Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 2 May 2023 00:27 - - {{hitsCtrl.values.hits}}

In the proposed new central bank bill, the procedure of protecting the capital adequacy of the bank has been changed from 15% of domestic assets to 6% of monetary liabilities which are called reserve money or the monetary base. In the existing MLA, it is related to the monetary base via the domestic assets, the source of the creation of such base. This has been avoided in the new bill by directly connecting it to the base. What this means is that a minimum of 6% of the monetary base is covered by capital funds. This is a too low protection, and it would have been better had it remained at the original level of 15% prescribed in the MLA

Stability of Central Bank in Volume II

Stability of Central Bank in Volume II

The Central Bank has issued its Annual Report for 2022 in two volumes, the first on the state of the economy and the second on its operations. The members of the public normally focus on the first volume since it is a rich source of the current and emerging economic situation. A scanty attention is paid to volume number two which brings out the financial position of the Bank. However, it is the volume which should be read and debated by the public because it gives clues about the stability of the Central Bank.

Thumping losses in CB in 2022

According to the financial results released, the Central Bank has made a thumping loss of Rs. 374 billion in 2022 as against a profit of Rs. 158 billion made in 2021. This is by calculating profits or losses in terms of the international accounting standards which the bank is following as its accounting and auditing template. These standards require the Central Bank to recognise the losses arising from the revaluation of foreign assets and liabilities due to exchange rate depreciation as a loss of income in the current year. But the normal central bank account systems require the bank to transfer such losses to a special account called the International Reserve Revaluation Account or IRRA and separate them from the distributable profits or losses. This is how the profit calculation should be made as prescribed in the Monetary Law Act or MLA.

But when this practice is followed by taking out the current revaluation losses amounting to some Rs. 610 billion, the loss of Rs. 374 billion in terms of the International Accounting Standards is converted to a profit of Rs. 235 billion that can be distributed by the bank it wishes to do so. However, as a prudential measure, the bank has decided not to make any profit transfer to the Government out of its financial operations in 2022.

Current CB management is not responsible for the losses

It should be noted that the present management of the Central Bank is not responsible for this malaise. In fact, it is a victim of the imprudent operations conducted by the Central Bank management in the past. Two of such imprudent measures included losing foreign reserves from around $ 7.6 billion at end 2019 to near zero level by March 2022 to keep the exchange rate at an artificial level of Rs. 200 per dollar and increasing the bank’s foreign liabilities to a level of $ 6 billion by that date. Hence, when the assets and liabilities were reassessed by using a collapsed exchange rate of Rs. 363 per US dollar, it resulted in a thumping loss of Rs. 610 billion as reported. This was much more than the generation of rupee profits by the bank during 2022 by lending to the Government at high interest rates of about 30%.

CB’s goal should not be making profits, but it should not make losses either

Profit making is not the goal of a central bank because it can make profits, unlike other entities in an economy, by printing money at its discretion and acquiring assets. If it prints more money, it can make a bigger quantum of profits. But those profits are made at the expense of those who hold on to the money it prints. When the money supply is more than the needs of the economy to conduct its economic transactions, the excess money creating an unwarranted total demand, known as the aggregate demand, for goods and services will lead to an increase in the general price level, on one side, and the depreciation of the exchange rate, on the other. When the general price level increases continuously over a period, it is called inflation.

Both inflation and the exchange rate depreciation will reduce the real value of the money held by people. For instance, if one goes by the underestimated Colombo Consumers’ Price Index, or CCPI, which is used as the country’s official measure of cost of living, a rupee earned in January 2021 is now worth only about 50 cents. Similarly, a person who has earned an income of Rs. 200 in January 2021 would have been able to command a basket of goods worth of one US dollar. The same one hundred rupees can command only a basket worth of 55 US cents in December 2022. Hence, the public is hit twice by the unnecessary money increases by a central bank, though it makes profits for it, leading to inflation and currency depreciation. This is not the goal of a central bank and therefore, it is not expected to make profits at the risk of generating inflation and currency depreciation.

