Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 2 September 2025 00:49 - - {{hitsCtrl.values.hits}}

Background

Presently, Sri Lanka is on a recovery journey from the deepest economic downturn in its history. The unhealthy fiscal policies of successive Governments have already been recognised as one of the major causes of this poor performance. Fiscal policy encompasses various decisions related to the national budget. Therefore, it is crucial to closely monitor budgetary behaviour and related decisions to ensure the economy moves in the right direction.

Presently, Sri Lanka is on a recovery journey from the deepest economic downturn in its history. The unhealthy fiscal policies of successive Governments have already been recognised as one of the major causes of this poor performance. Fiscal policy encompasses various decisions related to the national budget. Therefore, it is crucial to closely monitor budgetary behaviour and related decisions to ensure the economy moves in the right direction.

Fiscal illusion is a term originally introduced by the Italian economist Amilcare Puviani in 1903 and later developed and popularised by modern public choice economists1. It is often used to explain how governments and fiscal policymakers navigate budgets in ways that mislead voters, helping them gain and maintain popularity. Let’s take a closer look at the behaviour of Sri Lanka’s fiscal policy in the recent past to understand how this concept plays out in our own context.

Changing pattern in total public expenditure

In Sri Lanka, the role and size of the Government have often been subjects of public debate. However, especially in the aftermath of the economic crisis, many believe that the expansion of the public sector should be avoided unless absolutely necessary. For instance, public sector recruitment was nearly frozen for several years and, even today, new hiring occurs only after thorough evaluation. Moreover, the writer himself has listened to several speeches by current leaders emphasising the need to restructure loss-making and low-value-adding public enterprises in the country.

