Sunday Feb 15, 2026

Sunday Feb 15, 2026

Friday, 21 April 2023 00:10 - - {{hitsCtrl.values.hits}}

Sri Lanka’s negotiators with IMF Managing Director Kristalina Georgieva in Washington, DC during the Spring Meetings of the IMF and the World Bank last week

Activities at the Colombo Stock Exchange (CSE) were positive after the Central Bank Governor Dr. Nandalal Weerasinghe and the Treasury Secretary Mahinda Siriwardena gave the country an assurance that the IMF’s proposed external debt restructuring would not have a major impact on any sector, especially the banking sector. “It is envisaged that this DDO will be conducted on a voluntary basis and be based on our consultations with major T-Bonds holders,” said a joint statement issued by Weerasinghe and Siriwardene, after they participated in a virtual discussion with Sri Lanka’s creditors.

Activities at the Colombo Stock Exchange (CSE) were positive after the Central Bank Governor Dr. Nandalal Weerasinghe and the Treasury Secretary Mahinda Siriwardena gave the country an assurance that the IMF’s proposed external debt restructuring would not have a major impact on any sector, especially the banking sector. “It is envisaged that this DDO will be conducted on a voluntary basis and be based on our consultations with major T-Bonds holders,” said a joint statement issued by Weerasinghe and Siriwardene, after they participated in a virtual discussion with Sri Lanka’s creditors.

The risk is that such “voluntary” actions are bound to veer towards some arm-twisting of the banks with offsets/backstops to mitigate capital erosion. Capital Adequacy forbearance, consolidation of smaller banks/NBFIs are some possible sops that may be granted by the CBSL/Treasury to the banks. “Voluntary” with the CBSL in the past, has almost always been with the banks being told to do something by them, with veiled and implicit “offers they can’t refuse”. The influential Banking Lobby will no doubt want a quid-pro-quo of a haircut on bank liabilities authorised by the CBSL, so that they can avoid any CBSL Capital requirement forbearance or consolidations, which will most likely come with restrictions of profit distributions and bonuses. So challenging times ahead.

Principle

Sri Lanka has said many times that the country will ensure equity among its creditors. Very soon due to unnecessary speculation people/funds will not invest in bills with a tenure of over three months. Sources say the Government has yet to take a decision on its domestic debt restructure. Ironically, market speculation has made it difficult for the Government to raise funds domestically with repayment terms beyond three months, while pushing yields to over 25%.

Impact of haircuts

The EPF, ETF and Insurance Companies hold most of the bonds and will end up taking the biggest hit and of that private sector workers who have all along been the most productive, will be the ones taking the larger hit. On this they have already expressed concern as have some of the fringe political players. They may resist publicly through their unions resulting in litigation and/or call for an equal reduction in the pensions for the public sector employees. Therefore being selective in minimising the impact on the vulnerable segments of the Government Securities (GSec) holders, i.e. EPF, ETF and Insurance Funds who have been Primary Investors at the GSec auctions in the past are vital, to ensure that we don’t kill this captive group going forward.

