Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Saturday, 7 November 2020 00:05 - - {{hitsCtrl.values.hits}}

The obsessions associated with the advice and freely offered steering by some missions, ostensibly standing for humanitarian objectives and good governance with the high recognitions gained by them, leave many of us with no alternatives of any choice to reject or refuse their pronouncements, without being accused as fanatics.

The obsessions associated with the advice and freely offered steering by some missions, ostensibly standing for humanitarian objectives and good governance with the high recognitions gained by them, leave many of us with no alternatives of any choice to reject or refuse their pronouncements, without being accused as fanatics.

These dicta are so deep-rooted in the social web, that even governments with different political ideologies are compelled to include such thinking in their agendas and programs for development and progress.

The projected visions and stratagems sound convincing and promising, appearing to be ideally suited for the resolution of existing problems. They have highly ideological agendas including economic and social security reforms, as well as visionary outlooks for the formation of new regimes of good governance. Rampant corruption and gross insecurity provide good grounds for the propagation of such doctrines.

Sri Lanka a guinea pig

Sri Lanka has become a guinea pig of such interventions exacerbated due to its poor political leadership associated with half-baked and hybrid, circumstance driven policy stands, heavily subjected to the pressures and influence of corporate capital.

We have gone through this phenomenon for some time which gained sudden impetus from 2015 onwards due to the birth of a dichotomous rule of governance with a double-faced administration proceeding in two directions, one towards the establishment of a neo-liberal order while the other slogging behind with traditional pragmatism; now gone into the history as the Ranil-Sirisena Era.

It was, however, observed that Ranil factor advocating neo liberalism was more dominant of the two and paved the way and opening for many think tanks to freely influence and intervene in the policy planning process of the country.

Most of these think tanks are linked to networks controlled by corporate giants and international consultancy firms. They are well spread globally, therefore are in a position to easily propagate perceptions more akin to them.

The leading models always claim that they are independent, impartial and non-profit making. Unless challenged, such assertions are taken for granted and provide them the continued acceptance without opposition from any quarters including those with ideologically different views.

There are three such key organisations established as big players enjoying State patronage in the country’s affairs that we have to focus on. I will therefore briefly touch on these players who freely associate with the Government’s policy planning, with particular reference to their structure, known backgrounds and their involvements in the specific areas.

Advocata and IPS

There is a development in the offing guised under essential reforms for the State banks, heralded by one such institution, Advocata, which performs a high profile role providing recommendations to the Government for reforms in State-Owned Enterprises. Let us briefly examine the structure and make up of Advocata which is playing the forerunner role in this latest episode relating to the State banks.

It is one of the two leading ‘think tanks’ with firm footings now in Sri Lanka, the IPS (Institute of Policy Studies) and Advocata. The institute was established in April 2016 as a platform to discuss issues of economic freedom, progress and prosperity in Sri Lanka. Since its inception, the organisation is actively engaged in policy debates in Sri Lanka.

Its launch at the Lakshman Kadirgamar Institute was graced by MP Eran Wickramaratne, then Deputy Minister of Public Enterprise Development as the Chief Guest. As described: “The Advocata institute is an independent policy think tank based in Colombo, Sri Lanka. We conduct research, provide commentary and hold events to promote sound policy ideas compatible with a free society in Sri Lanka.”

The funding source of this think tank is not clearly known. It is an Associate member of the Fraser Institute’s Economic Freedom of the World Index and works closely with the Atlas Network. Both these institutions are leading think tanks in a global network heavily funded by the corporate giants. ‘Atlas Network’ is a non- profit organisation based in the US which acts as an umbrella organisation for free market groups. As of 2017 the Atlas Network had assets nearing $ 7,483,000 coming from several donors from the tobacco industry and giant oil corporates.

The Fraser Institute is a Canadian public policy think tank and a registered charity. It has a global network of 80 think tanks. While the institute receives funding from several giant corporates and foundations it has ceased disclosing its sources of corporate funding from 1980s.

Assisted by these two institutions, Advocata initiated a program in 2017 to accelerate the process of reforms in Sri Lanka with specific attention and focus on the revision of our laws. They observed that the laws relating to our lands were outdated and badly in need of revision to put back the derailed development programs on track.

On or about the same period the bilateral US agency, MCC, established their project unit in Sri Lanka, housed inside the Prime Minister’s Office with the approval of the Cabinet. Strangely the US managed MCC too advocated a policy initiative to fast-track the law reforms and the rule of law in the south.

The Institute of Policy Studies (IPS) is the other think tank actively involved in the development projects in Sri Lanka operated with State blessings. It is another ‘autonomous institution designed to promote policy-oriented economic research’ that contributes to socio-economic development through high quality policy-oriented research.

