Saturday Feb 21, 2026

Saturday Feb 21, 2026

Wednesday, 17 December 2025 00:26 - - {{hitsCtrl.values.hits}}

In the aftermath of an unprecedented national calamity, tax policy must go beyond mechanical application and reflect principles of equity, reasonableness, and

public interest — Pic by Pradeep Dilrukshana

It is a well-established principle that income tax is imposed on net income, after allowing deductions for expenses incurred in the production of income, losses and outgoings, as well as qualifying payments, including donations made to the Government, subject to the provisions of the Inland Revenue Act, No. 24 of 2017 (“the Act”).

It is a well-established principle that income tax is imposed on net income, after allowing deductions for expenses incurred in the production of income, losses and outgoings, as well as qualifying payments, including donations made to the Government, subject to the provisions of the Inland Revenue Act, No. 24 of 2017 (“the Act”).

Accordingly, people affected by Cyclone Ditwah may claim deductions for losses arising from the disaster for income tax purposes under Section 19 of the Act. At the same time, members of the public who contribute to Government-led relief efforts, whether in cash or in-kind, may claim such contributions as qualifying payments when computing their taxable income, subject to Sections 52 and the Fifth Schedule to the Act.

1. Losses and outgoings deductible by disaster victims

As stated above, losses are deductible in determining the tax payable by any person, whether a natural person (individual) or a legal person (entity), subject to the provisions of the Act. Sections 17 and 19 of the Act govern the nature and deductibility of such losses.

A business or investment loss generally arises where the expenses incurred exceed the income generated. Loss or destruction of trading stock or loss of a capital asset of a business where such loss exceeds the consideration, if any, received, constitutes a deductible business loss for tax purposes.

Accordingly, losses relating to trading stock, capital assets of a business, and expenditure incurred on repairs arising from such cyclonic disaster are deductible, subject to the relevant provisions of the Act.

a)“Losses are not accepted by the tax authority”: A myth

There is a common misconception in some quarters, particularly among certain auditors and taxpayers, that the tax authority will reject a self-assessment return simply because it declares a loss instead of income. As a result, some taxpayers resort to declaring artificial income rather than reporting the genuine loss incurred for fear of auditing or rejection of the return of income.

This belief is not only a myth but also dangerous. Declaring income that has not been earned, instead of a true loss, amounts to making a false and misleading statement to the tax authority and constitutes an offence under Section 190 of the Act.

Where a business suffers heavy losses, it may end up with an overall net loss for the year. Section 19 of the Act provides for such a scenario. This net loss can be used to reduce other business income, if the same person has any, or it can be carried forward for up to six years and used against future profits. In addition, such business losses may also be set off against the person’s investment income such as interest, rent, and royalties, except for capital gains.

Where a business suffers heavy losses, it may end up with an overall net loss for the year. Section 19 of the Act provides for such a scenario. This net loss can be used to reduce other business income, if the same person has any, or it can be carried forward for up to six years and used against future profits. In addition, such business losses may also be set off against the person’s investment income such as interest, rent, and royalties, except for capital gains.

b) Importance of maintaining records

It is imperative for taxpayers to maintain all relevant documents and evidence when claiming deductions for losses and expenses in general, and particularly those arising from the recent floods and landslides.

It would be naive to assume that tax officials will dispense with documentary evidence merely because the losses arose from an obvious and unprecedented disaster such as Cyclone Ditwah. It must be borne in mind that examinations or tax audits relating to losses claimed now are likely to take place after a minimum period of two years, possibly in the latter part of 2027. By then, the magnitude of the devastation caused by Ditwah may have faded into history, and the prevailing sense of sympathy and empathy may no longer influence the tax authority.

Therefore, it is critically important for affected taxpayers to retain all relevant records to substantiate their claims for losses and related expenses.

c) What documents are required?

The Act does not prescribe any specific documents to be produced in support of claims for losses, outgoings, or related expenses. The burden lies on the taxpayer to establish such claims to the satisfaction of the tax authorities.

However, the following documents and evidence are likely to be acceptable to tax officials in substantiating loss claims arising from the Cyclone Ditwah disaster:

2. Donations made to the Government and tax treatment

Any donation made by a taxpayer to the Government, whether in cash or in-kind, and whether made upon request or voluntarily, is treated as a qualifying payment for tax purposes under Section 52 read with the Fifth Schedule of the Act.

Any donation made by a taxpayer to the Government, whether in cash or in-kind, and whether made upon request or voluntarily, is treated as a qualifying payment for tax purposes under Section 52 read with the Fifth Schedule of the Act.

The rationale for granting this concession is that such

donations are, in substance, akin to taxes paid to the Government. Both taxes and donations fill the State coffer, which is crucial for financing essential state

functions, including public services, infrastructure development, defense, and law enforcement.

a) What donations are treated as paid to the Government?

Donations made to the Government of Sri Lanka, its departments, or to any fund established by the Government are regarded as donations made to the Government and, accordingly, constitute qualifying payments for the purposes of Section 52 of the Act. Consequently, any donation remitted to the Government of Sri Lanka through an official bank account maintained in the name of the Deputy Secretary to the Treasury qualifies as a deductible payment for income tax purposes.

It should be noted, however, that the Central Bank of Sri Lanka (CBSL) is not, in my considered view, the Government of Sri Lanka. Accordingly, any donation made to the CBSL may not be treated as a qualifying payment unless and until the necessary amendment made to the Act or the policymakers or the relevant competent authorities issue a clear clarification to that effect.

