Monday Feb 16, 2026

Monday Feb 16, 2026

Wednesday, 24 April 2024 00:18 - - {{hitsCtrl.values.hits}}

This article captures the core insights from the recent webinar hosted by the Daily FT, Board of Investment, SLID, CIMA, ACCCA and the International Chamber of Commerce. The event fostered dialogue with the diplomatic community from crucial markets about the critical role of Free Trade Agreements (FTAs) in Sri Lanka’s growth trajectory.

This article captures the core insights from the recent webinar hosted by the Daily FT, Board of Investment, SLID, CIMA, ACCCA and the International Chamber of Commerce. The event fostered dialogue with the diplomatic community from crucial markets about the critical role of Free Trade Agreements (FTAs) in Sri Lanka’s growth trajectory.

As Sri Lanka works to recover from its recent economic crisis through robust macroeconomic and fiscal policies, its future growth prospects remain constrained. The country faces challenges such as underperforming exports, which are projected to increase by only 5.27% annually from 2024 to 2028, and structural economic weaknesses, including persistently low labour productivity that has grown at a mere 1.4% over the past decade. To foster sustainable economic growth, Sri Lanka must enter new markets through efficiency-enhancing free trade agreements (FTAs), simultaneously addressing domestic constraints to unlock its FDI and export potential.

Sri Lanka’s economic growth hinges on efficiently utilising labour and capital to boost productivity growth. FTAs, if designed well with efficient trading partners, can enhance economic growth by improving trade structures, leading to greater efficient resource allocation and productivity gains. However, Sri Lanka must contend with two specific external developments as it pursues new trading partners.

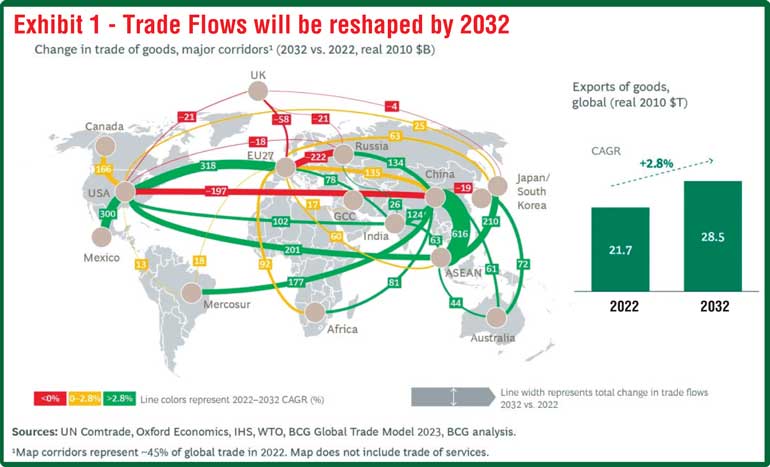

First, the global economy is experiencing a significant realignment due to economic and geopolitical shifts due to several factors—increased national security concerns, supply chain resilience, and protection of manufacturing jobs are reshaping the flow and nature of global commerce, with Asia continuing to be at the centre of gravity. Second, despite benefiting from the Global System of Preferences, Sri Lanka is at a preferential disadvantage compared to its competitors, many of whom have entered multiple FTAs with contested markets. To adapt, Sri Lanka needs to strengthen its existing alliances and cultivate new ones, which can enhance Sri Lanka’s economic resilience through the diversification of products and markets.

While the Developed West remains Sri Lanka’s largest revenue generator, the technological and demographic dividend of a faster-growing Asia (India and ASEAN) offers the greatest prospects for Sri Lanka’s FDI and exports. These regions are likely among the biggest winners in the new geopolitically aligned trade map while not discounting China due to its sheer market size, economic complexity, and growth trajectory. Cumulative ASEAN trade is forecast to grow $ 1.2 trillion in the next 10 years due to the region’s emergence as a critical destination for companies seeking to decrease their dependence on China (see Exhibit 1).

Sri Lanka has strong complementarities with ASEAN’s relatively complex and advanced economic structures. While Sri Lanka has recently completed FTAs with Singapore and Thailand and has announced negotiations with Indonesia, an agreement with ASEAN would provide a larger market under a single administrative arrangement (Rules of Origin), would be more amenable to exploiting potential value chain linkages, providing a further stimulus for exports and FDI. Deeper trade agreements are also more amenable to developing true economic partnerships, providing a platform to facilitate tangible trade and investment deals.

That said, FTAs are not a panacea and often fall victim when supply-side factors are not addressed. Sri Lanka has much to do to address the anti-export bias inherent in its trade policy, outdated labour laws, weak governance, corruption, inefficient trade infrastructure, hard and soft (e.g., bureaucratic border procedures), and weak product and market support for SMEs. The opportunity cost of inaction is high and continues to grow.