margin of ± 50 basis points. Accordingly, SDFR and SLFR will be 7.50% and 8.50%, respectively. These rates will continue to serve as the lower and upper bounds for interbank call money rates, and they will no longer function as the policy interest rates.

Advantages of having a single policy interest rate

There are several benefits of adopting a single policy interest rate mechanism. A single policy rate significantly improves the transparency of monetary policy decisions and their communication. It is more effective in signalling the Central Bank’s monetary policy stance, aligning market expectations, and facilitating the transmission of monetary policy. Temporary movements in the AWCMR due to short-term liquidity fluctuations or other exogenous factors are less likely to influence overall market behaviour because the Central Bank’s policy stance is clearly conveyed through the key policy interest rate, independent of such fluctuations. This clarity strengthens not only the monetary policy signalling but also transmission mechanism by providing a fixed benchmark for setting other market interest rates.

Under a single policy interest rate mechanism, it is easier for the Central Bank to communicate its monetary policy stance to financial markets, the public, and other stakeholders. Any changes to the OPR would be announced exclusively through monetary policy reviews conducted by the Monetary Policy Board, and these changes would be publicly communicated through press releases, media conferences, and similar channels. This ensures that there is no ambiguity about the monetary policy stance. This simplicity reduces uncertainty and fosters confidence in the Central Bank’s actions and intentions.

In a single policy interest rate system, while the SDFR and SLFR will continue to provide the lower bound and upper bound for the AWCMR, OMOs would endeavour to maintain it at or closer to the announced policy rate, reducing volatility. At times, the AWCMR may deviate from the single policy rate due to temporary liquidity fluctuations or asymmetric liquidity distribution. However, market participants would recognise such deviations as temporary and not indicative of a policy change, as adjustments to the policy stance would be signalled through changes in the OPR.

Concluding remarks

The adoption of the single policy rate mechanism marks a significant step in the Central Bank’s ongoing efforts to strengthen the efficiency and effectiveness of monetary policy signalling and transmission across markets and the broader economy. The Central Bank remains committed to regularly reviewing and refining its monetary policy framework and operational strategies, aligning them with evolving domestic and global dynamics, as well as adhering to international best practices.