Stance on State-Owned Enterprises

The Advocata Institute started with its flagship report on State-Owned Enterprises, and has since then published on price controls and barriers to enterprise. The Advocata Institute co-hosted Atlas Network’s Asia Liberty Forum in 2019, with leading economic and policy thinkers from over 30 countries in attendance. They also launched a project, to identify and advocate against legal and regulatory restrictions faced by businesses in Sri Lanka, providing entrepreneurs with a powerful platform to express their views.

Advocata’s report on State-Owned Enterprises in Sri Lanka, written in 2016 titled ‘The State of State Enterprises’ came into focus in the same context of Prime Minister Ranil Wickremesinghe’s vision 2025. IPS Chairman Razeen Sally, appointed by the RW Government in 2015, was a key contributor to both.

Then Minister of Public Enterprise and Development, Kabir Hashim, declared the intention of the Government to set up a new Public Enterprise Board Act, to lead the public utilities of the country towards a market oriented commercialisation to make them financially viable.

The Minister glorified the Singapore ‘Temasek’ model with the full blessings of his Prime Minister. He went on to enumerate the underlying concept of the proposed mechanism as a means of bringing the public enterprises under Corporate control for profiteering and freeing them for decision making beyond public accountability and controls.

IPS and Advocata played a dominant role canvassing this policy, actively supported by its affiliate Atlas institution, spurring the Government’s plans to privatise all SOEs as envisaged in the vision 2025. Recent statements by Advocata about the fate of the State banks require careful scrutiny in this background.

Quote: “The two largest State banks, Bank of Ceylon and People’s Bank, at one time a huge drain on the Treasury, are no longer making losses after reforms initiated in 1996 that strengthened their governance” – ‘Sri Lanka State Banks Reform and Robbery’ published by Advocata

State of the State banks

It is true that the PB and BOC are both contributing to the Treasury an amount every year as dividends and taxes. But only a few will know that this is the result of a vicious circle of activity in operation generating hypothetical profits.

Both these banks were created by the State to perform certain specific functions in the economy of the country. Are they fulfilling it now? They have become agencies for lending to the Government serving as its last lifeline and the source of sustenance of the State-Owned Enterprises providing oxygen.

The following account will be an eye-opener to understand the reality behind.

What is the total of the direct liabilities of the Treasury to the two State banks and its percentage of the total lending portfolios of the two banks?

The Treasury has guaranteed several loans and issued letters of comfort in lieu of securities for facilities of the actual borrowers, in addition to its own direct borrowings from the two banks including the red balances in the DST’s accounts.

The Treasury has guaranteed several loans and issued letters of comfort in lieu of securities for facilities of the actual borrowers, in addition to its own direct borrowings from the two banks including the red balances in the DST’s accounts.

What is the level of non-performing advances in the two banks? Have the banks made adequate provisions in their balance sheets on account of these NPLs according to CBSL guidelines?

Will a careful scrutiny of these details indicate that the declared profit figures are fictitiously inflated?

What is the actual position of lending to the following SOEs – CPC, CEB, Sri Lankan Airlines, Mihin Air, Water Supply and Drainage Board, CWE, Paddy Marketing Board – which constitute the few large SOE borrowers from the two banks?

Are their account balances diminishing or increasing? If the balances continuously keep on increasing in the red can the banks keep them in the regular sections? Are there any tangible securities to cover the liabilities? How many such advances are against letters of comfort issued by the Treasury? Are these Letters of Comfort subject to scrutiny by the auditors to ensure their legal validity? Are the accounting procedures followed conform to the CBSL regulations?

The PB was saddled with a total outstanding balance of Rs. 26,055,517,227.68 as at 31 December 2019 categorised as non-performing advances. Except Mihin Air and State Engineering Corporation, the only two State-owned institutions which account for a total of Rs. 2,913,552,739 in this mix up, the remaining comprise NPLs of the private sector. This list accounts for loans and advances over Rs. 100 m only. There are many advances below Rs. 100 m now figuring in NPL.

It should be noted that some advances out of this NPL list are granted to entities where directors of the bank were serving as executives of those companies, e.g. MTD Walkers issue.

