Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 7 July 2025 01:14 - - {{hitsCtrl.values.hits}}

Transitioning from stabilisation to long-term growth requires a bold, forward-looking agenda to promote growth enhancing structural reforms

Introduction

Introduction

In my article “Is Sri Lanka’s recovery sustainable?” published in the Daily FT on 18 January 2024, I argued that Sri Lanka’s economy could rebound relatively quickly, despite the severe economic collapse and loss of market confidence in 2022. Drawing on international evidence, I noted that recoveries following debt restructuring are often delayed when accompanied by banking crises. However, I contended that Sri Lanka avoided such a crisis due to the careful design of its domestic debt operation and effective communication by the Central Bank—factors that could support a faster recovery.

I also challenged concerns about a renewed foreign exchange crisis following the resumption of external debt servicing, pointing to debt sustainability analysis (DSA) that does not support such fears.

In this article, I cautiously suggest that Sri Lanka is now on the right path, driven by strong reform momentum from the Government and independent institutions. With improved economic and political stability, the country must now shift from crisis management to long-term planning. I outline key risks to sustaining this recovery and propose policy measures to address them.

Looking ahead, Sri Lankans must balance optimism with realism—remaining patient and committed to long-term goals rather than declaring early victory. With national elections now concluded, the country has a valuable window of opportunity to advance difficult reforms and ensure their benefits reach all citizens in the years to come.

Overcoming ‘reform fatigue’ is key

Thanks to strong political leadership and broad public support, Sri Lanka has reached the halfway point of its 48-month IMF Extended Fund Facility (EFF) program, launched in March 2023. This milestone marks a shift from economic stabilisation to a phase where people are beginning to expect real, visible improvements in their daily lives—though global economic uncertainties and domestic shocks could pose challenges.

Many past IMF programs in Sri Lanka often faltered due to political instability, economic shocks, and public fatigue with difficult reforms. To avoid repeating history, it’s crucial to maintain momentum and public trust. Clear communication about the purpose and benefits of reforms, along with measurable progress, can help sustain support. Involving citizens, businesses, and civil society in the reform process fosters shared ownership and strengthens resilience.

Public support for Sri Lanka’s reform agenda remains strong, shaped by the hard lessons of the 2022 crisis and a growing recognition that delaying reforms has long hindered progress. These reforms should not be viewed as externally imposed, but as long-overdue steps toward sustainable recovery. As early signs of improvement emerge, it is vital that policymakers remain committed, and the public stays engaged—even as the benefits take time to reach all segments of society. Sustaining this momentum is essential to securing a more stable, inclusive, and prosperous future. The key challenge lies in maintaining public buy-in, particularly as many have been influenced by decades of populist policies and may grow impatient if reforms do not yield immediate, broad-based gains.

The current IMF program is distinct from previous ones

The reform agenda underpins this IMF program places strong emphasis on improving public financial and debt management, strengthening governance, and implementing anti-corruption measures. Crucially, it also prioritises social protection to shield vulnerable groups from the adverse effects of fiscal consolidation. Its flexible design allows for periodic reviews and adjustments in response to evolving economic conditions. What sets this program apart is that it was negotiated during Sri Lanka’s most severe socio-economic and political crisis, with public debt sustainability as a central precondition—requiring an unprecedented debt restructuring effort.

The overarching goal of this reform agenda is to achieve sustainable and inclusive growth, anchored in stronger governance, greater transparency, institutional reform, and improved public sector performance. While governance challenges and limited institutional capacity remain, these are being progressively addressed as part of the broader reform effort.

A remarkable turnaround

Sri Lanka’s economic recovery has exceeded expectations. Real GDP grew by 5% in 2024, driven by rebounds in construction, tourism-related services, and industry. In Q1 2025, the economy expanded by an estimated 4.8%, following 5.1% growth in Q1 2024. High-frequency indicators, including the Purchasing Managers’ Index (PMI) for manufacturing, services, and construction, continue to signal solid expansion. On the fiscal front, reforms are delivering results. Government revenue is on track to reach 15% of GDP in 2025—the highest in 15 years—and is expected to rise further. The primary balance is projected to reach 2.3% of GDP in 2025, helping to reduce public debt in the years ahead.

