Friday Mar 06, 2026

Friday Mar 06, 2026

Thursday, 19 March 2020 00:10 - - {{hitsCtrl.values.hits}}

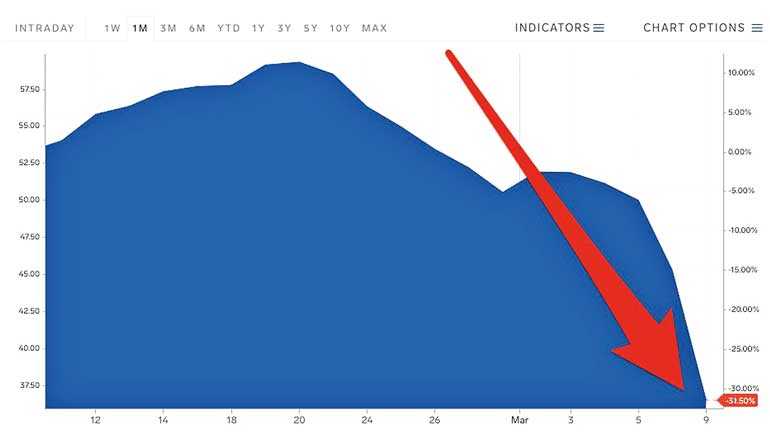

Over the course of the last 10 days or so, crude oil prices have dropped from close to $60 to just $28.03 a barrel

It came as no surprise when the WHO declared the virus a “pandemic”

Like with oil prices, stock markets worldwide have seen major declines in share prices and have closed numerous times

COVID-19, the coronavirus that originated in Wuhan and has been in the news for the last few months, has brought the entire world to a halt in the last few weeks. With 198,006 confirmed cases of COVID-19 and 7,948 deaths across almost 154 countries, it came as no surprise when the World Health Organization declared the virus a “pandemic” on Thursday.

Despite the biological nature of this virus, much of the crises we are dealing with today due to COVID-19 revolve around human behaviour and economics. Since almost all of these crises have been caused due to panic fuelled by misinformation and poor comprehension, I decided to take some time to explain the micro and macroeconomics behind some of COVID-19’s global economic implications and by extension their impact on Sri Lanka.

The oil price crash

Over the course of the last 10 days or so, crude oil prices have dropped from close to $60 to just $28.03 a barrel — the most significant price drop in oil markets since the Gulf War back in 1991. Understanding the reasons behind this sudden crash relies on understanding that almost all of the world oil market is controlled by a group of 15 countries called OPEC, the US and Russia.

Markets like oil that have a few major players controlling significant amounts of market share are called oligopolies. Since oligopolies are made of a few strong players, price competition is usually fierce; but at the same time, there is a high incentive to collaborate or collude with one another and push prices upward by cutting production. This form of collusion is often practiced within the oil oligopoly when prices start to drop and things were no different this time around when oil prices started to slowly decline due to reductions in demand as COVID-19 began spreading.

However, when OPEC initiated talks with its competitors to cutback production and minimse COVID-19’s impact on oil prices and in turn oil producers’ bottomline, Russia went in the opposite direction and increased production. The political tensions that sparked this response are beyond the scope of this post, but as a result of it OPEC and primarily Saudi Arabia did the same and began a price war in the market for oil.

Both Saudi Arabia, and Russia kept increasing their production, and reducing prices in order to capture more of the market from one another. This sudden increase in oil production, coupled with the declined demand for oil due to COVID-19 pushed oil prices to new lows on both the supply and demand sides and brought about the oil price crash we have seen in the last few days.

Whilst the oil price crash has hit oil exporting countries hard, there is a silver lining because of the timing of the price crash. Because of COVID-19’s impact on China, a manufacturing superpower, and the pace at which the virus is spreading across the world, aggregate supply or the total production of goods and services has declined world over. Sri Lanka’s manufacturing capacity for example has dropped by nearly $500 million in the last few months.

The sudden decline in oil prices can help mitigate this decline on the supply side because oil is a key input for almost every good or service due to its prevalence in manufacturing and transportation. The decline in oil prices will reduce production costs across economies and in turn cause a positive supply shock, where the production potential, output and aggregate supply increase.

Despite the decrease in crude oil prices however, fuel prices in Sri Lanka have remained unchanged. It is unclear when prices will be adjusted in line with the global change because the current government has done away with the fuel pricing formula used to adjust prices on a monthly basis by the previous government. However, it is unlikely that fuel prices will be reduced during the next few weeks since existing stocks sold in Sri Lanka have been purchased prior to the price crash in global oil markets. Furthermore, since the current Government significantly reduced taxation on income and some key goods and services like telecommunications, the Government could take advantage of the situation and finance its budget deficit be keeping fuel prices unchanged.

Volatility in financial markets

Like with oil prices, stock markets worldwide have seen major declines in share prices and have closed numerous times. The Dow Jones, and S&P both of which take into account the share prices of a variety of companies in the US have dropped by over 20%; similarly, the Nikkei, which takes into account share prices of companies in the Tokyo Stock Exchange has also dropped significantly in the last few days. Even the Colombo Stock Exchange has seen almost a 9% drop in its All Share Price Index over the course of the last week, and has been forced to close trading three times during this week. As share prices have dropped, stock exchange markets have transformed into bear markets with trillions of dollar wiped out of them.

