Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 9 November 2023 00:00 - - {{hitsCtrl.values.hits}}

While the country eagerly awaits the 2024 Budget, one trend I have observed is the absence of an evaluation of the previous year’s budget and the failure to capture the lessons learned. Year after year, we witness captive themes being presented and a set of numbers that are forgotten halfway through the year.

While the country eagerly awaits the 2024 Budget, one trend I have observed is the absence of an evaluation of the previous year’s budget and the failure to capture the lessons learned. Year after year, we witness captive themes being presented and a set of numbers that are forgotten halfway through the year.

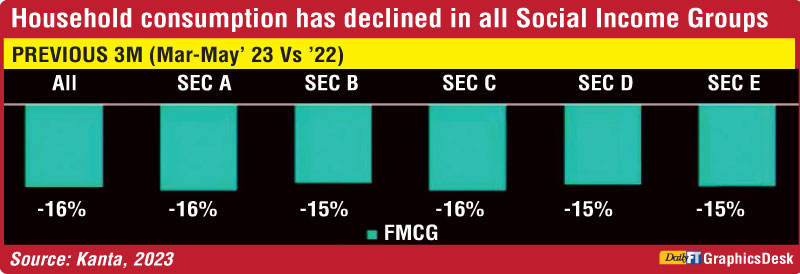

Budget 2024 will be a challenge as 40% of the country is teetering in poverty, and two-thirds of households in Sri Lanka are reducing their consumption, as per the NielsenIQ study. What Sri Lanka needs is a simple budget. This can be achieved, provided that transparency and the protection of wrongdoers are not the guiding principles. Hence, Mr. President, I have titled this piece “Give Us a Simple Budget.” Let me explain with five budget proposals.

Budget Proposal 1: Cut expenditure

Based on the data available in the public domain from January to June 2023 Central Bank data, the total revenue has increased to Rs. 1,317.05 billion, showing a growth of +43%, with tax revenue contributing to almost 90% of the total. Notably, tax revenue collection has increased by +50.1% to Rs. 1,198 billion.

However, a closer look at the expenditure reveals an increase of +40.5% to Rs. 2,559.6 billion, with recurrent expenditure soaring by a staggering +47% to Rs. 2,325.5 billion. This means that Budget 2024 must find ways to reduce expenditure to make the new taxation structure meaningful. If we continue to increase public sector salaries and offer promotions, especially during an election year, the balanced budget will lose its meaning. More importantly, what reforms have been implemented to put Sri Lanka on the right track is the next question. Let’s face it, reforms can be painful. What measures have the 225 taken to reduce expenditure is the question on every Sri Lankan’s mind, given the concerning behaviour in parliament.

Budget Proposal 2: Cut corruption

As the general public grapples with a 275% increase in fuel prices, a 200% increase in water prices, and a 350% increase in electricity prices, 34% of households have decided to stop buying milk powder, and another 27% plan to reduce their milk powder consumption. This situation has severe consequences, including stunted child growth. Reports from the Health Ministry indicate that children from Nuwara Eliya, Hambantota, and Monaragala are two inches below the average height of a typical child. UNICEF has found that 15.3% of children are malnourished, and 6.2 million people, including 2.9 million children, are in urgent need of humanitarian assistance. This is the grim reality in Sri Lanka.

In this context, media reports reveal that 119 super luxury vehicles have been imported into Sri Lanka using the migrant workers’ vehicle scheme, which is a criminal act. The value of these vehicles is worth Rs. 1.2 billion, and the loss to the Treasury can be calculated. Apparently, a single company has imported these vehicles, making it possible to trace the source and recover the funds. Will the 2024 Budget address these governance issues?

Another media report highlights a Rs. 10 billion loss in Government revenue, resulting from the import of 22,000 metric tonnes of sugar just one day after the sugar duty was increased from 25 cents to Rs. 50 per kilogram. Once again, the importer’s name is known, and this is a repeat of the Rs. 16 billion loss that the Treasury suffered from a similar situation some years ago. While there was a media outcry, no action was taken. Let us see how the 2024 Budget will address this, especially since the IMF clearly states that imposing taxes when the country’s people are unaware is a violation, and reforms are needed.