The outlook for 2025 remains positive, with growth projected near potential and deflationary pressures easing. The external position has strengthened, supported by a current account surplus, robust remittances, and a strong recovery in tourism and services exports. Gross official reserves rose to $ 6.3 billion by end-May 2025, providing about four months of import cover, while the Sri Lankan rupee remains stable, reflecting improved market confidence.

Despite this progress, near-term risks persist. Global trade tensions, Middle East instability, and volatility in energy prices and shipping costs could strain the external balance. A global slowdown may dampen tourism and exports, while climate-related disruptions threaten agriculture and rural livelihoods.

In the medium to long term, Sri Lanka must address structural challenges such as low labour productivity, climate vulnerability, weak governance and institutional capacity constraints. Tackling these issues is essential to sustaining growth, enhancing resilience, and ensuring the recovery is inclusive and durable.

Preparing the economy for the long road to recovery

Transitioning from stabilisation to long-term growth requires a bold, forward-looking agenda to promote growth enhancing structural reforms. By institutionalising reforms, investing in people and innovation, and building resilience against future shocks, Sri Lanka can lay the foundation for an equitable and sustainable future.

1. Continued efforts to institutionalise macroeconomic stability

Sri Lanka has made significant strides in institutionalising reforms aimed at ensuring long-term fiscal and economic stability. Key achievements include the establishment of a credible medium-term fiscal framework to uphold fiscal discipline, enhanced monetary policy independence to anchor inflation expectations, the accumulation of external buffers through adequate foreign reserves and a flexible exchange rate regime, and improved debt transparency and management to prevent future crises.

Looking ahead, the continued institutionalisation of these reforms is essential to ensure their durability beyond the current IMF program cycle. Sustained commitment to increasing government revenue, maintaining expenditure within statutory limits, and achieving a primary balance consistent with debt sustainability remains critical. Equally important is the improvement of governance in state-owned enterprises (SOEs), which is vital for long-term fiscal sustainability.

The full implementation of the Public Financial Management (PFM) Act by the end of 2025 will mark a major milestone. It will mandate the publication of a comprehensive Fiscal Strategy Statement, a Fiscal Risk Statement, and a medium-term PFM Reform Strategy. Embedding these reforms into legal and institutional frameworks will help safeguard fiscal discipline, enhance public trust, and build resilience against future shocks.

Public sector reform should focus on enhancing service delivery through digitalisation, performance-based management, and institutional streamlining. Modernising the tax system is also essential to raise Sri Lanka’s low tax-to-GDP ratio. This should include broadening the tax base, simplifying tax codes, and improving compliance through digital tools and risk-based audits.

SOE reform is crucial to reducing fiscal risks, especially from loss-making entities in the energy and transport sectors. The government is restoring cost-recovery pricing, limiting SOE borrowing, and drafting a new SOE law aligned with the PFM Act to institutionalise governance, transparency, and accountability. These reforms are vital to unlocking sustainable growth and restoring public confidence.

The Central Bank remains committed to price stability while ensuring financial system stability. Inflation expectations have been anchored through data-driven policy and the cessation of monetary financing. Strengthened by the Bank of Sri Lanka Act of 2023, the Central Bank now enjoys greater policy independence. Its equity position has improved, and official reserves are growing through foreign exchange purchases, supported by a flexible exchange rate regime.

Sri Lanka’s financial system remains stable and well-capitalised. Credit growth is supporting economic recovery, and non-performing loans are beginning to decline. The Central Bank is enhancing its supervisory and regulatory frameworks, including reforms to the Finance Business and Leasing Acts and the introduction of a Rescue and Insolvency Bill. Governance reforms are also aligning state-owned banks with private sector standards through independent boards and stricter oversight.

