Monday Mar 09, 2026

Monday Mar 09, 2026

Thursday, 23 November 2023 00:00 - - {{hitsCtrl.values.hits}}

No populist President whether left or right could do these reforms. If he could do these things he will be remembered forever

|

It is alleged that this Budget is an election budget; the borrowings are continued; and there is only excessive taxation, selling and borrowing.

It is alleged that this Budget is an election budget; the borrowings are continued; and there is only excessive taxation, selling and borrowing.

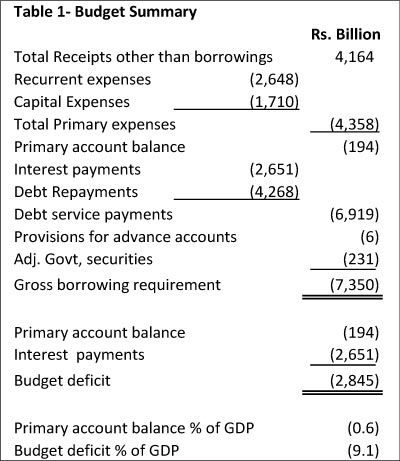

When reviewing the summary of the Budget it is evident that the Budget was prepared in line with the indicators of the IMF. The figures in Table 1 were extracted from the Annexures I and II of the Budget speech. There are slight differences between the figures in those annexures.

According to Table 1 total income is Rs. 4,164 billion and total expenditure other than interest payments is Rs. 4,358 billion. The difference between these two figures, which is the Primary Account deficit is Rs. 194 billion. According to the conditions agreed with the IMF in the year 2024 the Primary Account balance should be a positive one and it should be 0.8% of the GDP. However, the figure indicated is a negative balance of 0.6% of GDP. In the Annexures to the Budget speech, the amount of Rs. 450 billion allocated for recapitalisation of the banks, which was included in the capital expenditure, was shown separately. This indication was neither to the Parliament nor to the public. It is to the IMF. When this Rs. 450 billion is removed from the capital expenditure the Primary Balance will be a positive one and it is 0.8% of the GDP which is the expectation of the IMF.

Recapitalisation of State banks was included in the interim presented by Ranil Wickremesinghe for the year 2022 and it was included in the conditions agreed with the IMF. In the interim Budget it was proposed that 20% of the shares of state banks should be sold to the depositors and to the staff of the banks. According to this Budget it appears to be that Rs. 450 billion will be used to recapitalise the banks and then 20% of the shares will be privatised, which is not clear. The shares of the commercial banks the Government acquired through EPF, ETF and the Insurance Corporation could be sold in order to recapitalise a portion of the state banks. Or else the shares of the State banks could be listed in the stock exchange and 20% of the shares could be sold. Ideally it should be more than 20%. By this way in addition to the generation of quick cashflows to the Government coffers the entire banking sector could be made more competitive by injecting fresh blood to the two large State banks with a significant market share.

Destructive thinking

Destructive thinking

The Government delays this process to be in line with the destructive thinking of the country that assets of the State should be kept intact whether those assets are used productively or not. This destructive thinking does not understand the desire of the politicians to spread their personal power to the State sector entities. What this destructive thinking does is allowing the politicians to engage in wrong doings and then put the fault of the corrupt Government service and the corrupt society on the politicians.

State banks have fallen into this plight mainly due to the unsustainable loans given to the loss-making Government institutions such as CEB, CPC and SriLankan Airlines. The President has clearly stated that in his Budget speech. The reason for the losses of CEB and CPC in addition to their inefficiencies was that they have to sell their products to the public lower than their production costs in order to satisfy the political aspirations of the successive Governments. This situation is being reversed now. Mahinda Rajapaksa is solely responsible for the losses of SriLankan Airlines since he reacquired the company of which a large portion was privatised including the management, and which was running profitably, to satisfy his personal ambitions. Therefore, to that extent he is an economic assassin.

Ranil Wickremesinghe no sooner became the Prime Minister in 2022, addressed the nation and said that SriLankan Airlines should be restructured. He and his appointed commission for this purpose move forward very slowly. In the year 2022 the 13 loss making Government entities made a loss of Rs. 1,029 billion. Out of that Rs. 1,023 billion loss was made by SriLankan Airlines, CEB and CPC which was 99.3% of the total loss.

According to other data in Table 1, the budget deficit is Rs. 2,845 billion. The budget deficit is the residual balance after deducting all the expenses including interest expenses from the total revenue. This is a deficit and is 9.1% of the GDP. If the amount of Rs. 450 billion which the recapitalisation of the banks is removed from the expenses, the budget deficit would be 7.6% of the GDP. This value for the year 2022 was 10.2% and the revised figure in 2023 was 8.5%. Hence the deficit is getting reduced.

The need to borrow to finance the budget is Rs. 7,350 billion. Out of that Rs. 6,919 which is 94% of the money to be borrowed will be spent on repayment of capital and interest of the borrowed money. Therefore, views against continuous borrowing are not substantiated.

Thus, on the paper the Budget is fine, and it is in line with the agreed conditions with the IMF. However, there are several issues.

