Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 5 September 2022 00:10 - - {{hitsCtrl.values.hits}}

The greatest challenges are felt by households that include children, persons with disabilities and older people – Pic by Shehan Gunasekara

The IMF last week announced a provisional $ 2.9 billion loan to Sri Lanka for recovery from an economic crisis which has caused extreme inflation, shortages and protests. But once the loan is approved, the country has decisions to make on how best to spend the funds. Recent evidence shows that universal social protection could be critical to getting the country back on track.

The IMF last week announced a provisional $ 2.9 billion loan to Sri Lanka for recovery from an economic crisis which has caused extreme inflation, shortages and protests. But once the loan is approved, the country has decisions to make on how best to spend the funds. Recent evidence shows that universal social protection could be critical to getting the country back on track.

Lessons from the COVID response

Sri Lanka’s current crisis requires a large-scale emergency response. The COVID-19 pandemic caused significant damage to family wellbeing as well as the economy. The response put in place was nowhere near large enough to offer families adequate income support and trigger economic recovery.

Back in 2020, UNICEF recommended a large-scale, six-month expansion of social protection, which would have cost a total of 1.5% of GDP and generated significant demand within the economy, while reaching 86% of the population with essential income support. Unfortunately, the absence of an adequate fiscal response to the COVID-19 emergency meant that the economy has been unable to return to a strong footing, which has contributed to the current crisis. Subsequent policy decisions by the Government made an already bad situation much worse.

It is essential that the Sri Lankan Government and the international community learn the lessons from the limited response to the COVID-19 crisis. This means implementing, as soon as possible, an ambitious program of emergency income support to families. If families do not receive this support, social unrest is likely to worsen, which could lead to a collapse of the political system, with far-reaching consequences. Further, the economic situation could continue to deteriorate, exacerbating a volatile situation, while families across the country struggle to feed themselves and access public services.

This short note proposes an ambitious emergency package which, if implemented, should help stabilise the political situation, reduce the level of social unrest, offer vulnerable families – who now comprise most of the population – immediate financial support, and stimulate economic recovery.

Emergency support for children, persons with disabilities and older people

Across the country, the majority of families are suffering. Even among those who were previously secure, many have fallen into deep poverty and the crisis has left almost no one untouched. The greatest challenges are felt by households that include children, persons with disabilities and older people. Therefore, given that not everyone can be reached, support should be focused on these vulnerable categories of the population, which will also help those who live with them in the same households.

As the crisis is universal, it makes little sense to target the poorest members of society. Even before COVID, it was impossible to identify the poorest households in Sri Lanka. For that reason, back in 2016, more than half (58%) of people who were meant to receive the Samurdhi cash transfer – directed at ‘the poor’ – did not receive it. Further, targeting the poorest could exacerbate the current political crisis, given that most of the population would feel that the Government is abandoning them, while the targeting errors would create widespread resentment and generate further social unrest. Indeed, one of the causes of the civil war in Syria was the introduction of a poverty-targeted cash transfer to compensate for the removal of a universal fuel subsidy.