2. Reducing debt overhang

Sri Lanka’s debt sustainability has improved significantly following comprehensive restructuring efforts, including both bilateral and private creditors. A key institutional milestone is the establishment of the Public Debt Management Office (PDMO) under the Public Debt Management Act of 2024. This office will centralise debt management functions and align borrowing decisions with a medium-term debt strategy, enhancing coordination and transparency. Debt transparency has also advanced, with the Ministry of Finance now publishing quarterly debt reports that include both direct and contingent liabilities. Despite this progress, public debt levels remain high, constraining fiscal space for essential development spending. Interest payments continue to consume a substantial portion of Government revenue, crowding out investment in infrastructure, education, and healthcare.

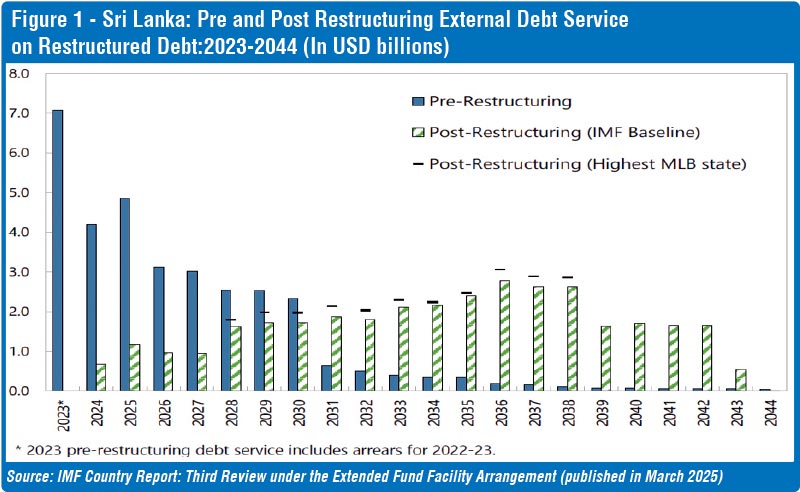

An added layer of complexity stems from the inclusion of macro-linked bonds (MLBs), which adjust debt service obligations based on economic performance. If Sri Lanka exceeds the growth thresholds specified in the MLB agreements, debt service costs will increase starting in 2028. While this has raised concerns about potential balance of payments pressures, the impact of triggering the highest MLB adjustment is expected to be modest (see Figure 1). Moreover, improved macroeconomic conditions could help offset the additional debt service burden.

Nevertheless, building adequate external buffers remains essential. In the face of global uncertainties, any shortfall in foreign reserves or export earnings could strain Sri Lanka’s capacity to meet external obligations once full debt servicing resumes. Until market access is fully restored, stable remittance inflows, robust export performance, and continued access to concessional financing will be critical to mitigating these risks.

3. Deepening governance reforms

To secure long-term stability and inclusive growth, Sri Lanka must now deepen its structural governance reforms. The authorities remain committed to advancing anti-corruption and governance initiatives, with the implementation of the Anti-Corruption Act already underway. This process is supported by annual updates to the Government Action Plan and quarterly progress reviews to ensure accountability and momentum.

A major milestone was the enactment of a comprehensive Asset Recovery Law in April 2025, alongside efforts to strengthen the asset declaration system. Amendments to the Strategic Development Projects Act and the Port City Act—expected before end of 2025—will introduce transparent, rule-based criteria for granting tax incentives, enhancing investor confidence and reducing discretion.

To curb revenue leakages, the Government is introducing new Customs legislation and has established a dedicated Tax Crimes Investigation Unit. Public financial management is being reinforced through a forthcoming Public Procurement Law and enhanced oversight of state-owned enterprises (SOEs). The proposed Public Asset Management Bill and amendments to the National Audit Act will further strengthen transparency, accountability, and enforcement mechanisms.

Sri Lanka is also enhancing its anti-money laundering and counter-terrorism financing (AML/CFT) framework under the 2023–2028 national policy. Reforms include updates to the Companies Act to align with the Financial Action Task Force (FATF) standards and improve beneficial ownership transparency. Additional measures are being implemented to strengthen financial intelligence, enhance money laundering investigations, and improve risk-based supervision of financial institutions.