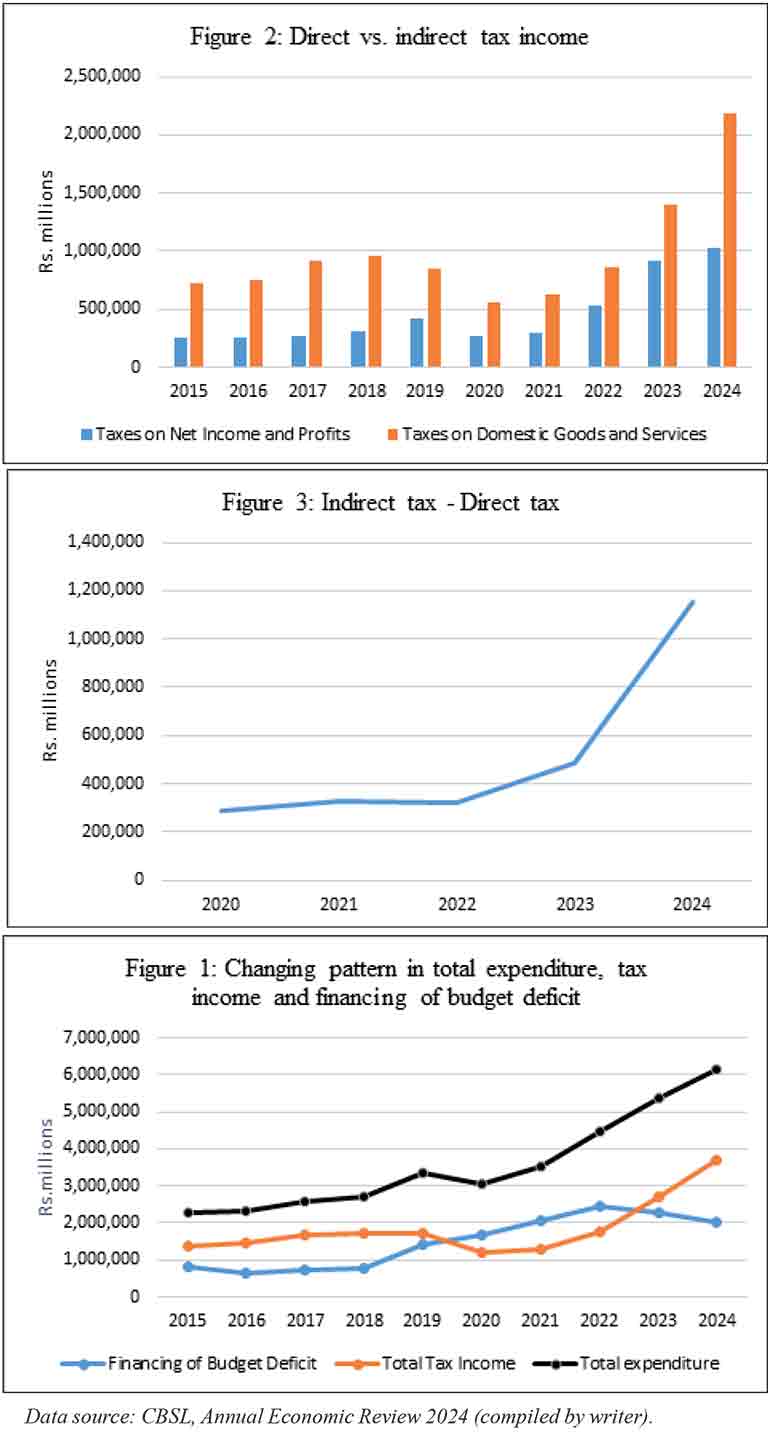

However, the trend in the absolute value of total public expenditure in the national Budget over the past 10 years tells a different story. Despite efforts to reduce inefficiencies and ease the burden of the public sector on citizens, total expenditure has continued to increase at a higher rate. As shown by the black line in Figure 1, the total public spending is not only growing, but after 2020, the slope of the curve shows a noticeably steeper upward trend. Therefore, the data indicate that Sri Lanka's fiscal policy is still moving in the direction of expanding the size of the public sector.

Shifting the burden to the present in a smart way

Total public expenditure should be financed through several fiscal policy decisions. In another way, the total amount of public expenditure represents the total burden on the citizens. However, fiscal illusion reveals several smart ways of shifting this burden. Fiscal illusion further presumes that citizens measure the burden of government by the size of their tax bill. Therefore, many governments use tricky ways to shift this burden.

First, the burden is being shifted to present taxpayers indirectly. Direct taxes, such as personal income tax, are more visible to citizens compared to indirect taxes like VAT. Therefore, fiscal policymakers in Sri Lanka tend to rely more heavily on tax income from indirect sources. This can be clearly seen in Figure 2. In each year, the orange colour bar representing indirect tax income is taller than the bar representing direct tax income. More importantly, Figure 3 also illustrates the growing gap between indirect and direct tax income. This difference (indirect–direct) has been continuously increasing since 2020. The situation has worsened even further from 2023 to 2024. Due to the regressive nature of indirect taxes, this trend is likely to affect the poor more severely and further widen income inequality in the country.

Strategically shifting the burden to the future

The second way to shift the total burden of expenditure is by transferring it to future taxpayers. This is reflected in fiscal decisions related to debt financing the overall budget deficit. In simple terms, fiscal policymakers tend to obtain loans to cover a significant portion of total expenditure. In this situation, future generations will need to repay the debt along with a penalty in the form of interest. However, policymakers can still keep existing taxpayers happy due to the illusion created by this strategy.

In Sri Lanka, this is clearly visible in the blue and orange lines in Figure 1. The total debt financing line appears as a mirror image of the total tax income line. For example, between 2019 and 2023, the total tax income line shows a slight decline and a gradual increase. Interestingly, the total debt financing line shows an increase and a gradual decrease during the same period. This indicates that fiscal policymakers attempted to shift the shortfall in tax income to future taxpayers, rather than reducing total government expenditure during this time.

Uncovering the fiscal illusion: a necessary evil

As citizens, it is vital to look at total public expenditure and understand the overall burden it places on them, rather than focusing only on their direct tax bill. However, many tend to praise the Government’s fiscal decisions that ultimately contribute to increased total spending. There is also widespread support for higher social spending by the Government. But understanding the concept of fiscal illusion helps us see the reality: the only real way to reduce the burden of Government is by cutting total expenditure in the national Budget. In that sense, it can be viewed as a necessary evil for the economy. Several news reports have already indicated that fiscal policy formulators have begun preparations for the national Budget for 2026. Let’s wait and see whether they intend to steer fiscal policy in a better direction or simply continue to mislead voters by maintaining the previous illusion.

Footnote:

1D. C. Mueller, Public choice III, 8. printing. Cambridge: Cambridge Univ. Press, 2003.

(The writer is a Senior Lecturer, Department of Public Administration, University of Sri Jayewardenepura, and is currently reading for the Ph.D. in Governance and Development, GSPA, NIDA, Thailand. He can be reached via email: [email protected].)