Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 5 May 2021 00:00 - - {{hitsCtrl.values.hits}}

A new publication argues that Sri Lanka has not benefitted from trade and investment diversion from the US-China trade war due to weak internal fundamentals

Last week marked 100 days since President Biden assumed office, and in that time, he has not moved to roll back the tough trade stance on China that his predecessor commenced. His Commerce Secretary and US Trade Representative have both indicated unwillingness to yank the tariffs back but have hinted at room for negotiation.

Last week marked 100 days since President Biden assumed office, and in that time, he has not moved to roll back the tough trade stance on China that his predecessor commenced. His Commerce Secretary and US Trade Representative have both indicated unwillingness to yank the tariffs back but have hinted at room for negotiation.

In the three years that have passed since the trade war began there has been much discussion and analysis on how it has impacted countries across the world. A recently-released international publication looks at the impacts on South Asian economies, in which the implications for Sri Lanka have been explored in a specific chapter. This article summarises some aspects of the chapter.

US-China trade war: A recap

Since mid-2018 the US and China have been engaged in a trade war with several rounds of retaliatory tariffs, with both countries imposing tariffs on hundreds of billions of dollars’ worth of goods. In January 2020, the two sides signed a preliminary deal (Phase One Agreement), easing the trade war.

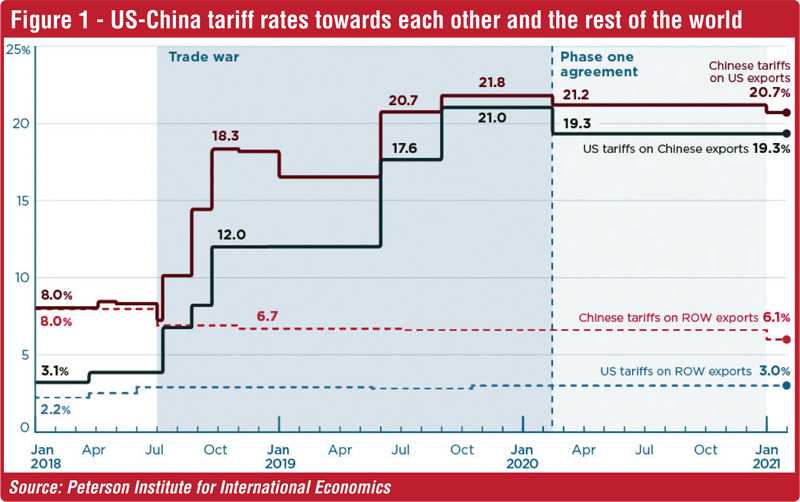

However, average US tariffs on imports from China remain high at 19.3%, which is six times higher than before the trade war began, according to estimates by Peterson Institute for International Economics (Figure 1). These tariffs cover 66.4% of Chinese exports to the US. Similarly, average Chinese tariffs on imports from the US remain at a higher level of 20.7%, covering 58.3% of US exports to China.

While the trade war has somewhat faded into the background with the COVID-19 pandemic, the high tariffs continue to take a toll on the US and Chinese economies. Also, the economic impact of the bilateral trade war has been a great concern to other countries, given the size of the US and Chinese economies, their share in world trade and the spillover effects on the rest of the world.

Trade diversion effects

Conventional trade models provide a framework for understanding the impact of tariffs on trade: tariffs raise the prices of foreign goods with the result of reducing demand for imports. In the case of tariffs being applied only to specific countries, as in the US-China trade war, tariffs can lead to trade diversion effects as US and Chinese importers can avoid the higher tariffs by sourcing similar goods from elsewhere.

The trade war between the US and China is hurting consumers, and producers of both countries, lowering their economic well-being. The loss of the US and China has benefited the exports of competing countries not directly involved in the trade war due to increased imports from the US and China. Specifically, China’s export losses in the US due to the trade war have resulted in trade diversion effects to the advantage of other countries. Moreover, companies have started to relocate their manufacturing activities out of China into other countries in Asia.

Impact of the trade war on Sri Lanka: Mixed

As a small and relatively open-market economy, Sri Lanka is particularly sensitive to trends in global trade. The tariffs imposed on China by the US raised the possibility of trade and investment diversion to Sri Lanka. While Government officials and businessmen in Sri Lanka highlighted the trade and investment opportunities for Sri Lanka to benefit from the US-China trade war, the outcome has been mixed so far.

