Wednesday Mar 04, 2026

Wednesday Mar 04, 2026

Wednesday, 15 March 2023 00:00 - - {{hitsCtrl.values.hits}}

Sri Lanka is neither in a Chinese debt trap nor in an IMF trap. Sri Lanka is in its own debt trap and IMF is helping Sri Lanka to come out of it

An article was published in the Daily FT (https://www.ft.lk/columns/The-IMF-trap/4-745927) on 3 March 2023, titled ‘The IMF Trap’ written by Devaka Gunawardena, Niyanthini Kadirgamar and Ahilan Kadirgamar. This is to inquire into the arguments raised by that article.

An article was published in the Daily FT (https://www.ft.lk/columns/The-IMF-trap/4-745927) on 3 March 2023, titled ‘The IMF Trap’ written by Devaka Gunawardena, Niyanthini Kadirgamar and Ahilan Kadirgamar. This is to inquire into the arguments raised by that article.

The authors brought arguments to prove that the present IMF program is a trap. This program is not yet disclosed to the public and hopefully would be disclosed by 20 March 2023 if the approval of the program would be approved by the Board of Directors of IMF on the same day.

Negotiations with IMF was started at the time of former President Gotabaya Rajapaksa. Nandalal Weerasinghe was appointed Governor of Central Bank on 7 April 2022. Ranil Wickremesinghe was appointed Prime Minister on 12 May 2022. He assumed duties as President on 21 July 2022. IMF team visited Sri Lanka from 20 to 30 June. It was announced on 1 September 2022 that IMF staff has reached a staff-level agreement on an Extended Fund Facility agreement with Sri Lanka. Inflation (Colombo Consumer Price Index) had reached double digits in December 2021 and in March 2022 it was 18.7%. By the time Wickremesinghe became the President it was 60.8% and it reached the maximum 69.8% in September 2022. Thereafter it was declining.

USD/LKR rate was 201 at the beginning of March 2022 and at the end of March it was 299. By the end of April 2022 it was 341 and by end of May it was 360.

Inflation was due to the excessive money supply by the Central Bank and also due to the rapid depreciation of the Rupee. To curb inflation, it is necessary to increase the interest rates. No sooner Weerasinghe was appointed Governor he took action to increase the interest rates. It is very true that it made the access to credit for economic activity extraordinarily difficult as claimed by the authors, but we have to save the nation first and others are secondary. If the sea is saved the ships will be saved automatically.

The authors claimed that although the US alleged that Sri Lanka was the victim of a Chinese debt trap, in fact, Sri Lanka was in an IMF trap. Sri Lanka is neither in a Chinese debt trap nor in an IMF trap. Sri Lanka is in its own debt trap and IMF is helping Sri Lanka to come out of it.

The main premise of the arguments of the authors seems to be that Sri Lanka has fallen into this situation due to excessive imports by Sri Lanka after the liberalisation in 1977 which was facilitated by the IMF. One of the critical missions of IMF is expansion of international trade so that naturally it should have been the case in the part of IMF. It is a misconception that the main cause of the present situation was imports.

Sri Lanka had budget deficits from the independence except for two years of 1954 and 1955 where the Minister of Finance was M.D.H. Jayawardana. From 1960 Sri Lanka had trade deficits except for two years in 1965 and 1977. During the time we had most controlled economy of 1970 to 1976, we had budget deficits as well as trade deficits.

The root cause of the problem we face today is continued budget deficits. The government debt in 2020 was Rs. 15 trillion and the sum of the budget deficits from 1950 to 2020 was Rs. 11 trillion. Hence the main contributor of the government debt was budget deficits. Since year on year there were budget deficits, immediately there should be borrowings to repay the loans. Thereafter there should be borrowings to pay the interest. From 2009 to 2014, 50.8% of the borrowings were used to pay the interest and from 2014 to 2019, 89.8% of borrowings were used to pay interest.

In some of the years, government revenue was not sufficient to meet recurrent expenditure other than the interest payments. In this case the Government had to borrow to meet part of the recurring expenditure, capital expenditure, interest payments and capital repayments. It has gone to that extent.

When there are foreign borrowings to finance the budget deficit these loans could be used to ease the balance of payment crisis. If there are no foreign borrowings or Foreign Direct Investments (FDI) what will happen is that the rupee would depreciate in the forex market against the other currencies. Hence the cost of imports will be more expensive in the local market which will be a hindrance for more consumption of imported goods and services. At the same time it will be a promotion for the export of goods and services. Therefore, at one point Rupee will start appreciating.

There are a number of factors influencing the currency movement from trade surplus/deficit, interest rates, inflation, forex reserves and economic growth to speculation and political stability. In India some time back the INR was continuously depreciating against the USD. It was the same after liberalisation in 1991. In 2003 INR was appreciated. The reasons include depreciating of USD against major currencies and large capital inflows to India.

According to World Bank data trade balance of Vietnam was negative up to 2011. It was positive thereafter to date. In Vietnam in the year 2021 imports to GDP was 93.2% whereas exports to GDP was 93.3%. Although in most of the countries the gap between the two is not so close, imports and exports go hand in hand. A country cannot restrict imports and promote exports as expected by the authors.

