Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 12 October 2021 03:33 - - {{hitsCtrl.values.hits}}

The rapid money supply growth propelled by substantial bank lending to the Government since last year has been a major cause of economic instability. The Central Bank has no policy space to mop up such excess liquidity, in the absence of fiscal discipline. The Road Map has not paid attention to this critical problem

The six-month Road Map for Ensuring Macroeconomic and Financial System Stability presented by Central Bank Governor Ajith Nivard Cabraal early this month contained a long “to-do-list” that goes beyond the scope of monetary policy, as I explained in the last week’s FT column (https://www.ft.lk/columns/Central-Bank-s-Road-Map-lacks-monetary-policy-framework-avoids-IMF-bailout/4-723902).

The six-month Road Map for Ensuring Macroeconomic and Financial System Stability presented by Central Bank Governor Ajith Nivard Cabraal early this month contained a long “to-do-list” that goes beyond the scope of monetary policy, as I explained in the last week’s FT column (https://www.ft.lk/columns/Central-Bank-s-Road-Map-lacks-monetary-policy-framework-avoids-IMF-bailout/4-723902).

A policy declaration with a robust monetary policy framework laying down the specific objectives, targets, and instruments would have been more appropriate, rather than a long slide show.

Economic imbalances disregarded

The monetary policy would be futile unless it is tied up with strict fiscal targets. The Government’s borrowing requirements are continuing to rise depending heavily on Treasury bills and bonds and foreign commercial loans. The Treasury bill auctions have been under-subscribed although the yield caps have been removed recently. Purchasing of the unsold portion of Treasury bills by the Central Bank causes an increase in its monetary base, and in turn, the money supply. The resulting inflationary pressures are already evident.

The exchange rate remains fixed as stipulated in the Road Map, despite the severe foreign exchange shortage exacerbating the anti-export bias. The foreign reserves are down to minimum levels as against the upcoming external debt commitments.

Monetary expansion continuing

The rapid money supply growth propelled by substantial bank lending to the Government since last year has been a major cause of economic instability. The Central Bank has no policy space to mop up such excess liquidity, in the absence of fiscal discipline. The Road Map has not paid attention to this critical problem.

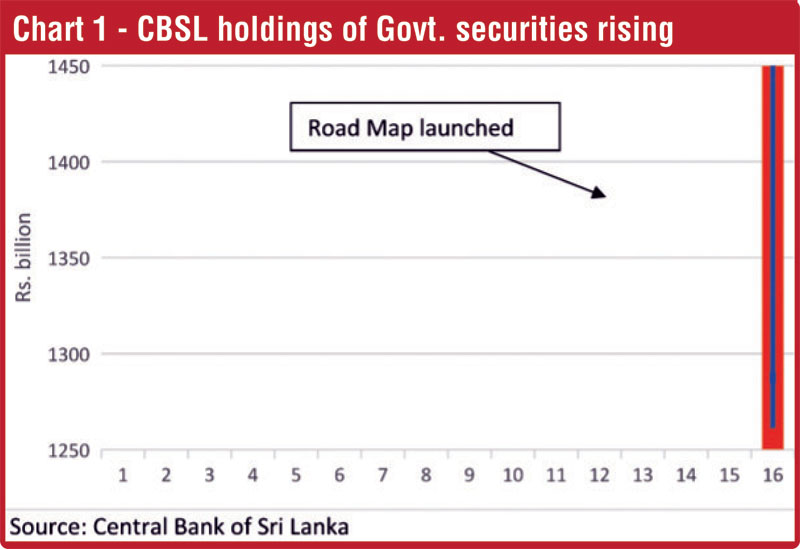

Immediately after the presentation of the Road Map, the Central Bank’s holdings of Government securities rose by 8% from Rs. 1,336 billion to Rs. 1,443 billion. This raised the monetary base (adjusted for net foreign assets) causing an expansion in the money supply.

The under-subscription of the Treasury bill auctions held following the Road Map indicates that the marginally increased cut-off yield rates are insufficient to sell the entire bill stock to the market. The balance portion of the Treasury bills was to be purchased by the Central Bank causing a rise in its monetary base, and in turn, the currency issue, commonly known as money printing. The aggregate money supply rose by 10 times the monetary base due to the money multiplier effect.