The common man, struggling to pay utility bills, questions why the Government allows such criminal behaviour. Respected economists are stating that the proposed 18% electricity hike in mid-November will push more households into the poverty belt, potentially affecting half of the country’s population. LIRNEasia research reveals that poverty in the estate sector is at 51%, rural poverty is at 36%, and urban poverty is at 18%. Let’s see how corruption will be addressed in the 2024 Budget.

Budget Proposal 3: Violations by public sector

Recent blatant violations of procedures at the Health Ministry, such as the waivers of registration (WoRs) allowing the National Medicines Regulatory Authority (NMRA) to greenlight drugs and appliances without the required checks, procedures, and local registration, have created serious issues for patients. The Government needs to take action and implement reforms to prevent such violations, especially since Sri Lanka Customs has stated that no such imports have occurred, while the Government Blood Bank claims that the release took place for a medical experiment. These are serious violations, and stopping such crimes is contingent on strong governance. People are eagerly waiting to see how the 2024 Budget will address this aspect, as it aligns with the IMF’s recommendations on governance and reducing corruption vulnerabilities.

Why not implement a transparent mechanism for all Government tenders, open for public scrutiny on a digital platform, as per the key IMF stipulation in the 16-point action plan on “Governance and Reducing Corruption Vulnerabilities”? The 2024 Budget should consider appointing a task force to address this report.

Budget Proposal 4: CEPA and export basket

Let’s face it, the Free Trade Agreement with India has failed to boost exports to India. Twenty years ago, Sri Lanka exported around half a billion dollars worth of goods to India, and today, we are stuck around the same value. We should have reached $ 5-6 billion in exports to India by now. India’s annual import bill is around $ 700 billion, meaning that Sri Lanka’s current export value represents less than 0.1% of the market share. The 2024 Budget must include an action plan for deeper integration with India on trade, even if it means implementing challenging reforms. Sri Lanka’s export business must reach thirty billion dollars, with products including apparel at ten billion, tea at four billion (leveraging the tea hub proposition), cinnamon adding value to reach two billion, rubber moving up the value chain to six billion, and IT/BPO contributing five billion. The rest of the product mix, such as Ceylon Sapphire, electrical solutions, spices, vegetables, and fruits, should add to a substantial billion-dollar figure.

Sri Lanka cannot overcome its economic crisis without addressing the core issue of exports, which lies in the supply chain. This requires significant economic reforms, including access to energy at concessional prices and addressing the human resource challenge, especially given that employment levels are above ninety per cent. Notably, the employment of women in the formal economy is below eight per cent, a concern that should be addressed in the 2024 Budget.

Budget Proposal 5: Tourism

While there is much talk about tourism development to accommodate five million visitors, the harsh reality is that without proper infrastructure, we cannot support such a high visitor load. Consider the supply chain of fruits and vegetables; the current domestic market demand is difficult to meet, resulting in high living costs. Therefore, a carrying capacity study must be conducted to assess the actual potential on a provincial basis.

For instance, in the Central Province, where there is a 63% tree cover, it’s possible to position it as the carbon-neutral province of Sri Lanka. However, addressing sanitary hygiene needs at the Dalada Maligawa is crucial, as it attracts 60% of foreign visitors. The two botanical gardens in the Central Province also require vehicle parking facilities. Without these basic infrastructure improvements, we cannot effectively promote a province like Central based only on geography to attract more visitors. This necessitates serious reform.

The Uva Province is best suited to become the adventure capital of Sri Lanka, but it needs further development of adventure sites similar to the Ravana adventure challenge. The Pekoe Trail is a positive development that can elevate the Uva Province to a global dimension, but more work is needed to create a revenue model around the Pekoe Trail.

Conclusion

While Port City is a positive development, financial reforms are necessary to transform it into the financial hub of Sri Lanka. Perhaps linking the Port City to a casino capital, similar to Macau’s relationship with Hong Kong, which generates $ 22 billion in revenue annually, could be a viable option. Mr. President, Sri Lanka needs a simple budget with actionable steps, not a three-hour speech delivered in a briefcase.

(The thoughts expressed in this column are solely the writer’s views and do not represent the views of the organisations he serves in Sri Lanka or the South Asian region.)