The authors claimed that the structural consequences of over four decades of neoliberal policies have exploded into view with the receding welfare state, a ballooning import bill and investment in infrastructure without returns.

In one hand Sri Lanka did not apply the neoliberal policies over four decades. It applied some of those policies of liberalising the foreign trade but there are a large number of State Owned Enterprises (SOEs), some of which make continuous losses. Profit making enterprises operate below the expected efficiency since these enterprises were used as employment generating institutions for the henchmen of the ruling parties. Some of these entities are virtually run by the trade unions and some of these are operated for the benefits of the ruling class. Maintaining these enterprises as they are, with huge burden to the government budget is never neoliberalism. That is socialist thinking of the country which is mainly responsible for the plight of the country.

On the other hand, based on the prevalent socialist thinking welfare is given to the poor as well as the rich. When the fuel prices are subsidised those who use more fuel will get more benefits and rich use more fuel. There are enough examples like this. Therefore, there should be cash transfers to the poor. This cannot be that difficult in a country where QR codes were successfully established for sale of fuel.

Ballooning of import bill cannot be fully charged to the neoliberal policies since still the exchange rate is managed and not fully liberalised. Mahinda Rajapaksa regime was mainly responsible for Investment in infrastructure without returns and this goes against the basics of neoliberalism.

The authors blamed the so-called pro-IMF contingent of Sri Lanka that they insisted that the tax cuts of the Gotabaya Rajapaksa government in 2019 triggered Sri Lanka’s crisis. The authors further claimed that liberalisation had hollowed out Sri Lanka’s tax structure long before Gotabaya Rajapaksa’s rule and for years, indirect taxes have comprised roughly 80% of total tax revenue.

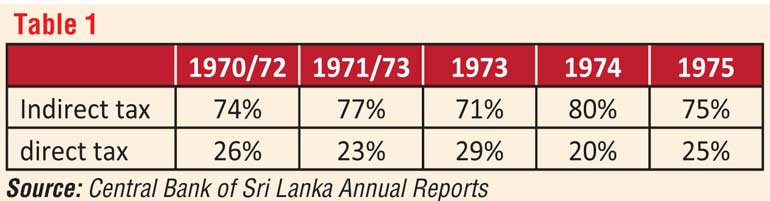

Any person with general knowledge of economics without any political biases would understand that the tax cuts triggered crisis and it was followed by the downgrade of the rating agencies with the realisation that debt was not sustainable. Tax structure of Sri Lanka was not hollowed by liberalisation. Long before the liberalisation during the time of a socialist Finance Minister the relationship between direct and indirect taxes were given in Table 1.

In Singapore which adopted liberalised policies right from the beginning and in India which adopted liberalised policies from 1991, and in many other countries, there are higher percentages of direct taxes and lower percentages of indirect taxes compared to that socialist era of Sri Lanka let alone the period where liberalised policies were adopted. Ironically none of the socialists, demand that this should be turned around, instead they demand that the ownership of the SOEs should be kept intact.

While claiming that the tax policy is not redistributive the authors criticise imposition of the direct taxes which is a move towards redistribution of wealth. They cannot demand imposition of wealth tax while condemning the current move.

Wealth tax was introduced in Sri Lanka in 1958. However, it yielded little revenue due to difficulties in determining the tax base and problems in administration. Following the recommendation of the Tax Commission in 1990, the Government abolished the wealth tax from the year of assessment 1992/1993.

Tax revenue to GDP in 1990 was 19% and the percentage was gradually reduced. In 2020 after the tax cut it was 7.7%. What else the IMF can recommend and what else the Government can do instead of increasing the taxes, especially direct taxes, at this point?

The authors suggested to apply the Keynesian theory of engaging in counter cyclical spending to help sustain aggregate demand. Where is the money? Our problem is overspending by the Government. Therefore, way out is to secure the IMF loan by proving that the debt is sustainable and agree with all the creditors. Curb the inflation and then reduce the interest rates. Takeaway the red tapes in the public sector, arrest corruption and get FDIs. Sell the unproductive SOEs. Persuade the banks to give credit to deserved entrepreneurs without excessively relying on the securities. Now the state banks are used to give credit without securities to the cronies of the governments. Ask the entrepreneurs to target the unlimited export market rather than focusing on the limited domestic market.

Parliamentary opposition and prominent think tanks singularly focused on demanding an IMF agreement as authors claimed because there was no other way to solve a crisis with this magnitude. It cannot be solved by foreign currency swap lines and restricting imports. Many requested a negotiated soft default which was more credible. Previous government did not do that. When the Government was trying to settle International Sovereign Bonds while the people were in long queues for gas and fuel, sensible economists ask the Government to go for a hard default and ease the burden of the people.

The authors mentioned that this so-called solution will have dire political consequences. That is why a populist government elected by the people cannot implement it. Sri Lanka was brought to this level by the populist governments, left and right. All of them were depending on the votes of the people. Sri Lankan leaders were not colossal as Gandhi or Mandela who took bold stances against the wishes of the masses.