4. Enhancing trade and investment

To strengthen economic resilience and reduce vulnerability to external shocks, Sri Lanka must diversify its export base beyond traditional sectors such as tea, garments, and tourism. Emerging sectors like information and communication technology (ICT), logistics, agritech, and green industries offer promising pathways for sustainable and inclusive growth. Agritech and value-added agriculture can enhance rural livelihoods and food security, while green industries—such as renewable energy and sustainable manufacturing—can position Sri Lanka as a competitive player in the global green economy.

Improving trade facilitation is equally critical. Sri Lanka ranked 73rd out of 139 countries in the World Bank’s 2023 Logistics Performance Index (LPI), a notable improvement from 92nd in 2018. However, further progress is needed in areas such as Customs efficiency, port infrastructure, and shipment reliability. Key priorities include digitalising customs processes, reducing clearance times, and deepening regional trade integration—particularly through platforms like the South Asian Free Trade Area (SAFTA) and potential free trade agreements with ASEAN and the European Union.

Attracting foreign direct investment requires a stable, transparent, and investor-friendly environment. While recent reforms help improve business registration and land access, challenges remain in investor protection, contract enforcement, and regulatory predictability. Strengthening land rights, simplifying administrative procedures, and enhancing the capacity of commercial courts are essential next steps.

Reforms to the Strategic Development Projects Act and the Port City Act, along with the rollout of a single-window investment facilitation system, aim to improve transparency and streamline approval processes. Aligning investment policies with green and digital economy goals will be key to attracting high-quality, sustainable investment and positioning Sri Lanka as a regional hub for innovation and logistics.

5. Promoting private sector-led growth

Private sector growth in Sri Lanka faces several structural challenges that must be addressed to unlock its full potential. These include inadequate infrastructure, limited access to finance, regulatory inefficiencies, and gaps in human capital and innovation. Despite Sri Lanka’s strategic location, underinvestment in critical infrastructure—such as ports, energy, and transport—continues to constrain competitiveness.

Small and medium-sized enterprises (SMEs), which account for over 75% of businesses, face persistent barriers to affordable credit. This highlights the need for financial sector deepening, fintech innovation, and stronger credit infrastructure. At the same time, regulatory complexity, slow contract enforcement, and bureaucratic red tape hinder business operations. A mismatch between workforce skills and market demands, coupled with low investment in research and development (R&D), further limits innovation and productivity.

To foster private sector-led growth, Sri Lanka must take a multi-pronged approach: Streamlining regulations and digitising business processes will help reduce costs, delays, and administrative burdens. Establishing a single-window clearance system will be key to improving the ease of doing business. Expanding access to finance—particularly for entrepreneurs in underserved regions—remains critical. This should include scaling up digital financial services, introducing credit guarantee schemes, and promoting inclusive lending models.

Building a knowledge-based economy will require increased investment in research and development, support for incubators and accelerators, and policies that promote digital skills, e-commerce, and technology adoption—especially among SMEs. By addressing these structural barriers, Sri Lanka can create a more dynamic, inclusive, and innovation-driven private sector that serves as a key engine of sustainable economic growth.

6. Investing in human capital

Investing in human capital through education, health, and social protection is essential to building a productive, inclusive, and future-ready workforce capable of driving long-term economic growth.

Education reform is essential to preparing Sri Lanka’s workforce for the future. While the country has achieved high literacy and school enrolment rates, its education system must be modernised to meet the evolving demands of the labour market. Reforms should prioritise aligning curricula with future-ready skills—particularly in STEM, digital literacy, and critical thinking. Expanding vocational and technical education, enhancing teacher training and performance, and integrating digital learning tools are also critical to improving learning outcomes. Stronger collaboration between the private sector, universities, and training institutions can help bridge the gap between education and employment, ensuring that graduates are equipped with the skills employers need.

Health system strengthening is fundamental to productivity and inclusive development. While Sri Lanka’s public health system is robust, challenges persist in service quality, regional disparities, and the growing burden of non-communicable diseases. Priorities include strengthening primary healthcare, investing in health infrastructure, and expanding access to mental health services. Leveraging digital health solutions and improving health data systems can enhance service delivery and resource allocation.

