Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 11 August 2025 00:39 - - {{hitsCtrl.values.hits}}

By Sri Lal Somaweera

The recent COPF discussions sparked debate on a push to raise Sri Lanka’s tax on cigarettes to be 75% of the price of the cigarette. This has resurfaced policy discussions, echoing a longstanding recommendation from the World Health Organization (WHO). Their aim is clear: discourage smoking, improve public health, and boost government revenue. But is this a practical target – especially in Sri Lanka’s current economic and enforcement landscape?

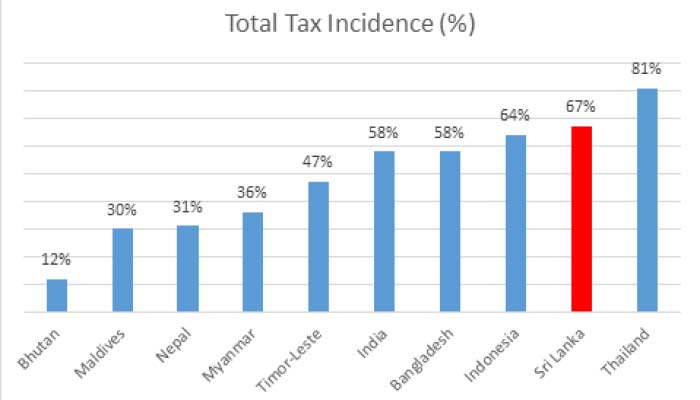

At 67%, Sri Lanka already ranks among the highest in Asia in terms of tobacco tax incidence. Moving to 75% would make it a regional outlier – surpassed only by Thailand. But as experiences across the region (and even globally) show, this metric alone doesn’t guarantee success. The practicality of such a move—especially within the region’s economic, social, and enforcement context—warrants a closer look.

Sri Lanka vs Asia: How we compare

Recent data reveals a wide variation in tobacco tax incidence across Asia. Only Thailand exceeds the WHO-recommended 75% benchmark, while much of the region – especially South Asia – remains far below. However, Thailand’s tobacco tax revenue has seen a decline over the past 15 years, now accounting for approximately 2% of total government revenue, largely due to high taxes pushing consumers towards cheaper illegal alternatives. But these disparities reflect differing economic conditions, enforcement capabilities, and consumer behaviour.

Tax incidence vs. Tax burden: A key distinction

While Sri Lanka’s tobacco tax incidence is high, it’s also important to look beyond percentage figures. A low tax incidence doesn’t automatically translate to a light financial burden on smokers.

In fact, when adjusted for purchasing power parity (PPP), Sri Lanka’s cigarette taxes are significantly more expensive relative to income than in many neighbouring countries. Sri Lankan smokers pay some of the highest tobacco taxes in Asia when measured in PPP-adjusted dollars. This means that even without reaching the 75% incidence threshold, tobacco is already disproportionately expensive for Sri Lankan consumers.

As a result, further increases could risk pushing more smokers toward untaxed or illicit alternatives unless paired with strong enforcement and cessation support.

Thailand: Tax incidence is not the only factor to consider

Proponents of high tobacco tax incidence often point to Thailand as a success story.

But a closer look reveals that even with a relatively high tax incidence, over 80%, drawing a link between high taxation and reduced smoking prevalence is not as straightforward. The country has coupled tax hikes with extensive (and costly) public health campaigns, cessation support, and strong enforcement mechanisms – including licensing requirements, and strict border controls – to combat the growing threat of illicit trade.

The lesson is clear: merely attempting to push tax percentages higher without carefully calibrated enforcement and market understanding can lead to unintended consequences—chief among them, the erosion of legitimate markets and the empowerment of unregulated ones. For countries like Sri Lanka, which already has a fragile legal market and rising illicit activity, this should serve as a warning rather than a blueprint.

The Philippines: Not quite the one-size-fits-all solution

The Philippines is another often-cited tobacco tax reform success story.

Between 2012 and 2016, the government overhauled its four-tier cigarette excise system into a unified structure, sharply increasing taxes faced by consumers. On the surface the results appeared promising: higher revenues and a reported decline in smoking prevalence.

However, the picture beneath the headline is more complicated. Whilst the reforms initially brought in more tax revenues, they also coincided with a sharp rise in illicit trade. Whilst the problem was relatively insignificant prior to the reforms, illicit trade rose to over 16% by 2018 significantly eroding the legal market, hurting local retailers, manufacturers and hampering tax collection efforts.

For Sri Lanka, the Philippines represents a cautionary tale: even when reforms are well-intentioned, rapid increases without recognising the need for improved enforcement measures may only fuel further illicit activity.

Challenges unique to Sri Lanka

Sri Lanka’s tobacco market has evolved significantly in recent years under mounting economic pressure. As real incomes have fallen, more smokers have turned to cheaper, untaxed alternatives such as beedis or smuggled products. The result: a growing illicit market that undercuts both public health and revenue goals.

Reaching a 75% tobacco tax incidence may appeal to international benchmarks, but for Sri Lanka, the more pressing concern is economic and market stability in the wake of the recent economic crisis.

Already facing some of the highest tobacco taxes and prices in the region, Sri Lankan smokers are already under significant financial strain – particularly lower-income consumers

Rather than rushing toward arbitrary thresholds, policymakers should consider a phased, pragmatic approach that reflects domestic realities. Gradual increases, paired with smarter tax design and better enforcement, may help going forward. Heavy-handed measures risk pushing more consumers out of the legal market, negatively impacting revenue collection and hampering public health ambitions.

Future reforms should focus on:

(The writer is an independent tax consultant with over 25 years of experience.)