Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 21 February 2023 00:25 - - {{hitsCtrl.values.hits}}

IFFs are inherently associated with international transactions, potentially resulting in unfair competition for domestic firms and misallocation of resources

Abstract

Amidst the local government election and heating up the discussion around 13A implementation, the discussion on economic recovery has been somewhat muted. The most popular vehicles that have been spoken widely in the discussions were, Tourism, Foreign Direct Investments, Foreign Skilled Employment, IMF bailout, creating Market Economy thus reaching out to trade without barriers and developing SME which is considered as the engine driving the economy.

Amidst the local government election and heating up the discussion around 13A implementation, the discussion on economic recovery has been somewhat muted. The most popular vehicles that have been spoken widely in the discussions were, Tourism, Foreign Direct Investments, Foreign Skilled Employment, IMF bailout, creating Market Economy thus reaching out to trade without barriers and developing SME which is considered as the engine driving the economy.

To-date, only SJB has provided its detailed road to recovery plan, NPP talks very high level textbook level theories with a panel of academics but lacks a pragmatic approach to resurrect economy, and the government led by SLPP harping on IMF bailout deal which is still strolling despite continued discussions with IMF, bilateral and multilateral creditors. Until an outcome is reached, government makes announcements divulging the real status of the economy.

Preamble

In this paper, the writer intends to focus mainly on Illicit Financial Flows (IFF) where SL Government, administrators and auditors should be aware of, thus carryout thorough examinations while auditing Multi National Enterprises (MNEs) and also granting Foreign Direct Investments (FDIs) in the guise of earning in foreign exchange. These two, IFFs and FDIs, have close nexus between them, thus require to make provisions to prevent such inward and outward flows which create room and avenues for hiding transactions, thus losing tax revenue to the host countries. It is also imperative to timely investigate and plug all streams where tax revenues have been stolen by the unscrupulous politicians and high-ranking public officials, before making grand scale plans for economic recovery.

Globalisation

A globalisation strategy is centred on reducing the tax of MNEs and primarily benefit the host nations in the form of foreign capital, transfer technology, employment and productivity. The push for opening the boundaries and making bridges across nations creates new challenges due to free flow of capital and in turn to be vigilant thus preventing illicit flow of capital out of the host nations. The old traditional taxing regimes, hitherto followed should be overhauled, aligned with the new global development to close all avenues of tax avoidance. With respect to FDIs, the MNEs can use financial engineering to move large sums across the globe easily, relocate profitable intangible assets or sell digital services from tax havens without physically being present, as a result inflating GDP in tax havens.

Illicit Financial Flows (IFFs)

There are various definitions of illicit financial flows, but essentially, they are generated by methods, practices and crimes aiming to transfer financial capital out of a country in contravention of national or international laws.

The word “Illicit” covers more than “Illegal “and goes further into moral and ethical norms, relevant to macro and micro economic settings. Money laundering, tax evasion, trade mispricing, terrorism and bribery, etc. fall under “Illicit” which constitute the bulk of the IFFs. Furthermore, broadening “Financial” is to accommodate both liquid and non-liquid assets. Combating these acts is of global concern and participation of countries is vital to curb such transactions especially across the international borders. Although the subject is widely spoken the scale of problem is still to be assessed. It is also said that the effect on IFFs has more devastation in the developing countries than elsewhere.

G8 and G20 countries are urging countries to take action on several fronts: strengthening their anti-money laundering regimes, enforcing greater transparency of company ownership, and supporting efforts to trace, freeze and recover stolen assets. IFFs are inherently associated with international transactions, potentially resulting in unfair competition for domestic firms and misallocation of resources. The member countries, G8 and G20 have committed to exchange information to tackle the evasion of IFFs and stressed the importance to have a framework and sets of rules for global compliance.

How to find and correct IFFs

The motivation of engaging in IFF activities is secrecy, this limits the ease of finding those transactions. With the absence of data, it is a difficult task to investigate thoroughly and assess whether a firm or an individual acts illicitly. However, at macro level the severity can be seen at global and country level. In applying to Sri Lanka, the absence of a Fully Integrated Information System, it will be a monumental task to plug the leakages with full visibility. Key channels of IFFs are listed below:

Transfer pricing

In most simplistic terms, the Transfer Price is defined as the price charged between related corporate entities for goods or services in an intercompany transaction. Transfer pricing is a profit allocation method used to attribute a Multi-National Enterprises (MNE) net income (profit or loss) to the tax jurisdictions where it operates its subsidiary controlled foreign corporations (CFCs). As an example, examination by comparing transfer prices or interest rates between affiliates in the same firm will be able to determine the levels at which MNEs workaround for less or no payment of tax at host country thus transfer profits in tax havens.

Transfer Pricing promotes flow of labour, capital, goods and services across national boundaries and furthermore, economic growth at unilateral, bilateral and multi-lateral levels. It is the responsibility of the respective nations to ensure that they earn the forecasted tax revenues and not to be worse off.

