Monday Feb 02, 2026

Monday Feb 02, 2026

Monday, 2 February 2026 00:14 - - {{hitsCtrl.values.hits}}

‘CASH only’ or ‘enjoy discounts for cash payments’ are common signs that hang on Sri Lankan shop windows. Even the Welipenna interchange service area has many eateries that do not accept card payments. The Southern Expressway is a major tourist gateway, and the country is losing revenue. In recent news, the tuk-tuk industry resistance to PickMe and Uber were reported. Tuk -tuk drivers in tourist hotspots such as Ella and Weligama whine about unfair pricing when on the other hand, tourists note that ad-hoc, exorbitant pricing is a nuisance.

High processing fees of global finance payment portals

The Government pledged to digitise all sectors and offer waivers for digital infrastructure. The vendors try to push it away. MasterCard, Visa and American Express are globally popular cards, but vendors incur a cost between 1.5%-3.5% as a processing fee. Also, cash transactions are almost impossible to track and can be kept off the books. The Central Bank of Sri Lanka recorded that 40% of the country’s GDP is informal. Since its activities stay ‘hidden’, the number could be higher. Those operating away from the tax net continue to remain that way and profit more.

Comparison with Asian countries

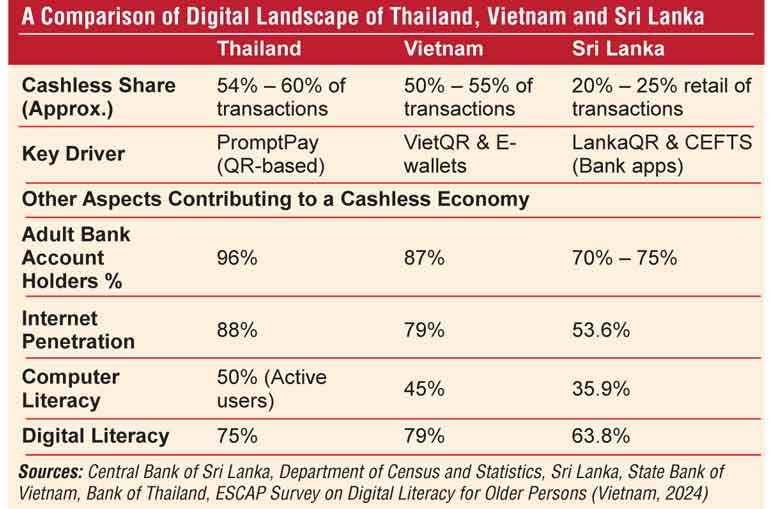

In countries such as Thailand and Vietnam, where the tourism industries are comparable to Sri Lanka, cashless transactions are more prominent. In Sri Lanka, the retail sector is still resisting the change where only 20-25% transactions are cashless. If the country plans to benchmark it such a transition does not come overnight but through systematic/attitudinal changes.

Approximately 30-35% of the adult population do not have a bank account. It is impossible to do cashless transfers without such basic knowledge of transactions. A silver lining here is digital literacy, which is the ability to operate a smartphone or a tablet, is fair among the population.

The gap in digital infrastructure is reflected in internet penetration where Sri Lanka again performs well below its competitors.

Attitude towards formality

Attitude towards formality

Apart from the obvious infrastructure deficiencies, there is also deep-seated anxiety among vendors. They fear digitised payments being easier to track will ‘force’ them into paying taxes. Filing taxes, auditing and calculating dues are costly. There are also para tariffs, levies that apply making the tax system incomprehensible.

The social dialogue between the Government and small holders regarding tax could improve. They need to be looped into the formal system and sensitised on tax education. Digitising tax administration is already in the works and that coupled with simplifying taxes could help the dialogue well.

Additionally, the percentage charged as a payment processing fee is seen as an unnecessary portion taken away from their profit margins.

A Sri Lankan vendor app

The Government’s proposals for a Unique Digital ID gives an opportunity for the tourism industry to go for a Digital Payment Wallet. India’s Unified Payment Interface emerges as a successful example. It alone carried out 50% of the global real-time retail transactions. This enables the Revenue Department to monitor income and the Government to observe economic activities more accurately.

The Government already has QR payment methods such as LankaQR and Just Pay. It is only a matter of streamlining these systematically.

An example of a vendor’s app would have a QR Code, accounts linked, and the ability to generate invoices/ sale receipts. It is imperative this is maintained in a simple format, in all three national languages in the least. The country’s digital literacy, which is fair and improving, and a user-friendly mobile app would not be a hassle to them.

Transparent pricing and trust

These are also important to eliminate scams against foreign nationals and predatory pricing. There are cartels maintained by vendors, tour guides and agents in main tourist attractions, setting extremely high price margins.

Cashless pay is not to rob livelihoods of tourist vendors, or to diminish profits. When the community grows, they can collectively demand simplified administration and lower payment processing fees. Record keeping will be much smoother. It is only a way to build trust and maintain a good outlook as a country. Yet trust is a two-way street.

(The author is a consultant to the Committee on Public Finance in Parliament)