This high volatility in global financial markets is driven by the self-fulfilling expectations that have arisen as a result of COVID-19. Investor confidence has taken a hit due to the rapid spread of COVID-19, and as a result with expectations of decreasing share prices, investors have resorted to rapidly off-loading their shares before their expectations come into fruition and they lose money. When enough investors do the same, the expectations end up being self-fulfilling as the supply of shares on the market increase, and share prices decline in turn. Since a share is basically a stake in the future output and earnings of a company, these expectations have gone the other way as well.

For example, Gilead Sciences, which claims to be testing a drug for COVID-19, has been one of the few stocks to rise in value due to the self-fulfilling expectations that this drug will lead to profits and an increased share price.

As investors move their assets out of stock exchange markets worldwide, the value of safe-haven assets has been on the rise. Gold for example soared close to the $1700 mark; the Swiss Franc and 10-year treasury yield have also seen increases in value. These assets have increased in value due to the increased demand stemming from increased volatility in other financial markets and the belief that these safe-haven assets will always hold their value. It’s also interesting to note that the cryptocurrency Bitcoin has also depreciated quite dramatically despite the fact that it is completely decentralised, is not governed by any central bank or authority and in turn may be considered a safe haven asset.

Scarcity due to panic buying

In addition to causing volatility in financial markets, self-fulfilling expectations are leading to scarcity as panic buyers rush to stores to buy exorbitant quantities of everything from masks and hand sanitiser to toilet paper. Within a day since reports of a second case of COVID-19 in Sri Lanka, long lines have formed outside of grocery stores and gas stations and shelves have been completely emptied.

The public expectation of scarcity due to COVID-19 has led to panic buying and a sudden surge in demand that has made the expectation itself self-fulfilling and temporarily created a shortage of these essential goods. Part of this sudden surge in panic buying can be attributed to social cues or peer pressure that leads to a “better be safe than sorry” attitude amongst the general public. In other words, our confidence in this expectation of scarcity is strengthened when we see lines form outside grocery stores and empty shelves; misinformation and the rapid communication channels available to us today have only worsened the prevalence of panic buying and artificial shortages.

As these shortages come into fruition, prices could increase and lead to increased inflation. This is especially problematic for low-income earning households that do not have the means to purchase and store necessity goods for long periods of time. Since COVID-19 has already impacted the supply-side of most economies by reducing their production potential, artificial shortages due to panic buying will only worsen the problem. Despite this, realising the human behaviour that’s causing this problem the key solution is to manage expectations and increase consumer confidence through clear communication between producers, governments and consumers.

Is a global recession on the way?

A recession is a significant decline in economic activity that leads to a decrease in output, and an increase in unemployment. The last major global recession we faced was back in 2008, when the world’s largest financial institutions crumbled due to deregulation in the financial industry, risky lending, and the burst of a housing bubble. The events that have transpired over the course of the last few months due to COVID-19 have definitely raised concerns over a potential global recession in the near future. The symptoms we have seen thus far suggest a recession on two fronts on both the supply and demand sides, whereas the recession back in 2008 was primarily on the demand side.

As mentioned above the supply side has already been affected due to COVID-19’s impact on China, and the impact on the world’s production potential will only increase as more people are infected by the virus, and global productivity declines due to an increasingly infected global labour force.

When it comes to the demand side, we are already seeing clear signs of recession as numerous industries are struggling to stay afloat amid the COVID-19 crisis. The airline and tourism industries as a whole have retrenched thousands of employees and in some cases even shut down as people keep travel to a minimum, and governments world over implement travel bans and border lockdowns to minimise the spread of COVID-19.

Similarly, recent developments in the last few days have led to the cancellation of numerous events in the entertainment and sporting industries that usually contribute billions of dollars to the global economy. For example, the NBA, UEFA Champions League, the English Premier League, the Indian Premier League and Australian Grand Prix have all been cancelled or postponed due to COVID-19.

Even the education industry has ground to a halt all over the world; universities and schools have either cancelled school for a few weeks or have resorted to online school. Almost every child and youth across the world has been affected by COVID-19 due to the impact on education, which is also a significant contributor to the global economy and economic development.

Sri Lanka remains highly vulnerable to a recession due to its heavy reliance on tourism, which is extremely vulnerable to COVID-19. There has already been a 17.7% drop in tourist arrivals in February, with Chinese tourist arrivals suffering a drop of 92.5%. The impact on the island’s economy will only worsen as the virus spreads, travel bans are imposed and consumer spending across the world declines.

Moreover, with a large portion of its population working outside of the country, Sri Lanka’s demand side may also be hit by reduced remittances from these exported workers in nations severely affected by COVID-19. Sri Lanka’s reliance on imports as a small island nation, also make it highly vulnerable to external global shocks that may transpire due to COVID-19.

Despite these symptoms and concerns on both the demand and supply side however, a global recession like the one we saw in 2008 is not guaranteed. This is because unlike in 2008, financial institutions today remain strong and well-capitalised. As a result they are in a much stronger position to implement policies that will help manage expectations, curtail the economic impact of COVID-19 and reduce the risk of a global recession.

The Federal Reserve in the US for example has already injected $ 1.5 trillion into financial markets in order to help stabilise them and cut their rates to increase investment in the economy; the European central bank and other governments world over have begun taking similar approaches to ease the situation. The global economic condition over the course of the next few months will depend on the success of these policies and the level of control we will be able to achieve over the spread of COVID-19 worldwide.

(Originally published at http://anuda.me.)

In addition to causing volatility in financial markets, self-fulfilling expectations are leading to scarcity as panic buyers rush to stores

The public expectation of scarcity due to COVID-19 has led to panic buying and a sudden surge in demand