Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 18 January 2024 00:30 - - {{hitsCtrl.values.hits}}

The economic transition envisaged in the Government’s reform agenda needs resources and skills, accompanied by right policies and institutions

The Sri Lankan economy is re-emerging from the worst socio-economic crisis. However, some cast doubts whether the current economic recovery would be sustainable. There are speculations of another balance of payments crisis due to external debt servicing once the debt restructuring process is complete. Others highlight a possible reversal of the reform agenda due to ‘political risks’ amidst forthcoming elections.

The Sri Lankan economy is re-emerging from the worst socio-economic crisis. However, some cast doubts whether the current economic recovery would be sustainable. There are speculations of another balance of payments crisis due to external debt servicing once the debt restructuring process is complete. Others highlight a possible reversal of the reform agenda due to ‘political risks’ amidst forthcoming elections.

Against this backdrop, this article attempts to assess the near- to medium-term macroeconomic outlook in light of the economic policies being pursued by policymakers at present.

State of the economy at present

Real GDP growth in 2023-Q3 turned positive after a spell of consecutive contractions for six quarters. Near term growth outlook remains robust despite negative spillovers due to tax changes. The leading economic indicators, such as purchasing managers’ indices for manufacturing and services sectors, show steady signs of expansion of economic activity. 2023-Q4 is also expected to record a positive GDP growth. More importantly, 2023 is expected to have recorded a ‘twin surpluses’ for the first time on record, i.e., a surplus in the primary balance of fiscal accounts and external current account. Market sentiments are expected to firm up, supported by well-anchored inflation (despite a transitory increase due to administrative measures), declining interest rates, bolstering official reserves, and the stable exchange rate. Debt restructuring process has reached an advanced stage. Policy credibility and predictability have improved with the support of effective and transparent dissemination of information on the conduct of public policies, mainly monetary and fiscal policies.

Could the resumption of external debt servicing result in another balance of payments crisis?

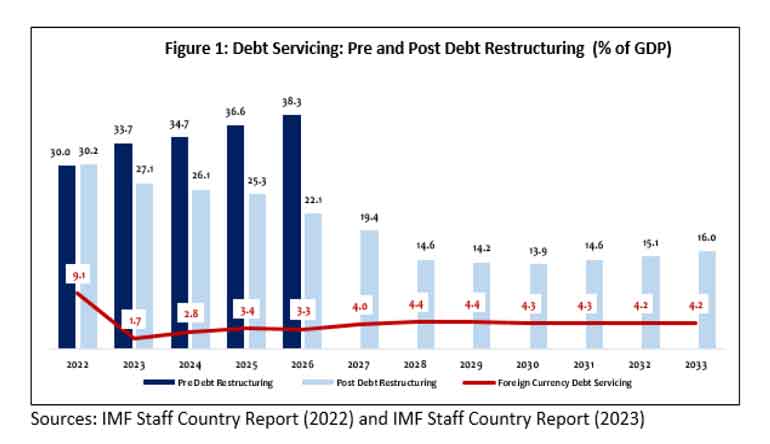

Sri Lanka’s total debt servicing would have reached over 38% of GDP by 2026 in the absence of any debt treatment (IMF Country Report – 2022). However, under the baseline scenario of debt restructuring, the same assessment conducted in 2023 revealed that the total debt servicing could be as low as 22% of GDP by 2026, and more importantly, the external debt servicing would be as low as 3.3% of GDP by 2026. Figure 1 shows a notable positive impact of debt restructuring on Sri Lanka’s debt servicing. Under the debt sustainability targets, foreign currency debt serving is expected to be maintained below 4.5% of GDP over the medium term (IMF Country Report – 2023).

Hence, the claims of excessive debt servicing burden on the Government and the possibility of another foreign exchange crisis due to large foreign exchange debt servicing are not borne out of debt sustainability analysis. The resumption of debt servicing would certainly be growth positive as it brings in more investor confidence underpinned by international support and improvement to the credit ratings of the country.