Mis-invoicing

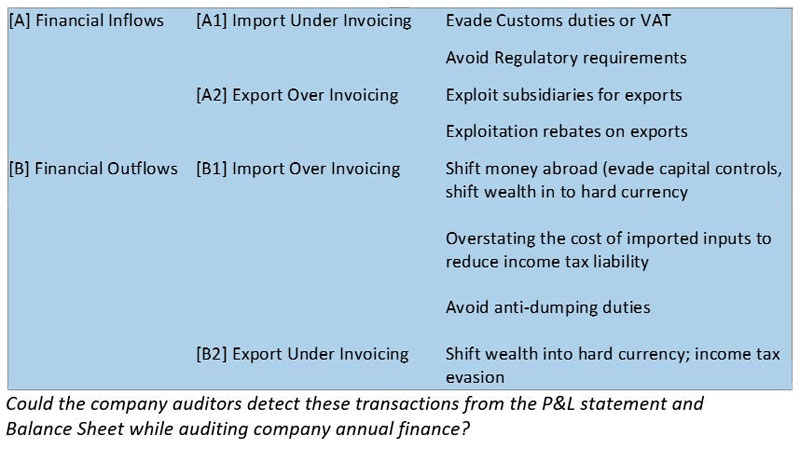

Trade mis-invoicing is the practice of knowingly submitting an invoice that misrepresents the value of goods being imported or exported. The table below illustrates various illicit channels being used for looting money and move to selected destinations.

Foreign Direct Investments (FDIs)

FDIs are important drivers encouraged by developing nations, mainly reaching out to MNEs for economic integration. In this process, the host nations benefit from capital inflows, stimulating growth, skill development, technology transfer, employment growth and boost productivity. Furthermore, to attract such investments, various concessions have been provided. Despite such lucrative inflows of capital, one should be aware that all FDIs will not bring capital in service of productivity gains. According to available global statistics, Luxembourg, a country of 600,000 people, hosts as much foreign direct investment (FDI) as the United States and much more than China. In the backdrop of genuine FDIs, there are special purpose entities, also called empty corporate shells operate with no real business activities to further minimise the global tax payments nicknamed as “Double Irish with a Dutch sandwich”. These shells or the entities are called Phantom FDIs (PFDI). In these situations, financial blurs, some significant parts of FDI will not make genuine economic advantages to host nations. To put in perspective, Luxembourg and the Netherlands host nearly half of world PFDIs, Hong Kong SAR, the British Virgin Islands, Bermuda, Singapore, the Cayman Islands, Switzerland, Ireland, and Mauritius host more than 85% of all phantom investments. Globally the PFDIs amount to over $ 15 trillion. Luxembourg’s $ 4 trillion in FDI comes out to $ 6.6 million a person. FDI of this size hardly reflects brick-and-mortar investments in the minuscule Luxembourg economy.

Nevertheless, these are empty corporate shells with no or few employees in situ, they still contribute to economy by way of providing advisory services to host nations. Despite low tax, it has been seen the tax revenue as a percentage of GDP has increased in those tax havens. This is astonishing and unbelievable. Will these types of investments suit Sri Lanka? They provide financial revenues but nothing in the area of technology transfer, growth in employment and skill development, etc.

Conclusion

As mentioned in the outset, this report meant to cover few illicit financial transactions out of many, therefore, a comprehensive study is required to assess the pros and cons before providing lucrative benefits in terms of tax, rebates and concessions for FDIs, export promotions and various subsidies for business activities to ultimately transform to growth in GDP. In Sri Lankan context, especially, the BOI offering tax handsome benefits, duties, etc. for a pre-determined period and the recently carved out Port City relinquishing control from the Government of Sri Lanka need to be re-reviewed. Are our policymakers encouraging phantom FDIs? Future will tell. Formulation of trade agreements too should be made to benefit Sri Lanka and not the distant party to have equity.

With these eye openings, in a “Developing” country like Sri Lanka, the policymakers should rethink the new strategies that suit local conditions and requirements before giving blanket approval to attract foreign investments. As a concluding note, the original SJB blueprint failed to highlight the StAR but in the recent workshop presenting the updated blueprint SJB highlighted the urgency of StAR. The writer believes that in the next revision of their blueprint we expect to hear IFFs and the new strategy to handle such activities. To everyone’s regret, NPP always accuses others to promote themselves. We have also heard the NPP leader was saying that they cannot prevent illegal or illicit activities in the short- medium terms as these activities are embedded in our economy. How long they will keep a blind-eye on them is questionable. It is to be aware that a political transformation will not bring immediate economic recovery as NPP slogans say.

Recently, the Governor of CB made a comment disregarding the IFFs raised by one of the Aragalaya members, particularly in respect of mis-invoicing despite clear warnings from IMF, World Bank, ADB, UNCTAD and OHCHR on illicit financial outflows affecting countries like Sri Lanka. Does Sri Lanka possess skilled personnel, professionals who have a wide range of competence and exposure in tackling the challenges and tracking down the IFFs in the new globalisation landscape? Name and shame all the corrupted politicians, government officials and importantly the kleptocrats. Finally, the writer would like to re-empathise the need of a fully integrated Information system and skilled staff to extract and analyse all fraudulent transactions.

References:

[1] Kasper Brandt; Illicit financial flows and developing countries: A review of methods and evidence;

[2] Markie Muryawan Mis-Invoicing – Trade Asymmetry, UN Statistic Division

[3] Illicit Financial Flows from Developing Countries: Measuring OECD Responses

[4] A Ciarb, SEIPEN and IBRAHIM BELLO IBRAHIM - THE CONCEPT OF TRANSFER PRICING

[5] https://srilankabrief.org/sri-lanka-cenral-bank-governor-disregards-trade-mis-invoicing-and-collaborates-with-corporate-and-political-corruption/