It should be noted, however, that the Central Bank of Sri Lanka (CBSL) is not, in my considered view, the Government of Sri Lanka. Accordingly, any donation made to the CBSL may not be treated as a qualifying payment unless and until the necessary amendment made to the Act or the policymakers or the relevant competent authorities issue a clear clarification to that effect.

b.) Whether the full amount of a donation made to the Government is deductible

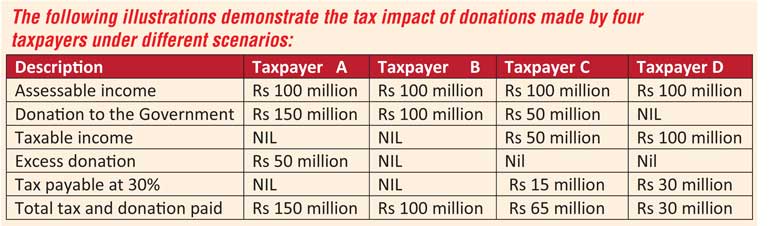

The full amount of a donation, whether made in cash or in kind, to the Government or to a fund established by the Government is deductible as a qualifying payment in computing the taxable income of the donor taxpayer. However, any portion of the donation that exceeds the

taxable income of the donor cannot be carried forward to subsequent years under the current law.

The above illustrations are self-explanatory and reveal an apparent inequity in the current framework. Taxpayers who contribute amounts exceeding their taxable income, often as an act of humanity and empathy towards fellow citizens during national disasters, receive no additional recognition or tax relief for the excess contribution.

In today’s highly competitive commercial environment, it is unrealistic to expect individuals and businesses to contribute their hard-earned income, even for the most deserving cause, without any return. Tax incentives play a critical role in bridging this gap by aligning public interest with private capacity.

It is therefore the responsibility of the Government to establish a clear, credible, and incentive-driven framework that rewards such contributions through appropriate tax reliefs. Granting such tax incentives will not empty or dry up the Treasury. On the contrary, as illustrated above, it will strengthen it. By doing so, the State can mobilise much-needed private capital for disaster recovery and reconstruction, enabling Sri Lanka not merely to rebuild what was lost, but to rebuild stronger and better than before.

3. Recommendations

Considering the magnitude and severity of the national disaster caused by Cyclone Ditwah, it is proposed that the following amendments to the existing tax laws and administrative instructions be introduced:

Considering the magnitude and severity of the national disaster caused by Cyclone Ditwah, it is proposed that the following amendments to the existing tax laws and administrative instructions be introduced:

a) Carry forward of excess donations

Any portion of a donation exceeding the taxable income of a taxpayer should be allowed to be carried forward, as was permitted under the former Inland Revenue Act, No. 10 of 2006.

b) Enhanced deduction for Government donations

Since a donor currently receives only a 30% tax benefit on donations, a deduction of 200% of the amount donated to the Government should be allowed as a qualifying payment. This would effectively provide a 60% tax benefit to the donor while simultaneously improving the Government’s cash flow.

This proposal to grant an enhanced 200% capital allowance to encourage investment in the Northern and Eastern regions of Sri Lanka was really borrowed from the budget proposal of the government for 2026,

c) Pragmatic approach by tax authorities

Tax authorities should be instructed to consider the severity and long-lasting impact of the Cyclone Ditwah disaster when auditing and verifying losses and related expenses, even where such losses occurred nearly two years prior. Otherwise, it would be like a bull charging a man who has already fallen from the tree.

4. Conclusion

Cyclone Ditwah has tested Sri Lanka not only in terms of physical resilience but also in terms of institutional responsiveness, social solidarity, and policy fairness. While the country has demonstrated remarkable unity and compassion, both from those directly affected and from those who voluntarily contributed to relief efforts, the existing tax framework has exposed certain gaps that warrant urgent attention.

The Inland Revenue Act No. 24 of 2017 already provides a sound legal basis for the deduction of genuine losses including disaster related and Government-directed donations. However, misconceptions regarding the acceptance of losses, practical challenges in substantiating claims, and the rigid treatment of excess donations have the unintended effect of discouraging transparency, generosity, and voluntary compliance.

The Inland Revenue Act No. 24 of 2017 already provides a sound legal basis for the deduction of genuine losses including disaster related and Government-directed donations. However, misconceptions regarding the acceptance of losses, practical challenges in substantiating claims, and the rigid treatment of excess donations have the unintended effect of discouraging transparency, generosity, and voluntary compliance.

In the aftermath of an unprecedented national calamity, tax policy must go beyond mechanical application and reflect principles of equity, reasonableness, and public interest. Allowing the carry forward of excess donations, enhancing deductions for Government disaster relief contributions, and adopting a pragmatic and empathetic approach in audits would not only bring fairness to the tax system but also strengthen public trust in revenue administration.

Ultimately, a tax system that recognises both the suffering of disaster victims and the selfless contributions of donors becomes an instrument of national recovery rather than merely a tool for revenue collection. Cyclone Ditwah presents a rare opportunity for Sri Lanka to reaffirm that taxation, at its best, is not just about numbers but about justice, humanity, and shared responsibility.

(The author is a retired Deputy Commissioner General of the Inland Revenue Department. He can be contacted at [email protected])