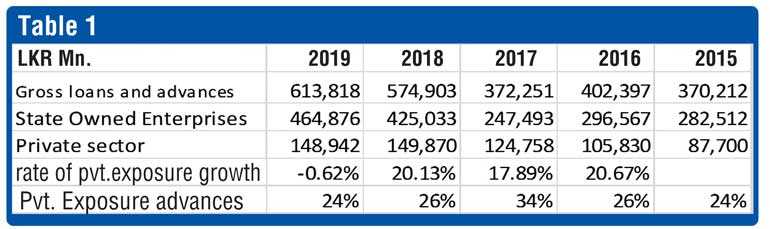

An examination of the growth of the Gross Loans and Advances will provide a better picture. Table 1 will illustrate this position; balances in LKR millions.

Result of change in ‘top management’

Quote from Advocata Article: “By the mid-1990s the two State commercial banks were insolvent and was bailed out twice with capital injections from the Treasury. The Public Enterprises Reform Commission, headed by Mano Tittawella, reformed the two banks. The top management of People’s Bank was strengthened with key staff recruited from private and foreign banks and a CEO was hired from overseas, to insulate the banks from politically directed lending.”

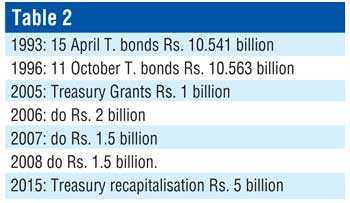

Does the researcher and the policy reform adviser know how many times the banks have been actually recapitalised? At least as an eye-opener to Advocata, the position of the PB is seen in table 2.

In addition to the above the PB has issued debentures to its own employees’ pension fund to raise Rs. 15 b on three occasions for supplementing recapitalisation.

All these grants and borrowings were required after the Mano Tittawella panacea offered with the recruitment of foreign and local experts to put the bank’s operations in order.

The hired overseas experts went away with hardly any input of their expertise leaving behind the residue of hired locals, recruited on contract (many of whom resigned with VRS packages from other banks).

Many of the new blood group have left, some after several years of slogging, leaving legacies of a sordid history ending up with Parliament COPE inquiries, etc. COPE had to order those responsible to pay back huge amounts exceeding 15 million for granting undue extension of services to some of these expert contractors.

COPE also examined audit queries raised on account of a digitalisation fraud that has taken place while these private sector specialists were advising the Board of Directors. The Chairman (then) admitted that they had to incur an expenditure of about 200% in excess of the original estimates. He stated at the COPE that they were first informed that the total digitalisation would cost around Rs. 745 million but at the end of three years they had to incur an expenditure of more than Rs. 2 billion.

The ironical position is that all this has happened under the liberalised operational authority granted to the banks during the tenure of Tittawella’s expert management teams brought in ‘to run the operations and strengthen the top management with freedom to take decisions outside the Treasury circulars’.

Quote from Advocata writing: “Over the last several years Bank of Ceylon and People’s Bank have paid steady dividends to the Treasury, contributing more than half the dividends of all State firms.”

Yes, these dividends have been paid from interest incomes the banks have earned, not from any aggressive commercial operations they engaged in, but from the very source to which they are paying tax and dividends. Any careful genuine observer would see this farcical operation which is like a vicious circle where the Government is paying interest and bank paying back a little of that to the Government.

Worsening shortfalls and inadequacies

But in conclusion let me state that currently there is a strong repetition of the status that prevailed when the international audit teams ‘Brooze Allen Hamilton’ and ‘Arthur de Little’ exposed many accounting faults in the ’90s, pinpointed in their reports. The following will throw some light on this.

The capital inadequacies existed then in PB as identified in the international audit reports (1990s):

Shortage of capital to fulfil BIS standards: Rs. 1,152 million

To write off (unrecoverable) loans granted to SLSPC and PMB: Rs. 1,700.50 million

Shortage in provisions for Employees’ Pension: Rs. 4,355 million

Provisions for bad debts: Rs. 3,231 million

Funding towards a loan recovery unit: Rs. 102.50 million

Total: Rs. 10,541 million

These shortfalls and inadequacies are in a worse state now. The current deficiency in the Employees’ Pension Fund can be cited as the best example.

The balance of the PB Pension Fund stands at Rs. 45 billion, whereas the actual amount that should be in the fund is Rs. 65 billion. Actual deficiency has been estimated as Rs. 18.5 billion.

This was only 4.35 billion when the bank was declared insolvent in the ’90s!

Is this the contribution of the ‘top management of People’s Bank strengthened with key staff recruited from private and foreign banks with a hired CEO from overseas’? Ironically it is the panacea prescribed by the think tanks to reform the State banks.

We can expose matters only to a limit permissible under whistleblowing as we do not enjoy any immunity or privilege to divulge all the information we have.

Skeletons have remained inside the cupboards for many decades. Why don’t the researchers address this reality to bring about a lasting solution instead of playing the front, eventually paving the way for foreign invaders?