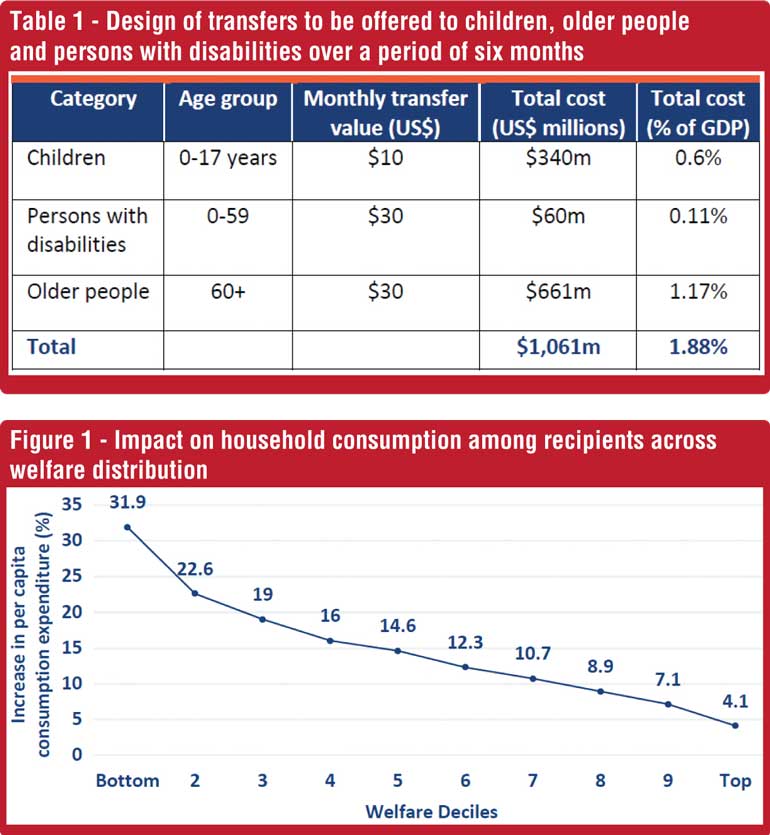

An emergency program of income support should, therefore, offer transfers to children, persons with disabilities and older people for a period of six months. While this program could be designed in various ways, one option is to provide transfers to every child aged 0-17 years (with the cash being given to the female caregiver, or a male if a female is not present), all persons with disabilities aged 0-59 years and everyone aged 60 years and above. 1The transfer values and costs are set out in Table 1.1.

The total package would require $ 1.06 billion. While this may appear to be a high cost over a short period of time, it is an investment that will have rapid impact and pave the way for long-term recovery – at the cost of little more than a third of the IMF’s loan (36.6%).

If the emergency package is not put in place, the real cost to Sri Lanka, through further hardship, losses in child development, social unrest, and reduced economic growth will be much higher and, in some cases – especially the losses in human capital among children – unrecoverable.

Since the transfers would be given to everyone in the categories, registration should be relatively easy, at least for older people and children. They would only have to provide evidence of their age and the additional complexity associated with poverty targeting would be removed. Identifying persons with disabilities will be more challenging: it would be necessary to design a reliable but easy-to-use disability assessment mechanism before registration commences (off-the-shelf options are available, such as a mechanism that has recently been introduced into Cambodia).

Prior to the roll-out of the support, it will be necessary to design the operational processes and set up an electronic management information system (MIS). Again, with the right level of commitment, this could be achieved relatively quickly, especially if it is built using an open-source MIS used in other countries. A payment mechanism(s) would have to be designed, using established financial service providers. Given the high rate of inflation, it is likely that frequent payments to recipients would be helpful (for example, every two weeks) and payment values should be adjusted each time, in line with the dollar exchange rate.

Likely impacts of the emergency transfers

Likely impacts of the emergency transfers

The emergency transfer package will have a significant impact on the wellbeing of households across Sri Lanka. In total, 88% of households will be reached. On average, a household would receive $ 32 per month, with higher amounts accessed by households with disabled members ($ 60 per month) and over-60s ($ 58 per month). The largest households – those with more than six people, which tend to be poorer – would receive, on average, $ 61 per month. The average increase in household consumption among recipient households, compared to pre-COVID consumption, would be 14%.

2As Figure 1 indicates, the highest increases would be among those who were in the poorest decile of the population prior to COVID, at almost 32%. This would make a significant difference to the wellbeing of households. However, given the scale of the current crisis, for many households the transfers are likely to be their only source of income and means of feeding themselves.

Emergency transfers would have further important impacts. They are likely to lessen the risk of social unrest and conflict and, as such, build trust in a new government, which will enable it to have the space to make further important policy decisions. In addition, the transfers will play a key role in promoting economic recovery.

After six months, the Government should consider continuing with the transfers, as it seeks to build a modern, lifecycle social protection system. Such a system would build the resilience of the population to future shocks, while offering income support to the most vulnerable members of society. The reformed social protection system could scale back from the level of emergency spending, potentially by reducing the age of eligibility for the child benefit – in line with a UNICEF proposal from 2020 – and by increasing the age of eligibility for the old age benefit.

Recurrent annual spending of 2% of GDP would be sufficient to give Sri Lanka a strong, modern social protection system that offers meaningful protection to all citizens across the lifecycle, building trust in a new government, while continuing to stimulate economic growth.

Footnotes

1For the purpose of these calculations, it has been assumed that 1% of all children would be identified as experiencing a disability and 2.5% of adults aged 18-59 years. In addition, it is assumed that, across all groups, there will be 95% coverage.

2Analysis in this section was based on Sri Lanka’s Household Income and Expenditure Survey for 2016/17.

(Dr. Stephen Kidd has for over three decades supported robust strategies and effective delivery in social development and social protection in Africa, Asia, the Pacific and Latin America. He is CEO of Development Pathways, the leading global consultancy specialising in designing and developing social protection systems.

Dr. Nayha Mansoor is an economist at Development Pathways working on the development, implementation and management of research and analytical work on social and economic issues.)