Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Wednesday, 3 June 2020 00:00 - - {{hitsCtrl.values.hits}}

Year 2020 is the year that USA renewable energy will outpace coal, while the UK grid is now on its second month without any coal generation. Germany’s grid is boasting over 60% renewables while India’s coal plants are operating at 42% load factor – scaled down. This global surge of renewables over fossil fuels during a COVID-19 shutdown was not seen in Sri Lanka, which until 16 May was largely running on high diesel and coal with large hydro reserves used in a limited manner.

The low renewable percentage is not only CEB’s reluctance to add renewables to the grid. The low hydropower generation for 2020 accompanied with high reservoir storage begs the question of how CEB is utilising this valuable national asset. The reduced demand during lockdown should have been the ideal opportunity to reduce the financial loss of CEB by removing the expensive power plants from generation. In a situation where the Rupee is under threat, with imports stopped, reducing fossil fuel generation would have reduced diesel imports by a substantial margin.

Yet the generation data shows a different story – with high diesel usage and patterns that brings serious questions of CEB’s procurement processes (referred to as dispatch) that seems to cost the beleaguered utility billions of rupees in the first five months of the year.

This article documents six significant instances where serious questions are evident on the data.

The procurement (dispatch) data

CEB procurement of energy from own and private power plants amounts to about Rs. 250 billion per annum. But this procurement is shrouded in secrecy with non-existent oversight. Economic Consulting Associates of UK conducted a dispatch review in 2017 and the report points to a serious deficit in method and application of guidelines and the lack of supporting documentation.

Though CEB claims that they adopt ‘Security Constrained Economic Dispatch,’ this is not available online, and requests for this, and the input data sources (such as climate projections) were unsuccessful. The sector regulator, Public Utilities Commission of Sri Lanka (PUCSL) is not in possession of this methodology documentation; a serious lack of oversight.

There is no audit of the procurement – a staggering lack of governance and oversight for an organisation that is running at a massive loss with all industry players tacitly acknowledging the cosy relationship between the CEB and private power suppliers. A 5% variation would incur a loss larger than the bond issue, and a 0.5% variation would be larger than the Government COVID-19 fund.

Not only audit, CEB has for a period refused to provide the dispatch data to the PUCSL and the public, a situation that changed after PUCSL went to courts demanding the same. The recent decision by PUCSL to release this data allowed this analysis, and I invite all interested parties and data scientists to analyse aided by visualisation from the site (www.hoateia.com).