Debt restructuring sans a banking crisis is a great advantage to secure a faster recovery

Sustaining the positive momentum of economic growth following a debt restructuring has not been easy in international experiences. Countries which underwent debt restructuring have shown mixed empirical evidence on the time taken to catch up with the lost output. The degree of output loss depends on the nature of the debt treatment and economic conditions that prevail pre- and post-debt restructuring. The post-restructuring outcomes are mainly determined by the severity of the pre-restructuring debt problems, debt treatment choices, and shocks. Research has shown that output losses are large when debt restructuring is accompanied by banking crises (IMF Staff Report, 2021). Because Sri Lanka managed to avert a banking crisis, the possible output loss has been significantly contained. Hence, the recovery of activity could be faster in the forthcoming years.

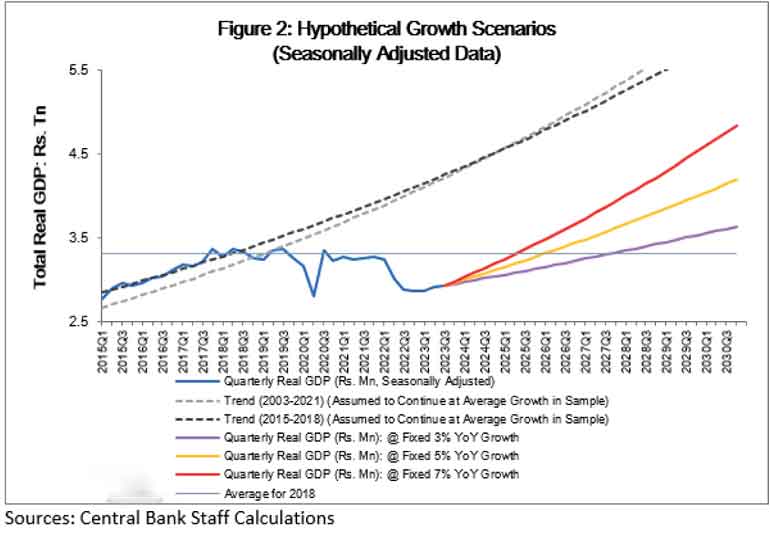

The key question that remains is how long it will take for the economy to reach the potential growth rate. Because the Sri Lankan economy has been battered by a multitude of shocks even during the period leading up to the external debt crisis in 2022, economic growth in the pre-crisis years has also been low. With an estimated cumulative loss of real output by about 11% during 2022 and 2023, the economy could take considerable time to reach the pre-crisis level of economic activity and the potential level. As Figure 2 shows, real economic activity has declined to levels seen in 2015. If the economy grows by 3% quarterly (y-o-y), it will take about another four years to reach the level activity of 2018. This time could be halved if the economy could grow by 5% quarterly (y-o-y). Hence, the economy would need to grow faster to catch up with the lost output during the crisis. Policymakers will need to ensure that the right policies are in place to sustain the growth momentum over the medium term. The economic transition envisaged in the Government’s reform agenda needs resources and skills, accompanied by right policies and institutions.

Addressing structural weaknesses remains key to sustaining the recovery

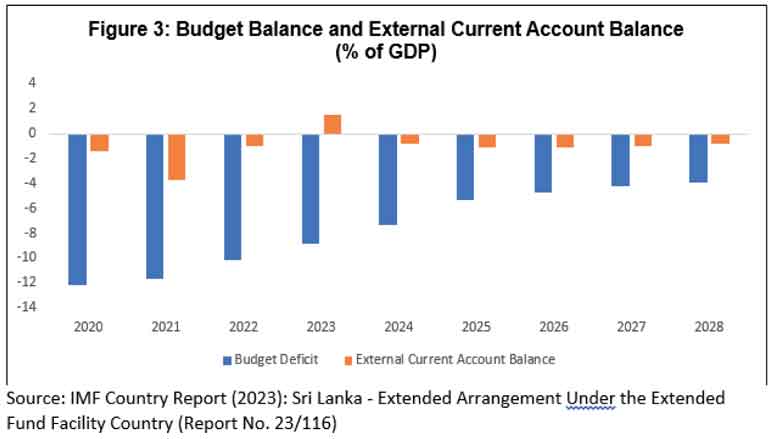

Sri Lankan economy lacked fiscal and external buffers as it has been plagued by the ‘twin deficit’ for several decades. Successive Governments in Sri Lanka have adopted populist budgetary policies, which are electorally popular in the short run but detrimental to long-run growth prospects. Consequently, Sri Lanka recorded perpetual budget deficits for decades resulting in accumulation of public debt to an unsustainable level. The persistent revenue under performance and discretionary Government expenditure caused a primary deficit in fiscal accounts. With perpetual budget deficits, public debt rose to a substantially high level. Consequently, foreign debt servicing became challenging.