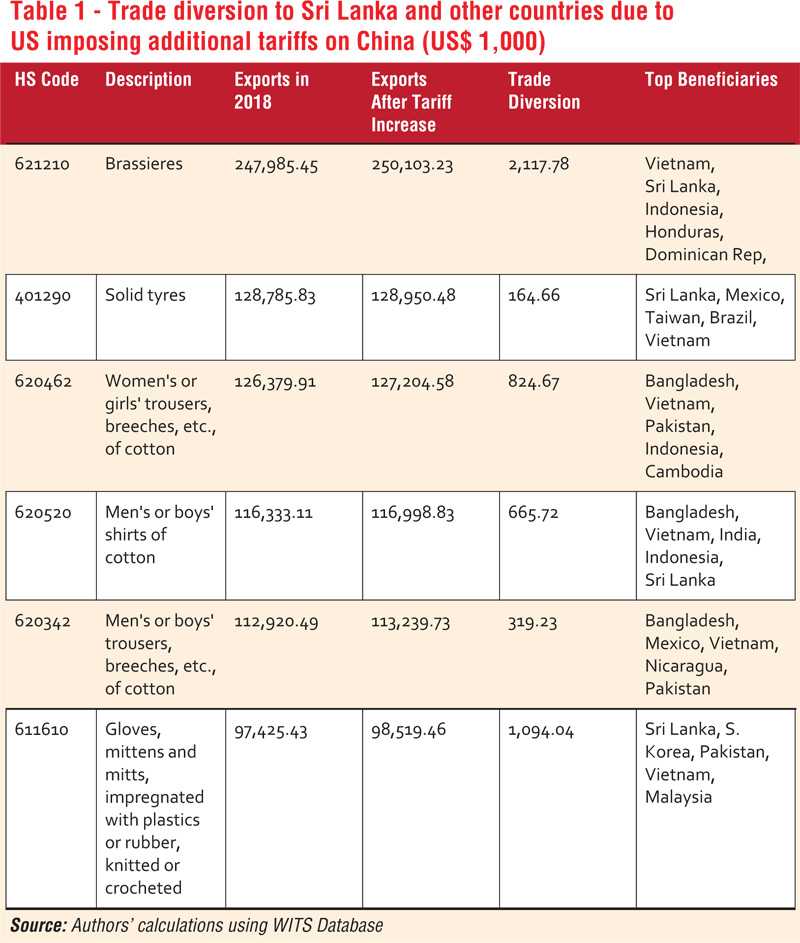

Various trade performance indicators and simulations show that the trade war could potentially benefit the leading exports from Sri Lanka to the US – namely textiles and clothing, and plastics and rubber sectors. Table 1 shows the top imports by the US from Sri Lanka in 2018 and potential increases in imports due to trade diversion caused by the US-China Trade War.

These products are already major exports to the US where Sri Lanka enjoys a comparative advantage over China but faces stiff competition. While the trade war started in the summer of 2018, tariffs imposed on textiles and apparel imports from China into the US were back loaded and came into effect in the autumn of 2019. Based on available data up to December 2019, Sri Lanka has not been able significantly benefit from the trade war.

To be clear, large diversion of trade in textiles and clothing may only become visible with certain time lags. The industry in Sri Lanka is yet to fully capitalise on the benefit of the trade war despite the initial interests of buyers in the US, and further study is needed on the added dimension of COVID-19 and how supply chain decision-making around the pandemic interacted with those of the trade war.

Investment relocation: Negligible

Similarly, signs of ‘investment diversion’ to Sri Lanka are limited up to December 2019. Because of the trade war, countries in Asia stand to benefit from international companies moving their production out of China due to export similarity, low wages, and investment climate attractiveness in terms of ease of doing business and sound institutional quality.

One country which has particularly benefited most from the trade war is Vietnam due to its relatively stable government, low wages, proximity to China/ASEAN, steady economic growth, and ease of doing business. Apart from Vietnam, other top contenders that are likely to benefit include Thailand, Malaysia, Taiwan and India. Outside of Asia, Mexico is likely to attract foreign direct investment (FDI) meant for China.

Although Sri Lanka had commenced several initiatives (including investment promotion missions and forums in Colombo and Beijing) to attract Chinese-based investors, Sri Lanka’s lack of readiness to promote the destination and provide conducive facilitation, held back the success of these efforts. A focussed investment promotion effort, to target specific investors in specific supply chains, was lacking. Moreover, domestic political, security and economic conditions during 2018 and 2019 further hampered the ability of the country to gain from potential investment diversion.

For Sri Lanka to have any chance of reaping the benefits of the ongoing trade war and associated shifts in trade and investment, the country will have to step up overall trade and investment reforms to boost competitiveness and create a favourable environment to attract export-oriented FDI.

[This article is based on the chapter 'US-China Trade War: Trade and Investment Implications for Sri Lanka' by Janaka Wijayasiri and Anushka Wijesinha in the edited volume, ‘The China-US Trade War and South Asian Economies’, which was recently published by Routledge. The publication is available at https://www.routledge.com/The-China-US-Trade-War-and-South-Asian-Economies/Choudhury/p/book/9780367513818. Anushka Wijesinha ([email protected]) is an international consultant and former Advisor to the Minister of Development Strategies and International Trade; Dr. Janaka Wijayasiri ([email protected]) is a researcher and consultant on trade policy.]