Losses not tolerated in CBs

But a central bank is not expected to make losses either. Those losses will reduce its capital base and when the capital falls to a critically low level of making its monetary obligations in the form of currency it has issued and demand deposits it is holding more than the capital, it is reduced to a venture with a negative net worth. In the case of a private business, a venture with a negative net worth is not a ‘going concern’ meaning it cannot do its business, and, hence, should be compulsorily wound up. A central bank cannot be wound up like that and, therefore, should be given new capital by the taxpayers. This is a situation that should be avoided.

When the Central Bank continued to make losses in 2013, 2014, and 2015 causing a depletion of its capital base, I warned the Central Bank in this series that it should take action to reverse the trend to avoid the state of a negative net worth in the Bank (Available at: https://www.ft.lk/columns/the-continually-loss-making-central-bank-puts-nation-on-red-alert/4-417877). In the subsequent years, the Bank was able to reverse the trend and avoid the obvious pitfall.

CBs can make profits in forex operations

However, there is no objection to a central bank making modest profits in its foreign exchange operations after ensuring the safety of its foreign investments. This is because the foreign exchange operations are done by a central bank as the agent of the government by managing the nation’s foreign reserves. What is earned through these operations is earned from the rest of the world and has no implications for the domestic aggregate demand and consequential inflation and currency depreciation. Since foreign reserves are there to meet a foreign currency shortfall and avoid payment difficulties, it is not expected to take high risks by engaging in speculative types of investment.

In the past, there have been occasions where the Central Bank has violated this golden principle. As a result, in the new central bank bill, it has been stipulated that the central bank should conduct its foreign exchange operations ‘having regard to safety, liquidity, and return in that order of priority’. Therefore, even in the case of foreign exchange operations, the priority is not making profits but ensuring safety first, and liquidity second. Hence, the central bank should look at the return in investments only after the first two have been satisfied.

Capital ratios are a protective measure in CBs

Unlike currency boards where every currency note issued should be backed by an equal value of foreign reserves, central banks are not required to maintain such a reserve backing. Hence, capital becomes important for central banks. To force central banks to maintain adequate capital funds relative to the assets they create, the laws governing them have provided for maintaining proper capital ratios. For instance, the Monetary Law Act which governs the present central bank has required the Monetary Board of the Central Bank to build up capital funds equal to at least 15% of its domestic assets defined as the difference between the total assets and foreign assets.

Monetary liabilities of a CB

By acquiring assets, both domestic and foreign, a central bank creates monetary liabilities known as reserve money or monetary base. They are of two types, currency which is a sight liability – because a central bank is required to pay value on sight – and demand deposits held for commercial banks and other institutions which are demand liabilities – because the bank is required to pay its value on demand. When the assets go up, these liabilities also go up. But in the case of foreign assets, there is protection because the central bank has a claim on a foreigner who is required to pay value in foreign currencies. Therefore, the risks arise from two sides. One is the loss of the foreign reserves by wasting them unnecessarily to protect the exchange rate or to make payments which are not of any benefit to the country.

But it leads to the reduction in the monetary liabilities or the reserve money creating a liquidity shortage in the system. To overcome this, the bank will have to create new reserve money by creating domestic assets. To restrain the bank from doing this extravagantly, the MLA has tied the creation of domestic assets to the capital funds of the bank. The prescribed 15% is the minimum and it should strive to maintain a high and a safe ratio.

