Friday Feb 13, 2026

Friday Feb 13, 2026

Tuesday, 1 March 2022 02:41 - - {{hitsCtrl.values.hits}}

Today, electricity shortage, power cuts, fuel shortages and the resulting supply and transport problems, ships waiting to unload pending payment arrangements, the controversy of Dollar shortage are the most widely discussed public issues. Ukraine/Russia embroil, silence of the UN due to the influence of Powers with Veto rights, is also a topic of all. Parliamentarians are engrossed in embroils over bringing of flash lights into the House, during the very limited time available to them to engage in matters of national interest!

We read press reports about a developing conflict between the CEB and the CPC on the fuel crisis and its impact on power generation. The most recent report was about a special circular by the Central Bank Governor restricting bank lending to the CPC. This was immediately followed by another, reporting about the President directing to provide funds for an uninterrupted supply of oil to meet the needs of the country.

The rationalisation of the CBSL Governor, is based on the view, “that the State’s banking system will not be able to operate in the future and may collapse due to continuing to provide loans to the CPC”. The rationale behind the directive of the President is that the Government has to ensure the supply of essentials to the public, come what. Public interest is growing to know the underlying truth of this state of affairs and whether there will be a sustainable solution to this mess. No one wants the banks to crash. At the same time people want to ensure an uninterrupted supply of their essential needs.

The CPC’s role in the power generation squabble?

CPC has been the sole supplier of fuel for electricity generation. The country’s electrical generation is heavily dependent on the thermal power generated and supplied by the private power producers. It is the CPC that supplies fuel to CEB along with independent power producers for their thermal power generation.

The adverse weather conditions and the lackadaisical approach of the CEB to promote and venture into alternate power generation schemes heavily contributed to the increased dependability on electricity generation through thermal power. This led to an increase in the volume of fuel consumption and resulted in the increase of oil imports. The demand for oil needed for power generation increased by 45.37% against year 2018 resulting in an increase of the revenue generated from this sector by 58.75%. This sector was the second highest income generator of CPC accounting for Rs. 118.6 billion compared to Rs. 74.7 billion recorded in year 2018.

It is observed that 90% of the sales of the CPC is in SLRs. While the Import Loans and Interest payments are settled US $. This exposes the CPC to a very high exchange rate risk because the settlement has to be on the current exchange rates. Ironically, the CBSL annual report 2020 indicates this as “the banking sector profits improved … as a result of … the movements in the exchange rates…” As at 31-12-2019, total CPC loans in US$ terms amounted to $ 1.9 billion and the amounts due on LCs opened and bills payable was $ 1.5 billion. The total receivables including trade receivables according to the 2019 balance sheet was Rs. 173,047,909,000 million.

The Loans and Borrowings of the CPC were as shown in Table 1.

By 2015 the total loans and borrowings stood at Rs. 361,664 million.

According to the CBSL report the accumulated loss of the CPC by end of 2017 amounted to Rs. 217.3 billion.

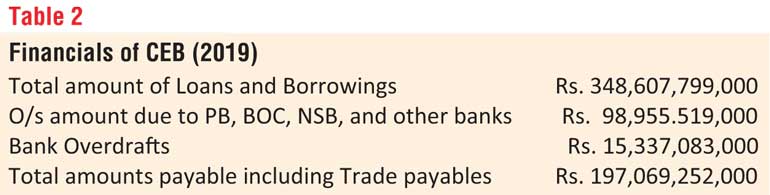

Financials of CEB indicate the following; (2019)

Refer Table 2 for financials of CEB (2019). Bank loans are repayable within a period of 5 years at interest rates ranging from 11.99% to 13.74% to these banks. It is presumed that the Trade Payables include amounts due to the CPC.

As at 31 March 2021 CEB’s Long-term loans o/s was Rs. 346.9 billion and Short-term loans of Rs. 36.6 billion.

The total accumulated losses of CEB for the period ending March 2021 stood at Rs. 176.6 billion

SriLankan Airlines

The other largest defaulter to the State banking sector is SriLankan Airlines.

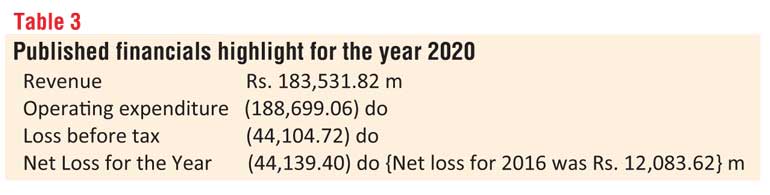

Refer table 3 for published financials highlight for the year 2020.

The total liabilities as at end of 2020 was Rs. 213,306.32 m

Loans and bank overdrafts stood at Rs. 78,264.92 m.

The crisis we are facing today is something that has silently grown to this magnitude like a cancer. All previous regimes have contributed in some way or other to this disaster.

Any one in authority who openly speaks will be the bad guy. Repercussions are important only to those who conduct their affairs with responsibility. Therefore, we have to look at things, more objectively and in a more introspective manner.

State Banks, are in a dire state today. CBSL Governor’s move therefor is praiseworthy as a move essentially required at least as a step towards a last-minute course correction.