Meanwhile, the lack of foreign exchange generation from the investments made with borrowed funds brought the economy to a standstill in 2022, as foreign inflows dried up and credit ratings plummeted. Simultaneously, the country’s trade competitiveness has been hindered by an array of factors: the lack of innovation and adoption of technology, retarded productivity growth, lack of market and product diversification of exports, overreliance on imports, discretionary exchange rate management, among others. External imbalances have been worsened by the primary income deficit in external accounts, that was mainly caused by the interest payments on external debt by the public sector.

Having learned the hard lessons of postponing reform implementation, the Government has embarked on a reform agenda that aims at addressing long standing structural vulnerabilities. This reform agenda is based on a five-pillar strategy, envisaged in the Extended Fund Facility (EFF) supported arrangement from the International Monetary Fund (IMF); (i) preserving the revenue-based consolidation, (ii) restoring public debt sustainability, (iii) maintaining price stability and rebuilding external buffers, (iv) ensuring financial stability, and (iv) reducing corruption vulnerabilities and strengthening governance, and raising potential growth.

These strategies are complementary. Achieving one strategy or two, without the others, would not be adequate to get the economy out of the woods on a sustainable basis. Figure 3 shows the expected adjustment in the budget deficit and external current account deficit supported by the reforms being pursued. The envisaged improvement of the twin deficit remains crucial in sustaining the near to medium term recovery of the economy.

Implementation of hard reforms has already shown promising results

The swift and sizeable policy intervention that was undertaken by the Government and the Central Bank in the wake of the crisis in 2022 helped curtail further worsening of the crisis and restore macroeconomic stability. However, reforms cause large adjustment costs. The longer the delay in reform implantation, the larger the cost of adjustment. Winning public support remains key for the continuation of the reform agenda.

The fiscal consolidation efforts have begun to show expected results. Following the announcement of the temporary debt standstill for selected foreign debt obligations in April 2022, the Government has been successful in carrying out the domestic debt optimisation operation and engaging with the external creditors to negotiate for a relief on external debt. The envisaged completion of debt restructuring process will trigger positive credit rating action, thereby helping to reduce risk premia of yields on sovereign securities. The debt restructuring, along with strengthened fiscal consolidation, will help bring down the public debt trajectory towards a sustainable path.

Several actions associated with the institutional and legal reforms have already been completed or are being initiated following the passing of National Budgets in Parliament. These actions, which are wide ranging, include autonomy for monetary policy making, strengthening fiscal consolidation and discipline, effective debt management, factor market development, protection of environment, climate change mitigation, international economic integration, digital technology, natural resources management, reforming state-owned enterprises (SOEs) and management of public private partnerships, etc.

A major reform that is expected to pave the way for economic sustainability is the enactment of the Anti-Corruption legislation in July 2022. Sri Lanka has also been the first Asian nation to undergo the IMF evaluation pertaining to governance and the Governance Diagnostic Report has been published by end September 2023. The findings of this governance diagnostic are being considered in the ongoing reform agenda. Another such reform is the expected enactment of the Public Financial Management Bill that strengthens fiscal rules.

In addition, a legislation is currently being drafted to establish an independent debt management office that will be responsible and accountable for prudent public debt management. Effective implementation of these legislative reforms is envisaged to improve the governance, transparency and accountability of public finance management, thereby strengthening the overall fiscal sector performance.

SOE reforms

The Government has taken hard decisions to turn around the loss making SOEs. These measures include the implementation of the pricing formulas for key utilities aimed at improving the financial performance key SOEs, restructuring the balance sheets of loss making SOEs and restructuring and partially or fully divesting non-strategic SOEs. Implementing these strategies would help improve competition and efficiency in the provisioning of goods and services, especially utilities, improve the good governance of such institutions, while reducing the potential burden of these SOEs on Government budget. In addition, several foreign debt obligations of the Ceylon Petroleum Corporation and Ceylon Electricity Board were absorbed to the debt of central government from end 2022 with the aim of minimising the financial burden caused by legacy debt.