Lower utilisation of hydro resources

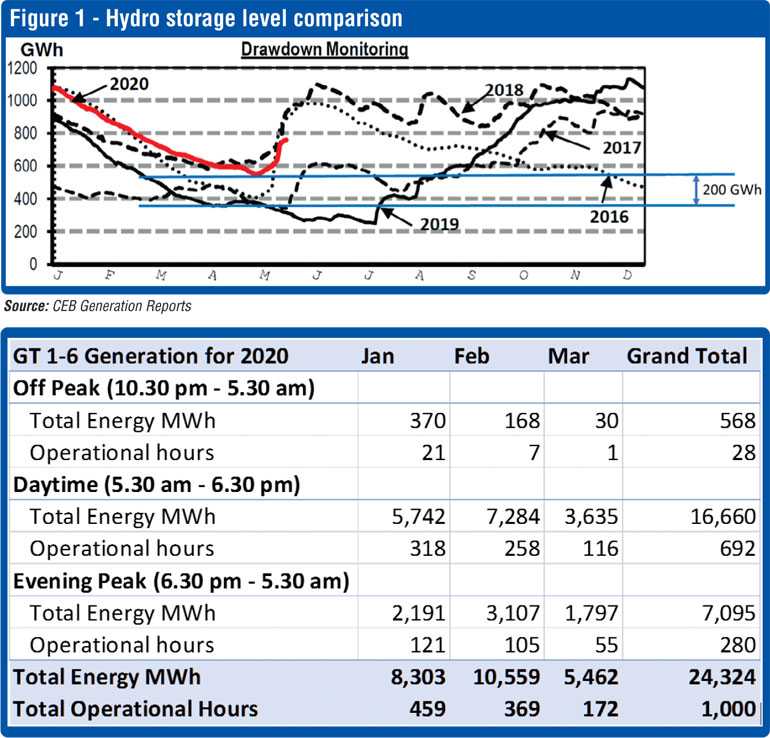

CEB appears not to have used the major hydro at its full potential in 2020. In the previous years, the CEB has used hydro, keeping a minimum of 350 GWh worth as storage in its major reservoirs to support hydrology and irrigation. However, in 2020, they maintained 600 GWh on average from early April and a minimum of 550 GWh in early May, at the onset of the monsoon – a difference of approx. 200 GWh.

The climate forecasts show that 2020 Yala season projected as wetter than normal. If we receive about 500 MWh worth of rainfall this year, there will be spillage of major reservoirs, resulting in wastage of hydro resources sans generation.

CEB engineers respond to this by claiming restrictions by water management for irrigation. But the Yala hydro generation projections in the Water Management Secretariat (available at the website) shows that CEB planned to generate 250 GWh (from Mahaweli, Laxapana, Samanala and Kukule complexes) yet only generated 175 GWh – a reduction of 75 GWh. The largest reduction of 110 GWh is for the Laxapana complex where no irrigation restrictions are present, and more usage from Mahaweli. Thus, the stated rationale appears invalid.

CEB could have avoided 200 GWh of diesel by using the available hydro within the first five months of the year. Assuming an average cost of Rs. 25 per unit (for oil based generation), this would have saved CEB 5 Billion Rupees and saved vital foreign exchange during this critical period of cashflow and forex stress.

Dispatch of Kelanitissa Small Gas Turbines (GT 1-6)

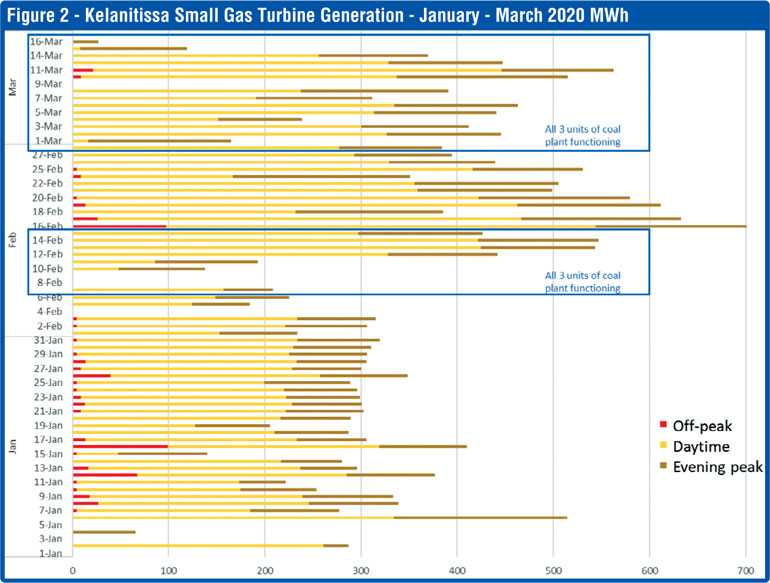

These are the most expensive power generating units of the CEB and are designed to be used in short bursts for system balancing. They are like aircraft engines running at high speed, with high wear and tear. CEB used them at full capacity at approximately 15 hours per day from January to 16 March – as a regular power plant – with the unit cost being Rs. 62.

These were even used during the period all three coal plants were running when the system had sufficient other lower cost power plants to take up the load. They were also run 586 MWh during off peak hours (10.30pm to 5.30am) when the system demand was low, and other (cheaper) power plants were not generating energy but were available (Figure 2). The 24.3 GWh of energy produced by these units cost Rs. 1.5 billion– even using a regular oil-based power plant instead would have saved over 60% of this cost – Rs. 900 million.