An effective social protection system is critical for reducing poverty, managing economic shocks, and promoting inclusive growth. Historically, Sri Lanka’s safety nets have been fragmented and poorly targeted. Current reforms aim to build a unified, data-driven system that prioritises the most vulnerable. Under the IMF program, the Government met its social spending target by March 2025 after resolving technical delays. Payments to vulnerable groups have been increased and extended, with retroactive payments underway. The second round of applications is nearing completion, and the digital welfare registry is being upgraded to improve targeting. By end-2025, 1.6 million households are expected to benefit.

To reduce long-term dependency, a World Bank and ADB-supported empowerment program will provide livelihood support to 1.2 million beneficiaries over the next three years, helping transition from welfare to self-reliance.

7. Building climate and disaster resilience

Building climate and disaster resilience is essential to safeguarding Sri Lanka’s development gains and ensuring a sustainable, inclusive future. By investing in green infrastructure, mobilising climate finance, and strengthening disaster preparedness, the country can reduce vulnerability, protect livelihoods, and enhance long-term economic stability.

Sri Lanka faces increasing climate risks—including floods, droughts, and coastal erosion—making climate-resilient infrastructure a national priority. Key areas for investment include expanding renewable energy, promoting sustainable transport, and adopting climate-smart agricultural practices to enhance food security and rural resilience.

Mobilising climate finance is critical to support these efforts. This should include tapping into international climate funds, issuing green bonds, and fostering public-private partnerships. Strengthening institutional capacity will be essential to effectively access, manage, and deploy these resources.

With many districts exposed to natural hazards, disaster preparedness must be elevated as a core development priority. This requires improving early warning systems, investing in adaptive infrastructure, and integrating climate risk assessments into national planning and public investment decisions.

8. Managing risks of demographic transition

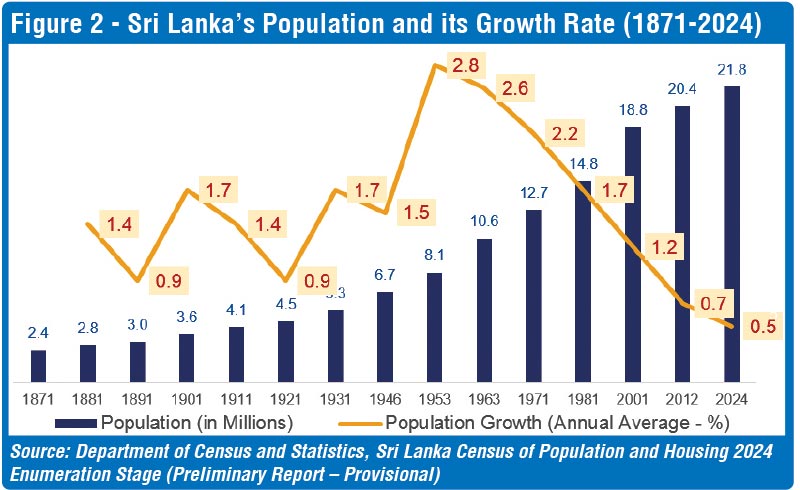

Sri Lanka is undergoing a significant demographic transition, characterised by a declining fertility rate and a rapidly aging population. This shift presents long-term challenges for labour supply, labour productivity economic growth, and fiscal sustainability. With population growth at a historic low of 0.5% (see Figure 2), the 2024 Census of the Department of Census and Statistics provides a timely opportunity to realign development strategies with emerging demographic realities.

To address a shrinking workforce and rising dependency ratios, Sri Lanka must take proactive steps to boost labour force participation—particularly among women—while retaining skilled youth. Expanding access to childcare, promoting flexible work arrangements, and enforcing workplace equality are essential to unlocking women’s economic potential. The Proposed Employment Act is expected to enhance labour market flexibility and increase women’s participation in the workforce.

Urbanisation adds another layer of complexity, requiring inclusive urban planning, affordable housing, and efficient transport systems. Developing secondary cities and integrating demographic data into urban policy will be critical to building a resilient, future-ready economy that can adapt to demographic shifts.