Options

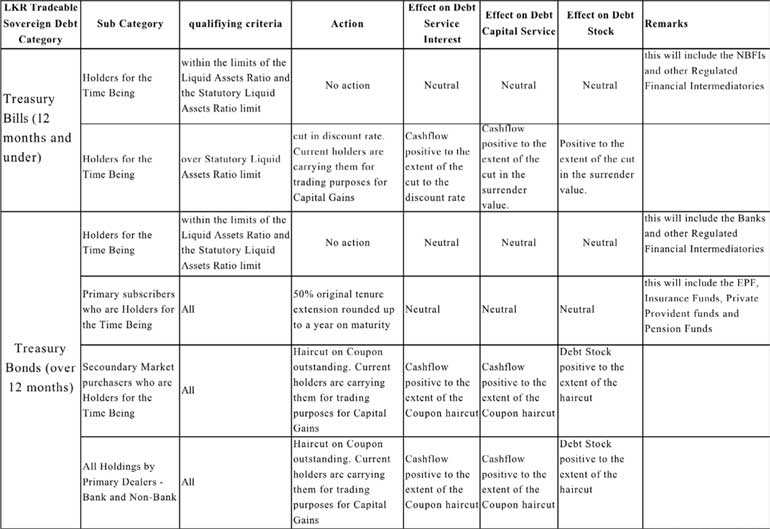

Firstly, protect long term investors who have invested for returns and not for capital gains. The haircut for that group could be minimised. However Banks, FIs and others, whose GSec holdings are held with the intention of trading for capital gains or acquired in the secondary market, must be prepared to take a haircut on the coupon rate or face value. Total LKR debt is 12.34tr of which bills are 3.78tr and bonds of 8.56tr. We need to assess what the respective holdings are and the NPV impact against these Categories and Sub categories based on the suggested action. This must be quantified by the Public Debt Department of the CBSL. The data has to be extracted from credible sources (CBSL Public Debt Department) and independently verified by the National Audit Office. The initial view is that these actions won’t result in any substantial reduction in the outstanding debt levels and or cash flows. The IMF is ultimately looking at the national debt perimeter and how we reduce it to a level that is considered sustainable.

Similar to what the IMF put on the table for absolute annual revenue targets until 2025, we need to get (from the IMF) the absolute annual year-end Debt Perimeters until 2025. This would be a far more complex calculation as it would have to take into account new borrowings (international and domestic), capital repayments if any within that period and similar to the annual absolute revenue targets set, the absolute Debt Perimeter targets would have to achieved with the least impact on the most vulnerable of GSec holders for the time being. The Central Bank should resolve not to pass on the pain, if any, to the public FD holders, to the benefit of Bank shareholders who have been the primary beneficiaries of high distributable profits over the past three years or so. They have indeed benefited immensely over the past few years, despite the Easter bombings, the pandemic and even the 2022 political turmoil.

Principle to follow

The starting point for this assessment of vulnerability is the primary investment intention for returns to key vulnerable stakeholders like retirees in pension funds. The chances are that this may not suffice, at least in the first few years, necessitating a marginal haircut to those as well. The CBSL holds 2.44tr (Circa 20%) of T-bills and T-Bonds. The Government needs to consider the impact (cash flow and notional Government Debt Stock) of subjecting these to a haircut, compared to the structure proposed on this table – especially the haircuts to coupon values and face values of GSecs in the CBSL debt stock. Writing off the CBSL holding would need to come with some sort of backstop/guarantee of the CBSL by the multilaterals – possibly the World Bank to ensure the Central Bank and the dependent banking sector does not go into a crisis.

The World Bank would have to come up with such a backstop to the CBSL as purely Central Bank (not GOSL) support until the GOSL can augment the CBSL capital by at least 2025 – the year of the planned primary surplus. All of this points to a professionally resourced Independent Debt Office (IDO) managing GSecs in the future. This IDO would be appointed and be responsible to Parliament and be under the oversight of an appropri ate Parliament Committee, leaving little room for GOSL requirements to be leveraged to the detriment of the debt service outflows of the Treasury and to the national debt perimeter. Capital gains in the market would have to take a back seat in the current circumstances, at least until the projected debt perimeter and debt service metrics are achieved and sustained.

Way forward

Sovereign debt restructure is a very complex route and one that requires careful management, especially given that Sri Lanka has limited experience. Most primary foreign debt holders of ISBs have exited by now by cutting their losses. The current holders (and even some banks) are holding them at steeply discounted values and can take substantial haircuts without any pain at all. Too bad if some have parked these in held-to-maturity classifications, benefiting from the elevated yields to their earnings. Certainly the starting point is clearly to target the projected Debt Perimeter in the proposed overall debt sustainability plan and work within that framework. This is an option worth considering when putting a robust framework together to address the haircuts.

But there certainly are other options that have been proposed. However to develop a structure, we require skilled professionals who have had hands-on experience. Moving forward, more pain is in store and corporate earnings will see deep cuts this year. However analysts say that the economy has entered the final, deeper stage of the downturn.

References:

https://youtu.be/jrN6HRiT0UY

https://www.reuters.com/markets/asia/sri-lanka-announce-debt-restructuring-strategy-april-cenbank-chief-2023-03-09/