Inflationary pressures

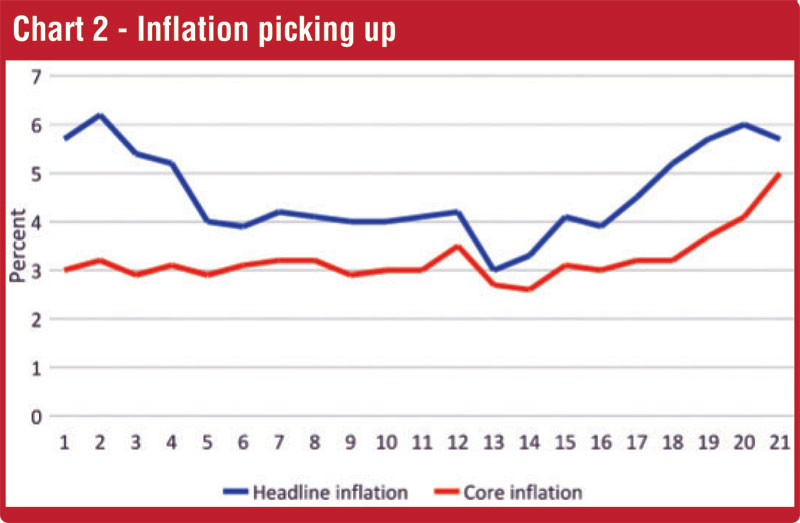

The year-on-year inflation, measured in terms of the Colombo Consumer Price Index (CCPI) rose to 5.7% last month from 4.0% a year ago. The maximum retail prices of several essential goods including rice, wheat flour, milk powder, and LP gas were removed last week, and therefore, inflation will accelerate further in the coming weeks.

The monetary expansion has resulted in excess market liquidity pressurising aggregate demand. These adverse trends clearly show the imminent danger in adopting the so-called Modern Monetary Theory-styled policy by the Central Bank to meet the fiscal shortfalls by printing currency, as I argued in a previous FT column (http://www.ft.lk/columns/Money-printing-to-repay-Govt-debt-worshipping-MMT-is-likely-to-magnify-economic-instability/4-710612).

In the backdrop of the supply shortages due to the pandemic and import restrictions, inflationary pressures are intensified further. The depreciation of the rupee is another factor that has led to push up inflation from the cost side. With the rupee depreciation, imports are getting costlier and as a result, the prices of consumer goods that form a significant portion of the consumer basket will continue to rise thus, accelerating inflation.

Apart from such direct effects of currency depreciation, further rounds of monetary expansion are going to take place as a consequence of possible increases in the budget deficit due to rupee-depreciation-led Government expenditure hikes.

Exchange rate distortions

Higher domestic inflation vis-à-vis the inflation of trading partners causes an appreciation of the Real Effective Exchange Rate (REER) putting exporters in a disadvantageous position. Hence, it calls for a depreciation of the rupee to sustain export competitiveness.

However, the Road Map envisages, “Considering the REER, maintain the Rupee at the very competitive level of Rs. 199 to Rs. 203 against the US dollar over the next three months, and review thereafter.” Commercial banks have been adhering to the fixed exchange rate rule despite the severe shortage of dollars in the market.

Meanwhile, the CBSL allows paying an extra Rs. 2 per dollar remitted and converted by workers abroad. This discriminates against other foreign exchange earners, particularly exporters. This type of dual exchange rate system was in force during the pre-liberalisation period.

The fixed exchange rate system prevents market adjustments needed in the backdrop of the overvalued rupee. The unrealistic exchange rate has led to the development of a parallel black market, as admitted by the CBSL itself in its recent press notice (https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/press/pr/press_20210927_repatriation_and_conversion_of_export_proceeds_e.pdf).

The attractive black-market rates tend to divert foreign exchange earnings including worker remittances away from the official channels to Informal Money Transfer Schemes (IMTS) such as ‘Hawala’ and ‘Unidyal’.

It would be difficult to keep the fixed exchange rate for long, as the Central Bank does not have sufficient foreign reserves to defend the rupee. Hence, substantial rupee depreciation is inevitable, which would be more painful than gradual adjustments reflective of market conditions.

Exporters discontented

It is reported that some exporters have decided not to bring the export proceeds to Sri Lanka defying the Central Bank’s export proceeds conversion rule. They are of the view that it is profitable for them to pay tax at 28% instead of 14% as warned by the Central Bank Governor, rather than converting the export proceeds at the unrealistic fixed exchange rate.

Exporters also have expressed their displeasure over the Governor’s statement that they are hoarding foreign exchange abroad.

Investors unconvinced

The Road Map does not seem to have made a significant impact in improving the market sentiments, as it lacks a coherent macroeconomic framework geared to stabilise the economy.

Global financial giant Citi has indicated that the downward risks are higher despite the Central Bank’s Road Map, as Sri Lanka would not be in a position to restructure her debt obligations without IMF assistance. Citi feels that the Road Map contains somewhat less clarity and longevity than some investors sought. In the circumstances, Citi has decided to remain credit neutral on Sri Lanka.

Reforms essential

A credible reform program is the need of the hour to rectify the macroeconomic imbalances and to win investor confidence.

In this regard, it is vital to improving the country’s debt sustainability. In terms of the global Debt Sustainability Assessments (DSAs), Sri Lanka is identified in the “extremely speculative/substantial risk” category along with seven other countries – Angola, the Congo, Congo DRC, Gabon, Lao PDR, Mali, and Mozambique.

It would be impossible to improve debt sustainability without appropriate fiscal reforms geared to reduce the fiscal deficit.

(The writer is Emeritus Professor of Economics at the Open University of Sri Lanka and a former Central Banker, reachable at [email protected])