We shall now examine some of the concerns relevant to the issu e.

1. How do the banks keep such large overdue balances as interest earning current loans and advances when they remain unpaid over a long period and when they have reported huge losses.

2. The hypothetically applied interests to these delinquent advances appear to have been a good source of income for the banks to show bloated profits.

3. What has been the role of the Bank Supervision Department of the CBSL in this regard. Loss making, long outstanding unpaid balances normally qualify to be categorised as NPLs and the resulting Impairment and Loan loss requisites under compliances by LCBs.

4. Did the auditors, apply the Securitisation yardsticks in respect of these advances? Banks have produced what are called “Letters of Comfort” to enable the auditors to treat these as government secured loans. There is a huge violation of norms in this process. A guarantee, of a loan by the Treasury tantamount to an obligation on behalf of the government. Can a letter issued by the treasury fulfil this requirement if the Minister of Finance has not obtained the cabinet approval for issuing such a guarantee?

Can such liabilities be provided outside the limits of the provisions of the appropriation bill which approves the limit of liability and borrowing powers of the government?

5. The CPC, CEB and the SriLankan Airlines have been granted billions as new facilities while the previous facilities remained unpaid over long periods. There is no evidence to show whether several letters of comfort have been taken in respect of each facility ‘or’ whether one letter obtained once is being used to take any amount any time as unsecured advances from banks.

6. When banks show bloated profits with interest amounts unearned accounted for as normal interest earnings, it is a deception. Besides, there are other things flowing out of the assumptive profits. Affordability of super luxury vehicles to executives, special perks, high salaries and allowances beyond state sector parameters, and expenses disregarding procurement guidelines (as was highlighted in some parliamentary COPE) are some.

The services offered to the public through the important State Bodies such as the CEB, CPC and the National Flag Carrier will have to continue uninterrupted. We do not need the IMF to give us the jab in this regard. Accordingly, with the Cabraal Hypothesis under which restrictions are now imposed as an eye-opener, let us find a way out to wake up the State Banks from their ‘Rip-Van-Winkle’ moral. We should now invite them to come down from their ivory towers to serve the people. It is now time to revive the Extended Scheme of Rural Credit (PB) and the ASCs of BOC.

The CBSL will have to ensure that the concessions of policy adjustments (such as lowering of rates) impact the credit movement in the right direction.

The lossmaking big SOEs have been continuing this deterioration through several decades developing to a stage of a point-of-no-return where normal reforms will not be able to bring about the needed transformation. Pumping in more public funds by way of grants and loans will never bring about the desired change.

Hence a program should be implemented to minimise their increasing adverse effects to the Public without becoming parasites any-more. The seriousness of addressing the issue to find a lasting solution to a problem of this magnitude Is too important to be left in the hands of a few people.

Radical reforms are not so politically economical in a democratic system. Governments are reluctant to initiate anything that will be a hindrance for the retaining of their power base.

But history and happenings elsewhere provide us good examples to follow. The directions of change can come from outside, the open society and not from the vested interests. Government can make it happen by opening a fair debate among the people. Knowledge, information, transparency and the emphasis of the need can favourably influence the acceptability of a change. Often, the change will be resisted by sources from within. But the reality is Public at large are the most powerful group to reckon.

What has to be done?

Sum up all the liabilities of these lossmaking SOEs.

Offer a suitable Haircut based on the questionable profits banks have made from these SOEs.

Absorb the adjusted amounts (after the haircut) into a new unit in the treasury ‘Agency for Recovery of Defaulted Obligations’ – ARDO – and entrust the recovery process to this body.

Advantages of such a scheme

a) The SOEs as well as banks will have clean balance sheets

b) The banks would be free to lend to other sectors for the development purposes as expected under the Acts.

c) The ARDO will monitor these SOEs to prevent wasteful expenditure, frauds, adherence to procurement policies, a system of uniform wages, salaries and other perks, etc.

d) ARDO to introduce performance-oriented targets which have to be compulsorily achieved by the respective institutions (SOEs)

e) Banks to work under strict guidelines not to lend to these SOEs unless otherwise they could apply commercial lending parameters and with the prior approval of the ARDO.

f) The CBSL to set up a special unit under the Bank Supervision Dept.to monitor the progress in recovery of the loan components absorbed by the ARDO

g) SOEs to be permitted to operate as commercially viable units and any directed deviations on account of Govt. policy to be compensated by the Govt.

h) If the banks fail to operate profitably under this system further reforms to be affected in the State Banking Sector.

How to absorb the liabilities?

Many appear to have confusions about this. The immediate response I received from a top guy in high finance was- where is the money to pay for these liabilities? They appear to forget that they already exist as state liabilities.

We know how Private Debt becomes Public Debt and finally end up as Sovereign Debts.

We also know how when the State Banks were declared Insolvent in the 90s long-term bonds (30 years) were issued to provide liquidity and breathing space for their revival.

In this instance too if the Government could, in compliance with the Appropriation Bill requirements,

provide long-term bonds to the banks and absorb these delinquent advances of the lossmaking SOEs, it will be only a repetition of the same exercise but to a bigger magnitude. When problems become too big, they have also to be handled big!

Let there be light!