Reducing the burden of SOEs through these initiatives will help them transform into growth enablers. Reflecting the impact of these measures, financial performance of major SOEs has improved significantly thus far. Such improvements should accrue benefits to the public and contribute towards enhancing social welfare. Also, financially strong and efficient SOEs would help improve ease of doing business in the economy.

Monetary Policy Autonomy with greater accountability

The Central Bank of Sri Lanka Act was enacted recently, replacing the Monetary Law Act, with the aim of ensuring greater autonomy for the monetary policy conduct without fiscal dominance. This new legislation is envisaged to eliminate room for taking policy missteps as in the past, particularly with regard to monetising the budget deficit, discretionary management of the exchange rate, etc., while making the Central Bank more accountable for managing the inflation at a targeted low level.

Subsequently, the Ministry of Finance and the Central Bank signed an agreement to maintain inflation at 5% level with a margin of +/-2%. As price stability takes hold, it helps induce stability on the macroeconomy, thereby incentivising economic activity on sustained basis. Consumer price inflation is expected to be maintained around the target level over the medium term, despite a short-lived upward shift due to VAT amendments beginning January 2024.

Factor market reforms are necessary to improve potential growth

Sri Lanka’s labour market is undergoing a major adjustment as emigration share of skilled and professional categories soared in recent years. Just when the country needs more human capital with diverse skills to revive the economy post-crisis, such exodus of experts from technical and professional fields affects medium term growth prospects. Further, Sri Lanka’s working age population is shrinking, affecting the growth potential in the medium to long term. Overhauling archaic labour laws to attract and retain the talent would be crucial at this juncture. Flexibilities of employment, women employment, termination benefits, etc., require fresh thinking in line with the modern-day requirements.

Another major impediment to long term economic growth is the lack of land rights to the private sector. Research has found that stronger property rights, accompanied by credible policies and institutions that facilitate equitable access and use of property would increase GDP by 5%. Measures that have already been taken to transfer of sole rights of state lands to grant holders of about 2 million farmers is commendable.

Closing remarks

Sri Lankan economy is undergoing an adjustment after a significant loss of real output and investor confidence, and unprecedented social costs in recent years. The lost output can gradually be regained underpinned by the reform path currently being pursued. Bolstering investor confidence needs the full completion of the debt restructuring process. The progress thus far in terms of carrying out reforms and debt restructuring has been impressive. Yet, the full completion of the debt restructuring process needs the agreement from the private external creditors. Such agreement is expected to be reached in the near term, following which Sri Lanka would be able to elevate from the ‘default’ rating.

Credit rating improvement will help reduce large risk premia on sovereign securities. As the economic conditions normalise with low inflation and low interest rates, real activity could be revived on a sustainable basis with the support of bold reforms that are currently in place, underpinned by the IMF-EFF supported arrangement. Benefits of the sustained recovery of the economy will help ease burden on the people and businesses suffered from the impact of the crisis. Permanent reduction in the twin deficit would be crucial to ensure a sustained recovery, reinforced by right policies and institutions, and more importantly robust growth strategies.

It is noteworthy to end this article with a quote from Prof. Ricardo Hausmann on growth strategies for the developing world: “In the economic growth process, countries in the developing world do not grow by making more of the same. In fact, ‘more of the same’ is not the way rich countries grow either. In the process of economic growth, countries change what they do. They change what they’re good at. They evolve their comparative advantage. They do this because they acquire new productive capabilities; they acquire know-how and technology that allows them to do more diverse and valuable things.”

References:

IMF Staff Report (2021): Issues in restructuring of sovereign domestic debt, International Monetary Fund, Washington, D.C.

IMF Country Report (2022): Sri Lanka - Article IV Consultation 2021 (Report No. 22/91)

IMF Country Report (2023): Sri Lanka - Extended Arrangement Under the Extended Fund Facility Country (Report No. 23/116)

Housman, Recardo: What are the Challenges of Economic Growth? Growth Lab, https://www.hks.harvard.edu/centers/mrcbg/programs/growthpolicy

The writer is the Assistant Governor, Central Bank of Sri Lanka.