Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 16 June 2025 03:10 - - {{hitsCtrl.values.hits}}

Students’ misconception of central bank’s development role

Students’ misconception of central bank’s development role

Central banks have always been a puzzle to ordinary public as well as to politicians. For public, it is the institution which is charged with and holding responsibility for the country’s economic growth and prosperity. I had sat on many interview boards, during my central bank days, to examine candidates who had sought to join the Central Bank as staff members. All of them had been the cream of the local as well as foreign universities holding either first classes or second-class upper division passes in the respective subject areas. One question which I posed to them was why they wanted to join the Central Bank. The answer just spat out of their mouths as if it had been kept well ingrained in their memory systems.

The Central Bank is, according to them, the institution in charge of the country’s economy deciding on and implementing the necessary economic policies to develop the country. Hence, by joining the Bank, they wanted to be a part of that management team and serve the country.

I do not blame them for holding that misconception because that was how they had been told by their teachers at schools and professors at universities. I recall a way back in early 1990s when we had organised a discussion session for the commerce schoolteachers who supplied monthly regional economic data to the Bank. There was a survey to assess their central bank literacy, and one question was the role they perceive for the Bank in the economy. Almost all had answered that the Central Bank was the institution in charge of the economy and its economic growth.

|

A central bank is merely a facilitator and not an active participant in economic activities

|

Politicians asking central banks to twist monetary policy

Politicians believe that it is the duty of the Central Bank to supply the needed money for the government to finance the budget so that the government could adopt policies to steer economic growth. This belief makes them desire the central bank to twist its monetary policy to support the government budgets which do not generate sufficient revenue to undertake the scale of expenditure planned by them.

This belief is equally shared by politicians of developed as well as developing countries. Even the President of the United States, the country viewed as highly developed, shares this view as openly expressed by the current incumbent to that position, Donald Trump. His conflict with the Chairman of the Federal Reserve Bank recently on this ground was analysed by me in another article in this series.1

When the Fed refused to accede to Trump’s request to convert the interest rates to negative rates during his first term, his anger was expressed publicly by calling those who manage central banks ‘boneheads’ or stupid people. During his current term when Fed chairman Jerome Powell, an investment banker installed in that position by Trump himself, did not yield to his request to lower interest rates against the background of rising future inflation expectations mainly arising from Trump’s unsound tariff policy, he threatened to remove him from the position.

I have observed that when the Central Bank officers appear before the Parliamentary Committees in Sri Lanka, the Governor has the difficult job of educating the sitting members what a central bank is before coming to the main items in the agenda. A classic case in this respect I recall is when Governor Sunil Mendis appeared before the Committee on Public Enterprises or COPE in 2005, a COPE member charged the Central Bank for making losses in the previous year. His argument was that if other state banks could make profits, the Central Bank should not have gone into losses.

Governor Mendis, though not a career central banker, told the member that if the Government desired the bank to make any level of profits, he could easily do so by printing money, but it would accelerate the inflation rate in the country. So, the Government could choose between the inflation and the Central Bank profits. Obviously, the Government would go for a low inflation. I still do not know whether that Parliamentarian understood what Governor Mendis said. But after that response, he did not ask any more questions.

Past Governors following modern monetary theory

In the past, there had been occasions when even central bank heads were subscribing to that view. Governor W.D. Lakshman, a university Don in economics, thought that it was the duty of the Central Bank to support the Government in its expenditure promotion ventures. Without publicly admitting it, he followed the ideology propounded by a breakaway small group who called themselves modern monetary economists. They in fact adopted the Keynesian economic policy prescription proposed in mid 1930s by the influential British economist, John Maynard Keynes. Lakshman as well as his successor, Ajith Nivard Cabraal, followed the modern monetary theory to the letter with disastrous results for the country on the inflation and exchange rate fronts.

In this background, the new Central Bank Act or CBA, introduced by the Government at the instance of the International Monetary Fund, put a stop to the adoption of the modern monetary theory by future central bankers as well as future Governments.2

New Central Bank

In September 2023, Sri Lanka abolished its decades-old Central Bank by repealing the Monetary Law Act (MLA) No. 58 of 1949 under which it had been established and set up a new central bank by enacting the Central Bank of Sri Lanka Act (CBA) No. 16 of 2023.3 MLA had been enacted in 1949 based on a report4 submitted by one-man commission headed by John Exter who later became the first Governor of the newly formed Central Bank.5 Since the establishment of the old central bank under MLA in August 1950, the legislation was amended from time to time to incorporate the new developments in central banking relating to Sri Lanka’s economic conditions and political aspirations.