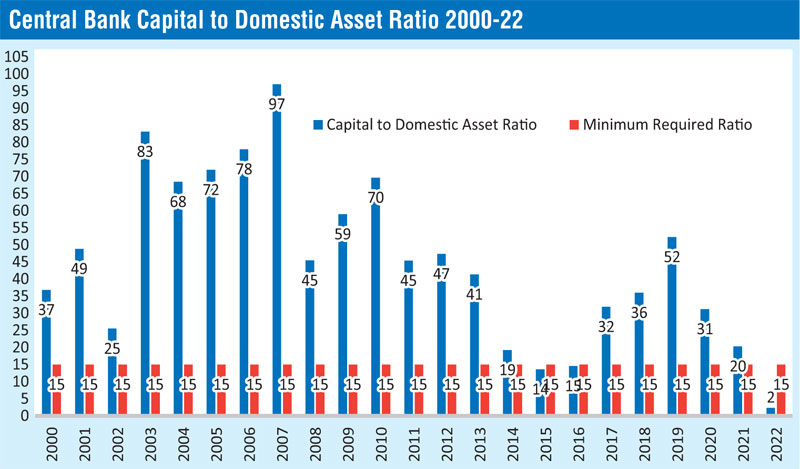

Maintaining a 100% capital ratio under CB modernisation project

Under the Central Bank Modernisation Project which was in operation during 2000-4, the Bank had agreed with the funding agency, the World Bank, that it would bring the ratio gradually to 100% over time. This was a protective measure introduced by the World Bank to see that the money lent to the central bank will be used properly. It required the central bank to refrain itself from making annual profit transfers or if it is done, to keep it at a low level and transfer the entire surplus to the capital funds. As the figure shows, the central bank was able to attain this goal by building the capital funds from 25% of the domestic assets to 97% by 2007. However, as the figure shows, in the subsequent years, this goal was abandoned by the central bank and as a result, it fell below even the 15% in 2015. The advantage of maintaining up to 100% of domestic assets as capital funds is converting the operation of the central bank to a virtual currency board. Accordingly, a part of the reserve money is covered by foreign assets and the rest by capital funds.

As it is the Central Bank is not insolvent. But it may if it does not adopt a suitable strategy to cut its expenses and keep its books balanced in the next few years. This is a malaise which the Monetary Board should avoid

Depletion of capital ratio to 2% in 2022

The thumping losses made by the central bank in 2022 causing the depletion of the capital funds to a bare minimum level has reduced the ratio from 20% in 2021 to 2% in 2022. But as the graph shows, it is a deterioration started a few years back. In 2019, the ratio was 52%. But since the central bank transferred the entirety of its profits to the government in 2020 and 2021 without concern for the need of building capital funds, on one side, and the increase of domestic assets dramatically, the ratio began to fall. Strangely, the Monetary Board at that time did not think it necessary to protect the solvency of the bank.

New central bank bill has diluted CB’s capital requirement

In the proposed new central bank bill, the procedure of protecting the capital adequacy of the bank has been changed from 15% of domestic assets to 6% of monetary liabilities which are called reserve money or the monetary base. In the existing MLA, it is related to the monetary base via the domestic assets, the source of the creation of such base. This has been avoided in the new bill by directly connecting it to the base. What this means is that a minimum of 6% of the monetary base is covered by capital funds. This is a too low protection, and it would have been better had it remained at the original level of 15% prescribed in the MLA.

Present capital level is even below the diluted ratio of new central bank bill

The currently depleted capital base of Rs. 82 billion is just 6% of the monetary base of Rs. 1,349 billion as at the end of 2022. But since then, the monetary base has expanded to Rs. 1,643 billion by end April 2023 causing the ratio to fall to 5%, below the minimum level prescribed in the new central bank bill. This presents a high solvency risk for the Central Bank and the Monetary Board under MLA or its successor, the Governing Board, under the new central bank act should not take it lightly. It may require the Central Bank to go for austerity measures just like it has recommended to the rest of the nation under the current readjustment program with IMF.

Since the bank is not able to create domestic assets under the IMF program and even the existing interest earning investments in Treasury bills amounting to Rs. 2.8 trillion are to be converted to a negotiable 10-year bond under the new central bank act as a part of the domestic debt restructuring, its income base in the next 5 years will be drastically reduced. The bank has a committed expenditure of Rs. 10 billion as personnel expenses and another Rs. 2 billion as other expenses, it will face a serious solvency problem in the next few years.

CB is not insolvent as yet, but may be if prudent policies are not adopted

As it is the Central Bank is not insolvent. But it may if it does not adopt a suitable strategy to cut its expenses and keep its books balanced in the next few years. This is a malaise which the Monetary Board should avoid.

(The writer, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected].)