Generating from oil over hydro during the monsoon

The monsoon began early May aided by the cyclone, but oil-based generation was slow to decline and further anomalies began showing up

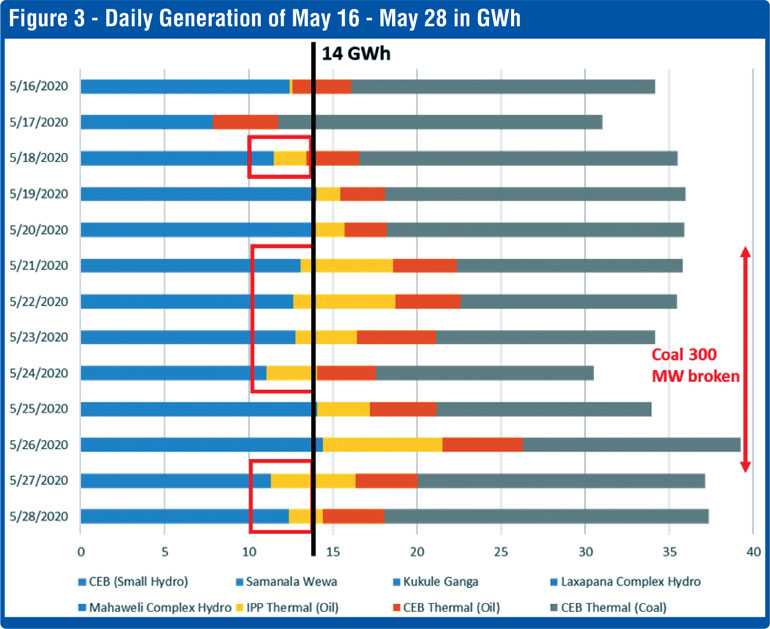

a. In the first week of May, CEB daily hydro generation was about 6 GWh. From 10 May onwards, CEB reservoirs were filling with on average 13.8 GWh worth of water per day. However, they waited until 16 May to increase hydro generation to 12 GWh per day. If CEB increased generation by 5 GWh per day from 10 May, the savings would be Rs. 750 million.

b. CEB increased hydro to 12 GWh on 16th, and then reduced it to 7 GWh on the 17th Sunday (even with significant rain) to allow 3 GWh of oil plants to run, when these oil plants could have been shut down on the 17th and saved Rs. 96 million. This pattern recurs on 24th Sunday – another Rs. 74 million. Why do Sunday demand reductions result in reduced hydro with oil plants being more expensive? (Figure 3)

c. With the failure of the coal plant Unit 2 on 21 May, the CEB inexplicably reduced hydro generation, paving for extra generation from private oil power plants. On the day the power plant was back in operation (28th), CEB could have easily used hydro to remove private oil plants to reduce costs. (Figure 3)

d. If during the period 18-28 May the CEB generated 14 GWh hydro (generation amount of 19th and 25th and 26th May), the savings would be Rs. 275 million. (Figure 3) Note that in January, CEB hydro generation was as high as 16 GWh per day.

The water management meeting minutes (available at the Secretariat website) does not give constraints for hydro use, and reservoir levels are over 63% full (see figure 1). In the period dispatch was lowered (18-28), the average daily inflow was 15 GWh, so using 14 GWh would not have even reduced storage levels. No plant breakdowns are mentioned in the generation reports.

Thus, this appears as a choice – with significant financial implications to the organisation and country. Who has made these decisions, what was the financial impact analysis that preceded the same and who authorised this are all important questions to be answered. Data visualisation across multiple timeframes point out to a surprising idea. That there seems to be less of cost optimisation, as hydro seems to be reduced and increased to provide a certain amount of diesel generation and IPP even when there are sufficient hydro reserves available. This certainly warrants a detailed third-party audit.

The generation reports also state the following with respect to Sapugaskanda A oil plant. “Continuous Operation to avoid Start/Stops as per the decision taken at power crisis meeting held on 15 April 2020.” The regulatory filings indicate that the startup costs are merely Rs. 33,000 whereas running this plant for one day would cost 23.5 million per day. But it is not only this plant – the barge power plant and Sapugaskanda B oil plants are also used continuously. A curious choice when these plant operations contribute significantly to air pollution in Colombo.