Conclusion

Sri Lanka has made notable progress in stabilising its economy, with early gains from fiscal and monetary reforms. Revenue collection is improving, inflation has eased, and debt sustainability has strengthened following successful debt restructuring efforts. However, sustaining this recovery will require the full and timely implementation of deep structural reforms already underway.

Institutionalising fiscal discipline and building resilience to external shocks—anchored by strong political commitment and public support—remain critical. Key priorities include strengthening public financial management, modernising the tax system, reforming state-owned enterprises, and enhancing governance and transparency. Equally important are investments in human capital, export diversification, and private sector development to drive inclusive and sustainable growth. Proactively addressing emerging risks—such as demographic shifts and climate change—will also be essential. As Sri Lanka prepares to resume full debt servicing in 2028 amid a complex global environment, maintaining reform momentum and public trust will be vital to securing a durable, inclusive, and future-ready recovery.

Sri Lanka now has a historic opportunity to make the current IMF-supported program the last one it will ever need. By fully implementing the structural reforms underway and embedding them into strong legal and institutional frameworks, the country can break the cycle of repeated external assistance. Achieving durable macroeconomic stability, restoring investor confidence, and building robust domestic institutions will lay the foundation for self-reliance. With sustained political commitment, public support, and a clear long-term vision, Sri Lanka can transition from crisis management to resilience—ensuring that future growth is driven from within, not dependent on external bailouts.

Reference:

Asian Development Bank (ADB): (2024). Sri Lanka Country Partnership Strategy (2024–2028): Country Climate Plan. Manila: ADB. https://www.adb.org/sites/default/files/linked-documents/cps-sri-2024-2028-ccp.pdf

Asian Development Bank (ADB): (2023). Charting Sri Lanka’s Aging Population. ADB Blog. https://blogs.adb.org/blog/charting-sri-lankas-aging-population

Department of Census and Statistics, Sri Lanka (2025): Census of Population and Housing 2024 Enumeration Stage (Preliminary Report – Provisional) https://www.statistics.gov.lk/Population/StaticalInformation/CPH2024

International Monetary Fund (2025): Country Report - Sri Lanka: Fourth Review Under the Extended Arrangement Under the Extended Fund Facility. https://www.imf.org/en/Publications/CR/Issues/2025/07/02/Sri-Lanka-Fourth-Review-Under-the-Extended-Arrangement-Under-the-Extended-Fund-Facility-568271

International Monetary Fund (2025): Country Report - Sri Lanka: Third Review Under the Extended Arrangement Under the Extended Fund Facility. https://www.imf.org/en/Publications/CR/Issues/2025/03/03/Sri-Lanka-Third-Review-Under-the-Extended-Arrangement-Under-the-Extended-Fund-Facility-562827

United Nations Development Programme (UNDP): (2023). Country Programme Document for Sri Lanka (2023–2027). New York: UNDP Executive Board. https://www.undp.org/sites/g/files/zskgke326/files/2023-01/sri_lanka_country_programme_cpd_2023-2027_final.pdf

United Nations Conference on Trade and Development (UNCTAD). (2022). Investment Policy Review: Sri Lanka. Geneva: UNCTAD. https://unctad.org/publication/investment-policy-review-sri-lanka

World Bank Group: (2025). World Bank Group to Support Sri Lanka’s Clean Energy Transition with $150 Million Program. Washington, DC: World Bank. https://www.worldbank.org/en/news/press-release/2025/06/20/world-bank-group-to-support-sri-lanka-s-clean-energy-transition-with-150-million-program

World Bank Group: (2025). Five Ways Sri Lanka’s Local Authorities are Empowering Communities from the Ground Up. https://www.worldbank.org/en/news/feature/2025/01/20/five-ways-sri-lanka-s-local-authorities-are-empowering-communities-from-the-ground-up

(The writer is an Assistant Governor of the Central Bank of Sri Lanka and currently serves as Alternate Executive Director at the Executive Board of the International Monetary Fund (IMF). The views expressed in this article are solely his own and do not represent those of the IMF Executive Board, management, or staff. Also, they do not reflect the views of the Government of Sri Lanka or the Central Bank of Sri Lanka.)