Sunday Feb 15, 2026

Sunday Feb 15, 2026

Friday, 25 November 2022 00:00 - - {{hitsCtrl.values.hits}}

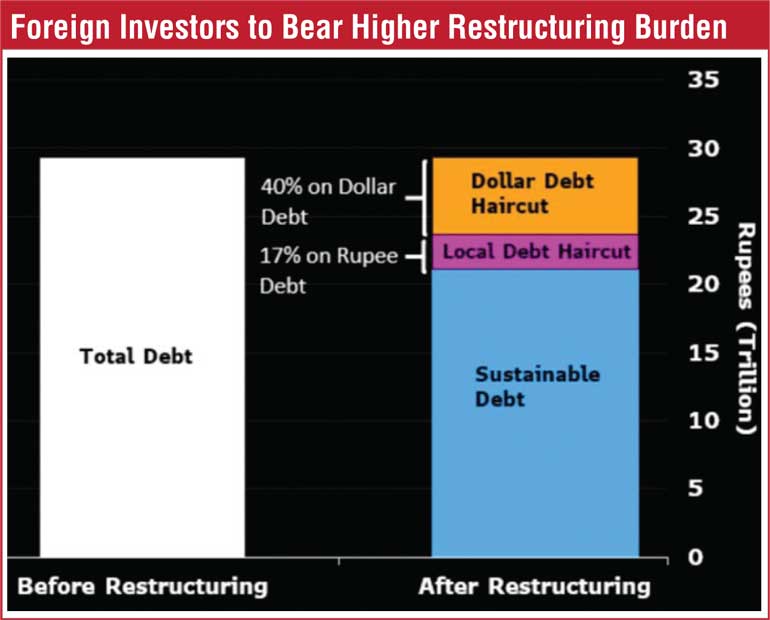

It is not an understatement to say that there is much speculation today over domestic debt restructuring after a Bloomberg report suggested that “Sri Lanka USD debt holders will be likely to bear higher restructuring costs than domestic lenders”. The report further said, “They may think they are getting short changed. But that is not necessarily the case. The reason – rupee lenders will suffer an additional implicit inflationary haircut. Bloomberg is right to say that a fair debt restructuring will consider the inflationary impact borne by the rupee lenders.” The report goes on to say, “Our calculations suggest parity between domestic and external lenders amounts to a 17% explicit haircut for domestic creditors and a 40% haircut for external lenders to bring the debt to a sustainable level.”

It is not an understatement to say that there is much speculation today over domestic debt restructuring after a Bloomberg report suggested that “Sri Lanka USD debt holders will be likely to bear higher restructuring costs than domestic lenders”. The report further said, “They may think they are getting short changed. But that is not necessarily the case. The reason – rupee lenders will suffer an additional implicit inflationary haircut. Bloomberg is right to say that a fair debt restructuring will consider the inflationary impact borne by the rupee lenders.” The report goes on to say, “Our calculations suggest parity between domestic and external lenders amounts to a 17% explicit haircut for domestic creditors and a 40% haircut for external lenders to bring the debt to a sustainable level.”

Sri Lanka has said many times that the country will ensure equity among its creditors. Very soon due to unnecessary speculation people/funds will not invest in bills with a tenure of over three months. Sources say the Government has yet not taken a decision on domestic debt structure. Ironically, market speculation has made it difficult for the Government to raise funds domestically with repayment terms beyond three months, while pushing yields to over 30%.

Impact of haircuts

The EPF, ETF and insurance companies hold most of the bonds and will end up taking the biggest hit – private sector workers who have all along been the most productive, will be the ones taking the full hit. They have already expressed concern. They may resist publicly through their unions resulting in litigation and or call for an equal reduction in the pensions for the public sector employees. Therefore being selective in minimising the impact on the vulnerable segments of the Government Securities (GSec) holders, i.e. EPF, ETF and insurance funds who have been primary investors at the GSec auctions in the past are vital, to ensure that we don’t kill this captive group going forward.