The coal-oil nexus

Failures of Norochcholai coal plant are too common to mention. In the year 2020, the full 900 MW generation occurred only on 56 days out of 147, with 90 days one unit (out of the three) was not functional. From 2015 and 2019, the full 900 MW was available only 82 out of 1,826 days – a meagre 4.6%. It appears that these deficits were mainly filled by private oil plants.

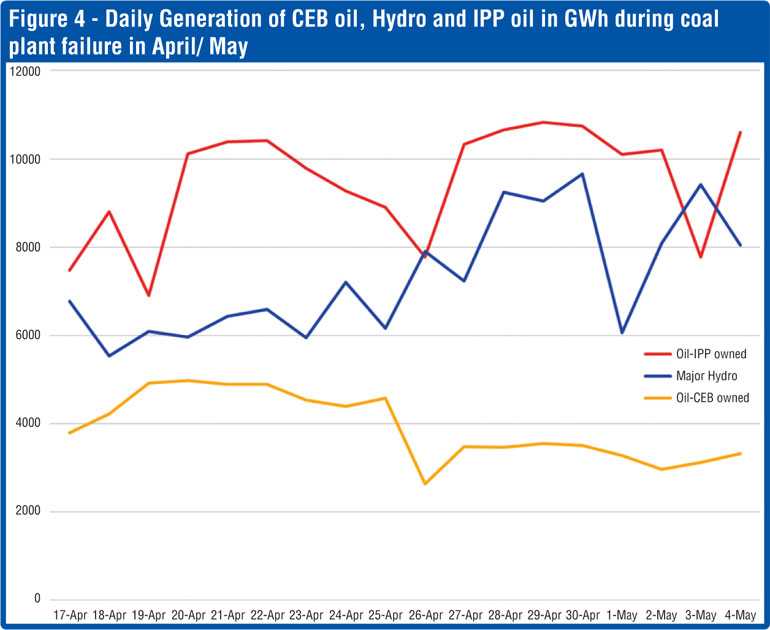

For this analysis, two failure events are considered after lockdown; the Unit 3 failures from 17 April to 4 May (17 days) and 21 to 26 May (five days).

The 21-25 May failure discussed earlier, hydro dispatch was not increased but decreased as noted earlier with an increase of approx. 5 GWh per day of private and CEB oil plants (figure 3).

For the 17 April to 4 May period, in the first week, hydro generation was average 5 GWh per day while CEB oil was 6 GWh per day. In the second week, CEB oil was reduced to 4 GWh per day while hydro was increased to 8 GWh per day. By keeping the total output of CEB plants constant, expensive private oil plants were allowed to run an average of 10 GWh per day (Figure 4).

Ample hydro reserves were available for a larger hydro dispatch for both weeks to reduce expensive oil plants. As pointed out earlier, CEB actually underutilised hydro in April compared with CEB’s own projections shared and published by Water Management Secretariat, and this underutilisation was in Laxapana complex (100 GWh) which has no irrigation constraints.

It is difficult to understand the logic of so many fluctuations from the stated dispatch methodologies – for example the high hydro dispatch on 3 May with lower dispatch before and after with no system constraints or operational failures declared for Hydro or IPP. Was it because someone either in CEB or on private plants wanted more/less overtime on Sunday?

Kelanitissa combined cycle power plant

This is the countries cheapest oil-fired power plant, operated by CEB and also CEB’s largest with 163 MW. This has been under maintenance since June 2019. Instead of fast tracking the repairs and having it ready at least by January 2020 (when high thermal requirements are needed), the CEB preferred to tender for emergency power.

If this power plant was dispatched at 75% plant factor for 2020 and displaced more expensive private plants, assuming a Rs. 3 difference in costs, the CEB would have saved Rs. 1.3 billion to date.

