Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 10 March 2023 00:20 - - {{hitsCtrl.values.hits}}

We all have a prime responsibility to contribute in numerous ways to rebuild our economy and regain the reputation of our beautiful island

Resource constraints for a fast forward journey

Sri Lanka is one of the very smaller island economies in the world. Yet, we have more than 22 million people with a very high population density of 341 people per sq. km. Our economy is outgrowing the capacity of the resource base to support it. Carrying capacity of this small island economy surpassed decades back. Shrinking forests, rising human/wildlife conflicts, eroding soil, fast-growing inequality in access to resources, and mounting natural disasters are alarming consequences of over-consuming our finite natural resources to meet infinite economic demands. The country’s reputation as a resource-rich small island is fading away. We are moving from the notion ‘small is beautiful’ to a threat ‘small is vulnerable’ as our capacity to satisfy fast-growing demands of the current economy and our human enterprise is swiftly declining. We increasingly depend on external sources to meet our excess demand for consumptions.

Sri Lanka is one of the very smaller island economies in the world. Yet, we have more than 22 million people with a very high population density of 341 people per sq. km. Our economy is outgrowing the capacity of the resource base to support it. Carrying capacity of this small island economy surpassed decades back. Shrinking forests, rising human/wildlife conflicts, eroding soil, fast-growing inequality in access to resources, and mounting natural disasters are alarming consequences of over-consuming our finite natural resources to meet infinite economic demands. The country’s reputation as a resource-rich small island is fading away. We are moving from the notion ‘small is beautiful’ to a threat ‘small is vulnerable’ as our capacity to satisfy fast-growing demands of the current economy and our human enterprise is swiftly declining. We increasingly depend on external sources to meet our excess demand for consumptions.

Living beyond our means

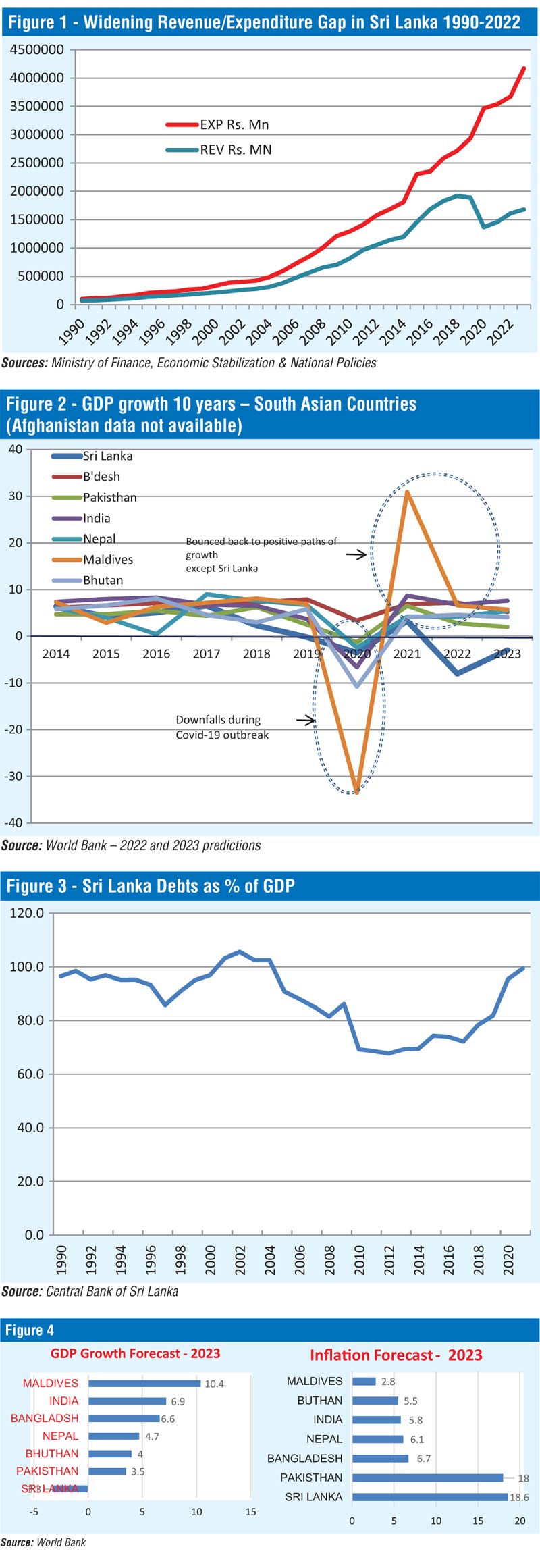

Expenditure of our economy is rising much faster than our revenue generation. As depicted in Figure 1, Public Expenditure/Revenue Gap continued to grow steadily over the last two decades and widening of the gap accelerated since 2016. In 2020, COVID-19 made the situation worse. Public revenues declined much faster against sharply rising expenditure, making it nearly impossible to bridge the gap without radical and painful measures to cut down the cost and increase revenues.

We rely heavily on borrowed funds, both foreign and domestic, to fill the ever-increasing deficit.