In view of some major deficiencies in MLA, relating to the invisible hand which the Ministry of Finance was alleged to have been using over its monetary policy operations, the necessity for introducing a new central bank legislation had been felt by both the Sri Lankan intellectuals and multilateral lending agencies. There were two attempts at doing so, one in 2004 and the other in 2018, when Sri Lanka sought for IMF assistance to resolve its chronic as well as acute external sector issues. But they were aborted by the Governments that came to power in 2004 and 2019 on the ground that they did not fall in line with their accepted policy.

However, following the economic crisis that crippled the economy in 2022, Sri Lanka sought an extended fund facility (EFF) from IMF and one of the conditions of the IMF package was the introduction of a new central bank legislation to remove the existing Government controls over the central bank policy and permit it to conduct only what a central bank should do, namely, the maintenance of price stability as the main objective and ensuring financial system stability as the ancillary objective.6 The enactment of CBA in September 2023 was following this loan covenant.

Influencing real economy through nominal policies

Though central banks have only nominal weapons like changing interest rates, expanding credit and money supply, there is a belief by some sections of economists, namely, those who follow Keynesian economic policies since the publication of John Maynard Keynes’ General theory in 1936 and more recently those who adopt what is known as modern monetary theory (MMT), that central banks can influence the real economy through their nominal weapons.7

The underlying argument is that when people have newly created money by the central bank, they increase their demand for consumption and investment goods by augmenting the aggregate demand (AD) and suppliers will step up production to meet that demand by increasing the aggregate supply (AS). Increase in AS will create economic growth and with the higher supply of goods, it will neutralise the pressures for prices to increase. Hence, in the medium to long-term, money could create economic growth. This was the vogue in economic policy in the Post-Second World War era, and it was natural for nations to prescribe the Keynesian remedy for economic growth uncritically to all the countries in the world. Keynesian policy remedy was for developed countries with an unutilised excess capacity and without international trade.

Even in 1949, John Exter warned in his report to those who advocate the use of central bank’s money printing power to usher economic growth in countries like Ceylon, as Sri Lanka was called at that time, with no self-sufficiency, excess capacity but heavy proneness to international trade.8 In the first interview after the establishment of the central bank in 1950, he emphasised it further by announcing that the bank’s role is to create the necessary monetary conditions for economic activities to take place and not by producing goods and services by itself.9 Yet almost all finance ministers in the post-independence era and several leading economists had adopted and advocated Keynesian type economic policies for Sri Lanka.10