Options

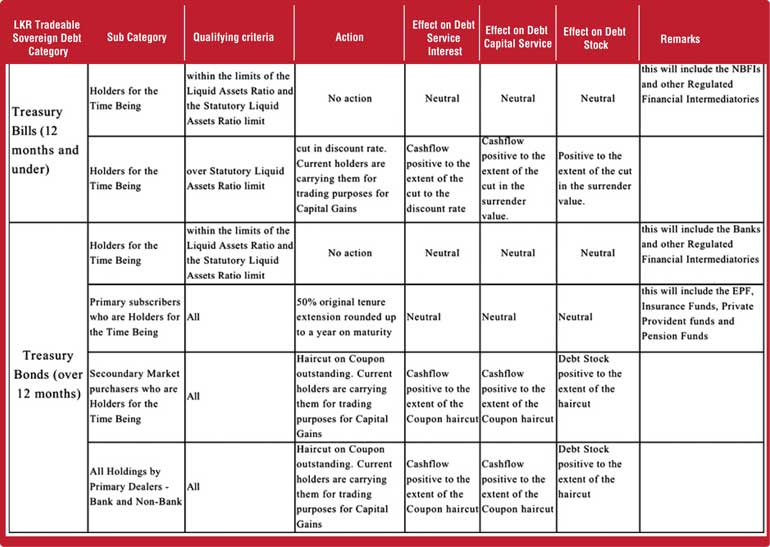

Firstly, long-term investors who have invested for returns and not for capital gains. The haircut for that group could be minimised. However banks, FIs and others, whose GSec holdings are held with the intention of trading for capital gains or acquired in the secondary market, must be prepared to take a haircut on the coupon rate or the face value. Total LKR debt is 12.34 trillion of which are bills of 3.78 trillion and bonds of 8.56 trillion. We need to assess what the respective holdings are and the NPV impact against these Categories and Sub categories based on the suggested action. This must be quantified by the Public Debt Department of the CBSL. The data has to be extracted from credible sources (CBSL Public Debt department) and independently verified by the National Audit Office.

The initial view is that these actions won’t result in any substantial reduction in the outstanding debt levels and or cash flows. The IMF is ultimately looking at the debt perimeter and how we reduce it to a level that is considered sustainable. Similar to what the IMF put on the table for absolute annual revenue targets until 2025, we need to get (from IMF) the absolute annual year-end Debt Perimeters until 2025. This would be a more complex calculation as it would have to take into account new borrowings (international and domestic), capital repayments if any within that period and similar to the annual absolute revenue targets set, the absolute Debt Perimeter targets would have to achieved with the least impact on the most vulnerable of GSec holders for the time being.

|

President Ranil Wickremesinghe discussed debt management with IMF Managing Director Kristalina Georgieva, at the COP27 climate summit recently

|

Principle to follow

The starting point for this assessment of vulnerability is the primary investment intention of returns to key vulnerable stakeholders like retirees in pension funds. The chances are that this may not suffice, at least in the first few years, necessitating a marginal haircut to those as well. The CBSL holds 2.44tr (Circa 20%) of Tbills and Bonds. The Government needs to consider the impact (Cashflow and notional Government Debt Stock) of subjecting these to a haircut, compared to the structure proposed on this table. Especially the haircuts to coupon values and face values of GSec in the CBSL debt stock.

Writing off the CBSL holding would need to come with some sort of backstop/guarantee of the CBSL by the multilaterals – possibly the World Bank to ensure the Central Bank and the dependent banking sector does not go into a crisis. The World Bank would have to come up with such a backstop to the CBSL as purely Central Bank (not GOSL) support until the GOSL can augment the CBSL capital by at least 2025 – the year of the planned primary surplus. All of this points to a professionally resourced Independent Debt Office (IDO) managing GSecs in the future.

This IDO would be appointed and be responsible to Parliament and be under the oversight of an appropriate Parliament Committee, leaving little room for GOSL requirements to be leveraged to the detriment of the debt service outflows of the Treasury and to the national debt perimeter. Capital gains in the market would have to take a back seat in the current circumstances, at least until the projected debt perimeter and debt service metrics are achieved and sustained.

Arbitrage

All primary dealers and banks are currently using the CBSL window at 15.5% to raise funds to buy GSecs with manifestly substantial arbitrage, whilst the GOSL debt service costs remain elevated and the money printed to sustain the CBSL window earning the CBSL at 15.5%. The banks are not using their FDs and Primary Dealers are not borrowing at AWPR from the banks, because both rates are well above the CBSL overnight window rate.

T-Bond auction bids which are rejected are then, in a secondary offer, offered to the failed primary bidders at the WAY of the successful bids, thus ensuring the full offer amount is taken. Tbill auctions do not have this secondary offer mechanism. If the next 2-3 Tbill auctions are offered and accepted at progressively lower yields (and the higher bids rejected) and TBonds offered in lieu, the currently inverted yield curve may well normalise from its current inversion. The signals to the markets may well have a knock-on effect of lowering the T-Bond yields at future auctions.

Broader capital haircut options

Way forward

Sovereign debt restructure is a very complex route and one that requires careful management, especially given that Sri Lanka has limited experience. Certainly the starting point is clearly to target the projected Debt Perimeter in the proposed overall debt sustainability plan and work within that framework. This is an option worth considering when putting a robust framework together to address the haircuts. But certainly there are other options that have been proposed. However, to develop a structure, we require skilled professionals who have had hands-on experience, firstly to give a clear brief to the consultants negotiating on behalf of the Government and secondly to give confidence to the creditors (especially private) in their engagements that we mean business.

References:

https://youtu.be/jrN6HRiT0UY

https://www.ft.lk/columns/Dollar-debt-restructuring-is-key-to-any-recovery/4-741640