Our post-pandemic economic recovery is rather weak. We are confronted with absolute lack of resilience and incapacity to recover from the economic downfall due mainly to policy oscillation with limitations and weaknesses of our linear economic path.

We recently entered a self-created gloomy world with deepening economic, fiscal and human crises while other countries in South Asia are making steady progress in recovering their economies. All South Asian countries were able to bounce back in 2021 from the downfall of their economies in 2020. Now, they are moving ahead to sustain positive GDP growth levels in 2022 and 2023. But, Sri Lanka is predicted to remain with a negative GDP growth as shown in Figure 2.

Our economy is shrinking and we are getting marginalised in the South Asian region with unprecedented pressure on our already limited fiscal capacity not only to tackle urgent livelihood problems and social needs but also to make mandatory debts servicing payments. Hence, we are on an unsustainable fiscal path.

Spending is rising and revenues are falling short, requiring the Government to borrow huge sums each year to make up the difference. We face staggering deficits. Our public debts have increased dramatically, rising from 69% of GDP in 2010 to 99.5% in 2021, equalling the total value of all goods and services produced in the economy. This means that nothing is left in our economy for us to claim as our own debts-free goods and services. The escalation was driven in large by a slew of fiscally irresponsible policies and undisciplined revenue/expenditure management practices, along with a deep economic downturn. After decades of distorting the picture of living on borrowed funds and misinterpretations of economic declines for the populism driven political survival, we have arrived at a critical juncture of reality and truth. Every political party and bureaucratic subservience is to blame.

Lack of potentials to grow

Recovery of our economy depends very much on the potential to grow compared to other South Asian economies. Growth potential of our economy is far below that of other South Asia economies with the predicted lowest negative GDP growth of -3.0% and highest inflation of 18.6 for 2023. As forecasted, Maldives will reach the highest GDP growth of 10.4% and the lowest inflation of 2.8% in 2023. All other South Asian economies except Pakistan will have 4% and above GDP growth with single digit inflations. Our country is falling behind in the steadily growing South Asian region, making it extremely difficult for us to maintain a competitive position in the market and to retain the market share of exports and tourism. Upgrading the country rating of South Asian economies will be continued in contrast to downgrading of our economy. If we fail to unite, act fast and work hard collectively to regain our position, most of foreign companies and investors will leave us, making our country an abandoned island in South Asia.

Comparatively, the slowest growth performance expected from our small island economy for 2023 and after will not be sufficient to improve the deficit situation in the short run because recurrent expenditure of the Government will remain very high to pay essential services and spend money for the welfare of a large number of poor households. Once the entire revenue is used to pay the essential recurrent expenditure, nothing is left for other mandatory expenses related to debt servicing and infrastructure maintenance. As a result, we are getting squeezed further without funds for all other priorities to expedite the GDP growth performance. Revenue generation, on the other hand, will remain quite low as the majority of economic enterprises are forced to stay behind without their economic activities. Implementing the most stringent austerity measures of cutting down cost and increasing tax revenues at this juncture of deepening economic crisis will be a difficult exercise.

Choose to fail or succeed

If all income-earning citizens are not prepared to unite rather than divide, sacrifice instead of resist and participate instead of disrupt to raise revenues and cut expenses, we together with our next generation will move onto a nowhere-to-turn path of decline and collapse. Government, on the other hand, will fail to reach cost cutting/revenue collection targets and public debts will outstrip the entire island economy, growing to above 100% of GDP for the rest of this decade. Interest rates will remain at unaffordable high levels for business enterprises and individual borrowers. Private investment will be discouraged and foreign investment will be diverted to other stable and progressive South Asian countries around us.

Accelerated spending on rising political populism and politically divided competition for power, will not generate urgently needed financial resources to overcome the on-going fiscal crisis. Ineffective bureaucratic service units and emerging political cost centres will speedup cost escalation, bringing unprecedented pressure on the fiscal capacity. If we fail to cut down rapidly escalating cost drastically to facilitate stable revenue growth, our next generation will have to face an extreme version of the current crisis we are confronting today.

We all have a prime responsibility to contribute in numerous ways to rebuild our economy and regain the reputation of our beautiful island – Pearl of the Indian Ocean. We have to change our mindset to pull together, not to pull apart, to put politics aside and to do the right thing to bring the economy back to a sustainable path of growth. We cannot miss this most consequential moment in our history to change cost-escalating, divided, faulty, fragile and inefficient political-economic structures and to form completely a new solidarity-based sustainable pathway to growth and prosperity, driven by truth, trust, inclusive collaboration, collective actions and mutuality.

Every citizen of our small island must understand the magnitude of the crisis without prejudice. Although it is difficult to live at this juncture of human suffering and rising cost of living, our prime responsibility and commitment must be to contribute as much as possible for rebuilding the economy before it collapses. If not, human suffering will continue with social unrest, triggered economic dislocation and escalated structural violence making it extremely difficult for the next generation to live.

(The writer is former Director Research People’s Bank, Head of Research and Development Bank of Ceylon, Senior Researcher UNDP Regional Centre and Member of the Team – Post-Covid Development Alternatives (PC-DEAL).)