Of transparency

Asked specific questions about dispatch, CEB noted that they factor in an opportunity cost for water; however the calculations for the same are not in the public domain. This cost cannot be a constant across all reservoirs (Laxapana complex doesn’t have irrigation uses), and should be close to zero beyond the specific irrigation requirement (i.e. the cost of 200 GWh unused must be close to zero).

This type of fluctuations is NOT present in other countries such as Germany, UK and Australia who have online data visualisation tools and use cost optimisation logic and market mechanisms. In those grids, such drastic fluctuations are not visible. This also comes with the transparency of data – where it is not only generation, but also the costs that are made transparent and visible to the public. In Sri Lanka, these vital data are shrouded in secrecy.

CEB is expected to file a document called Bulk Supply Tariff – which gives the planned generation from each power plant on the grid along with detailed pricing – before each season. This document for 2020 is still not published yet by PUCSL, which only has June-December 2019 data, although five months of the year has already passed. So, the costs cannot be calculated with accuracy (I have used average and specific costs of the second half of 2019 for analysis).

This is not the way to run a Rs. 250 billion procurement. Public has the right to know these since we pay for electricity, subsidise CEB losses and pay for coal/hydro plant capital costs out of our taxes.

The report of the eminent panel appointed to investigate the 3 February 2020 power failure (available at https://energyleakslk.wordpress.com/2020/05/24/investigation-on-electricity-supply-interruption/) also places the System Control Centre (SCC) of CEB in poor light, observing “that there is poor ‘Work Flow’ practice at the system control operations where there was no clear evidence of proper flow of authority, tasks, steps, people in making the final decisions of operations at corporate level which are highly economical and socially sensitive business operations.”

The report also mentions that SCC still relies on manually generated data and the existence of two generation reports for the same day with significant discrepancies. This begs a question of the accuracy of data CEB submits and on which this analysis relies on. What is real?

It is sad to notice that though the Committee was appointed by the Ministry of Power and Energy, thus far it appears that no action is taken on findings and recommendations. This was not surprising, and this is not the first time, and unlikely to change as long as the Ministry acts with subservience to the CEB. It is said that even the cabinet papers of the Ministry regarding policy are being written by the CEB.

What should be done?

1. Independent third party review and improvement dispatch and decision methodology: It is obvious that there are sufficient issues of concern at the vital procurement. As we show, there are significant instances of suboptimisation, when corrected, can save the country billions of rupees from State and utility coffers, and save a similar amount in vital foreign exchange. A 1% optimisation would save Sri Lanka double the amount of President’s COVID-19 fund. An independent third party expert review of the dispatch methodology and assumptions, how CEB uses tools and techniques, and the management actions that override them (including technical and economic analysis of the so called ‘power crisis committee’) is needed, ideally with international expertise. This should result in recommendations to update the methodology and management review process. It is important to note that PUCSL has been asking CEB to conduct dispatch audits from 2013 and this was ignored by CEB. Implementing recommendations of the previously mentioned committee including automation of process and reporting and improving workflow should happen immediately.

2. Independent third party dispatch audit: It is vital to conduct an immediate third-party dispatch audit for 2019 and 2020 (at least), to assess the utilisation of the methodology and financial impacts to the country. This should be an ongoing process on a quarterly basis.

3. Assess the reasons of regular plant breakdowns address root causes: In the wider context, the questions on delays of fixing CEB’s cheapest (and largest) oil power plant should be addressed, alongside inquiring the nature of regular breakdowns of Norochcholai power plant.

4. Improve and support sector governance: It appears that the sector governance process is broken. While keeping in context that for two years regulatory action of PUCSL was hobbled due to CEB Union forcing members to stop co-operating with the regulator – and zero intervention by Ministry to address this serious breach of governance – PUCSL must play out its role as the regulator – and be firmly supported by the Government.

It is difficult to do this type of data analysis and not wonder if there is a cosy relationship between those who make critical manual dispatch decisions to burn oil and those who benefit from it. One is also forced to wonder whether the trade union actions are really about shielding vital dispatch data masked under other guises.

I acknowledge the contribution of multiple people behind this work including data scientists, programmers and technical reviewers.