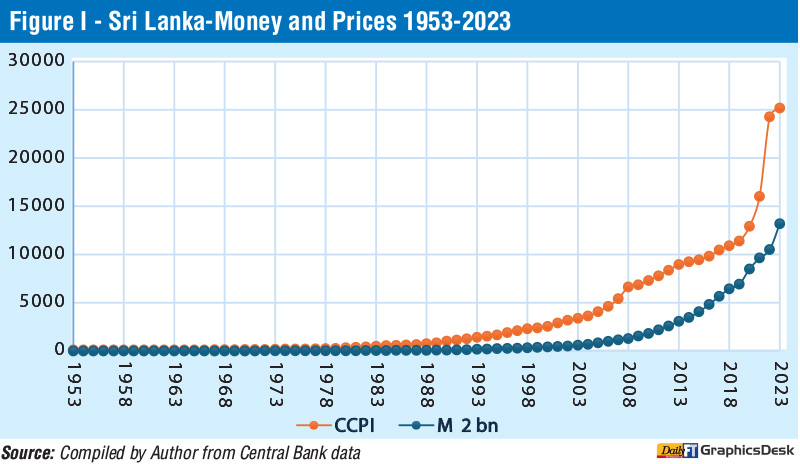

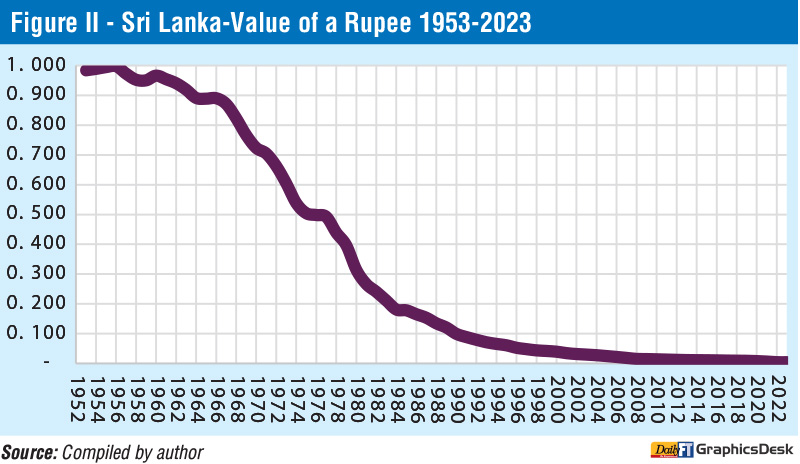

The result was the heavy deficit financing by the Government by resorting to money sources from the banking sector. This strategy did not lead to economic growth as expected, but to the elevation of the general price level as shown by Figure I that has plotted the two variables during 1953 to 2023. The corollary was that the value of a rupee in 1952 fell to a fraction of a cent by 2023 as shown in Figure II.

Real sector development through monetary policy action

In the original MLA, Exter had laid down two objectives for the central bank, one a stabilisation objective and the other, a development objective.11 In the stabilisation objective, the central bank was mandated to preserve the domestic price stability and the stability in the exchange rate. In the development objective, it was required to promote and maintain a high level of production, employment and real income, on one side, and encourage and promote the full development of the productive resources of the country, on the other. This development objective was misconstrued by many that it was the responsibility of the central bank to get engaged in real economic activities.

But as Exter had explained in the commentary to this section, the bank was expected to attain all these objectives through monetary action.12 What it meant was that the central bank should seek to attain its development objective by changing the interest rates, and credit levels and not by directly participating in economic activities. In fact, section 117 of MLA had prohibited the central bank to engage in trade, commercial, and other business activities.13 Section 114 of CBA has introduced the same prohibitions covering a wider area of business and operations by the central bank.

The objective clause in original MLA was changed to ‘attaining economic and price stability’ by an amendment to MLA in 2002.14 This did not mean that the Central Bank should engage itself in economic activities, but it should endeavour to keep AD equal to AS and removes pressures for prices to increase. In other words, the Central Bank should control nominal variables with nominal weapons, and it was up to the real sector agents – households, businesses, and governments – to produce real goods and services. Economic prosperity comes not from nominal variables, but from the production of real goods and services. Hence, a central bank is merely a facilitator and not an active participant in economic activities.15

Footnotes:

1https://www.ft.lk/columns/Trump-dis-order-Worst-is-not-attack-on-Fed-Chair-Jerome-Powell-but-weakening-strength-of-US-institutions/4-775879

2https://www.ft.lk/columns/IMF-bailout-conditions-plus-new-central-bank-act-will-close-doors-to-Modern-Monetary-Theory/4-746753

3https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/laws/acts/en/central_bank_of_sri_lanka_act_2023_e.pdf ; The Speaker certified CBA on 14 Sep 2023 and new CBSL was set up on 15 Sep 2023.

4The report commonly known as the Exter Report can be accessed at: https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/about/Exter%20Report%20-%20CBSL.pdf

5For John Exter and his contribution to the central bank, refer to Wijewardena, W.A, 2017, Central Banking: Challenges and Prospects, BMS Publication, Colombo, Chapters 1 and 2.

6IMF staff report on Sri Lanka, March 2023, p 21

7An analysis of the issues involved can be found in Wijewardena, W.A, 2022, The great Inflation Debate: Does Money Matter? In FT at: https://www.ft.lk/columns/The-great-inflation-debate-Does-money-matter/4-732953

8Exter Report, p 27-8.

9Quoted by Wijewardena, Central Banking: Challenges and Prospects, p 20.

10A comparison of the budgetary policy of the first finance minister, J R Jayewardene in 1947 to Gotabaya Rajapaksa in 2021 can be found in Wijewardena, W.A. 2021, Budget 2021: A reversion to J R Jayewardene Policies of 1940s, in FT at: https://www.ft.lk/columns/Budget-2021-A-reversion-to-J-R-Jayewardene-policies-of-1940s/4-709239 ; Howard Nicholas and Bram Nicholas have recently argued that a future government should amend the CBA on this ground: see: https://etislanka.com/2023/11/23/why-the-central-bank-act-should-be-significantly-amended-by-a-future-sri-lankan-government-part-i/ .

11S 5 of MLA

12Exter Report, p 10.

13For details of why the central bank should not run businesses, refer to Chapter 11 of Wijewardena, Central Banking: Challenges and Prospects.

14For an analysis of the economic and price stability, refer to Chapter

17 of Wijewardena, Central Banking: Challenges and Prospects.

15For a detailed analysis of this issue, refer to Wijewardena, 2027, Central Banking: Challenges and Prospects, Chapter 20.

To be continued

(The writer, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected].)