The tax revenue based on the conditions agreed with the IMF should be Rs. 2,949 billion which is 9.7% of GDP. According to the revised estimates of 2023, it is Rs. 2,596. There is a deficit of Rs. 353 of the tax revenue. In 2024 there was no agreement with the IMF to increase the VAT rate. What was agreed was to expand the VAT base and remove SVAT. Those who supply goods and services to the exporters are not liable to pay VAT on the said transactions, this system is called SVAT. Based on the request of the exporters the Government decided not to remove SVAT. Therefore, the Government has increased VAT rate by 3% from 15% to 18% with effect from 1 January 2024.

Based on the Government revenue estimates, tax income on VAT in 2024 would be Rs. 2,235 billion. The corresponding figure in 2023 was Rs. 1,376 billion. Accordingly, there will be an additional income of Rs. 859 in 2024. Collecting tax in this manner is an easy task compared to chasing behind the persons who are liable but do not pay taxes. The sum of the expenditure for the 50 tax proposals made by the President is Rs. 212 billion. Out of that the expenditure for the salary increase of the Government servants is Rs. 133 billion. Aswesuma benefit including the benefits to elderly and differently able persons is Rs. 205 billion. The Government estimates that all these expenses could be recovered from the increase of VAT rate.

The more difficult task of expanding the tax base should be addressed even with allocating more personnel out of the excess Government employees. In 2024 the portion of direct taxes out of the total tax income is 28%. In 2023 revised estimates it is 33% and in 2022 it was 30%. This percentage should be increased not in principle but practically.

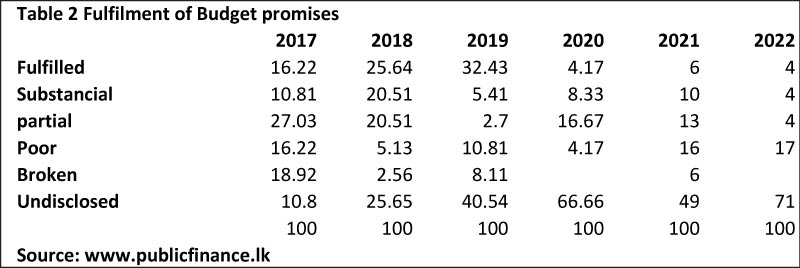

The provisions were allocated for 50 Budget proposals in 2024. In Table 2, summarised information is given in respect of the implementation of Budget proposals as percentages based on research done by Verite Research (www.publicfinance.lk). Progress of implementation of the Budget proposals from 2017 to 2022 were identified in six categories namely, fulfilled (progress on the promise is over 80% of the target), substantial (progress on the promise is between 66% to 80% of the target), partial (promise is between 33% to 66% of the target), poor (progress on the promise is less than 33% of the target), broken. No progress has been made on the promise or the promise has been removed from the action plan), and undisclosed (No information is available to determine the status of the promise or available information is insufficient/unusable). In mid-year 2023 for 2023 the progress of the Budget proposals were 8%- progressing, 24% -lagging and 68%- undisclosed.

It is the duty of the Parliament which is responsible for public finance to overcome this situation.

Revenue targets are unrealistic

There were comments that the revenue targets are unrealistic which is true. In 2023 in the revised estimates compared to the initial figures in 2023, there was a shortfall of Revenue of 16.7%. Estimated VAT revenue came down by 21.95% and income tax revenue came down by 5.26%. To compensate for this, the Government revised the expenditure estimates. The worst hit was capital expenditure of which the reduction rate was 35.9%. Interest expenses were kept intact. The reduction of salaries and wages was 1.6%.

Therefore, what would happen is when the revenue drops, these fairytale Budget proposals such as Anuradhapura Maha Vihara University construction for which Rs. 400 million was allocated will go out of the window and Verite Research could identify those as undisclosed. There are more than 20 proposals for which there were no financial allocations. Hence those are already on the undisclosed list. This time in addition to interest expenses, the Government will not be able to touch the increase allocated to salaries which is Rs. 133 million. What is disturbing is the possible reduction of the allocation to the capital expenditure, in case of a revenue drop.

In summary, there is no evidence that this is an election budget. This time unlike in previous election years, Government has not borrowed money to give benefits to the people such as the salary increase. That was done by increasing the VAT which is collected from the people. Therefore, if this is aimed at an election the Government will have to answer the people for the increased cost of living at an election.

The President said that he was yet to decide whether he will re-contest presidency since he is fully concentrated on rebuilding the economy. If he decides that he will not contest the presidency the time left is more than enough to make the structural changes to the economy which are lagging. These structural changes are privatising the deserved public enterprises in a transparent way, making a revenue authority, digitalising Government activities for which a Budget allocation is there, introduce KPIs to public sector and stop promotions based on seniority as Sarath Fonseka did at the war. Create necessary conditions to attract FDI, expedite making EPZs as promised, and enter FTAs with important countries with favourable terms. No populist President whether left or right could do these reforms. If he could do these things he will be remembered forever.