Saturday Feb 14, 2026

Saturday Feb 14, 2026

Monday, 27 March 2023 00:20 - - {{hitsCtrl.values.hits}}

Tax evasion is one of the major financial crimes one can commit. By definition, evasion refers to the illegal and wilful failure to pay one’s taxes to the state. Evasion can happen in many ways, it could simply be hiding a source of income from the tax office, to something far fledged as to keeping oneself entirely off the record. In November 2022, the President in his capacity as Finance Minister brought about a very interesting measure to strengthen tax administration in the Government Budget which read as follows:

Tax evasion is one of the major financial crimes one can commit. By definition, evasion refers to the illegal and wilful failure to pay one’s taxes to the state. Evasion can happen in many ways, it could simply be hiding a source of income from the tax office, to something far fledged as to keeping oneself entirely off the record. In November 2022, the President in his capacity as Finance Minister brought about a very interesting measure to strengthen tax administration in the Government Budget which read as follows:

“The government has identified the cash economy as one of the tools that is used to evade taxes. Therefore, measures will be taken to discourage cash transactions and encourage bank/card transactions, with specific limits.” (Budget Speech 2023 – Annexure VI)

This proposal complements numerous other tax administration strengthening measures including the linking of IT based platforms of the three key revenue collection agencies, all in a bid to exchange information, curb evasion and broad base the tax net.

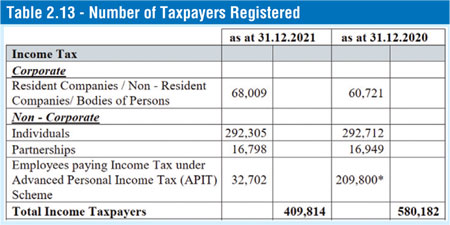

Interestingly as per the 2021 Performance Report of the Department of Inland Revenue, the total number of individual taxpayers registered for Income Tax as depicted in Table 2.13 below amounts to less than 300,000 in a country where the population is over 20 million with a labour force of 8.5 million (source – CBSL Annual Report 2021), the numbers are rather trivial. Of course, the tax-free threshold was Rs. 3 million per year of assessment at the time but with a self-assessment regime, the State relies on the goodwill and morality of the citizenry to pay one’s fair share of tax. Cash transactions have undoubtedly aided in keeping numbers off the record.

In neighbouring India; my experience has been that most vendors don’t keep cash counters, most of the payments are channelled digitally through QR codes, and of course, charge cards are accepted but cash transactions, even for something small and sundry, is not the norm. Back home though, one can easily purchase as much as a luxury property in liquid cash.

The Inland Revenue Amendment Bill (Gazette Supplementary) which was issued on 16 March 2023 (yet to be formally enacted), introduces a clause to deny the tax deduction or the capitalisation of a sum into asset where payments are made by a person to another person amounting to Rs. 500,000 or more, in a day, a single transaction, or a series of transactions related to one event other than by way of an account payee cheque or account payee bank draft or using a credit card, debit card or electronic payment system through a bank account. This is expected to come into effect from 1 April 2023.

The Inland Revenue Amendment Bill (Gazette Supplementary) which was issued on 16 March 2023 (yet to be formally enacted), introduces a clause to deny the tax deduction or the capitalisation of a sum into asset where payments are made by a person to another person amounting to Rs. 500,000 or more, in a day, a single transaction, or a series of transactions related to one event other than by way of an account payee cheque or account payee bank draft or using a credit card, debit card or electronic payment system through a bank account. This is expected to come into effect from 1 April 2023.

The Bill defines “single transaction” to mean the purchase or procurement of any goods or services, on a single invoice, receipt or statement but relaxes the restriction on certain payments such as:

With tax rates looming between the 30% to 40% range, an expense disallowance would undoubtedly go a long way in forcing the payers to comply with channelling payments through the formal economy and invite new taxpayers and funds to propel the same. This is a much needed reform and once implemented, it would be interesting to see the merits of it in times to come.

(The writer is the Partner – Tax Services of BDO Partners and Heads the firm’s Tax Practice. She is a Chartered Accountant, an Associate Member of the Chartered Institute of Management Accountants (UK), Member of the Chartered Institute for Securities and Investment (UK) and a Chartered Global Management Accountant. All views expressed are personal and do not represent the views of her organisation.)